Traders-

After a very good week, the focus for me now shifts to the FED next week. In this newsletter I will be sharing my thoughts why I think a lot of folks are anticipating a dovish fed and how I will fade it.

I think a lot of folks are counting on repeat of last FOMC where the market sold off before FED and rallied at the FOMC. This time I believe it will be reverse. I think the market will sell off heavy at the FOMC. Keep reading my plan for levels and context below.

Let us review first some charts starting with E-Mini Weekly Auction in Chart A below.

Chart A shows we had a late week dip but the value did not move lower. This Value Area and Point of control may become resistance next week and may need to be overcome to trade higher.

If you have not already, read all about the Value area and the Point of control here in this educational post: Orderflow 101

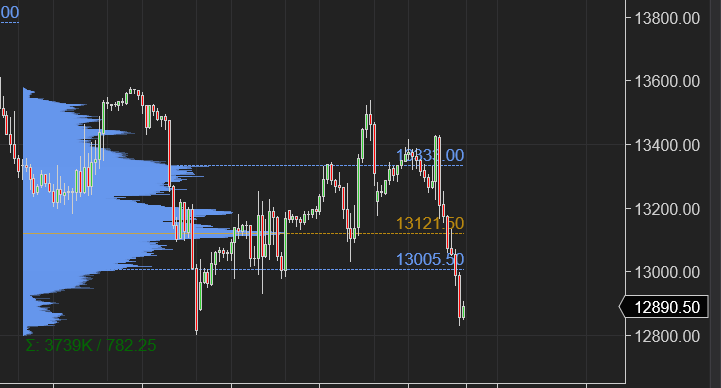

Similar story here with the NQ Weekly auctions. Chart B NQ.

NQ in 12600-12650 IMO starts becoming attractive for a lot of folks IMO for swings. It is now trading about 12900.

While these charts all look very negative I will explain how I will be personally careful being very bearish here in run up to the FOMC decision next week. I will be sharing how I see this play out next week, in run up-to the FOMC day as well as what I expect the immediate reaction may be AFTER the FOMC day.

Let’s kick off this weekly plan with a wrap of last week’s plan

My primary thesis was that there may be an impulse move into 4200 from prior Friday’s close at 4251 but that impulse move may get bought for a test of 4300-4310.

This is exactly how it went down on Monday with the weekly high being around 4310. Eventually on Friday we managed to break 4200 to trade down as low as 4120.

Here is a link to last week’s plan if you have not already reviewed it: 4/24 Weekly Plan

Some of my other calls also did very well. For instance I called the low in XOM around 78/80, and this was indeed the low of the move in XOM and several other oil related stocks shared by me on the week, for a bounce as high as almost 90.

I was not too bearish on NEM and other miners. Gold miners however did not really go any where on the week to close the week around where we started at 73. Note that I am not in the camp that think the Gold run is over. In fact I think the Gold run is just beginning and I will share later why I think so.

My calls on earnings of major players played out very well

In fact even before this week, I was bearish on TSLA earnings at around 1100. I also mentioned in one of my daily plans that TSLA stock has the heaviest option activity of any stock in NYSE and the MM were unlikely to pay out any one neither at 900 nor at 1100 however the stock remained weak for me after earnings.

Well sir the break came on Tuesday when the stock dropped heavy. Finally testing 830 lows in days to come. This is where I warmed up to this stock and this stock ended up rallying about 100 points, trading as high as 930 on Thursday/Friday.

I was also quite bullish on Meta FB before its earnings at 170. AFAIK, I was only a handful of people bullish on FB before its earnings . In hindsight this was a good move as the stock rose more than a quarter a couple days after it’s earnings. A lot of people were thinking this would have gone the same route as NFLX. I did not agree with that. I thought FB was undervalued to start with. FYI I was the one who was bear on NFLX before its earnings when the stock lost 130 handles or about a third of its value and I shared this the week before with this forum. NFLX now here around 180-190 I think is setting up what FB did this quarter for next week. I think in Q2 earnings NFLX may surprise to upside, but there is long ways to go yet.

