Traders-

This will be a slightly longer post and focus more on the OrderFlow educational aspect. The US markets will be closed on Tuesday in observance of the Independence Day. Grab a coffee so you do not fall asleep and get ready to learn something different.

This is my continuing series on order flow education where I share my personal views on tape reading and real time , market generation info rather than use past tense indicators. I am sharing how I personally visualize each session, so if you are active in intraday time frames, this post may be of interest to you. I personally think this is an important post for any one who is interested in price action and order flow.

If you want this newsletter to be automagically delivered to your inbox every night while you sleep, consider subscribing and sharing as that is the right thing to do to help the channel grow ;)

Towards the end of the post I will paraphrase the weekly action as well as my levels and share my levels for next week. Note that I do not think a lot of folks are going to be active next week as July 4th the markets are closed in the US. It happens to be smack in middle of the week; so I anticipate real liquidity return the Monday after on the 10th.

Without further ado, let me do a deeper dive into what I am looking for when the US session opens.

First let me share what I am NOT looking at. I am not looking at ANY indicators whatsoever. Whether that is a RSI, or a MACD or Ichimoku or even moving averages. I do not use any indicator in the intraday trading. Yes some will say that what I am about to share is also an indicator. I respectfully disagree and I will explain why it is not in a bit.

But going back to my point about indicators - in my mind the indicators are past. They are certainly useful in longer time frames. For instance, 50 day and 200 day moving averages, RSI, 20 day Bollinger bands - they are useful in longer time frames. I am sure there are many others which are useful but I mention these as I use them myself in the longer term. Sparingly but yes I do use 50 and 200 day averages in my analysis.

On the shorter time frames, like the intraday time frames, I am active 6-7 hours every day. I am watching Level 2 which is basically a glorified time and sales.

What is a time and sales?

For the uninitiated, it is a real time tally of the trades which happen at offer and trades which happen at the bid. This is as real time as it gets. No lag. No past tense. Real time.

Yes, it does not include all dark pool orders but then in a market like NQ or the emini S&P500 there are no dark pools. There is only one Limit order book (CLOB) and every one gets matched the same way based on the matching algorithm provided by the echange. Really large block trades get traded in a funky way based on the product - for instance, the EMini ES matching algorithm may be slightly different than that of the treasury futures where if you are not in line, you may still get preference to match you with another trader who may be wanting to trade the same size as you are. However that is a conversation for a different day but suffice to say, I am watching level 2 predominantly every day, this is where I spend most of my eyeballs (when I am not tweeting).

This is the most real time way you can interact with the market IMO.

Also note that my intraday levels are for the intraday session only. I do not like to hold any trades over night in the futures when it comes to the daily levels- my daily plan levels are only for the session in context. This is important to mention because it determines my bias for the day. So if on Monday the market closes below 4430 but on Tuesday it opens above 4430 - in that case, on Tuesday, my context is that the market opened above 4430- not that it closed one day ago below 4430. That is past history already.

Now can you use these concepts in anything longer term?

Yes, you can and this is exactly how I come up with my levels by stringing together individual sessions but it has to be seen in a continuum rather than day to day. If you do not follow the market every day, intraday then you will lose a lot of important context. This context can not be captured on charts alone - I really do not want to hurt any one who may be a heavy chart user by saying this and my apologies if I did end up hurting someone’s feelings. This is really my opinion and mind you before I was a tape reader, I was a chart trader for 10+ years. So I know both worlds very well. Do they both complement each other? Yes, in long term analysis they do. However, there is just an extra layer of perception when you watch the tape which is somehow missing if you just watch the charts.

A lot of guys in the US, especially on the East Coast simply can not watch the CME or the CBOT markets during the cash session. The markets open at 930 and by then they are at their day jobs. The closest markets I have seen behave similar to the Emini ES are MJNK which is the mini Nikkei with similar moves and point value like ES. And in the Europe it is the BUND (FGBL ticker). Now Bund is the German bond market but in terms of moves it is very similar to the ES. So any one disciplined enough to trade the MJNK at 7 PM in night or the BUND really early in the AM has these options and I just wanted to share as a FYI. If I can not sleep, I will not mind trading these myself.

Rest of this section is divided into below subsections:

DOM- if you are very very new to level 2 then I will say start with this one. If you are a DOM power user already, skip this.

