Folks-

Hope every one is super charged for another week ahead of us.

The markets of late can be considered to be treacherous with a lack of direction by many. However, it is the regimes like this that offer most learning opportunity as well active sessions for active traders.

About a month ago, I called out that further depression in emini S&P500 prices below 3600 could be hard to achieve outside the context of a new trading range forming here before the year end.

What have the markets since done?

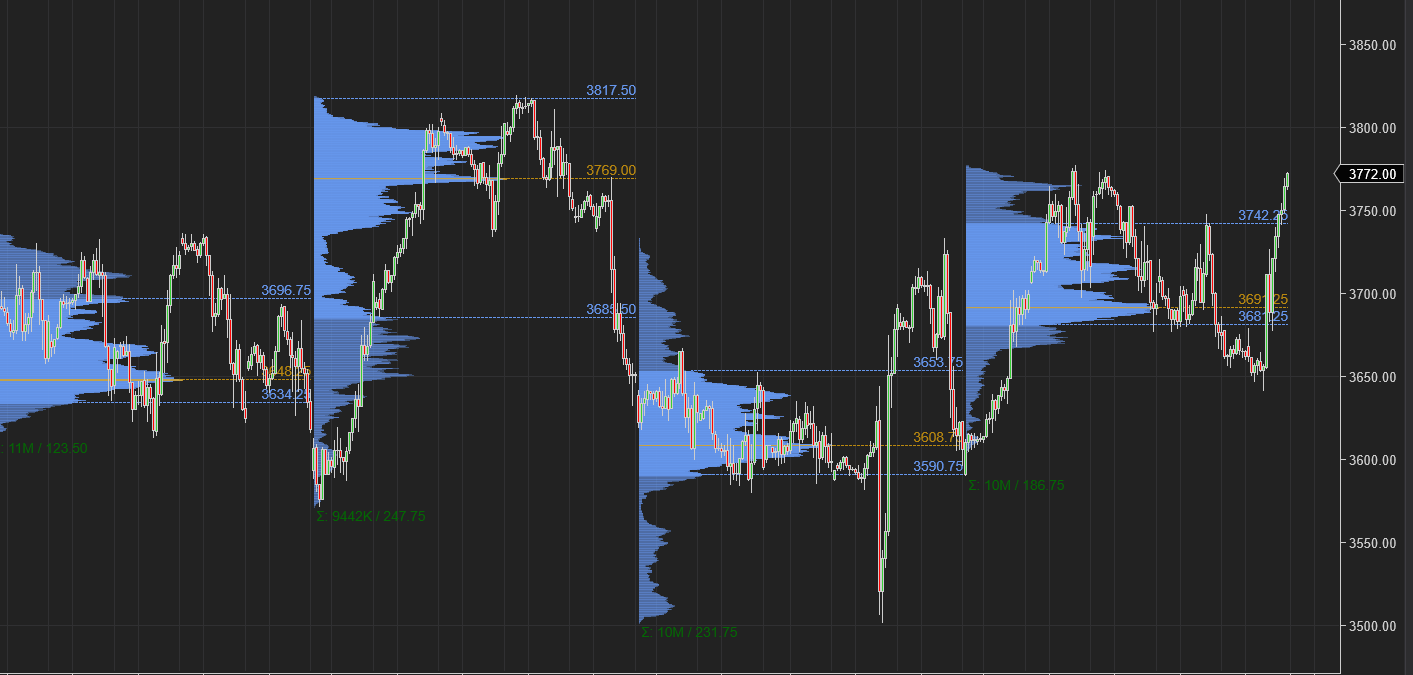

Chart A Emini carves out a giant range.

