Traders-

From my plan from last week, I had expected:

A 75 BPS rate hike and a very hawkish (verbally) FED.

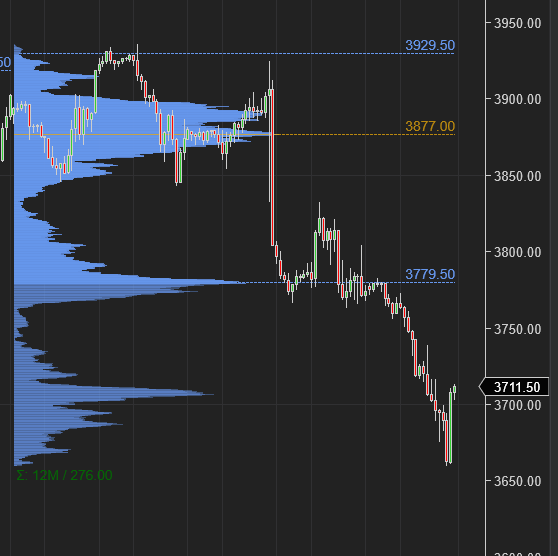

A sell off into 3720-3750 as result of this hawkishness from resistance at 3950.

A test of TSLA 310 and a failed breakout. The failed breakout was a low confidence call but I was surprised at the extent and speed of the decline of almost 50 points in a 310 dollar stock within a couple of sessions.

Chart A: Emini Weekly Auction. Multi nodal profile on high volume, but lacks confidence.

Here is a link to the weekly plan if you have not yet read it.

I do not have a take on the FOMC and their decision other than the fact that I was not at all surprised at a 75 BPS rate hike whereas many were thinking it will be a full percentage.

See this is not a very strong willed FED. There are political pressures also on top of the record national debt. Let us accept it, whatever the FED is doing in terms of rate hikes has got nothing to do with the fact that the inflation has barely budged. There are no proofs that raising the rates has lowered the CPI. None. And how could it? Even at 4-4.5 % FED fund rates now, the rates are actually much lower than than the actual CPI itself. We have a very lose monetary policy right now on top of the fiscal overspend on populist programs.

At any rate, I was expecting this FED chair Powell to come in guns blazing and be very hawkish verbally. So I expected a test of 3720-3750. What I did not expect was that the 3720 level will actually break and trade about 60 handles lower to my 3666 level.

This may have something to do with the fact that the market anticipation of terminal FED rate or the neutral jumped a lot from under 4 % to over 4.5%!

What did not also help was the fact that a lot of folks had expected a bounce AFTER the FOMC. This bounce did come for about a 100 points but was extremely short lived.

With the conclusion of this week’s auction, I do want to touch upon where my bias has been this year as we are days from entering Q4 market.

I became a bear on the emini S&P500 at 4803 on January 3 2022.

At 4100-4200, I expected a retest of 4600-4700 and a range to form between those levels.

We saw this range for most of the spring before breaking down towards 3600 in June.

This is when I shared the range low of 3600 before that bear market rally of July.

I reiterated my bearish bias at 4200-4300, in fact 4300 was almost the contract high last month before a crushing almost 600 point drop within weeks.

We are now back to these June lows. I think what happens next for rest of the year depends on these levels here like 3720 as well as some of the related markets, especially the bonds and the Big Tech.