Traders-

We are about to sign off on a volatile but very good month of September for OrderFlow traders as we enter a brand new quarter on Monday.

I was bearish at the open today from Scenario # 1 from the trade plan. See this link below.

I reiterated this with multiple warnings on my Telegram and Twitter that how a crack in AAPL today will not be good for the S&P500 emini if we closed below that 3685.

This turned out to be quite alright.

As soon as we opened, we made a beeline for the lows .

During the mid day, we saw a weak rally attempt into 3670- which I warned the folks on my Twitter may not last and we could retest those Tuesday night lows.

Eventually we sold down more than 50 handles again into sub 3620. I had expected this and I had expected a lot of buy limit orders here. This is where we saw that “power hour” pump in the market and we ended back above 3660 at the open again.

Very good day for the levels today!

Not only emini levels very good, we continued to see good action in oil, weak action in AAPL, we also saw the car wreck that CarMax KMX stock turned out to be.

I was a big bear on this KMX stock and it ended way lower, lost about 25% of it’s value today. This was from my weekly plan.

On the earnings side, I had expected MU to rally off the EPS and it did rally off from the LIS around 47 to 50, but I was expecting a bigger move and that did not come through. This was really an earnings idea for me to see if it will rally sharply after the EPS and it just did not have the horsepower.

I was also bearish on GNRC and that stock fell about 8% today from the weekly plan after that initial attempt to rally due to the inclement weather.

Now tomorrow could be a little tricky due to the PCE inflation numbers.

PCE is one of the key gauges that the FED watches.

The good thing though is the number gets out before the actual cash session open and should give a good gauge of where the dice may land.

I do not have a prediction on the PCE as I like to react rather than predict these numbers which is really anyone’s guess . However I do think FED has a huge dilemma ahead of this numbers.

If it comes in too soft then the FED may have already tightened too much. Can FED really tighten too much though with almost 10 trillion dollars still on it’s balance sheet? But that is a question for another day.

If it comes in too hot and the bond market crashes, the FED then has another set of unique challenges.

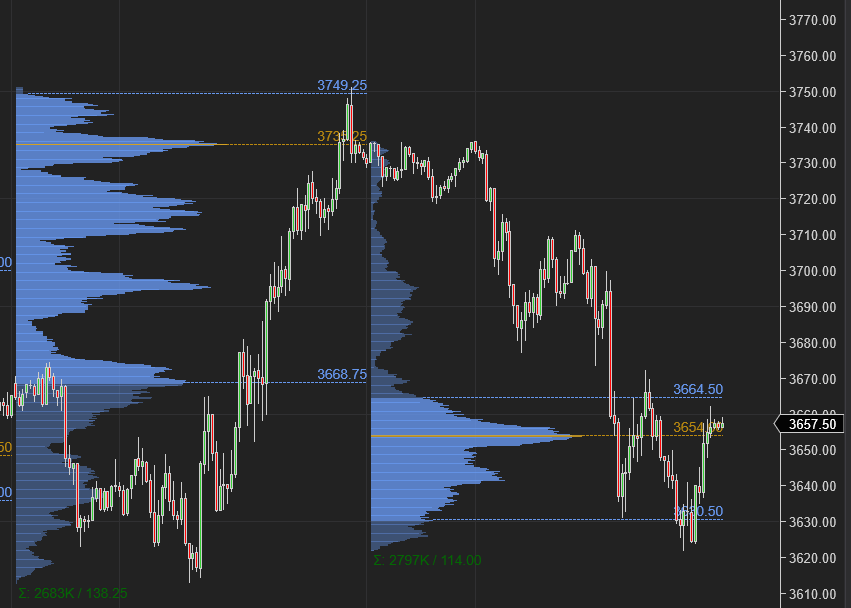

Chart A shows not much directional clarity for me personally. Only key thing to note here will be that b profile shape at the lows. If you have sold at the lows , may be you are a little nervous at the moment?

The S&P500 landscape I think will look very different tomorrow.

I predicted this range at last week in my plan and we have not really budged away from this over 4 days this week. However, I think tomorrow the decisive push may come.

Levels for tomorrow

More than levels, I think the bigger tell tomorrow will be if we are able to close below 3650 or above 3730 tomorrow? That will be a bigger indicator in price action where we may be headed next.

Scenario 1: If we open or bid above 3685 tomorrow, I want to lean on being bullish to target 3730-3750 zone.

Scenario 2: If we open or offer below 3630, we could see more bearish tape , going to retest some of the levels around 3580.

I will think a little mixed auction if we open and remain between 3630-3685, probably favors more range bound action that could break to the downside.

At time of this post we last traded around 3670.

I think it was key to note that while we sold off in equities today, we did not see see the same enthusiasm on the downside on TLT and Dollar notched up another day of weaker balancing at the lows.

In fact this was the decisive turn in the indices off the lows and if this repeats tomorrow, it may support the lows if retested.

At this point, I think the equity markets are paying a lot of attention to what the bonds are doing and I do think in this sense , TLT is acting as a leading indicator once again.

A lot of the action tomorrow is going to come down to the econ data tomorrow morning, an hour before the open. I will be sharing my thoughts and any updates to this plan may be shared on my Twitter or my Telegram.

Stay tuned. Subscribe below for similar insights, up to 5 times a week.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

I noticed the ability to get a notification when Tic tweets went away for me. Makes it much harder to stay updated with his current thoughts and I have to manually check his page instead of getting tweets pushed through. Anyone else having this issue? Tic, is this something you turned off? Thanks!

Ty for your services. Am not a twitter guy. Even though I haven't lost with you, since haven't got much of telegrams update intraday. Have decided to part away. 🙏🙏