Structure - the very first thing I want to be aware of when the opening bell strikes is the structure itself. Where is this market opening in terms of prior day, prior week, in relation to my own levels etc.

Internals - market is alive and the internals are its pulse. So I want to know what is the internals of the market actually doing.

Momentum- 7 out of 10 days in market tend to be range bound and only 20-30% are trend days. This part of the analysis lets me visualize if this market is trending or likely to balance. I also throw in some tools like VWAP just to gauge what other traders may be thinking or likely to do.

This is it!

I do not do any super complicated analysis outside of this. If something is gonna work, it is gonna work for me using these 3 things. If it is not gonna work, then even quantum physics is not gonna work.

Why do I say that? Because the intraday session is simply too fluid. You have atleast 100000 large traders and equally smaller traders active at any point. These large traders may initiate an algorithm to sell or buy at any time. This makes the market very unpredictable and finicky. Yes, there are guys who will claim that you buy calls now every day and you are set for life ;)

But I disagree (respectfully).

This strategy, whatever it is, is working in this moment. In these few weeks and months. I do not think this will continue to work. I think this is actually an extremely bad strategy! So if I plan to be doing this for a long long time for years to come, I have to come up with a solid plan. A robust strategy based on some underlying principles which do not change every week!

Use the July 4th FREEDOM discount below to read the post. This is one of the lowest prices this year, do not miss the chance to subscribe before price hike!

DOM

Reading the tape or the DOM is more of an art than science and it is mostly about the screen time. I think you need at least one year to 18 months of screen time with the DOM to begin getting conversant with it.

There is no one single, right or wrong way about reading the DOM. Individual traders can interpret in different ways based on their time frames. As far as I am concerned, I use it to gauge buy and sell pressure via at-bid and at-ask trades.

This link below is a start to begin understanding the basic concepts behind it.

Macro-Structure

I use Volume Profile to understand the macro structure of the market at the open. Notably I am cognizant of where the market has opened with relation to prior day’s range. Where are prior day’s HVN and LVN? These HVN and LVN can potentially offer support or resistance levels.

Start with the post below.

Part 2 and Part 3 further explore the volume profile concepts along with the market structure.

Market Internals

I think most people will know but some may not that the S&P500 market is a market-cap weighted index made up of about 500 stocks. NYSE itself has over 3800 stocks that trade on this one exchange alone. What the index does, during the cash session hours, is largely a function of what these 500 stocks do on an intraday basis.

For any one who is a short term trader, I think market internals are crucial. Market internals are a family of indicators that measure the state of certain market attributes. For instance, TICK measure the number of stocks that are trading on an uptick versus downtick.

Market internals can provide quite a bit of an edge if you know what you are looking for. In below post, I share some of my thoughts on a couple of these very important indicators.

Momentum

At end of the day, momentum is the only thing that matters during execution. Entire Wall Street and their dogs (and some cats) are trying to figure out one thing and one thing only - momentum of the market.

In intraday time frames, I have not yet created a super formal momentum post but I do share some thoughts every now and then. This is on my plate to do a post on intraday momentum but here again I do not use any technical indicators save the are minimum, like a VWAP or Tic TOP.

On shorter time frames, Tic TOP is an extremely important concept to understand. See below. I keep an eye out on Tic TOP all day and it saves me from stepping in front of the momentum freight train.

On longer term momentum, I do use some commonly available tools like Bollinger Bands.

With this section, I hope to start a conversation about market generated information and order flow. This is definitely a different way of looking at things rather than traditional indicators and oscillators. In my view this is a more dynamic way of looking at the auction rather that past tense indicators which are static. The obvious advantage is that this is more real time. The downside is that it requires active participation from the trader- you need to be more involved which takes time. I have for years watched the DOM every day 6 hours a day. I love it, I really enjoy it, I do not plan to stop any time soon.

Look, my view on the time and effort commitment is very clear. Trading is a career. It is not a hobby or a pastime. Well it can be a hobby but then do not expect to get really good at it! If you look at other careers, a doctor takes 12-14 years. An engineer or a CPA can take 6-7 years to get fully qualified. Be prepared to put in similar effort in this endeavor as well. Yes, you do not need a degree (thank god!) but you still do need a lot of experience and screen time! Do not expect to find a holy grail like x crossed y and I am rich now. Won’t happen but you may develop a methodology which is unique to you over time which should be the goal.

