Volume Profile Part 1

Introduction

Traders,

I want to spend a few minutes talking about the Volume (Market) Profile. I warn you beforehand there is going to be some ink dedicated to my personal opinion about indicators and the structure of market itself. I think this is important to lay the groundwork of why a technique like profiling may be a better analytical tool compared to other similar tools available today. I will get a little philosophical. If this is not your thing, you can save your self 3 minutes and skip to Section C.

Why do we need any analysis at all?

Market is an unstructured environment. There are very few, if any rules. Any thing can happen at any time in markets.

Market participants, for as long as the markets have been around, have tried to box the market into quantifiable or subjective rules. Some times it works. Most times it does not. In this quest, traders try an endless variety of tools AND indicators. Charts, oscillators, various methodologies like Elliot Waves are BUT an extension of our quest to be able to predict the market.

A lot of times these tools do not work. A fundamental reason for these tools to not work is that they are inherently built using past data whereas the markets are always forward looking.

At end of the day, what we need is a framework we can use to leverage whatever information market provides us , use context , use any other factor to our advantage in order to extract an edge. While no methodology works 100 % of times, we want to be in a position where we are able to be right more often than wrong. We want to win bigger when we are right and lose smaller when wrong.

I do not use any technical analysis in my own trading except one tool which I often refer to, mostly for daily and weekly time frame analysis. This is Volume Profile . This will be a multi-part newsletter with 3 aspects:

Understanding the basics of volume profiling

Operationalizing & implementing the Volume Profile

Optimizing the volume profile

I intend to cover the introduction this week and address the other 2 in coming few weeks. If you have never used volume profile before , you may want to set one up in a sandbox or demo environment and just play with it for a few weeks. I included some instructions on setting one up for Think or Swim Platform (Section F) as I assume most readers have access to it. All charts are courtesy of Think or Swim and/or Ninja Trader. For those readers who are familiar with Volume profile already, this installment may not be a great value add but I hope they get some benefit from the forthcoming newsletters.

Without further ado, let us dive into it.

A: Background:

Most of the early work to my best understanding in market profile which was a predecessor of volume profile was done by Peter Steidlmayer back in the 1970’s. If you have not already, I highly recommend reading his book “Steidlmayer on Markets: Trading with Market Profile” which describes Market profile very succinctly. While some of the technical concepts he described may not be very relevant today due to the technology shift and how the markets have evolved, the underlying structure of what he describes stay true today almost 50 years later.

B: Structure of Markets:

Markets globally in 2021 at their core are a price-advertisement.

Almost all market phenomenon we hear and read and tweet about, spectacular crashes, breathtaking all time highs, FOMO is at it’s heart simply a price event. Market is never wrong, though price may be fair or unfair.

The reason public markets exist and function so well is because they provide a framework through which various entities like the corporates, the governments, the municipalities can issue their stocks, bonds, debts etc. and let the market decide a “fair” price for them.

In essence they are willing to take a risk in return for “favorable pricing” from Mr. Market. If the market likes and accepts their offering, it is willing to pay higher and higher prices for their issues. If the market rejects their issuance, higher prices are rejected and lower prices are accepted. This is a very simple example however this is the basic way market operates 24 hours, 5 days a week.

In a perfect world, traders and investors will be able to see this phenomena in slow motion 4K, make their bets and earn millions of dollars in profit and set sail into the sunset 🌅… However, due to an increasingly entropic world, millions of players and their varied intentions, the markets have made this pricing process extremely difficult to read and make any sense off. For any one new to the markets, they will be forgiven 100 % for thinking the market is schizophrenic 😜 with its never ending mood changes, jumping up and down several hundred price points within a day!

Fortunately, the market leaves subtle clues in form of price action, which a shrewd and experienced operator can decipher , given enough motivation and screen-time.

If you have made it this far, you already have the motivation 🙃 Read on for some pointers on screen-time.

C: Organizing the market:

So, is there any hope for making sense of it all? I think there is. And based on my own trading from past 15 years, I have seen several examples where even the most volatile of markets can make sense when you organize their actions in a meaningful way.

What is this way that I speak of ?

This is where the concept of Market Profile enters the picture.

To be able to understand what the market may do next, you need to be able to understand how good (or bad) of a job it has done so far to advertise it’s price to its prospects. Market (or volume) profile is a graphic representation of this activity.

In all my writings, I use non-standard way of describing things and this will be no different: In its simplest form, the market profile is a graphical representation of which price is every one positioned or traded at, for a given time period. How much volume was transacted at each tick? How much time the market spent at each price point? Profiles answer this question.

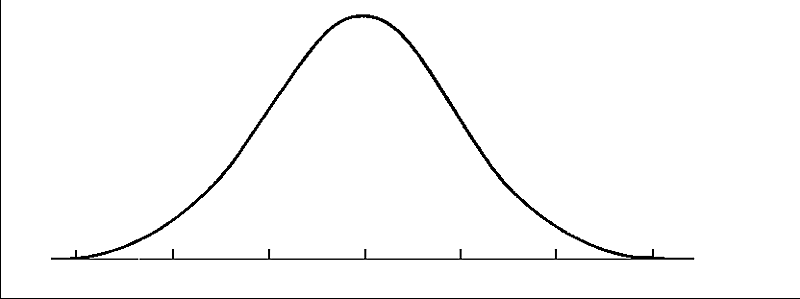

Look at this chart below. This is a beautiful representation of balance and symmetry. One look at it and I know instinctively there is a LOT going on at the middle of x-axis and very little interest at it’s extreme edges. This illustration is a crystal clear representation of what market or volume profiles represent in markets.

