Folks-

Next week is a heavy event risk week, with the first set of key events beginning on 26th, Tuesday with the GOOGL earnings.

GOOGL has been steadily losing ground ever since it’s split and is now trading below a key 110 order flow level right before its earnings.

Personally, I think this chart above harbors a slightly bearish tint into the GOOG earnings, especially given recent earnings from SNAP and TWTR.

Then MSFT is another huge earnings on Tuesday along with GOOG and the stock is consolidating here below 270 which has been a key resistance in past few weeks.

Both Chart A and Chart B are weak but are balanced by recent action in TSLA and AAPL.

For instance, we see TSLA below managed to pull a fairly decent run off its earnings lows and has managed a close above $800 key resistance.

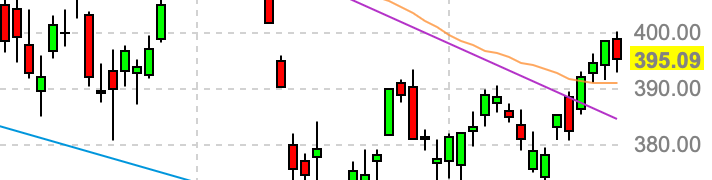

Finally, looking at S&P500 itself via SPY in Chart D below.

Chart D has SPY close above the key downward trend line right below 390 though Friday auctions as quite weak.

These two earnings events on Tuesday are followed by Wednesday’s FOMC rate decision as well as the FOMC Powell presser. This will guarantee fireworks.

On Thursday, we have the GDP numbers which is expected to add 0.4% to the GDP for the quarter as well the earnings announcements from both Amazon and AAPL.

Looking at some of the related markets..

Dollar eased off record highs and is now consolidating right above 105 which is a key level for the currency.

Crude oil cooled off and had a lowest close in over 3 months with it closing below 95 dollars a barrel which is a key level for this commodity.

TLT rallied hard and stopped short of $120 key order flow level this week. This stall looks weak ahead of the FOMC at a key level.

The relative under performance of GOOG and MSFT compared to TSLA and AAPL was a bit perplexing for me. I would think when you look at these 4 companies, AAPL and TSLA will be the poster boys of risk posed by chronically high inflation and low growth (or recession).

I would not personally give a lot of weight to TSLA guidance compared to what comes out of GOOG, MSFT and AAPL guidance next week. What you have with TSLA executive team is a level of unpredictability which I think needs a few more years to verify and trust compared to the usual what comes out of AAPL , GOOG conferences.

Weekly Auction in S&P500 Emini via Chart H below..

Chart H probably shows me presence or build up of longer term shorts here, but the bulls may not give up so easily. Read my thesis below to find out what levels may be at play here.

So what is priced in or is this a new bull market?

Last time I spoke about what is being priced in, I said at 3666 that a lot of current situations with respect to inflation, recession etc are priced in at that level. There was not a lot of sense in continuing to remain negative at that price point.

It’s time to revisit that now at 4000. I do think a lot of positive things are priced in as we begin approaching some of the weekly levels mentioned below.

This is an equilibrium and we will need a catalyst to break this equilibrium- whether to the upside or the downside, but probably to the downside.

This equilibrium could be the events of this week, whether that is the MSFT/GOOG, AAPL earnings or the FOMC /GDP. I think GDP and FOMC will not be enough to break the impasse and we will need a major earnings miss or a bad guidance from one of these 2 trillion dollar market cap giants. Roughly half of the Nasdaq Market Cap is reporting their earnings next week- on a week when we also get the FOMC and rate decision!

Furthermore, technically S&P500 and many key stocks have closed above their 50 day moving averages this week— this is an indicator observed by several funds and managers. I use it as a gauge of trend & momentum. A close below 50 SMA is bearish and a close above 50 SMA is generally bullish,

However I do think the days of S&P500 above its 50 SMA may be numbered and it may close below it soon and resume its downtrend . More on this later with the technical context.

Before diving deeper into next week, I want to recap last week's action for transparency and keeping a high level overview active for the continuous auction.

For new readers, I do recommend they read the below few weekly plans to remain abreast of my continuous auction levels and parameters.

Beginning of last week, my primary expectation was that 3870 may offer resistance and we could trade down below 3730 to find support or break it to trade recent lows sub-3700. The week started off quite well for this thesis as we sharply sold down from my levels into 3820.

