Hi folks -

Welcome back to another weekly plan. We had some great levels last week, with high volatility which I will be recapping below for transparency.

But before we go there, I want to get some admin stuff out of the way. With recent price increases and some folks’ payment methods expiring, they told me they could not get in at lower prices. To mend this, I am offering one time opportunity to get back in at the prices prior to current price hikes. Limited time only. These prices will not expire and will not go higher ever as long as you do not resubscribe. This subscription includes daily emails plus the chatroom. Prices will increase after this one-time opportunity. No exceptions will be made for anyone after this to get in lower. Link below.

Recap of last week

Let us start with the weekly recap followed by the day-by-day auction.

My main resistance level on Emini was 4210 with the expectation we could remain offered below this level.

This level was in fact the high of the week before a sell-off about 140 points lower.

On the Nasdaq NQ side, my level was the exact high of the week as well before an almost 400-dollar sell-off.

Some other ideas from the weekly plan -

I was a META bear at 240-242 before a 10-dollar sell-off in the stock.

I was bearish on TSLA at 165-166 before a large-sized sell-off.

I was bullish on TGT at 150, we came close to this level before a large rally.

I was a WINGSTOP bull before a massive rally off my levels.

I was bullish on a couple of other names which did well on the week, but nothing spectacular.

JPM 142 to 135.

Uber from 30 to almost 40.

If you enjoy my content and find it value add, remember it helps me grow the platform by word of mouth when folks like, share, and comment on the content. This is an independent platform that is supported by folks like yourself. We do not advertise, Substack is currently being censored by some other powerful social media platforms. So that means every interaction with folks goes a long way to maintain its independence and low cost. I have other channels to share my ideas but none of them is as cost-effective for folks like this one due to the fact that I can be hands-off with admin, back office, billing, etc. Do not be shy about showing your support for this channel, if it helps you in any way.

While this was at the weekly time frames, below were my main calls for intraday, grouped here by the day. I recap most of my levels and calls every week and if I miss something it is due to a lapse in recollection -

Tuesday

Sell off below my key level on strong volume in the IB session leads to a loss of about 60 handles.

AMZN sells down about 20% after the ER.

Wednesday

I was bearish for the FOMC below the 41XX level with targets at 40XX.

We stayed below this level ass day and sold down about 60 handles from here AFTER the FOMC.

Thursday

I was bullish on AAPL at 165 for a test of 172 for its ER.

I expected more sell-off from 4100 but then I shared a key support at 40XX which I thought will be the support going into AAPL earnings.

These were the highs and lows of the day on Thursday.

Friday

AAPL reopened at 170 from my 165 level and proceeded to trade at 172 later.

I shared the 4100 key level with the context that I will not fade the open if Tic TOP opened above 1-2%. This was the case and we remained strongly bid all day with no pullbacks in Tic TOP.

Read more about Tic TOP below. A very important indicator.

So this is the week that was. About 15 key levels and ideas. Each one has been recapped above for transparency. If I omitted anything, my bad, it was not intentional.

I made a bad call the week before and I realized the data I was looking at it was bad to start with. This underscores the importance of good data because if your input is bad, the results will be equally bad, if not worse.

In the next section, I am about to dive deeper into the emini S&P500 weekly context, the driving force, and levels followed by about 6 other ideas I have for subscribers exclusively. I am going to share an extremely-extremely important chart that may foretell what is about to happen next in the stocks. You do not want to miss it.

So let us dive into the Emini levels first

First and foremost, we need to be cognizant of who is in the driver’s seat at the moment.

