Traders:

A quick summary of the action today and what I am watching next:

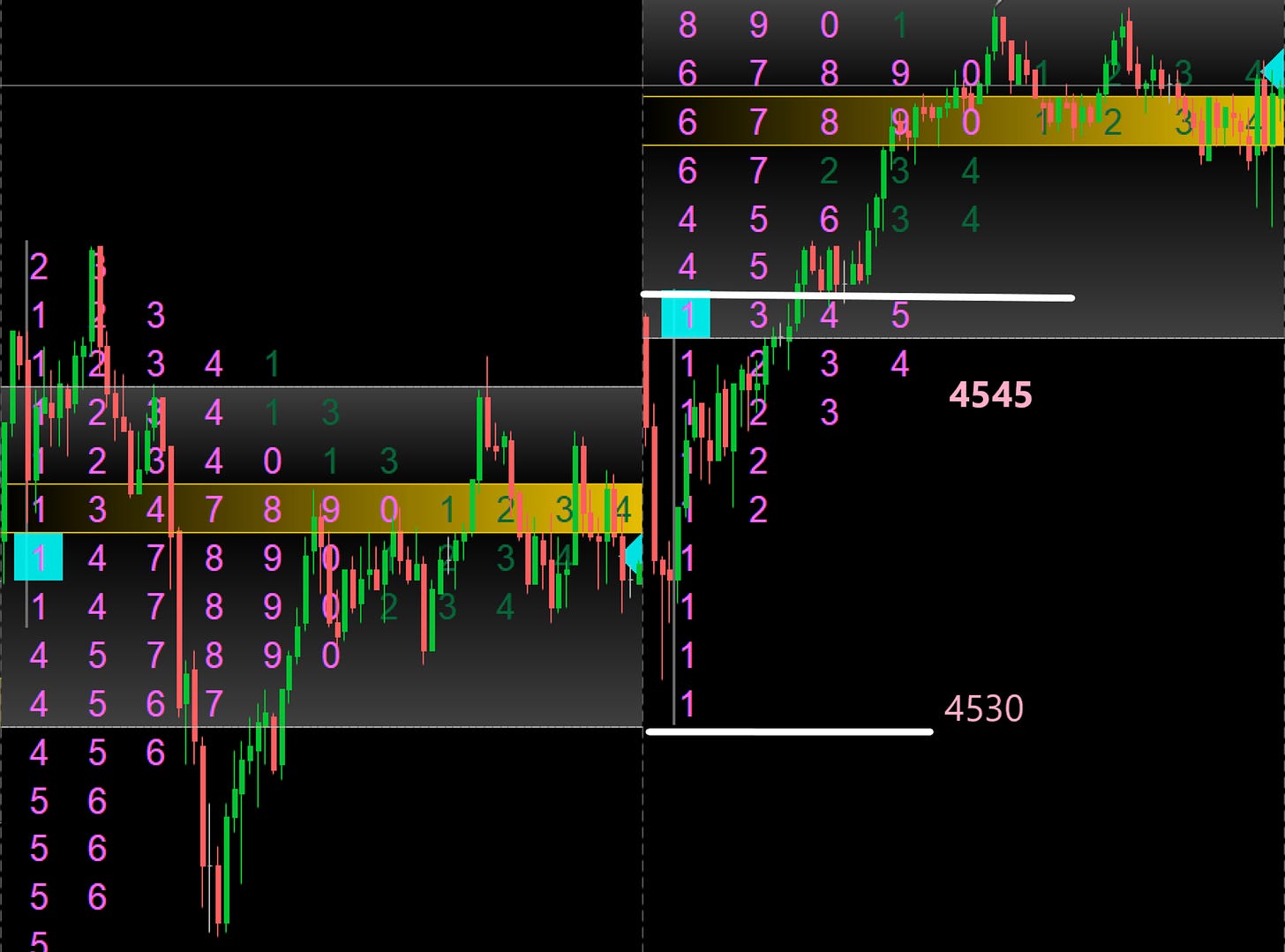

We opened right above the Value Area High (VAH) from Friday and quickly auctioned off below it. Traders pushed S&P500 emini all the way back down to Value Area Low (VAL) at 4530 as next logical target. A fast moving single print established a good low within the Initial Balance (IB) and while 4545 provided some resistance , it eventually broke leading to a 20 + point zipper.

If you are new here, read these definitions first: VAL and VAH

4545 orderflow level was covered in depth in my morning tweets. See here: Tic Toc 4545

So, overall pretty textbook trades today.

For tomorrow, I will continue to leverage what’s been working thus far. I will be leaning on 4545 as potential support. And if/when broken, use it for resistance. Stay tuned for another update if I see significant overnight orderflow appending these market parameters.

Hope you enjoyed this wrap up. Make sure you subscribe and share as it helps me reach more traders 👍

Attached chart with the graphics (for reference).

Thanks. What are the numbers within the volume distribution? Thanks in advance. Is it possible to add a link so other can read the concept? Thanks!

Thanks Tic