However we could not trade lower than this 3800 area after Tuesday as the market tone shifted into another gear post NFLX earnings on the 19th.

This BTW was covered by me in my Tuesday plan. That is why I could not be bearish on NFLx at 190 and certainly not at 150 for longer term investment time frames . This turned out to be correct as rallied above 220 on Netflix immediately after its earnings .

S&P500 also found bidders presumably as one of key stocks like Netflix which was beaten down for so many months now found a new fresh lease of life .

I warned ABOUT this in my Wednesday thru Friday plans that I expected dips into 3900-3910 to be bought for a trip into 4000 which may act as resistance .

This was the primary theme for the rest of the week as we ranged between 3910-4000 areas for most of last week finding sellers at 4000 and selling off into 3940 on Friday.

On other earnings, specifically TSLA , my expectation was that the 780 level may offer resistance after the earnings and 730 may hold the floor as support , this was the case as the rally into 780 immediately after the earnings got sold into 730s . As expected , we rallied from 730 after having sold into it from $780.

What I did not expect was a continued rally above 780 onto 800 and beyond. To be clear, Tesla is one of my favorite tech stocks and I expect this to be bought with any dips. Remember a lot of folks who are regular pumpers of this stock own this stock probably at an average price far lower than where this market is . I like the fact that this company is a leader in a nascent one trillion dollar market . However the stock is too overvalued for me at these levels and I am willing to wait for lower prices . With recession probably around the corner, I may as well get my wish.

It is just that I personally can not justify this stock here at 800. I have had a good track record with this stock calling several 100+ ranges . This last week's events are reminiscent of prior events, especially around the earnings, where the stock will gap up to as high as 1200 and I would fade that move — only to see the stock shed 300-400 points later on.

Despite their stellar earnings , I personally cannot be a buyer here 800 and I will warm up to this stock on any prints below 600, preferably 550.

So these price action events last week have fragmented the market more so than the last few weeks - this is good. For a healthy trend down - or up- I think it’s better to have folks evenly divided, bullish and bearish rather than everyone leaning the same way. Last week has convinced many that some sort of low is in, in fact I think a majority of folks believe we have seen the lows and I personally like this outcome as it sets the stage for cleaner moves and an end to the chop.

While the sentiment seems to be elevated and begins to aggregate to one side of the equation (i.e the low is in), the technical picture is a little bit more clouded.

Average perception still on balance seems to be let’s dollar average into this dip as "I have this few grand in the bank being eaten by inflation so why don’t I just buy a few TSLA here and a few AAPL there".

My private view is any and all of this small retail buying will be fed to even more distribution by large accounts.

Speaking of AAPL and TSLA as I said earlier, in my view these two stocks are more vulnerable to economic slow downs, Chinese lockdowns as well as a chronically high inflation than some other mega caps like MSFT may be. So I am quite perplexed by this strength . I think the only thing that makes sense to me is that TSLA tends to have higher short programs whether outright short or through various options selling or put buying etc . It is also more sensitive to social media engineering and this just tells me that the institutional programs are selling into GOOG and MSFT with little fight from smaller buyers while the institutions may be selling into TSLA as well, but the constant trickle of small orders & short covering may be keeping it buoyant - for now.

Only time will tell if my thesis is correct however I would think unless the FED aggressively begins to ease and we avoid a recession, maybe I am wrong after all :)

Well, for me, the FED is a political creature. In this day and age of political division, they would not move at all unless the politics required them to. And I think to that end, the politics still demands that the FED address inflation as a priority as that is the dominant issue with a majority of Americans right now and hence I think they will remain hawkish or ATLEAST pretend to be hawkish - until a time comes, probably later this fall in September that the popular opinion turns to recession or unemployment situation, causing the FED to pause. That may be some sort of a bottom in the markets- albeit I would think a temporary one. I will address that if and when we get there.

If you are asleep by now, wake up, grab your coffee as the next section is kind of key.

This BTW is a free preview of my trade plan. My subscribers get up to 5 such plans every week with my commentaries on major events, key levels based on OrderFlow rather than just traditional analysis, you can also receive these updates in your email by subscribing below. Subscribe now before prices go up!

Given this context, will we have a huge drop next week? May be.. may be not. I would think the options sellers will be aware everyone expects a tremendous move next week and will have prepared accordingly.

