Hi guys-

Excited to share another installment of the weekly plan where I will be discussing the following-

Has the general market bottomed and where do I see it head over next after 4000?

My view point on names like AAPL, TSLA, NVDA etc

My thoughts on some related markets like the oil and gold.

Some earnings and my thoughts on the action on them next few days to weeks.

Remember as always these are my personal opinions, there is nothing more to it than my preparation and levels for the week ahead, which I am glad to share with folks here in the Substack.

Let us start with a quick recap of the week that was

Here is the link to the last weekly plan

Both of these are important weekly plans and if you have not yet already, I will recommend that you review both of them.

The Friday close on the 6th was near 3900 and I was bullish for a test of 4000-4050 this past week. I quote from the week before:

Scenario 1: I think unless there is a close below 3845, we could see SPOOZ supported for a test of 3950, followed by 4000 upon a daily close above 3950. Dips I think if any into 3845 could get bid up.

Scenario 2: A Daily close below 3845 could target 3750 which may get bid up for a move back above 3800.

Overall, my longer term thoughts have not much changed. Unless we see some closes below 3750-3800, we could see 4000-4050 IMO retested.

I expected the line of least resistance to remain up and I thought names like Gold could be supportive of the stocks. Gold BTW had a stellar week, rising from it’s close at 1840 to above 1900 within a week!

This could be validated I think also by below two scenarios:

BABA, KWEB etc : Longer term readers know I became a BABA bull at 70 dollar and change. It has had a good rally and is now trading near 110. I think BABA and Chinese stocks could have room to run. I think China reopening is bullish for stocks. I want to see as long as KWEB remains supported on 30 dollar area (now 34), I think we could make a push unto 37-40.

Gold- Longer term readers know my thoughts on Gold. I had called for NEM bottom at 40, it is now trading near 55 dollars. I think if Gold were to remain supported near 1840 (it is near 1860 now), it could support the stocks.

I am evidence based, thematic trader. I will become bearish if my thesis above is voided. Until then I think the line of least resistance remains to the upside and we could see a test of 4050.

Overall, a very good week for the equities and risk on in general - in fact the last 2 weeks have led to impressive performance across the board for the bulls.

Can the good run continue?

To answer this, I want to look at a couple of related markets and then dig deeper into the technicals , structure, order flows and sentiment.

But before that, a quick poll.

AAPL

Apple Inc is a key market when it comes to correlations with the general SPY market. It is up in sympathy with everything else but I think it is close to running into some resistance near 135-136.

While AAPL has lost 25% or so in last one year, I think on many valuation metrics this stock is very expensive still.

This is assuming everything else remains the same and there is no further deterioration in the macro. I do not see a significant improvement in the macro a year or two out for names like AAPL.

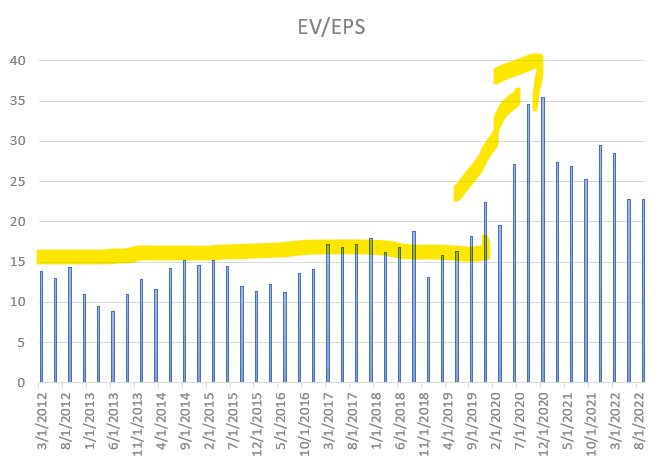

I had touched upon the potential pitfalls and perils of using metrics like PE ratio to valuate stocks like AAPL- both the P and the E can fluctuate wildly due to economic conditions and these for me are not very good metrics. A better metric in an instance like this for a stable and mature company like AAPL could be the value to EBITDA or value to earnings. If you look at this from this perspective, you can still argue that the AAPL stock is historically overvalued.

Figure A below. I need to get better in these newsletter graphics but I think for now this conveys my sentiment sufficiently.