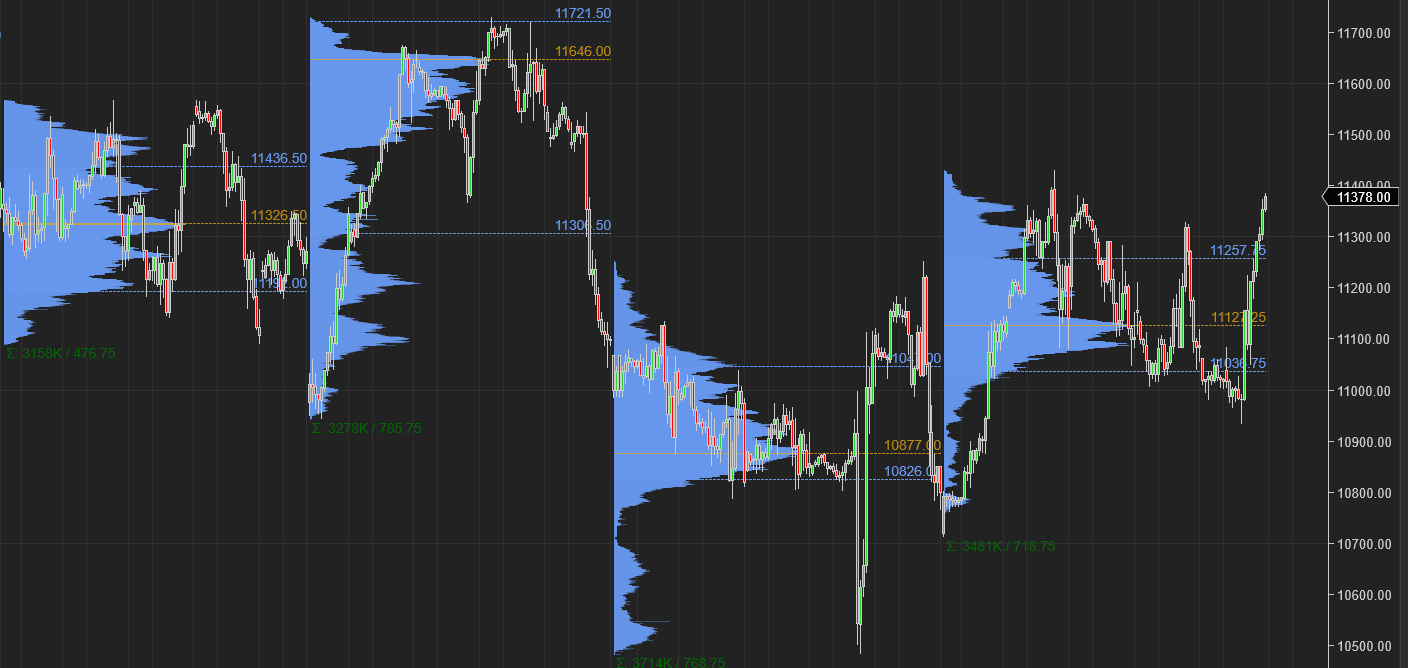

Has the Nasdaq NQ (QQQ proxy) done any better?

Chart B below for the NQ.

This in spite of the majority of folks calling for targets ranging anywhere from 2900-3200 while emini S&P500 enjoys trading this range for over 20 trading days now. Lot of so called “experts” have been proven wrong as this market refused to make new lows over last month or so.

At times my calls can be very contrarian and may not agree at all with the majority view. This is why I like the readers of this blog to understand - if you want me to also parrot off the consensus view, then that is not going to be the case.

Where else did we see this play off this week? Several times actually:

On Thursday, majority of the folks bulled up due to the NFLX and tech earnings. We bombed. I had a bearish view on that day (due to TSLA).

On Friday, nearly every one I spoke with was bearish on backs of SNAP earnings, we rallied 100 dollars. I was bullish at the open as my daily plan had prepped and prepared me what I wanted to see if we opened above few key levels like 3630 and 3700. As well as the sentiment being too negative right at the open.

A quick recap from last week:

On the emini side, I had expected the market to remain range bound between 3560-3640 before the TSLA ER. I had expected directional clarity to come if we opened or closed above/below 3640/3560.

We actually opened near 3600 on Globex Sunday night and rallied above 3640 immediately. This was a strong cue for Monday that as long as we held this level, we may retain a bullish bias to rest of the week. This level was visited only on Thursday Globex night was infact the low of the day on Friday.

