Traders-

Happy May!

Welcome to a slightly delayed and slightly abridged Weekly Plan as I take some time off but wanted to send out some thoughts regardless.

The week that was, like the few weeks before it, saw a complete collapse of volatility. Short-term as well as longer-term volatilities have crashed to levels not seen for a couple of years now. This is a complete lack of fear. The markets are pricing-in everything to perfection! If you shut down the news and turn off your social media apps, you will hear nothing but a quiet hum of the machines, powered by algorithms scooping up any and every dip!

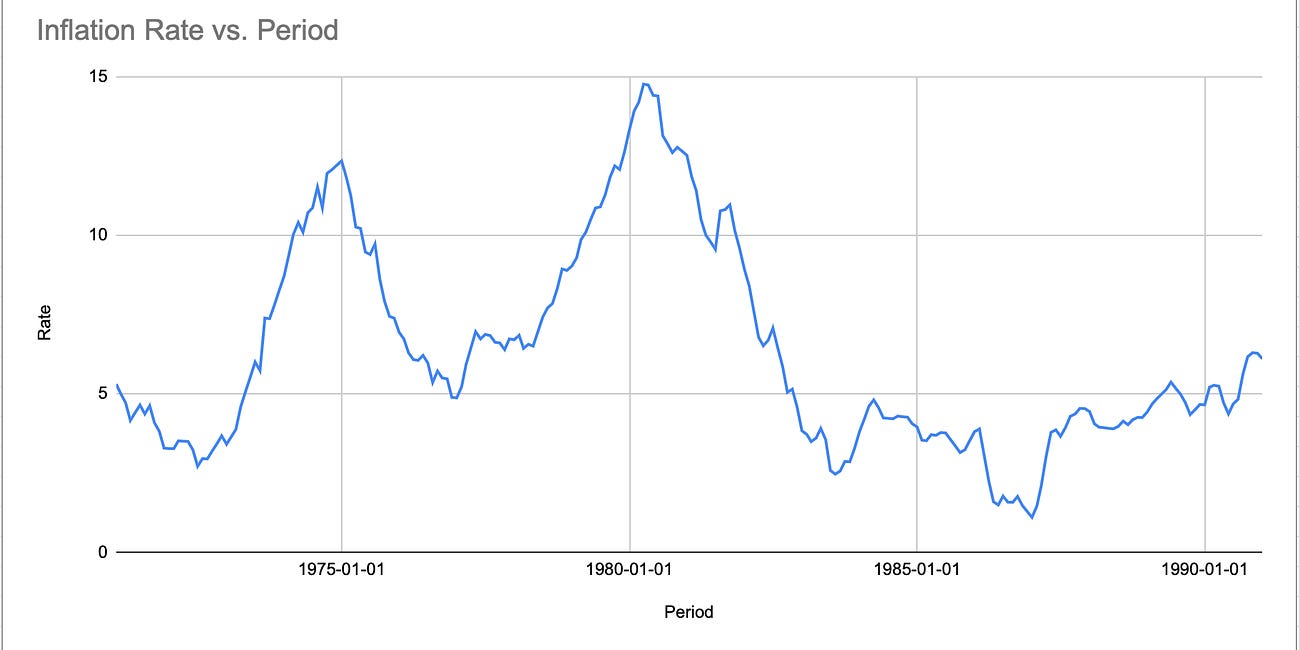

Last week was quite eventful and the events themselves on balance were negative. The message whether that is from the GDP shrinking or the higher-than-expected inflation numbers seems to be a net negative for the economy ahead- we seem to be headed in an era of slower (or no) growth, marred by higher prices in some sectors. The official term for this is stagflation. I have done some research last year on the effect of stagflation on an index like the S&P500. This goes back to the 1970s era.

You can read all about it here. Shared a link below.

In these types of environments, precious metals and real estate have done better than the S&P500 which tended to be the least-performing asset. Again, the data set is over a 10+ year period and not day-to-day or weekly movements.

Short term, I think there are a few considerations or themes active in the market at the moment-

Most market returns in the last few weeks have come from very few, large-cap stocks.

The idea behind this is if there is going to be a credit crunch and if there are going to be issues with refinancing debt which renews this year, then it is better to be positioned in names like MSFT and AAPL which are still growing both top line and bottom line, as well as have little to 0 debt.

With the failure of key banks like the Silicon Valley bank, which have traditionally been a funding source for many startups, there is also a view that these larger mega caps will absorb the smaller players and lead to consolidation which will further lead to growth for these 5-6 names.