Quick recap of last week

A recap of some of my levels and ideas shared in last week or so.

ROKU: ROKU was up about 3% on the week but at one point it was up about 6%. It is now consolidating here and may be waiting signal from the general market to test 59-60 area before next bigger move.

WE stock was an absolute monster gainer this week having gained more than 25% on the week alone but it is much higher from the 20 cent LIS I shared a few days earlier.

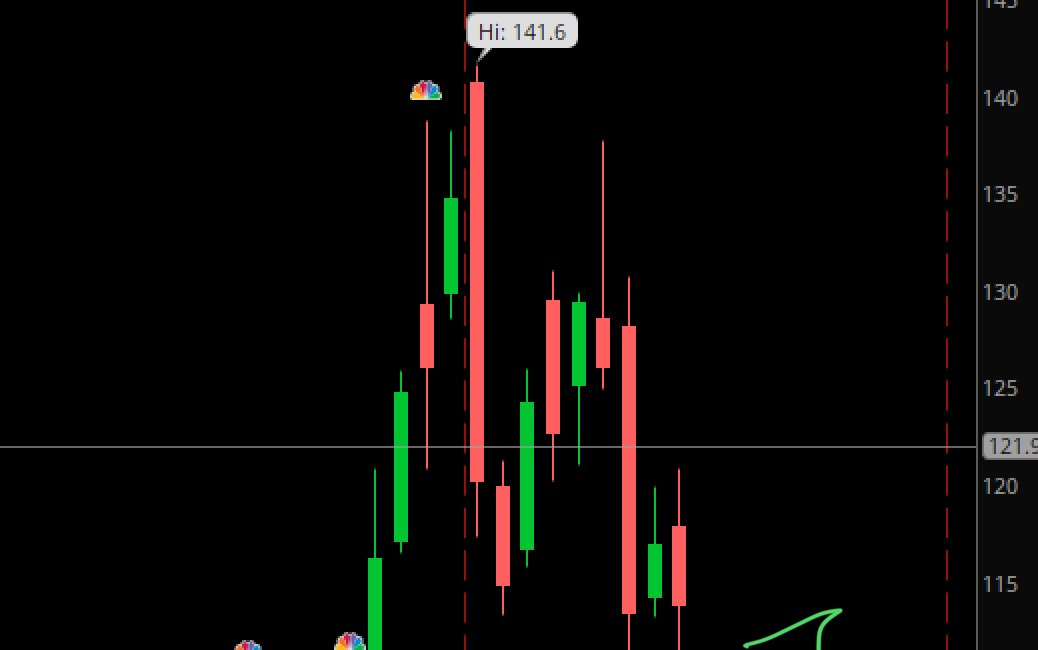

MRNA: I have expected a test of MRNA to 125 area before finding sellers again, it did rise about 3% on the week missing the 125 mark.

TSLA: my main support level was 240 this week which also coincided with being the low of the week in TSLA. It rose about 20 points from 240 after having fallen about 35 points from my resistance point last week.

U was an absolute beast this week. It came down to that 36, rallied to almost 45 before being subdued. A move of about 30% on the week.

I was a Bitcoin bull as well along with names like COIN and MARA. MARA alone rose about 10% this week but the numbers towards mid of the week were much higher.

ACN- I shared 290-300 as support on this and we saw about a 15 dollar rally in Accenture this week.

VSH- I have been a VSH bull for some time now near 24 area and the stock was up about 8% this week.

SWN and SNAP were both up 10% this week.

Overstock Stock was up a whopping 36% on this week alone! You can not say overstock or stocks without toc. Try!

On the S&P500 Emini side, my key levels were 4390 and 4495 on the weekly time frame. We did briefly dip below 4390 at one point but were not quite able to keep the market under it for long. Along with these two levels I had shared one more key level which was pivotal for the week along with my NQ level on intraday time frames. On Friday we did end up retesting that 4495 before closing the week at 4480.

Other than these I did share some other ideas from day to day like JPM, CVNA, Gold and Oil which did quite well for the week.

The markets just have been extremely active last 4 weeks or so and this is one reason I have been able to find a lot of these movers- stocks that move 10-20% in a session are an exception not the norm. Like last 3 weeks alone I think I have probably shared more than 20 names which have had more than 2-3 Standard deviation moves on the weekly time frames and none of this was an NVDA or an AAPL. Just look at this list above! I am not sure how long it will last but I think for any one who is an active trader should not be complaining if the market is too active. It is just that I do not think this level of activity will last for long and is a result of liquidity on the sidelines, options shenanigans and short squeezes.