We see above that historically AAPL has been in a 10 to 15 range with the pandemic fueled spending making this surge to 35. It has since come down near 20-25 but I do not think it will stay here. I do think these will deflate further and will settle near 15.

AAPL bulls will probably not find comfort in the fact that some of their competition, like Samsung, profits have collapsed YOY. Samsung phones tend to be mass marketed and are far cheaper than comparable iPhone devices. Sooner or later I think this will catch up with Apple.

Longer term, this is yet another supportive evidence for my thesis that AAPL for me begins getting attractive below 120.

Now let us look at some other usual suspects like the bonds and the Dollar

TLT

Regulars readers know I turned a TLT bull around 92 before it’s massive rally to almost 110. About a 20% move within a few weeks.

I shared my thoughts on how I see a potential breakout in TLT Play out for the equities a couple of days ago. This is how the technical situations now looks like for TLT. Chart B below.

On an admin side note, before proceeding further, I do want to share that the prices have now slightly gone up. This is to ensure we have the serious group of folks in the room. This is not the end to price hikes and I eventually see pricing taper out near 100 dollars a month. However, any one who remains subscribed at these lower prices will not be impacted. So this is not a bad time to join and be part of this orderflow community!

Bonds, and I use TLT as a proxy for the overall market will remain the engine I think for a time to come and the S&P500 will remain the caboose. In that context, TLT action is key.

Dollar/Gold

Gold which I have been bullish since 1600s and I recently reiterated my bullish bias here in the substack at 1700 and then again at 1800 is on a tear. It is now trading above 1900.

SLV which I shared my bullish bias at 16 is now almost 22. NEM which I shared at 40 is now almost 55.

Can this insane and wild run continue?

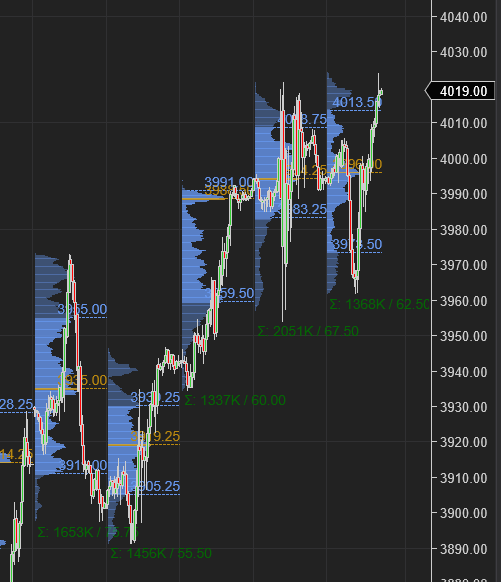

Chart B : 5 Day composite auction in the Emini S&P500

When you look at the Gold, it looks quite robust. It is now up about 250 handles from the 1700 dollar support I shared here a few months ago.

The main challenge when analyzing gold going ahead into 2023 and beyond will be to be able to answer the question - will it remain inversely correlated to the US Dollar and by that logic will it continue to be correlated to the stocks?

Last year or so, what have we seen?

Dollar goes down, Gold goes up, stocks go up .

Dollars goes up, Gold goes down, stocks go down.

Is this a time now that this relationship will breakdown?

I think so. I think right now the market focus has been excessively on the rate calculations and what the FED will and will not do. This drives the dollar story.

However, I think this focus will shift to the recession in a few months.

Once it happens, I do think that the Gold will go up and the stocks will come down. Generally in the US recessions, Gold has outperformed the stocks.

In 2008 - the gold was up 16% while the S&P500 crashed 37%.

In 2000/2001- we saw market crash but Gold up 5%

In 1970s, the Gold was up almost 100% while the markets went no where.

So there is historical precedence for the Gold to do better than the general markets in recessions and I think the technicals do look quite good in Gold right now.

From a key events perspective

Next week there is CPI news from various other countries like Canada, the UK as well as the Chinese GDP on Monday though the US markets will be closed on Monday to observe Dr. MLK Day.

We also have the US PPI on Wednesday.

A lot of FED speak as well ECB Chair Lagarde comments on Thursday/Friday with SNB Chair Jordan speaking Friday as well.

The earnings season is in full swing now however we do not begin seeing major earnings the week after from tech sector which could set the tone for these markets.

Tesla stock has been wild.