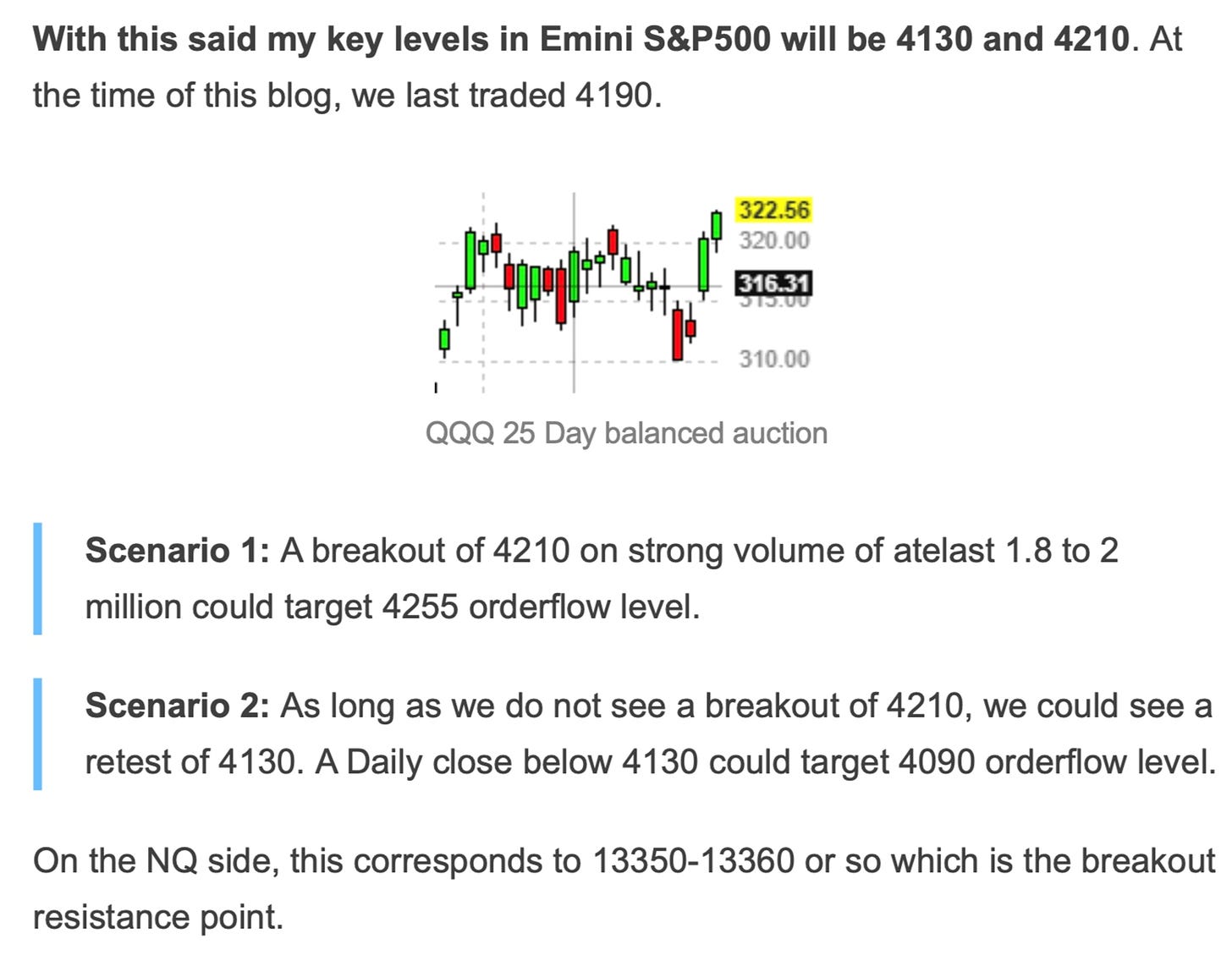

As far as the technicals go, it is by now no secret that the market is in a range. It is a narrow range of about 150 points spread over 30+ sessions. These ranges have a lot of fuel stored in them to cause a large-scale move when they do eventually break.

On the longer time frames, I have been myself bearish in this range from 4060 and then 4200. While the market has sold off several times it approached 4200, each time shedding more than 100 points, the lows have not held. They get bought every time. You can look at it as the lows being bought or the range high being sold, but the bottom line is we are stuck in this range for over 6 trading weeks now.

When you look at the inflation numbers, the change or the delta has plateaued out in the last 5-6 months even as interest rates have risen. Recent econ data shows the GDP shrinking more than expected and S&P500 earnings take a deeper haircut. This has given rise to fears that we may enter a phase of low or no GDP growth and at the same time an era of higher rates. Not a good combination for growth-oriented assets like stocks.

Several large banks have failed. For a bank to make any money, it has to pay out less on its deposits but then at the same time earn more in loans. This is very easy when you have a low-interest environment as anyone who has any deposits earning 0% in a bank checking account knows that they pay 20% interest on credit cards. However, in higher interest rates eras like now, the deposits have competition in the form of treasuries paying higher rates, money market funds paying more, etc.

This means either the banks have to raise the interest rates they pay on deposits else those deposits will flee or they have to sell off their assets which are in many cases long dated bonds purchased when the rates were low so their value is now lower as well.

Either way, this is not a win-win for the banks. So something must be done.

What is this something?

This is where the market anticipates the FED will begin cutting rates as early as June. Yes, you read that right. The bond market is indicating the FED to begin cutting rates as early as June which is 4 weeks away.

My take on this -

I do not know. I do not think anyone can predict this FED which is extremely coquettish when it comes to getting a hang of their next steps. Though I think they will cut later in the year or next year when the economy is in bad shape rather than now when the economy is still adding a quarter million jobs!

I have a better indicator than this. I am going to show you my favorite FED chart below which I think is going to be able to foretell what happens next in the market.

Are you ready?