Weekly Plan 1/1/2023

A New Start

Traders-

A very happy new year 2023 and I sincerely wish every one who can read this message, grows this year and achieves whatever goals they set out to achieve.

What you are about to read for next few minutes is my personal opinions and thoughts on where I see things headed in 2023 - this should not be considered anything other than my personal 2 cents.

I would not blame any one for saying good riddance to the year 2022 that was in markets ! This is a year that the most would rather forget. On the equities side, it was the worst year dating back to the 2008 Great Financial Crisis.

S&P500 lost about 20% this year. Technology stock heavy Nasdaq actually had an even worst year, losing about a third of it’s value this year alone. Even the small cap Russel 2000 had a better year than the Nasdaq.

Nasdaq stocks came under attack primary from the rising rates - some of the worst performing stocks in this index in2022 were actually the former stars of 2020 and 2021.

TSLA lost about 66 % of it’s value in 2022. NVDA shed half of it’s value which was quite a bit better than it’s losses in Fall of 2022. Some of the more exotic names which were all time favorites of retail investors in 2021, like AMC, lost 75%.

The award for biggest losses however goes to the crypto stocks like COIN that lost 85 % of it’s value in 2022. Miners like MARA lost 90% ! These stocks were hit by scandals, scams and eroding confidence in the crypto coins.

Amidst a sea of these losses, you will think you could have escaped them by diversifying to bonds.

Nope.

2022 was also an exceptionally bad year for the bonds and certainly very bad for bonds and stocks when held together. Egged on by high inflation, which at it’s peak touched 9%, coupled with an extremely strong dollar took the wind out of bonds.

The 30 year treasury bonds lost as much as 35% of their value , a drawdown not seen in decades! This was undoubtedly the worst year ever for stocks and bonds as far as I can remember.

Amidst this carnage, did any thing survive?

Yes.

In fact it did not survive, it thrived.

Driven by the geopolitics and war , the S&P500 oil stocks and the energy stocks in general did very well. XOM rallied 80% on the year, almost doubling. OXY more than doubled.

Many of these, like XOM and OXY were shared by me earlier in the year. For instance, XOM was shared by me near 60 area before it rallied to almost 120 dollars this year. OXY in 40s.

It is hard to believe that the oil itself was trading for less than 0 dollars (negative) only a couple of years ago as there was no way to take physical delivery of the contract due to collapse in demand and saturation of storage. The crude itself was little changed this year , however other energy products like the heating oil and natural gas as commodities had a bumper year!

For those on the active trading side, the one theme that worked for most part of the year was that the stocks and the US dollar had a perfect, inverse correlation.

This in large part was due to the interest rate sensitivity of the stock market. This is something I have not seen in years - mostly because the rates have been zero (0) for almost a decade. This year was different- if you caught this early on in the year, and were able to recognize the havoc that the higher rates and as a result the higher US dollar will wreck on the growth darlings like TSLA at 400 or a META at 300, you stepped away from this incoming freight train in time and were not crushed. I remained a bear on tech darlings like TSLA and AAPL for most of the year, starting at 400 and then again at 330 , however I did warm up to TSLA near it’s recent lows of 110.

Back in September-October, I made a call here in this Substack that the US dollar at 114 and the US yields near at 5% have peaked.

The turned out to be alright as we have now sold off about a 1000 pips in the US dollar to end the year near 103 and saw a huge rally in the treasuries of about 20% from those lows made back in the Fall.

Will this trend continue in 2023?

While I think the US dollar will not go below 100, I think it will remain range bound and I do not think that the US dollar will now make new highs in this year.

This does not mean that the equities will continue to dance in tune with the US dollar.

I do not think so.

I expect this relationship to break at some point in the year and I expect the equities could resume their downtrend due to a new, more negative theme - the US recession. More on this later with specific levels I will be watching.

The following factors will be IMO the key forces acting on the S&P500 this year:

The extent of the US recession - no recession, mild recession, severe etc

The extent to the housing market downturn - I think some cities are much more vulnerable than others. For examples, I continue to see weakness in SFO, Seattle, Austin, Portland, Phoenix etc. headed into the 2023.

The China reopening - this is good on many fronts but the export demand will remain soft.

The geopolitics/ Ukraine Russia war - end of war, continuation of war, or escalation of war.

I am not going into all the mechanisms of a recession and how it works it’s way into the S&P500 pricing, however, let us look at another relevant metric- AAPL stock price.

