Folks-

My plan last week had called for resistance at 3950. I was quite bearish even though a lot of folks were already calling for 4000, and some were also calling out for a test of 4200 last week after prior Friday’s rally. I thought this was strange as we had barely cleared 3900 on a Friday! This was a classic bear market rally.

The stage was set for the week on Monday itself with the auction going no where after supposedly such a great Friday the week prior to it.

Well, the floor fell off on Tuesday and we saw a tremendous trend day , losing about 150 points within one session. I remained a bear on Wednesday, Thursday and Friday where my levels capped the market on both ends. On Friday, in the last one hour we saw a sharp rally which I had not expected but it did come once we closed above my 3790 key order flow level. The market rallied about 1% in last one hour.

Not only did my levels did quite well to contain the market, some of my other ideas like PLTR, Oil, OXY, TSLA and AAPL did quite well. Read the link below for my plan from last week.

In this newsletter, I will try and explain my personal opinions on where I see the next 200-300 points in S&P500 come from. I will also opine on several topics including some key tickers like TSLA and AAPL.

As always remember, these are all my personal opinions and nothing more and should not be treated as any thing more than my personal 2 cents. This blog is a personal journal for me and I use it to prepare for the week ahead. I am happy to share the levels and my thoughts with folks who like my work and have subscribed.

Here is the link to my previous weekly plan for those who may not have read it yet.

On top of that, my work is based on level 2 analysis. Level 2 is same as tape reading which basically means an analysis of all the trades that take place on any given session. While chart based analysis can see the static picture of the market in any given time frame, order flow or tape reading is a bit more dynamic in the sense the order-flow can change from minute to minute or hour to hour. I rarely use any charts and when I do it is for benefit of folks to show them an example. Due to the nature of my methodology, my view of the market can change and this is why I usually have 2 scenarios every day at a minimum while I retain a longer term bias.

My longer term bias since January in the S&P500 and since last Fall in the meme and Russel type stocks has been sell the rallies. I became a bear in the S&P500 in January at 4800 and we have shed about 25% of its value since then. I have been a major bear in related markets like Bitcoin and TLT. I have been a bear on names like AMD and AAPL and NVDA for several weeks now. If you are still with me, read on what I may be seeing this week which may dictate what we see for next several weeks leading up to the AAPL earnings and the FOMC in last week of July.

Let us take a 10000 feet view of the market

Before diving deeper in scenarios and levels, let us look at some of the related markets and SPY itself.

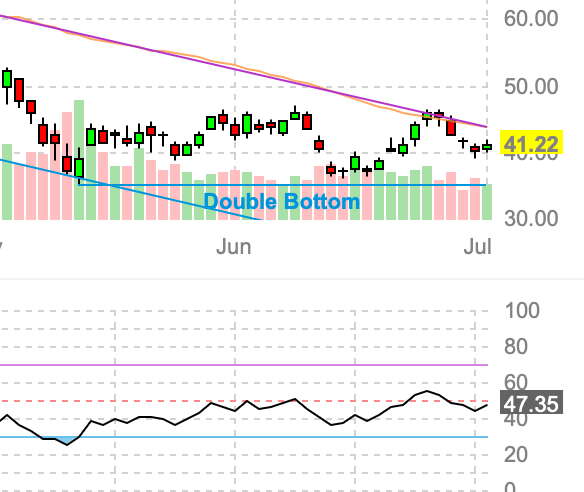

Chart A above. This is a common theme in other risk names like QQQ and ARKK etc, not just limited to the SPY.

You can see, and I am using this as an example chart to show what I am seeing , you can see this is classically a very bullish pattern potentially. We are seeing a higher low in the oscillator as well as potentially a higher low in the index itself. So, no doubt this looks robust technically. Does the order flow and the fundamentals support this too or this is just a trap? Read on to find out more.

Chart B ARKK. Similar technical patterns as Chart A above. But are the charts telling the full story?

Few other things I want to talk about

Bitcoin

The fall out from Bitcoin crash this last month continues. Three-Arrows was the latest to fall victim to this mania and the hedge fund filed for bankruptcy last night in a Manhattan court.

On price action side, Bitcoin rallied sharply from my 17500 level last week and my newsletter called for resistance at 22/23K last week.

Indeed we have since sold down and are hanging now near the lows around 19K this week. Bitcoin is kind of in similar boat as Palantir PLTR when it comes to the sentiment and fan following which borders on cult following IMO.

BTW I had also called for a short term top on PLTR last week in my newsletter at around 10.5 and we fell below 9 this week!

PLTR at least has earnings and it has revenues which Bitcoin does not. Both do have a very strong sense of loyalty and sponsorship from their patrons. This is good. Not necessarily bad.

However, what is working against Bitcoin in particular is the amount of spamming and bad players who are in it to benefit from the mania. A lot of companies were simply Ponzi schemes, offering “yield” on Bitcoin anywhere from 5 to 20%. This is as if Bitcoin had earnings which it was returning to it’s coin holders! No, this was all based on it’s price appreciation and now that the prices are falling, these Ponzi schemes are also winding down.

For now Bitcoin is here stuck in this range, but I think as soon as this gives way below 17500, I think we may see 12000 after that.

Long time readers know I am neither a perma-bear nor a perma-bull but I will favor the side with most favorable orderflow. I am not going to venture out to say whether Bitcoin has value or not, or whether it is digital gold or not as that is strictly my opinion. However, I do think when it comes to a low in Bitcoin we are far from one.

The way I see this, there are several bad actors in this saga- from brokers like HOOD, to exchanges like COIN, to the miners like MARA and finally evangelists like MSTR. Personally, I do not think we get to the bottom until some of these fail. I do have a view that favors one of these going to 0 very strongly over the others, and long time readers know who that is. Once we see this, we see capitulation and in my opinion (IMO) we see some sort of low gets put in.