What matters more is what happens the week beyond, and I think it will become hard for this market to find succor here at these unfair risk to reward levels and the line of least resistance IMO remains down.

My thoughts and levels for next week

I will be leaning on guidance issued by the trio of giants next week : GOOG, MSFT, AAPL.

My key levels for next week will be 3851 on the downside and 4060 on the upside.

I personally think the market has rallied off lows due to two reasons 1) the still expanding balance sheet of the FED on account of it continuing to buy MBS 2) the perception that the inflation has peaked.

I think the former is due to the FED wanting to ensure systemic functioning of markets rather than anything else (forced to choose between stocks and bonds, they will save the bonds ) AND I think the latter is priced around 4000-4060.

If they are hawkish on Wednesday, I expect the market to sell off . If they are perceived to be dovish, I expect the market to go nowhere (for the time being).

So there’s that. However it will be the mega cap earnings this week that will have my ears and eyes glued to it. I can not even stress how key it will be to the action this week!

An outright miss or negative guidance by any one of these 3 may cause the market to close below 3851/3900 on D1 time frame and I think that may lead to a retest of next support that comes in at 3770.

A beat plus a neutral guidance may cause more balancing here even testing the higher week level at 4060.

I will be surprised if any of them beats as well as issues a very rosy guidance.

Outside of these weekly levels, for Monday's session my LIS (line in sand ) will be 3920 on the downside and 3990 on the upside. Friday close was 3963.

I would expect ahead of key events starting to go down on Tuesday, we may find some balance between these two levels.

Let’s review the technical lay of the land

We see S&P500 has crossed not only above this 50 SMA as well as this trend line as well. While I remain bearish on longer timeframes outside of these weekly levels, the market can stay irrational for a long time (may be another couple weeks ).. a clear sense for me will be if S&P500 fell back below this trend line which coincides with my weekly levels. if this happens, I think this will be a potent indicator that the longer term downtrend has now resumed.

Any updates to this plan as well as my levels plus my updates in GOOG AAPL MSFT earnings will be shared with the subscribers a day before those respective earnings. Stay tuned.

Remember as always , all of this is my personal opinion. I am also expressing my personal opinions like a million other guys out there. This is my personal journal I use to prepare for the week ahead and I am happy to share with folks but none of this should be considered a recommendation to do anything other than read my personal opinions. Any and all of these levels and ideas may be wrong . Always keep that in mind.

Few other points..

There has been a lot of chatter about how the US dollar has peaked as the FED now takes a pause in hiking and the other Central banks like the BOC and the ECB, BOE etc get started.

I think before I declare a top in the US dollar, I will like to see if break that key support at 105. I will be surprised if Dollar has peaked here as I see it being influenced by the FED and the road map for FED really seems to be causing a recession so we can get rid of this pesky inflation problem. I am not saying they will succeed, I am just saying they may pretend to remain hawks for a few more months and that may keep dollar bid and other currencies subdued. This means even for something like Gold which I think has already or is very close to a decent low, may remain range bound or choppy here before it takes off. Remember a strong US dollar is FED’s ally in fighting inflation. If they lose dollar as well, it will light a fuse under inflation rocket, sending it to stratosphere.

NFLX

Netflix stock shared by me as being bullish at 190 rose to above 220 this week. It is now trading around 225. I do think it will not be a nice, clean ride up for Netflix if rest of the market remains soft. I think as long as 230/235 holds, we may see a 197-200 again on Netflix. Guidance from the ad giants such as GOOG becomes key next week. GOOG dominates the ad business with 90% of the business ownership, has strong margins and price power. However, if GOOG falters, I would think they take every ad based business with them. The nascent ad based business plans from NFLX may not be spared either in that case.

Some parting notes ..

Normally this price action as we saw last couple weeks will be enough to convince me that we have seen some sort of long term low. However in this instance while the technicals have been robust , the macro foundation does not support this for a number of reasons .