AAPL stock is down about 25% on the year. It’s PE ratio has also been hovering around 18 which is historically low but not low enough.

I became a bear on AAPL at 180 and has maintained that we could see it trade below 100 dollars from last year or so.

AAPL is big.

It is very big and constitutes about 7.5% of the S&P500 index. It is even a bigger component of some other benchmarks. For instance, Warren Buffet’s Berkshire is made up of almost 40% AAPL.

Almost every one who passively invests in the S&P500 and the US stocks, some how ends up as an owner of AAPL. There is no way to escape it. When you look at it’s price performance, it is down about 25% but I think there is more room for downside.

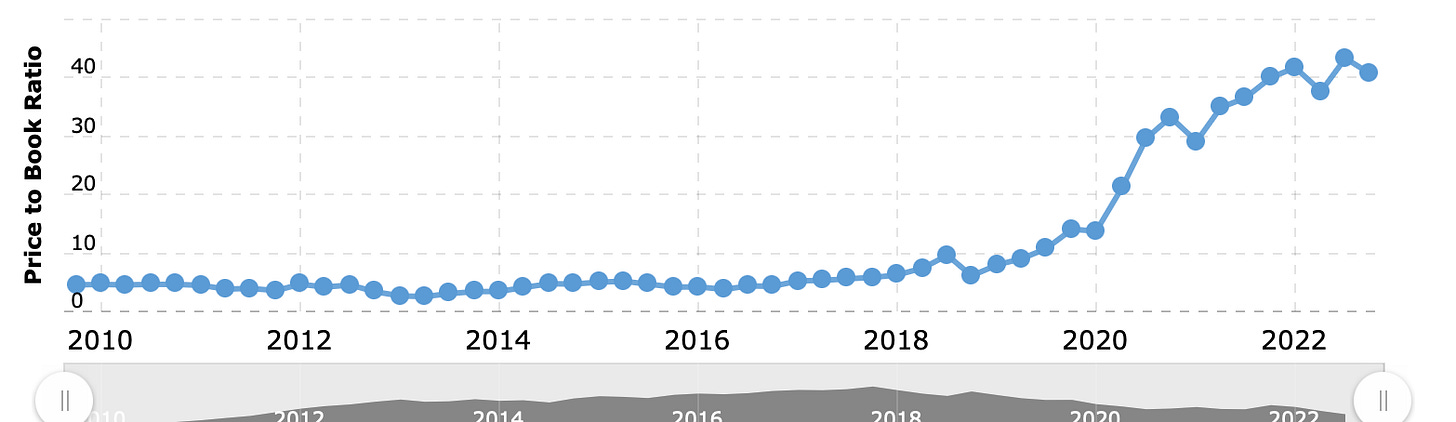

Look at one key metric for the stock- it’s price to book ratio.

This is extremely high in my view and I think it needs to come closer to it’s very long term averages of about 10-15 . It is 40 now!

I think this will deflate in the recession and as a result it will exert pressure on a lot of indices and ETFs that hold AAPL as one of their main constituents.

This is why I do think AAPL could grind down below 100 and I think those will be attractive levels for me personally.

On the Emini S&P500 side

Let us zoom out from weekly and daily auctions to where I think in the structure we are at the moment.

Last year at 4800, I became bearish on the S&P500 and remained a bear for most part of the year , with few exceptions where I called formation of large sized swing ranges.

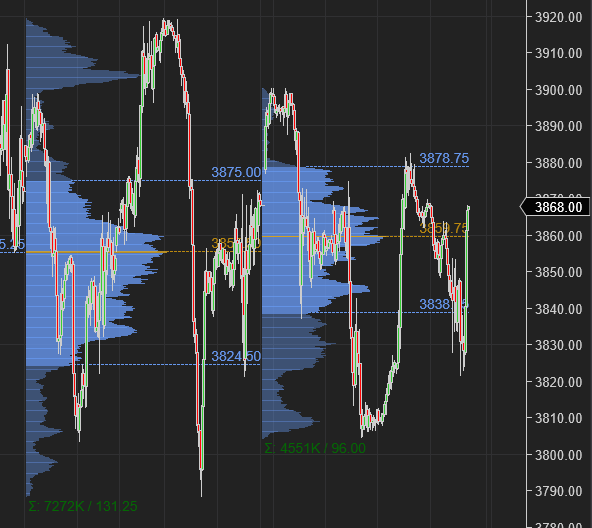

Most recent of these examples was when back in September I called that further action below 3500 may be hard to achieve unless we tested 4150-4200 again. This was a good call as we rallied above 4100 before finding longer term sellers to retest 3800 last month from that 4150 area.