Let us say the y-axis represents the volume (or time). The x-axis is the price, let us assume the left most x is 1 and the right most x is 10, with the middle being a 5. If this was the profile for one whole day, without a second thought I know the market loves that $ 5 price. If there ever was a “fair price” for this asset, this $5 is!

At this point, I think it makes sense to ask if you are still with me or completely lost?

If you have not thought in these terms before, it may make sense to re-read up until here. Give it a few minutes to absorb. If you are still able to understand this then keep reading 👍👍

Now this is but a very rudimentary example. However the good thing about thinking in these terms is the outcomes or possibilities of market organizing it self like this are handful. These situations or “day types” as I call them will be covered in a different post. However, it suffices to say that for any given time frame, the market will either “accept” the advertised prices or “reject” them.

What does it mean?

Acceptance: in simplest terms, using a profile, you will see a bulge at certain prices. This means for howsoever momentarily , that zone or that price is being deemed fair by market. These bulges are also known as “High Volume Nodes (HVN)”

Rejection: you will see almost no bulging at these levels. This means the prices are unfair. This may be represented as Single Prints on a TPO chart or “Low volume Nodes (LVN)” on a volume profile chart.

Now unfair doesn’t automatically mean “bad”. Price rejections almost always are great way to identify good support and resistance levels. Price rejection almost always means a lack of inventory at that price.

In our case, if you are my reader for some time, consider this newsletter from Wednesday: Daily Plan. How very little time was spent at this price (4541-4545). There was almost no bulge here at this price. This means there is really very little inventory to be sold at these levels. If I had a cheat sheet, it will be:

Lack of bulge at the lows = Demand

Lack of bulge at the highs = Supply

Of-course there are finer variations to this. You have to know if these rejections happened in previous acceptance zones, or if these rejections occur in previous rejection zones. For example, a lack of bulge above a well established bulge may indicate a market coming out of a consolidation zone and should not be considered rejection but rather a market moving higher. The good thing is we can start using these bulges and skinny-LVN to start forming some hypothesis of our own. The bad part is there are sub-variations in these as well , however with any thing else , more screen time will lead to a better understanding of nuances.

I hope you are still with me and getting at least some value out of these. These take a lot of time for me to draft and if it helped you learn something new, make sure you hit the share button to allow me to reach more traders, like your self.

So to summarize this section, first step to become an order-flow practitioner and trader, is to :

1) Start thinking in terms of price acceptance and price rejection.

2) Visually know that Profiles offer an easy way to see where accepted and rejected pries are for the given session

3) Form your own hypothesis using the HVN, LVN, single prints to formalize where these “pain points” or references live within your session of choice

4) Actively look for formation of these new structures or nodes throughout the session and see prices interact with them

If you could take one thing away from this post, it should be for an infinite and unstructured environment like the market, only references matter. Good references will profit you. Bad references will let others profit off you.

D) The 70 % rule:

I don’t know or understand what is the reason behind 70% value area rule, however, I am sure statistically it is is important and captures few of human emotions in some way or shape.

So, now you are beginning to think it terms of how market organizes itself. You have added a volume profile indicator on your workstation. You are starting to observe the session as it progresses. You want to now know if there are other things that may impact market action. Yes, so value area on most days (but not all of them) acts as a natural containment or support/resistance level.

What is value area? Well here is a definition : Value Area , but suffice to know, within the TOTAL Bell Curve of the session, this zone contains 70% of all volume or activity.

The upper and lower bounds of this zone are natural support and resistance lines. If they don’t work for a given session, they may offer some kind of opportunity the following session. They are “high probability” levels to offer some thing. In my experience they are 60-70 percent effective in terms of offering some pause to the price on following day or even within the same session.

E) Putting it all together:

I intentionally want to keep the implementation part separate from this introduction part. This is to create a space between learning it and knowing it . For those who have never worked with a profile or another statistical approach before, they should probably just slap it on their workstation and just watch for a few weeks to a month or two. For more experienced traders, they can start thinking in terms of value .

While there are several strategies that can be potentially developed off this information, a few of my favorites are:

Value moving up or down

Expansion of Value Area

VPOC shift

Rejection at the VAL and VAH followed by new Value formation.

Explaining these by itself require an additional installment or two.

Now are there markets which are more suited to this type of analysis than others?

I think this works in most cases, however it works better in markets with on balance a 1-2% average true range a day. Just from an opportunity flow perspective, I will avoid markets which move less than half a percent on balance. I know many swear by 30 year bond ZB_F and ten year ZN_F etc. but those put me to sleep and in my opinion not the best markets to trade with profile. Let me know if you agree or disagree 👎

I think this is quite a bit to chew through for most new to the profiling concepts. So I will stop here.

If this made sense to you and you want to continue to receive further updates to this topic in your inbox, make sure you subscribe below to stay on top. Feel free to share with any one else interested and AMA re: profiles on my Twitter: Tic Toc

F) Setting up a simple profile tool:

Last but not the least, let us add a sample profile on a TOS chart.

When you launch the application, you want to add a time based chart. It can be a 1 minute, 5 minute or any intraday time frame chart but preferably 15 minutes or less (as TOS will lose profile granularity on any thing over 15 minutes)

Click on Studies» Add Studies

Select Profiles and choose Volume Profile

Double click on the Indicator . Time per profile should be Day. ON expansion setting must be NO.

That’s it . Take it for a spin and let me know what you think .

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. You may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading you choose to undertake. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

What a classic simple explanation about Volume Profile Studies, never read such a detailed explanation by Mr. Tic only. Thank you very much. Wish we can say this to you in person.

Great content Tic. Helpful for someone like me who's only been trading for 18 months so still leaning some of the basics