At time I feel I do not get enough credit for these insane calls and I think the reason is because the substack price is too low! It is jokingly low. Another reason is if you look at the list of ideas above, I have not shared a single one of them on Twitter or Telegram in last many weeks now. My decision in part is due to Twatter censorship of Substack. I am looking for a new Social Media and it may be YouTube. My levels have been exclusive for this Substack. I have a much larger audience on Twitter than this platform and since I do not share this on Twatter any more, it gets construed as that I am a permanent bear. This is not true. I am more of a permanent bull by nature than a permanent bear. This is not necessarily a bad thing, I would rather have a room full of 100 hardcore serious traders than a 1000 non-serious ones!

At any rate it is not my problem but I did want to try and address some mis-information that I am a permanent bear. I am not. If anything, I love volatility as I do much better when it gets very volatile than when it is not very active. I am far better when the volatility is in excess of 2-3% than when is a half percent day!

I have been busy in some other things in life but I am thinking about raising the prices a lot, like 300-400% to counter this misinformation. I think there is a good number of serious full time traders who follow me who remain interested in the message of order flow, regardless of market conditions. This is a matter of time but I need to sort a few things out first. This I think should not impact older, most loyal readers many of who are in at like 33-35 bucks a month but only new ones.

A quick question to help me make the content more relevant for different interest.

What is the main market you are active in?

My levels for next week

From the auction last week, 4390 and 4495 will remain my key levels on the Emini. 15000 will be my key level on the Nasdaq NQ.

Again, these are weekly time frame levels. Weekly levels can be combined to create a composite longer term auction framework. So what does that mean?

If 4390 has been a level for 4 weeks in a row, then it is a critical longer term level. If you are a bear, you want the market to remain below it not above it. These are also known as composite profiles. In general when we see the S&P500 making new 52 week highs, this market needs to consolidate and break that consolidation to the lower side to restart a longer term downtrend. This is Auction Market (AMT) 101. I assume most of the readers know this so I do not cover this every week. Ideally in longer time frames, I like to see my levels make lower lows for downtrend and my levels make higher highs for a bullish market.

Don’t ask me why or how this works but this has been my personal experience. Since my own levels are a combination of technical analysis as well as order flow and fundamentals and some other prop stuff, it gives me a good level of confidence to gauge if the market is in a downtrend or uptrend. If you go back a few weeks, my own levels have been making higher highs. If I am a bear, I need these levels to begin consolidating and make lower lows for a confirmation to me that a new downtrend has started technically speaking.

A common question is why I don’t have a lot of charts in my newsletter.

Well it is because I do not use them! Occasionally I use some charts to show a profile or a gap that can be filled for illustration purposes, but I am not gaining any huge insights from these charts. I spend most of my time in Order Flow research rather than create glossy charts and graphs.

Scenario 1: I expect some support to come in around 4430 if the area is revised for a move back up to 4455-4460.

Scenario 2: A break of 4430 could target 4390 which may be a support for a move back to 4430.

My edge case scenarios will be below 4390 for the bearish trend move and above 4495 for a bullish trend move. While we did break out of that 15200 in the NQ, I think the move was not very strong. This puts 15200 in crosshairs again because we did not cleanly break out of it in my view- this is why I think we can retest 15000 which may determine next larger move. NQ is around 15350 right now.

I also think XLF could potentially be an over performer compared to other sectors. We will see how it goes but I am liking the current strength in XLF type names.

NQ case was greatly helped by the move in AAPL which became the very first 3 trillion dollar company! Unprecedented!

My long term levels in AAPL where I will buy it will be shared once and if we get closer to those. The reason being when I share my levels ahead of the move, they are misconstrued as if I am calling for the market to get there in a week! I am not. These are very long term levels. For instance, I had called for a test of 137 on TSLA when TSLA was 403 in 2022! I called ARKK 30-40 dollar test when it was trading 123! It took us over a year to get there!