For my earnings calls, NFLX was the best one as I was a bull on NFLX at 230. The stock rose to about 290 following it’s earnings. I have been a NFLX bull from the 180s earlier this year whereas a lot of folks have been too negative on this.

As far as TSLA was concerned, I was not chasing the earnings as I gave a very clear reason that even the best pumps by it’s CEO are not working and I will avoid it. That was at 204. We did rally briefly to 220 Orderflow resistance before the earnings and then dropped back near 200 again.

Tesla CEO also made headlines this week when it was announced his firms may be reviewed by the Federal government in guise of “national security”. I thought this may be a positive for the stock as it may delay or prevent the TWTR sale to Elon, and I was indeed right as we then bounced about 5% off the lows on this news.

SNAP Snapped

My earnings call on SNAP snapped. Though I had expected 10 dollar level to be my LIS on this name. This level was easily broken and my call was void. I personally think Snapchat C suite is aggressively and unnecessarily too pessimistic about their own prospects. I do think SNAP is quite oversold here around 6-7.

Not only I had shared these calls ahead of the earnings in real time, I was also an oil weekly time frame bear at 86-88.

We sold down to 82 dollars on Oil which was my target and we rallied.

I also shared a bearish weekly thought on Gold at around 1650 and I had expected gold to sell down to 1620 if dollar remained super strong. This was indeed the case as we lost about 30 dollars on the gold an ounce before finding support at that 1620 level.

Chart C : 1620 Low on Gold before a 50 point zipper

TLT

On TLT, continues to make new lows trading slightly sub 93 at time of this blog as the yields make new highs.

If you look at these yields themselves, they have had a crazy tripling within a few months. In fact only a year ago they were close to 0 and now they are pushing up on the 5%. This is an enormous pressure on the system - especially as indebted the folks are.

This in my view is what happens when you have some very misinformed people at the helm. I had always warned about inflation going much higher than that 2-3% and here we are officially knocking the doors of 10% thought the real, unofficial inflation could be way way higher than this.

Look, there are two factors I need to keep in my mind with this whole “yields going up forever” narrative:

I need to assume that the inflation has not peaked at 8.6% and will continue to go up in near term.

I need to assume that if 1 above is true, then the FED will continue to fight this inflation.

I think neither 1 nor 2 is true.

I think the inflation is closer to a peak but it will be endemic- in the sense, that it may carve out a new floor here of about 4-5% inflation for several years primarily due to the energy and food costs which are going to be the real victims of this Ukraine Russia war once the dust settles. I do not think this inflation genie will now go back to the old standard of 2-3%, I do not see that happen. If you think about 5% inflation in the West for next several years, this is a huge deal and breaks many models based on last 10-15 years of inflation/rates.

The reason I think so is that I think the FED has a lot of leverage on housing inflation, wage inflation and local healthcare inflation - they can crush it using financial tools, if they are motivated enough to do so. However, I think they have very little to no control on global energy and food prices. This is perfectly clear in hindsight with enormously embarrassing episode with the Saudis - they exert an outsized impact on gas prices. I think this is also one of the reasons the US is pushing for us to wean away from oil based energy in our homes and cars - but I will like to see a plan for the heavy industry and farming as well, where is that?

If I am right about the CPI, then I think that the current yields are already equal to what the inflation rate is going to be a year or so out. If I am wrong about this, we are going to see very interesting outcomes in next year or so in the bond markets and equities.

Look, when you look back 40-50 years, we are now reverting to the mean when it came to “normal” inflation and normal interest rates. COVID and the 2008 financial crisis created an aberration which is now being corrected.

On top of this you also have to understand that the FED has two key attributes which few understand:

It is always looking at the old data. It is not forward facing, always backwards facing.

I think it will also be under political pressure to not keep raising rates, even if the inflation had not peaked. Yes , I am saying if inflation has not peaked, I think the FED will still surrender and not do any thing about it - once we begin to see large scale job losses and people losing their homes. When that happens is any one’s guess but I think if rates stay here around 4-5%, we are probably 4-6 months from that outcome.

Not only is the FED backwards looking you also have most folks expect that the current thing will continue forever. It is rarely that simple.