This is a FREE preview of my newsletter which I reach out to subscribers 5 times a week. To get a copy of this in your inbox delivered the day this is published, consider subscribing below. The basic subscription is absolutely free and gets you access to these free previews plus much more in educational content.

Read below post for a lot of free educational content.

The FED Pivot

We as a people, and I use this for us Americans but many other societies are similar now a days, are quite pain averse and that makes us short sighted at expenses of longer term considerations.

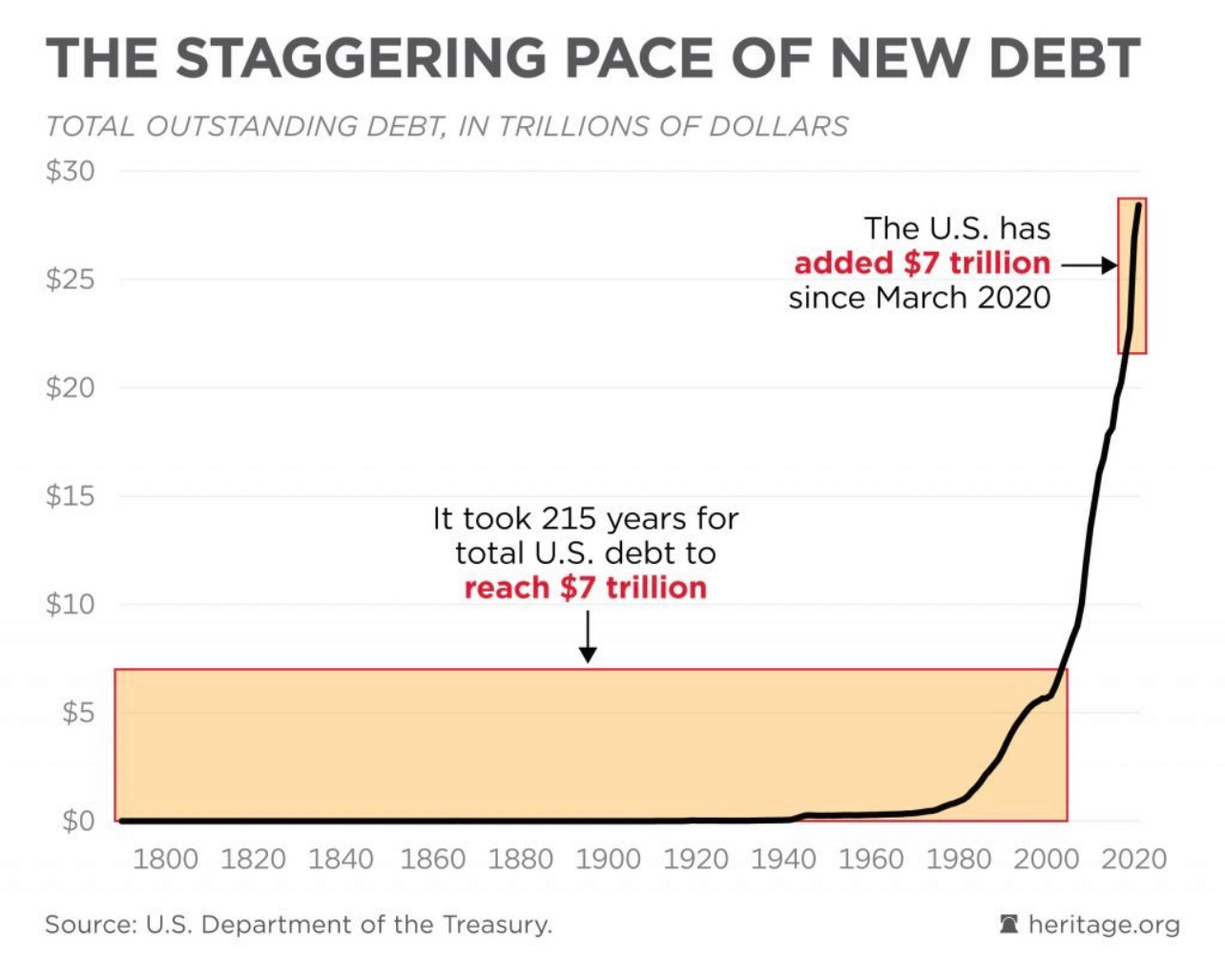

A classic example is what we are now seeing in the markets. We are down about a quarter on the SPX and we are now beginning to see calls for the FED to pivot. To start easing again, barely a month into their tightening has started. I would think if enough people demand this, due to being pain averse, we may see the FED buckle under political pressures and stop, and perhaps even reverse the course even.

Where will this lead us however? A FED easing into 10% inflation is a recipe for even higher inflation.

When you look at the task ahead for the FED, if you look at it from how much the markets have sold off, it may make a lot of sense that we have had a decent sell off and this is the time for the FED to wrap up it’s tightening and embark on easing. Given enough political pressure they may as well do it.

Politicians being politicians will go the easy route- if enough folks are hurt by the stock market crash, they would not care any thing about printing more money as long as it supported the markets.

However, we are in a spot where the market crash is quite large- blue chips are down 20-40% but there are some other stocks like SHOP and HOOD of the world which are down more than 80% off their highs. This market crash impacts folks, it impacts their pensions, their retirements and it is painful - but it is nearly not as painful when looked at in relation to the pain inflation is wrecking on folks. Inflations impacts 100% of the people. Market crashes do not impact everyone. Now every one wins if inflation peaks and goes down on it’s own.

But I dont think it will and there are 3 main reasons for it.