Weekly Plan 10/16 '22

No place to hide

Traders-

There is a fine line between what is priced in any given moment and what is still being deciphered or yet to hit the price. In my experience, anything that I read or see on the news, by the time it is seen by me (and others) it is either already or very close to being priced in.

So, I do not normally chase the news, unless to fade it.

I am back with another newsletter. Always remember this newsletter is my personal journal I document my levels and thoughts to prepare my self for the week ahead and I am happy to share it with the folks. This is for entertainment and education and should never be considered any thing other than that and certainly not recommendation to do anything else like buy and sell things ;)

Then there are some events and news which when they hit the wires, could only be proverbial tip of the iceberg.

One such development that I am learning more of is the US crackdown on the Chinese semiconductor industry.

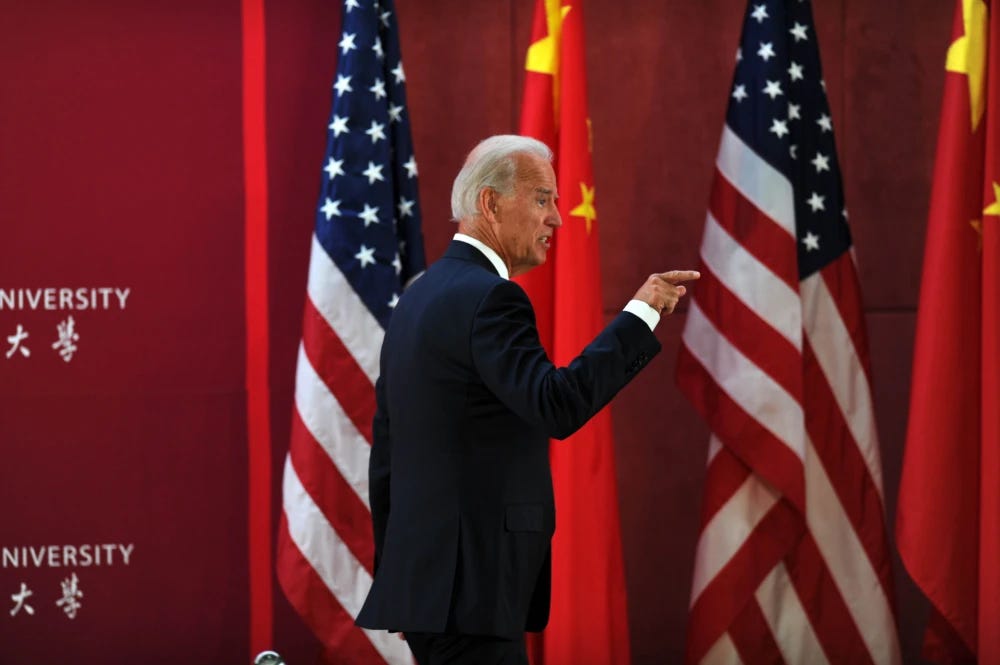

The US has been in economic skirmishes with China for over 4 years now, starting with Trump’s tariffs and verbal threats. I was personally never clear of Trump’s intentions and frankly I did not think they caused any harm to the Chinese economy, however the most recent spate of news emanating about Biden admin’s attempts to throttle the Chinese semi industry has piqued my interest.

This to me is the most broad based action taken against China in guise of “national security” and it clearly shows to me that the hawks inside the Biden admin who are adamant on cutting off any technological exports or know how are in-charge at the moment.

These controls against China will be implemented in a few ways in my understanding, main ones of those are:

Neuter the country’s capability to purchase and import any chip manufacturing equipment from the US or it’s allies.

Pretty much ban any technical know how consulting by the Americans to the Chinese companies engaged in such manufacturing processes.

Any one evading these controls may be jailed, if you are a naturalized citizen, you may lose your citizenship.

This news has been out for a few days now but I think if you look under the surface you see the extent and scope of this initiative.

My primary thesis for being bearish at start of the year and maintaining my bearishness in spring of 2022 was the Ukraine Russia conflict and how I thought that will cause a large scale demand destruction for many multi nationals.

With these news controls, I believe this is a continued step in de-globalization and upending of decades old global processes- whether that is logistics and supply chain, manufacturing or trade.

Now folks may ask what difference does it make to the American companies if China can not import a few chips.

Well, unless you sell hamburgers and coffee, it matters a lot- to companies like the AAPL and TSLA.

For years, they have perfected the logistics of cheap manufacturing and super high markups - these depend on cheap labor.

American engineers travel to the China and train their local counterparts on how to design and manufacture these devices- and the heart of these devices is the semiconductor. This may come to a halt.

Last but not the least, a large part of valuation of companies like TSLA is due to their projected growth in China. How much market cap should come out of TSLA if it can not make and sell any more EV cars in China?

Even if these measures are not ultimately draconian, I infer from these that trade hawks are in charge in the admin right now- and that is probably unlikely to change for next 2 years or so.

The reason I shared this blurb is to make my case that this is new catalyst - some thing I had not fully understood before. This news catalyst represents a new unknown for the market and the markets do not like unknowns. Keep reading and I will cover in more detail what impact, if any this may have on my intermediate levels.

What do you think about these new restrictions? Are these just bark an no bite or you agree with me that this is potentially seismic?

See the markets did not use to be this exciting 40-50 years ago. We did not have same level of retail participating in the equities and certainly not in the bonds pre 1980s.

This all changed after the marriage between the US and China (East and the West) after 1970s.

American economic structure morphed from more creation (manufacturing, heavy industry etc) to more consumption (import cheap everyday product from China). Along the way, debt and out debt based markets took off.

Having debt in last 15-20 years was cheap. It did not cost much to have debt. Most of us have cheap mortgages paying 2-3% on them. However, debt is hard. Debt costs to service and pay back.

So, I think with the trade hawks in this administration, we are going back to that era where there will be a premium on real, hard assets and production. There will be value for local labor and trade again.

This in itself is (potentially) good for folks who have been marginalized for so long. However, this may not be super good for inflated software and tech stocks. The divorce will be painful but if some of these manufacturing jobs can come back, longer term this may pay off for many folks who have seen their jobs vanish overnight and be offshored (to the extent the automation and robots allow). It will just not be a smooth transition, it is not a 1-2 year thing, we could say it is a may be a decade or longer process. We are seeing history in making in our lifetimes.

So have the stocks bottomed?

I have written extensively on this in last 3 weeks or so, and I will not repeat but here are my main thoughts in summary on this: