Traders-

This was yet another week where the market respected my levels and my scenarios were quite on the point - along with several other ideas which did quite well like META, COIN, CVNA etc. All shared here with subscribers and much more.

Here is the link to last week's plan if you have not yet read it.

My primary thesis was very simple around two levels - 3666 and 3700. I expected further softness below 3666 and I expected we could start filling some of these gaps on upside if we closed above 3700. This turned out to be quite prescient - we barely did any trading below 3666. Over the holiday shortened long weekend, we remained below 3700 BUT we opened above it once the US markets opened on Tuesday.

Well, we did not look back below it for rest of the week and ended up staging an impressive rally to end the week about 6% up. On Wednesday I expected any dips into 3700 to get bought - and shared levels like 3830 with folks. Eventually on Friday my longer term level of 3900 was targeted and we closed the week close to 3910.

Unlike many other participants I avoided being bearish above my key weekly levels as soon as we broke out of that bracket at 3666-3700. I shared these updates almost on a daily basis via an updated daily plan. If you have not already, consider subscribing to my newsletter to receive up to 5 similar posts directly in your inbox , the moment they are published.

In this newsletter, I will share my bias and levels in the general market for next week. I will also share a couple of stocks which I think look promising. Also my thoughts on the NKE earnings. Q2 earnings season will soon begin - I have made some good earnings calls in the past whether that is NFLX, SNAP, AMZN, META or GOOG. I expect to make some good calls this season as well exclusively for the subscribers.

My bias in this newsletter and my levels must be seen in context of my longer term trend as well as how the events in July are setting up to be.

There are 4 very distinct and powerful events set to go down in July which will pave the way for S&P500 IMO for next quarter or two. The first such event is the US June CPI on the 13th.

We then have the FOMC rate decision on the 27th followed by the GDP number on the same day.

If this was not enough, we tentatively have the AAPL earnings set to be released in that last week of July (ETA 26th). Even next week is quite event heavy with the G7 meeting ongoing as well as the various key Central Bankers to speak next week with Bailey from BOE, Lagarde and Powell on the 29th of June. I would say next 4-6 weeks are one of the most event risk heavy weeks I could think of.

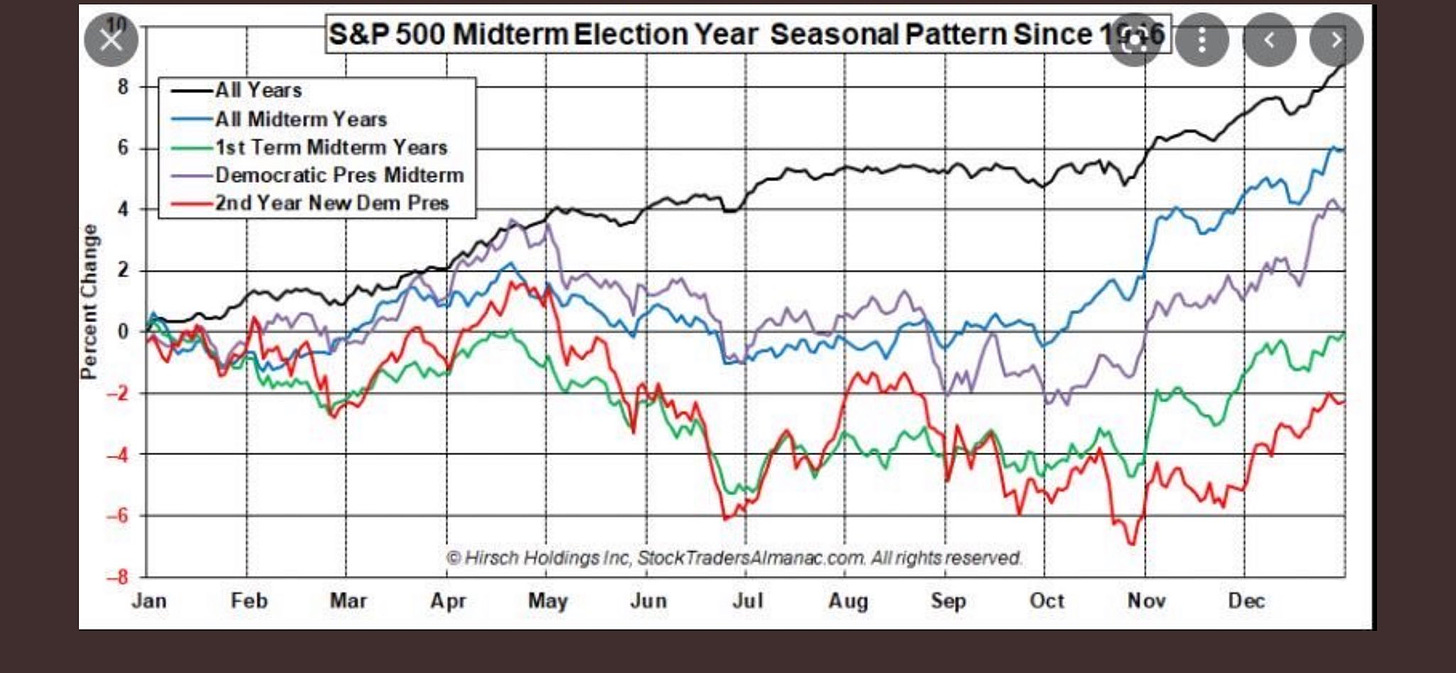

Against this backdrop, we have the S&P500 market in a downtrend and a vast majority of participants expecting the FED pivot and are hoping for a low in the markets and want new all times highs. This is also an election year. BTW my follower has shared this chart with me which is quite nice. Sharing FWIW.

Against such event risk backdrop, here are the questions I am asking my self:

Let us say that the CPI comes in less than expected and it appears the CPI has cooled off. Let us say the CPI comes in a lot less hotter than expected and YOY number is 7.9 to 8%. Does the FED now declare victory and reverse their tightening course? Even at a 8%, it is far-far higher than their desired 2%.

If by the time FOMC rolls in, let us assume S&P500 now due to a less than expected CPI has rallied hard and has rallied into 4200-4300. Does the FED come in dovish when they see SPX trade 4300 right before the FOMC decision?

Will the FED pivot?

My take on all of this is it does not matter even if the CPI comes in lower than expected and the S&P500 rallies - I do not think the FED will reverse course at all and I think they remain hawkish - at least they remain as verbally hawkish as they are now, and SPX trading at 4300 gives them even more of a reason to be hawkish than let us say if it was in the dumps.

No, I am NOT calling for a FED pivot. I am saying I think there is NO question of FED pivot whatsoever. Now if the GDP came to be negative again on the 28th and if it is proven we are actually in recession, I think that could be a buyable bottom for me if the S&P500 was in dumps then around 3600. But let us say S&P500 is trading 4200-4300 and GDP comes out to be strong or even positive, there is no question in my mind of these prints being unfair and extremely high.

Look, when you turn off all the noise and drama from 1000+ self proclaimed inflation experts on the internet, you will begin to see that most of the inflation is being caused by crude oil prices. Crude oil was almost unchanged last week. I do not see inflation come down meaningfully unless we begin to see Oil below 100 dollars.

If you like my work , feel free to drop a line below and share my newsletter as it helps me get to more traders like yourself with the message of the tape.

Has the market bottomed?

I am not an astrologer and I do not speak in terms of absolutes and certainties. At it’s core all of us folks who are market participants, are relying on some sort of pattern recognition - whether that is a chart or that is the tape reading like I do to try and predict what may happen in the future.

With its endless permutations and combinations this task is extremely difficult if not outright impossible - yet I am surprised at hubris of those who speak in absolutes as if their pattern recognition skills have now enabled them to see through these infinite permutations and combinations and only they have the keys to the future.

For the S&P500 has certainly had an impressive rally this week off my 3666 but so did we see this during week of March 18th and then again on the week of May 27th. Both of these times it looked like we have had a bottom only to give up these gains later. See Chart A below.

What I wanna see is a double bottom pattern in the Weekly time frame (for strictly chart based folks to help them visualize). Alternatively it could be a higher low and a higher high on weekly time frames. Personally , until I see either one of these, I find it hard to believe we have seen the lows yet.

Again, to be clear- I am not doubting that we can have bear market rallies in a bear market. In fact my own newsletter has called many of these 10-12% rallies in last 6 months. What I am doubting is that we make new highs in the bear market. That does not pass the sniff test for me.

If you are still with me, keep reading below for nuances and my 2 TOP scenarios + levels for the next week.

Most of my levels can take a lot of effort as they are based on level 2 analysis which is very different from traditional chart based analysis. I would always give a priority to these levels than my tweets which may be off the cuff remarks or not as well researched as these levels. I would rather share these with a smaller, cozy group like your self than outright with 125,000 folks publicly and this is where this Stack comes in.

Speaking of cozy, I feel we have now a good sized quorum to spread the message of the tape and order flow in form of serious traders, like your self. Since we have reached this threshold, I need to put up a bigger barrier to entry to gate-keep non-serious folks out. To this end, I have decided to significantly increase the barrier to entry which will soon take effect. This will NOT effect any one who is already subscribed to my newsletter but only any one joining later.

My levels and main scenarios for next week

A lot of folks have declared a win that the lows are in. There are equal number if not more who thinks we will keep going down. We closed the week around 3910.

I think both of these groups may be frustrated to some extent next week as we await the CPI and lead up to July 4th liquidity vacuum.