Hey traders-

Mixed day for me today.

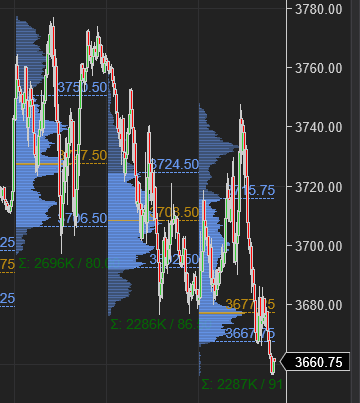

My plan from last night and my levels in Emini S&P500 were spot on. Scenario 1 was at play at the onset of the cash session, though these levels had played a big role overnight as well with both low end and the upper end of the session capped by my levels in the Globex session.

Note the levels shared are from Emini S&P500 and not SPX.

I use Emini as it is easier for me to view the OrderFlow data and it is also trading all night so I know where the key inflection points may be throughout the night. It is easy to convert these levels into the SPY as well as SPX.

I also often use the term IB which means Initial Balance. It is the first hour of trading of NYSE.

It does not matter what time zone you are in, NYSE opens for business at 930 AM EST.

Or 830 AM CST. Or 130 AM Hawaii time.

So, as I said, we opened around 3700 and Scenario 1 from last night was in play. At 3730, I sent out a message that I was expecting a higher test as long as 3722 held.

The resistance came in around 3750 which was the ultimate intraday target for Scenario 1 , we dropped to 3720 area. Broke it after some support and traded down to 3670, found buyers there to trade then as high as about 3700 again.

Overall, I was pleased with the S&P500 levels.

My other call regarding SNAP did not turn out to be good. I had expected if 10 dollar level held, we may see SNAP trade higher.

However, SNAP had weak guidance again, we dropped below that 10 dollar mark and at time of this post, the stock lost about a quarter of it’s value to trade near 8 dollars. Very weak action at the earnings.

From time to time , I talk about how I measure and use momentum and edge in my own trading.

We hear about edge all the time but I want to do a deeper dive today into this concept and use an example to show what a trader having an edge may look like.

The formula I use for edge is below:

Trading Edge = (Win/loss Ratio+1)*(Probability of win)-1

Let us talk about these one at a time.

Win/loss ratio is the ratio of your average win size by your average loss size. Let us say I make 10 points on average and lose 10 points on average. This means over a large sample size of trades, my average win/loss ratio equals 1.

Now let us say my system, does not matter what it is, let us say that my probability of win over a 100 trade sample size is 50 %.

What is my edge then?

Edge = (1+1)*0.5-1 = 0 . This means I have no edge and I can not make money on a large number of bets. If I add commission costs and I add internet fees and all then I am likely losing money on this.

Do I need to then find out strategies that work all the time , like 100 % of the time to make money then? What is my strategy only works half the time, but when I am right, I make 10 points and when I am wrong I lose about 5 points?

Let us plug these in our equation and let us see what we come up with.

Edge = (2+1)*0.5-1= 50%.

Note in above example I used win/loss ratio of 2 as I am on average having a win which is two times the average loss in this example. This is tremendous edge and in fact even the best run casinos barely have a 5-6% edge, yet they churn out profit most of the days.

Now what happens if our accuracy is super high, like we are right 80-90% of the time? And our average win to loss ratio are almost the same. This is a very difficult feat to achieve but let us say some one is right 80% of the time and win and loss are same size.

Are they then a lot better in terms of trading edge?

Take a guess.

Their edge will be barely any better than the 50% guy in our previous example, in fact it will be around 60%.

Even if I get a 10-12% edge , on a large enough sample size when the cost of making a trade is low or 0, I consider that as very good edge. And it is possible just even on having a 50% accuracy. Traders have a positive edge even when they have a 20-30% probability of winning when their average win to loss ratio is large (like 2-3 or more).

I bring this discussion today to share my personal thoughts on how I will approach any of my own levels. Now I could have any type of strategy. It could be a break out or a mean reversion or something more exotic like an indicator based strategy like RSI/MACD or even moving averages, it simply comes down to defining an edge and making sure it is positive, even if it is positive by just an inch.

A positive edge therefore I think is a must to the road to profitability. Yes, random large rewards occasionally may feel good, but unless backed by a consistent, positive edge, they will not suffice. This concept is key to understand before we can start getting into betting size and frequency distribution etc. I wanted to share this as this is how I visualize the trading problem. Now I do think some one intraday time frame can get by with a smaller edge as long as their costs are low and their trade frequency is quite high. But if I am making one trade a week or a month then I think I will need a much larger edge to make a dent. So to some extent I think it is a function of how frequently you trade as well.

So once I have executed a 1000-1500 trades, I know my edge very well - whether it is positive or negative. If it is positive, then I know very well what is going to cause a bad day for me. Assuming the win % does not change much over a very long period of time, if it has been 60% for last 4 years, then it is going to probably stay 60% for next year or more. So then that means the main variable is the win to loss ratio on any one trade- and I think this is the key factor that can make or ruin any one’s day. Must keep a watch on this. If my win to loss factor has been a 1 or 1.2 for years, I do not want it to be 0.1 or a 0.2 on any given day. Hope this made sense.

I will not get into the weeds of strategy development as everyone has their own individual style and it is not feasible to cover it here in this blog.

What is your edge? Do you have a positive edge?

My levels for tomorrow

So Fridays of late, last few weeks have seen us sell down. Normally the week will remain supported and then the Friday will come in as strong sell off day.

This is what I have been observing past few weeks. Will tomorrow be any different?

My key level will be 3630. I think this may act as initial support if tested, the low of past few composite auctions.

Scenario 1: To sell off more here, the bears I think will need to break 3630 and keep the market below it or we can float up back to 3670-3680 area. An IB close below 3630 then exposes 3590.

Scenario 2: An open or bids above 3700 I think favor a retest of 3730 followed by 3750.

At time of this post we trade around 3655. Additional scenarios may be shared in threads or thru my Telegram in the AM.

Today, I also saw some weird action in some names like VZ. I have shared this name a few days ago at 34-35 as how I see it supported.

Today it rose to around 37 bucks.

This is one of those companies which is knees deep in debt. A lot of debt that needs to be rolled over at higher interest rates.

If this action holds, I think the market is not buying into this whole argument that we will continue to see the rates keep rising. In this sense, I find the sell off in TLT and some of the other US bonds a bit excessive personally.

This is a FREE preview of my daily plan. Make sure you share your feedback in order to continue to receive similar plans for free in future.

Just as I was about to send off on the levels for tomorrow, I also happened to read about a possible review of Elon Musk’s companies and his acquisition of Twitter by Biden admin in guise of “national security”.

I had seen this coming and I had been saying for many months now that I do not think that sale of Twitter will be allowed to go through to some one like Elon Musk who is unpredictable as well as politically neutral. I think I will soon be proven right in this context and I think this sale will not happen. If I am right , this may actually be good for TSLA stock though as it lifts an overhang from the stock and may be a catalyst in the short term :)

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Thanks Tic. Any chance I can get access to founders telegram. Been requesting for a month as well. Sent a few DM’s.

Thanks Tic. Another great day for orderflow. The Market profile is my edge!