When you consider these points, you see that the sell off in the bonds I think is extreme and may be even a little unfair (in context of historical trends).

What are your thoughts? Do you agree with me about the terminal inflation to stay in the US to remain 4-5% for a while or think it will now drop lower? Drop me a line and participate in the poll below.

Read the link here to my prior weekly plan.

Some folks are not clear about few terms like IB, RTHC etc. I ask that you read all of the posts in the link below.

A lot more educational content is on it’s way but it is subscriber only. So make sure you subscribe to me and turn on the notifications whenever I issue a new post.

To this end, on Friday I shared my thoughts on what I understand by an edge in trading. Here is the link.

I was a little underwhelmed by the response, but I thought it was because there was some math in it and most of us are a little intimidated by it :) In layman’s terms, an edge is simply every time I pick the mouse to click on buy and sell, how many dollars am I going to make on average. Or lose?

Is it 5? 100? -200? This is the edge in layman terms.

To win in trading, I need a positive edge. IF I do not have an edge which is greater than 0, I need to stop and invest time to find one. There are no alternatives.

In intraday, it becomes hard to find an edge if I am one trade a day trader. It is very hard. Because, even when the market is one directional, which is rare, like 20% of all sessions, even then I can get stopped out. So I need to design and implement a strategy which is multi trade or multi lot or something which is not passive in the sense that I am just sitting there with one trade all day and expect it to return a greater than 0 edge. Markets do tend to range most of the days- my edge must be able to account for choppy days. I do talk to a lot of traders, personal friends and online as well where I see a common theme of wading into this problem without any preparation or without any understanding of what it is ? If we focus only on being right and making money, I think it wont work or atleast it will be very hard. Therefore the focus must shift to strategy development and finding that elusive edge. Rest will take care of itself.

Much more on this to come, stay tuned.

My levels for next week

Let us quickly look at some of the key catalysts and planned news events for next week before wading into the levels.

I think the key event for next week will be the AAPL earnings.

AAPL may be the key factor that underpins rest of the market through next week.

Other key events :

UK PMI on Monday

Consumer confidence on Tuesday

Bank of Canada rate announcement on Wednesday. The Canadian housing market and labor market right now is suffering due to high rates already plus it really has not done enough to dampen USDCAD at all. It now approaches 1.40, most notably I went bullish on it at 1.20 last year.

US GDP and the ECB on Thursday

AAPL and AMZN on Thursday

Core PCE on Friday

This is a packed week with event risk and will make for an exciting week for sure ! Not a dull moment! If you want my take on these events and also receive about 5 emails from me every week with my levels, then subscribe below. Why miss out on all the action this week with so many earnings and events? Also read all about my thoughts on AAPL and AMZN below.

In some other news.. I had shared O income REIT about a few days ago at 54-55 and we see good action in this , floating up to 58 dollars. I keep my eyes on this, it is a respectable REIT and I remain bullish on this on any weakness with more than 5% yields. They have a stellar track record of growing dividends and are now part of the Dividend Aristocracy.

Their main risk of-course is that as rates go up, they may not be able to expand. The price of the properties they own may drop. If you are short term oriented, these are big risks.

However in the bigger picture, I think they are great. Eventually, as we all age , I think it is nice to have an offline source of income as priorities of life shift. What I like about O is though it has historical returns since it’s inception in the 90s less than that of the S&P500, it has a low beta- this is desirable when I think the general market may still have lower to go.

Names like O, VOO, VTI etc are some of the tools I think that can help realize that goal. VNQ is also great from Vanguard for some one like me who really does not want all the risk owning RE outright, plus maintenance costs etc . VNQ is also more diversified however it has the same risks as any REIT. As rates rise, the underlying properties lose their value.

I avoided this O name and was pretty neutral when every one was bulled up on this around 65-66 but I think here around 50-55 they look nice to me.

AMZN

With AMZN, my LIS is 116 dollars. I think if this LIS holds, we may test 127-130 on this name. They report on the 27th.

What is a LIS?