We have now seen about a 20% rally off the lows and the market seems to stall every time it touches 123-126 area. Tesla management also caused another flutter in the automotive industry by suddenly lowering the prices on all of it’s products by as much as 15%. This brings most of their vehicles within a range to allow some to claim the Federal EV tax credit to the tune of 7500 dollars - this puts the total discounts in the vicinity of 20% plus.

This move I think will have widespread impact for a long time on the automotive industry as some of extremely popular car models like the Model Y now become appealing and can price-compete with the likes of legacy automaker’s bread and butter offerings.

My personal view is that from a stock price perspective, the price cuts in Tesla cars are a gimmick. This will for sure lead to a surge in the demand initially and a drastic cut in the available inventory - however, it is key to keep in mind that the car industry in general is not going to have a couple of good years I think. I say that from a perspective of me not considering TSLA a car company but rather a tech company - so I am saying in the short term it may prop the price up, however, longer term this will not have a substantial impact until the market consensus recognizes that TSLA is actually a software/tech company rather than a car company.

So my take remains - TSLA stock is in a bottoming process longer term but this price cut in the US and Europe is a not a major contributing factor to that bottoming process from my perspective. If you want to celebrate the price cuts as some sort of miracle for the stock price , that is your prerogative but I do not believe this will matter much in overall scheme of things.

My levels for this week

So for this week, I really want to zero in on 2 key markets which I think could be instrumental.

AAPL and TLT.

On the TLT side, I think this breakout attempt has faltered- this could keep some pressure on the TLT unless we close above 107-108. I do think this market may not be in a hurry to do so yet. Chart D below.

On AAPL, I think 135-137 is key resistance and needs to be overcome by the bulls.

This translates to 4060 area for the S&P500 Emini for me. We are trading near 4020 now.

I think unless we see a close or two above 4060 area, this rally may fizzle out.

Scenario 1: Unless we see a Daily close now above 4060, I think we may see a retest of 3950 support zone.

Scenario 2: A Daily or weekly close below 3950 may target 3850.

The edge case scenario may be continuing FOMO on a close above 4060 this week and the next, however, see my notes below on how I see that ultimately resolve.

Slightly longer term, folks who read this post regularly know I was a bull at 3800 all thru December. This support held very well. I have been bullish last two weeks or so as well as I was expecting a test of 4050 or so.

This test is now happening. I think the next major move will require a break of 4060 on the upside.

I do want to share my thoughts briefly on the much anticipated FED pivot

There is renewed optimism for the longer term equity bulls that a FED pivot in now coming soon and that they will begin cutting rates as well this year.

Whether they cut the rates or not, I will not be too rosy about the prospects for the S&P500 any time soon. I think 4200 is a formidable resistance under many scenarios and will be hard to overcome.

Even if the FED stops or even if it reverses course and begins cutting rates aggressively, I think it may not be very beneficial to the stocks, many of which remain aggressively overvalued. See my posts about AAPL, MSFT, NVDA etc

These stocks need a full scale QE 4 or a QE 5 to pop to new highs again - absent that, I think it does not really matter whether the FED cuts or not. Appetite for another QE is not there right now- fiscally or monetary.

This means that below markets in my view are to benefit more from an impending FED pivots than let us say S&P500 or a meme stock like GME:

Bonds (obviously if the yields fall more)

Gold /PM (precious metals) - Dollar decline story

I would say even the banks could benefit if the yields stay relatively high without the economy falling through the floor.

This is why I am not sharing the same enthusiasm that many bulls are as far as the S&P500 goes when we approach 4200. Now if we are near the June/September lows, I may be singing a different tune but I am not there at 4200!

This Substack will be the first to know my most up to date views on this topic. If you have not already, make sure you subscribe below and leave me a comment if you agree with my thesis.

There is actually also the question of when more speculation about a FED pivot fuels, it ignites the fire under speculative commodities like the Oil. This means that Oil as a key input in hundreds of finished goods as well as energy needs, keeps inflation high for a long time. This means higher rates for a longer period. This environment is not very helpful for the equities to start with!

Some other things I am watching this week

A lot of the names which I shared in my first weekly plan this year have rallied hard- many of them are actually up 50% plus YTD. I think some of them may be able to use a resting period. Few notes on other stuff:

NFLX earnings

This stock is now up about a 100% from it’s lows which was close to when I became a bull on it. They report on Thursday AMC.