This is because there is just a lot of misinformation and bad information out there on the internet! Not every one has same goals as you and I. Like I have accounts which may be short term speculation on intraday time frames, I have accounts for IRA, I have accounts where I only care for dividends and not necessarily for growth, I have accounts where I just have short term cash waiting. None of these is 0DTE! It is really not one size fit all! Like any one who has owned assets understands this inherently but when you have folks chasing ‘get rich quick schemes’ a lot of their energy is spent in things that move up or down in a day so they can buy 0DTE short term options. In my experience, only the option sellers are becoming richer not the option buyers in such short term examples. Anyways, I just wanted to share my 2 cents on this as I feel a lot of folks are chasing these moves without really a good understanding of supply and demand or support and resistance concepts. I just talk to a lot of folks one way or the other - and I know for most part that these short term options are becoming all the rage now a days. Which I still think is still better than having a short or a long on a leveraged product with no stop loss as the risk is limited on these options. But I digress.

Back to some other stuff I am watching in next few weeks

Summer Travel

I had been bullish on stocks like CCL and ABNB earlier but at much lower levels around 10 and 100 respectively before they ran up but then I had anticipated a slow down in the reopening. I was wrong as the surge in travel demand continued through the Summer as I write this post.

On the macro front, I still expect a recession to hit the US in late Fall and that has not changed. However there can be a gap between current technical momentum and when the reality finally hits.

This means when you look at something like CCL which is a poster child of pent up wanderlust, I think this may have some juice to squeeze if it were to slightly pull back into 15.5/16 or so levels. I could see a test of 20-21 even. This is continuing example of two Americas- the haves and the have nots. This gap is bigger than ever and I think this is powering in a rather perverse ways some of these luxury/disposable income plays.

Banks

I have also been a big bank, XLF type bull. I had shared names like JPM around 130. Note that I was also a bull on the regionals like WAL at 25 with 40 dollar target which was met recently.

On JPM side, I have a new LIS around 137 area and it is now trading 145. I expect the banks to continue their march higher on the backs of higher loan income. This could help names like V as well which is now trading near 237. My V LIS will be around 220 dollars.

On other banking type institutions, I was also a SQ bull around 55 and PYPL bull around 60 as well. I think if this SQ holds this 58-60 level, it could continue to trade higher to test 80.

Energy

I have also been a long time energy bull. Very few people realize that the energy market is actually not very big and I think it could be or rather should be bigger.

With energy, if you are arguing that the economy is strong and the consumer is strong, and when you add into the mix the fact that the geopolitics is now more fragmented in addition to a prospect of 4 more years for the current political climate in the US, if you add these up, I think one could conclude that the energy should remain in demand. This obviously is true for both renewables like Solar and traditional energy like Gas and oil. In fact, if you remember, I had called for a low in the natural gas many months ago sub 2 dollar and it is now approaching 3 again.

Now is oil for every one? Oil is notoriously volatile due to the fact that it is rather a small market. Moves of 300-400 pips in one day are not uncommon.

But when you look at derivatives, for instance SWN, I think they are more mellow.

I had shared 3.5 level support in SWN several months ago before it doubles and more recently I had shared 5-5.5 support and this week it was up about 10% from this level.

I think if this holds, we may see a test of 8. SWN is not the only one. There are so many other energy names which look good to me.

Bottomline is that I think energy market remains a small market and may have room to grow. At 2-3% of the S&P500, even if it just goes to being a 4-5% market, it could lead to large moves in its derivatives.

WMT

Walmart recession stock was a bullish idea from me around 137 area and is now pushing above 157. I think Walmart could push higher still into 160s as long as 154 level holds.

SNAP

SNAPCHAT, I was perhaps the only bull at 8 dollars on its sell off post ER last quarter. The stock is now approaching 12 dollars, in fact a few cents from it.

I think longer term SNAP has seen a bottom at 8 bucks. This is similar to my call for PLTR at 6 and then 10.

Shorter term 11-11.5 will be my LIS or support on the SNAP.

One thing I think that is noteworthy is that SNAP CEO is a very pessimistic guy, which is very strange for me personally. He always manages to tank the stock on earnings calls but then the stock does get bid up. This has been going on for a few quarters now.

Bitcoin

I was also a st Bitcoin bull on Bitcoin at 25 K before it moved to 31k. I have now moved my LIS to 28 K and I think if this holds, we may see 36-37k test . This helps names like MARA which I had a bullish bias on at 11 before it moved to like 15.

This is it for now folks. Have a great weekend!

~ Tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal and personal opinions.