LIS stands for Line in Sand. For me there is a level in all things that I look at where I think if we close below, then my thesis has been wrong. In other words, it is my stop loss level. Once we close below a LIS, there is nothing more for me to analyze, I was wrong. I may reconsider the idea if we happen to retake the LIS, but in many instances a LIS that was once a support could become a resistance. I hope the concept of LIS is clear. This comes naturally for seasoned traders but at times when we are very new to this, then it may not make sense.

AAPL

As I said, AAPL is the big elephant in the room and it keeps staring at you when you do your analysis and prep your levels for the week ahead.

For me, this week, 144/145 is key LIS on AAPL. It is now trading around 147.

I think if we do not see a Daily close below 144, we may want to retest 151-152 on AAPL. I have mixed thoughts on AAPL this ER. I have been an AAPL bear from 180 , and it sold down to 130is.

However, I think AAPL product and service sales may remain strong in the US and it may suffer elsewhere. Dollar strength may also weigh on their profits due to FX conversion.

At any rate, if we hold 144 this ER, I will think it may float up to that 152 and we will reassess our thoughts there.

On the flip side, I do think AAPL of all the events next week has true potential to cause a large volatility event in the S&P500. May be even the last one month of balancing could be leading up to this earnings on Thursday.

My key levels in the S&P500 Emini

Tactically, I would want to see if the UK PMI as well as the consumer confidence on Tuesday cause any softness in the market.

My key level this week will be 3680.

In general, I see the bears now need a Daily close below 3680 for next bearish raid. I have been right so far in over last month these prints around 3600 are being supported and the auction this past week has provided some food for thought that being the case. I think as long as we do not see this weekly close below 3600, it keeps the narrative alive that we could see a test of 3950 on the Spooz.

If we do not have a Daily close below 3680, I think we may make a push into 3825-3850. We closed near 3760 on Friday.

Scenario 1: My initial level will be 3700/3710. I could see the market hold if visited for a test again of 3760.

Scenario 2: An IB close below 3710 or a RTH Close below 3710, may target 3680 which could be weekly support zone.

Scenario 2 above voided if we manage a RTH Daily (D1) close below 3680. I will share some updates via daily or threads function, if that is indeed the case.

On the NQ side, I think 11000 may act as support on weekly time frame. Now around 11300. We may want to push into 11800, if this 11000 LIS to hold with no Daily (D1) close below it.

I think the bears near this 3600 have tasted frustration this last month. The market has held up and digested a lot of hawkish data points. What if any of the data , like PCE or Consumer confidence were to come in dovish?

What the bears here want is a good solid weekly close below 3600 for the levels like 3400-3425 to materialize. If you see Chart A above, this balancing here around 3600 can bear fruit on the downside if we manage that weekly close below this range.

To summarize: event heavy week with AAPL and AMZN major earnings on Thursday. Markets have remained rangebound for a month or so now. This week may cause the trend resolution. My key level will be 3680. I will be bearish biased below it and will be bullish biased above it. The bears will need to get a Daily close below 3680, preferably after Thursday for it to hold sway. A close below 3680 on Monday or Tuesday may not carry much weight for me personally.

I will sign off with food for thought

It was at XOM around 30 and OXY in 40s that I became a bull on energy stocks. Both these names were shared here in the Stack. OXY is now slightly trading around 70 bucks.

With political expediency , the Strategic Petro reserves in the US are close to run out. They are at lowest levels in decades.

I think a) as this war drags on b) the economic output still remains strong , we soon become hostage to the OPEC as the country depletes its SPR.

We see that even as oil made new lows, the oil stocks did not. They remained stable.

I have said this few weeks ago and I will say this again - I think we have some sort of floor under oil prices due to these dynamics covered above and I THINK oil stocks may enjoy a summer or more of inflows due to these factors as well.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Thanks Tic, I'd also love your thoughts on META. The stock got punished during $SNAP's earnings but we are now below March 2020 levels. I lean bullish here but would appreciate your views.

Thanks

Thank you Tic.

I paid double to get in a fouding member's telegram. I've been waiting for a month to get in.

I left this messages few times. And you replied to send DM but you'd never checked. Please I want to be in there.