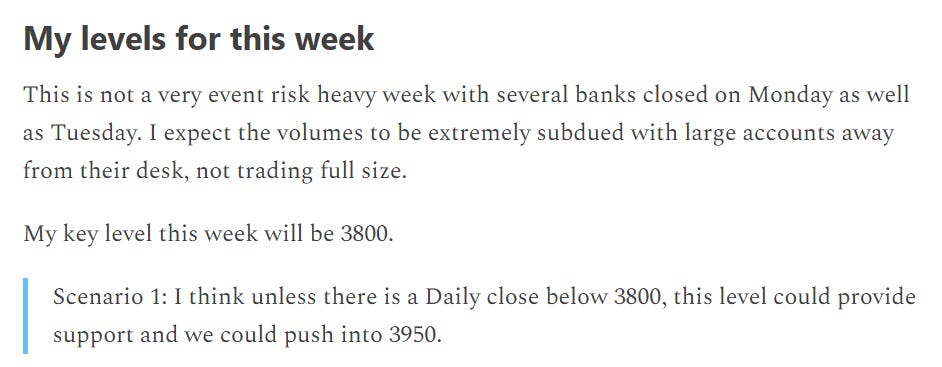

At 3800, about 10 days ago, I called that further bearish action may come but come on a Weekly close below 3750-3800 zone. This level has held for last 10 sessions. Several attempts have been made to take it out but all have failed at time of this post.

BTW here is a link to my prior weekly plan with my primary bias at 3800:

The above post also touches upon how I identify trending versus bracketing markets. This is a key concept.

We saw this in last two weeks - many become very bearish at 3800 and they become uber bullish at the upper side of the range - only to taste frustration as the market goes the other way. Most recently we saw this on Friday as folks became very bearish at that Daily LIS level 3820 only to see a 50 point rally in less than half an hour to close the year at 3870!

On an admin side note, I want to share a few notes which hopefully could answer few questions about pricing of this Stack:

The Substack chat feature is now fully operational. You can join by clicking on the link below but you would need to install the Substack app first which is available in the Play/App stores. This chat has allowed more real time updates to be shared with the subs. These are not every day but I think they are valuable in very high volatility.

This newsletter goes out almost every day- it fully journals my personal plans and levels and stocks which I am myself watching. I am happy to share these with the folks. This journaling has helped me personally as well to stay focused and be more diligent about my own research. It has helped me stay on right side of the momentum - for most part. Similar services can cost up to 100 or even 200 a month and this publication is still a fraction of that cost.

I also think most part of the year, I have managed to remain pretty contrarian. I like to maintain that and part of that is belonging to a smaller group of traders and not chasing crowds.

The features like Chat will only increase in future and as we bottom and rally from those lows, I think a lot more names will pop up on my radar which I am happy to share. However due to this increase in functionality , the price also has to go up to maintain exclusivity. To that end the pricing will go up in the new year. However any one who has subscribed already and does not resubscribe remains unaffected by these changes.

I also invite any one who is good at any thing, and most of are very good at some thing, to start their own Substack. Substack is the new face of publishing- you set your own terms to publish whatever you want. Start your own Stack and drop me a line below so I can check it out ;)

So, now going back to the Emini S&P500..

On longer time frames, we are technically in a bear market in the S&P500, Nasdaq, Dow etc. The average bear market age tends to be about 10 months. The average declines can be 25-30%. Most, not all bear markets come with a recession, this one has avoided it yet (dependent on how you measure a recession).

There is really nothing average about this bear market, as the macro factors are all so unique. I think this is the most unique macro year in almost 50 years. In 2022 , we shed 20% on the S&P500, however at the lows we were down around 25%. Rising interest rates and stocks do not get along very well. This has been seen time and time again- there can be decades where the market goes no where because the rates were going up!

Now will 2022-2030 be the decade that the S&P500 goes no where? I do not know but you can at least see all the ingredients are there if this turns out to be so.

Keep reading where I think the S&P500 Emini may bottom, if it bottoms this year. Plus my views on crypto, trends, macro and much more. This is a very important post and you do not wanna miss it !