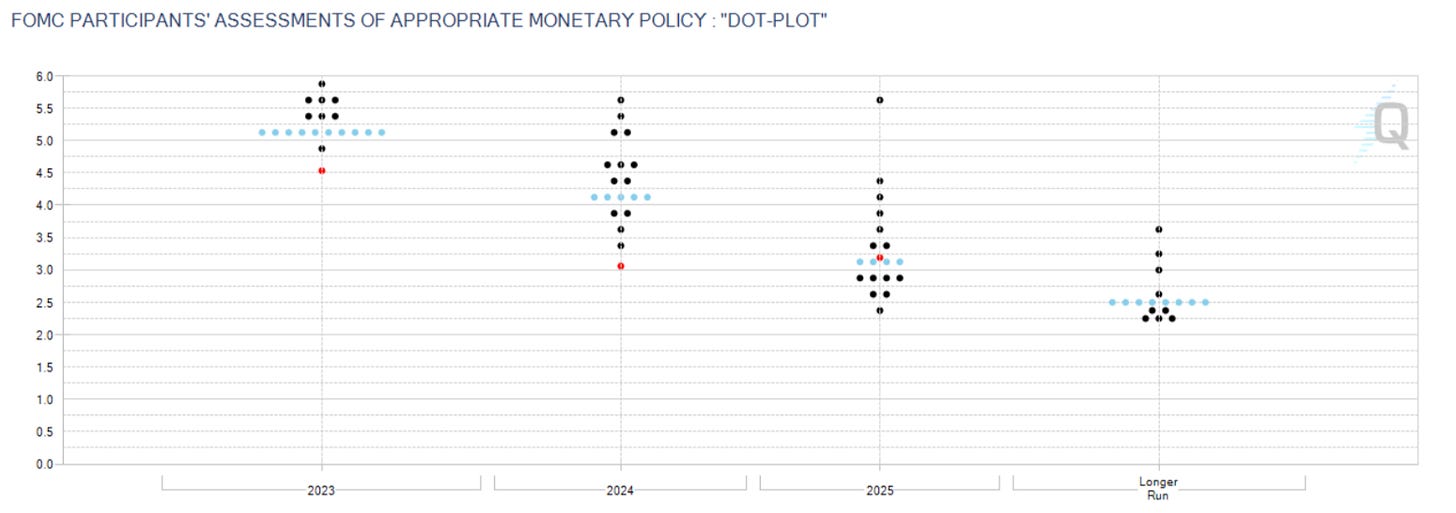

And then on top of this all, there is the question of FED easing. Rather there is a question of FED tightening any further. Chart A below with the median estimates of the FED funds rate in the next few years.

The next FED meeting is on the 3rd of May.

83% of participants believe there will be a 25 BPS rate hike taking the current FED funds target rate to 5-5.25%. Only 17% believe there will not be any rate hike and no one thinks there will be a 50 BPS or larger rate hike on Wednesday.

These numbers, which think there will be a 25 BPS rate hike are significantly higher than the 47% only a month ago in the wake of the banking crises.

Regardless, of whether it is a 25 BPS or no rate hike, I expect this FED to cut rates later this year but I do not think we will go back to 2% in the longer run- at least not without leading to much higher inflation in the US and elsewhere. When the US Central Bank creates liquidity, this in turn lowers the US Dollar which in turn leads to higher inflation elsewhere as well. The US is seen as an exporter of inflation now for a lot of these countries which are still growing rapidly and consume a lot of energy in the form of oil and gas which is still priced in US dollars globally.

On top of these themes, the most recent banking failure, of First Republic FRC 0.00%↑ last week is seen as bullish by short-term traders as they see this leading to a further bulge in the FED balance sheet which by now is set to lose all of the tightening that was done in last one year or so.

This is the 2nd largest bank failure in US history. Perhaps this bank could have been saved had there not been too much panic and negativity about these banks. But I think the main damage was done during the earnings presser. The earnings call lasted about 10 minutes and not a single question was entertained by the management. On top of that, all guidance issued previously was nulled.

When you place a relatively large bank like FRC with deposits in excess of 100 billion dollars, under FDIC receivership, the FDIC can not plug this hole. The total Deposit Insurance Fund (DIF) at the FDIC is about 128 Billion. Barely able to cover the losses of one bank, and here we have one large bank failing roughly every two weeks. Now the market thinks this is bullish in the short term as this liquidity has to come from somewhere if not the FDIC.

So, really a combination of these factors, from the banking crises-induced liquidity injection in the system to a run to the relative safety of cash fortresses mega caps, and bets on the FED easing this year is leading to the sell-offs not holding the lows. The sells off are not sticking at the lows.

As far as the event risk goes next week, there is not going to be any dearth of it. It is a fairly event-packed week and I think it should be a very active session every day for all 5 days next week to wrap the week up with Non-Farm Payrolls on Friday.

The 10 Bagger Conundrum

I do want to share a personal note about long-term market performance from the perspective of how some PMs may look at it.

In the PM community, hitting that 10-bagger is a huge thing and a sign of utmost respect and performance. 10 baggers refer to stocks that have gone up one thousand percent.

Last week one stock, out of nowhere hit a 37-bagger!

If you had a dollar invested in this stock, you turned that into 37 bucks overnight!