Weekly Plan 1/8/23

Traders-

Following a process is important in order to develop a methodology which is based on objective analysis and follows the evidence rather than making guesses based on nothing more than feelings.

This was all the more clear this week where the support at 3800 held like the rock of Gibraltar in face of immense bearish opinions and feelings where several folks were calling for anywhere from 3500 to 3600 after the release of the FOMC minutes.

This is not a criticism of any one in particular - but a reminder in general to be cognizant of the message of the tape and what the market is actually doing rather than what one can think the market is going to do.

From my perspective, I was bullish at the 3800 support per my week plan.

Here is the link. Make you read the publication if you have not yet already.

Some area of interest near 3800, and I quote from the prior plan:

When you look at these two factors, there is not a whole lot of catalyst at the moment for this market to sell off. Market says well there is no recession as far as I can see, and then the market figures the dollar is in no hurry to make a new high. Thus, it remains range bound, eating up all the juicy put premiums.

If you are bearish here at these 3750-3800 levels, these factors are not helping you. This is why I am not very bearish here near these lows around 3750/3800, unless we actually break them and the Dollar spikes because who knows when recession will come, right? If this happens, this support will become resistance. That means I am reacting if that happens rather than predict something which has not happened in almost 15 days now!

This is why I think the longer term sellers may at-least want to wait for higher, more favorable levels like 4050-4100 to re-emerge.

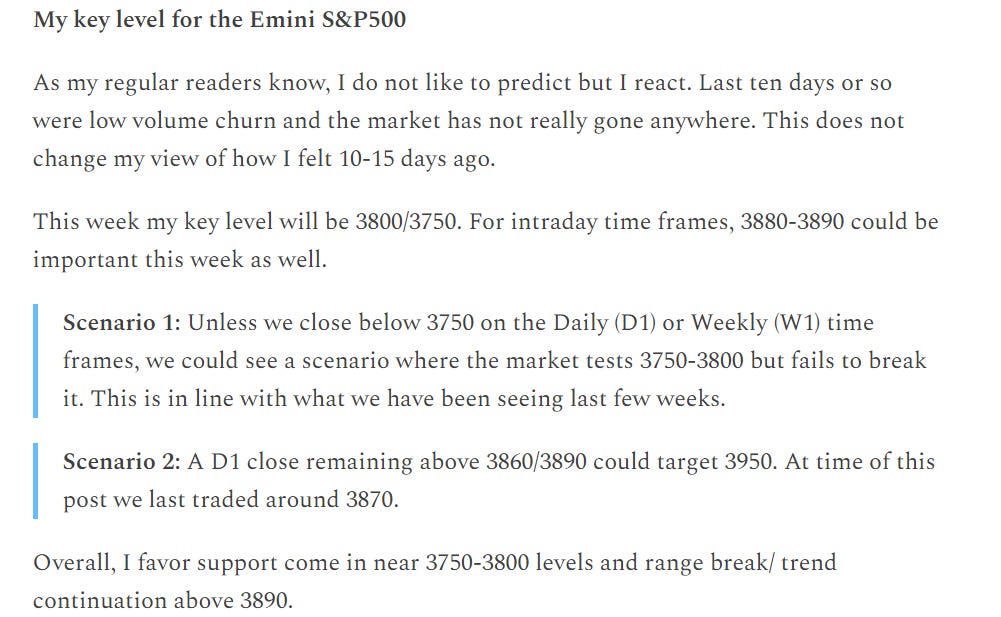

The 2 Scenarios below from last week:

Thus we see, analysis based on tape reading can be objective and even when it seems that the analysis is at odds with 99% of popular opinion, it can withstand the pressure. Opinions may not move the market. Orders do.

Please note that the price is going up tomorrow night. I do not have a timeline when the price may stop going up - but I can tell you any one who is subscribed and does not resubscribe will remain grand fathered at current monthly prices. Prices are now roughly 20% higher with some more room to go up.

This was overall a good week for the stocks.

SPY is up about 1.5% on the week. Some of more common OrderFlow names like SCHD had a better week - it is up almost 2.5% on the week.

TSLA had a bad relative week against the benchmarks - however, it had a better performance on Friday.

What is more noteworthy atleast for me is that the TSLA relative volume exploded last few days. If the general market holds here, I think this will help TSLA bulls in days and weeks to come.

Tesla right now is evoking a lot of emotion for both bulls and bears. A lot of long standing TSLA bulls, some of who were exhorting others to “mortgage everything” and go all in to TSLA at 350-400 only last year, appear to have capitulated this week near 52 week lows. Bearish noise around Tesla stock I think hit an all time high. Short sellers are up billions of dollars on this stock, having shorted this at 300-400 range. New shorts may have joined the bandwagon - however I do think fresh shorts here at 100 area are in a dangerous spot.

Do not get me wrong - I was a TSLA bear too for most of last year, where I said any rallies above 400 may be short lived and unfair. I reiterated this view at 330 dollar area where I was met with similar disdain that I am meeting with the bears here near 100 now, only difference is I took a lot of flak from the TSLA bulls at 330 for my views.

Now near 100, I personally do not share the enthusiasm for TSLA bears. I think if you believe TSLA is a car company, then you are justified in thinking that it can go trade 20-30 dollars or some other ludicrous targets I am hearing. I personally do not think it is a car company, I think it is a software company and they have put a car around software- it is the same thing that AAPL did putting a phone around software a decade ago. This is my personal view and I think any one who considers TSLA just a car company is wrong.

Other factors that may help TSLA bulls is China reopening and lowering of prices in China may all contribute to strong sales. I am not worried about margins as they can still have robust margins driven by add-ons. I think 140-150 is a decent longer term resistance in TSLA if we can trade it.

What do you think ? Is Tesla a car company or more than that?

Last Sunday, I also had shared quite a few names which I liked in the overall market. Most of them had a good week and many of them were relatively stronger than the general market.

I want to summarize some of that action here below for transparency. Always remember this blog is my personal journal I use to prepare and document my thoughts on the markets and should not be construed as any thing more than that:

Financials/Banks (XLF): About 3.2% rally this week, about a percent higher than the general market.

NEM/SLV: NEM had a 11% week and is up about 30% from the lows. SLV is now up more than 30% off it’s lows.

BABA: up 20% this week alone. This was shared by me around 79 with my bullish bias.

CCL: a 15% week.