CPI vs real rates gap: this gap has never been higher in recent years . Even if we accept the argument that CPI has peaked (which I don’t think it has ), you are still talking about a 10% increase in YOY prices which is permanent now . Let’s say by some magic the CPI drops to 5-7% from 9. This is still extremely high and it means we are looking at 5-6% rose YOY on prices , this ain't coming down to 2-3% which is the sweet spot for bull markets with a 2.5% Fed rate

Europe: the continent is in a very deep mess and I think the full impact of this is not realized yet. They have soaring inflation with even wider gap in rates and CPI, they are already in recession , they are going to see more pain when it comes to the CPI due to their energy woes

Energy itself: oil has been steadily losing ground over the last several weeks. And now it has closed below 95 dollars. I personally do not think oil will remain this low for long and I think a 100 dollar chronic oil is more realistic than a downtrend in oil.

Due to this reason, I think this market, while may see volatility go down , may still manage to grind down for the next several weeks and months .

With VIX extremely low , what this tells me is we are far from the bottom. Think from FED perspective, they have come under tremendous attack and to restore their credibility the fastest path they have before the mid terms is to continue to remain hawkish. They think what they have done so far is working and they won’t see a reason to let off so easily .

They want a soft landing. What does a soft landing look like ?

Let me say soft landing certainly does not look like the CPI at 6-7% and S&P500 above 4200!!

The fastest path to a soft or a softish landing for this FED is S&P500 in low 3000’s to deflate this tremendous bubble . This is so perfect for them with unemployment still in 3% and the market so close to the 4000s. Bonds also helping them with yields lowered already by uninformed dip buyers thinking this is some sort of magic low. This FED IMO (in my opinion) will remain very hawkish UNTIL we begin to see the unemployment tick up. That could be as early as this Fall.

Things are going as planned for them at the moment and our well heeled dip buyers are proving to FED they need to keep pressing harder. This market is a dream come alive for this FED. So I think they will be hawkish with this TLT around 120 and they will be dovish with TLT around recent lows. Supporting the bond markets is very important for this FED while at the same time they battle this inflation. I think ultimately FED will not only fail in its battle with inflation but it will also not be able to save the bonds from making new lows. Powell is not a strong decision maker, if he was, he would be hiking even more aggressively , deflate the asset prices while these companies are still cash rich buying back their own stocks and putting their names on stadiums .. move swiftly, do it while the unemployment is still low at 4-5% and spare the folks a prolonged recession. If this leads to S&P500 in low 3000-3200, it is a price worth paying IMO if we can avoid runaway inflation and a very deep recession.

Do you agree ?

Ultimately IMO none of this will be to benefit the S&P500 bottom hunters.

While this logically makes sense, the market can remain illogical for extended time frames . For macro to align with technicals, I think we need a daily close below 3900 (now 3963). Absent such a close, the range bound conditions may continue and I can see the S&P500 trade up to 4060. I could see NQ trade up to 13000 (now 12400). I think the bears want to see a daily close below 11800 in NQ. They want to see that Daily candle close below 3900 in Spooz.

What do you think? Drop me a line below

If you enjoyed this newsletter make sure you like and share this with your folks so we can spread the message of tape reading with trading community. This was a FREE preview for folks on eve of this historic week. Subscribe below to receive a plan like this almost every day the market is open and ticking!

To summarize: we are close to a meaningful resistance in S&P500 market IMO. That number could be 4060. On the downside, 3851-3900 is a key level which if we manage to get a daily close below will probably unleash a bout of good sized sell off. Some other shorter term intraday levels have been shared above in prior sections.

Just from a risk-event perspective this week is unique, maybe it’s historic. I do not recall a week where we had the FOMC, the GDP, the earnings from giants such as GOOG, AAPL, AMZN, MSFT all crammed within 2 days out of each other. This is a recipe for volatility and while volatility can create opportunities, it is also a double edged sword. Whether right or wrong, I will be sharing my thoughts and opinions with folks every day and hopefully we are able to stay on right side of the market every day, wish everyone the very best of luck

Be nimble. Trade well.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

This is great tic ; ready for another profitable week. Just as fyi i went from making $2-3k a week and last week made ~25k. I never thought I could do that -your guidance got me there. thx you

Initial jobless claims has been increasing bit by bit and may not be a good sign I feel. In the East Bay, CA, a few months ago people who (over)paid $1m-$1.3m for a regular 3-4 bed home are seeing their neighbors list for $900k and still listed after a month, as opposed to being pending in a week. Those buyers might be negative equity in a short few months. I have seen the same open houses week after week. Not great for psychology. Hope you are having a great weekend, awesome read as always!