To cap this week, I shared this plan in which I turned bearish on AAPL and AMZN before their earnings. I made my case why I thought the call buyers were unlikely to be rewarded in AAPL. Well, AMZN got clobbered after its earnings, it lost more than 200 Billion dollars in its market cap and shed about 500 points from its highs that it was trading right before its earnings. AAPL also fell, and I remained a bear on AAPL on any pops into 166. The stock closed at 157 on Friday.

So this is the week that was- lots of traps that saw a lot of folks got bullish thinking the market has bottomed but I steered clear of this all week as I knew we are still below my key orderflow level 4310 and were unlikely to have a solid bottom unless we were to overcome that.

Don’t miss any of my updates during and after the earnings season where I send out a daily plan to my readers almost every day- keeping a pulse on the market. Subscribe now.

Looking at the S&P500 in next week

Next week is going to be all about the FOMC on Wednesday and NFP on Friday- an event packed week.

I am expecting the market to start the bottoming process next week for an intermediate term trip back to 4466-4500 recent range high. These bottoming processes are not a turnkey thing where you can turn them ON or OFF by a button. Flows are involved, several different players with different goals and time frames take part in it and therefore it can be messy and choppy.

My primary expectation is that a lot of participants are going to count on a dovish FED and expect the market to sell BEFORE and rally AFTER the FOMC, like it did on last FOMC.

I do not think so. I think the exact opposite.

I think the market may rally BEFORE the FOMC and sell AFTER the FOMC.

Why?

Despite the recent negative 1.5% shave in the GDP, I think the actual economy remains robust driven primarily by the spending of consumer. I think this negative GDP was mostly due to the export going down compared to import and I think this GDP alone will do nothing to change FED’s mind about the state of the economy and therefore I do not think they change their tune much this FOMC at all.

My take on the FOMC

Despite the dip in Q1 GDP, I expect due to the wage inflation, low unemployment, overhang of the stimulus, the Q2 GDP will be very hot. Rolling 10 year inflation expectations are about to jump 3%. In this backdrop, I think the FED will deliver on it’s promise of 50 BP rate hikes for next 2-3 meetings. On this particular FOMC, I think the FED may come out to be confident and verbally do more quantitative tightening than they will actually. This may cause a dip in the equities and a rise in bond yields even more as the FED is perceived to be more hawkish than expected.

However, I also do not expect the FED to remain hawkish after this FOMC. The reason being their credibility has taken a hit when the inflation turned out to be not so transitory. Now Jerome Powell has been saying he does not think there will be any recession any time soon. If he turned out to be wrong again, they lose whatever little credibility they have left.

This may culminate in a surge in dollar $DXY against vulnerable pairs like USDJPY which is now trading back below 130 and is already at 30 year highs. This may also take the Gold to the shed which is now below 1900 again. I will remain bullish on Gold on any dips back under 1870-1852. The FOMC may also cause softness in Bitcoin which I have been bearish on since 46000 and is now trading around 38000. I do however think any dips into 34500/35000 may get bought for a trip back into 41000.

Also, I really do not think that the rates will have any impact whatsoever on inflation. I believe this inflation is here to stay and with 6 months left to the mid terms the Biden admin has a call to make - go to mid terms with inflation or go to the mid terms with inflation AND recession (and 10% joblessness).

I think this is a fairly easy choice for them to make. Don’t you think so?

The FED will give up its pretense of fighting the inflation and the market knows this. This is why I think we are probably quite close to that swing low in S&P500 for a move back to the recent range high at 4500.

So how do I want to see this play out next week?

On Monday and Tuesday, I think if we open and remain bid above 4140, I believe we may test 4238-4251 before the FOMC.

My expectation then will be that on or after the FOMC day is when the markets make that climactic low, test 4000-4050 and then rally from there to close the week or early following week above 4200, thereby putting in a climactic low.

Now, a couple of nuances in this.

I think that 4140 is quite key in this, especially for that first half of my thesis. Let us say Monday rolls in and we either open below 4140 or worst offer below it, I think that opens the door to more volatility rather than that expected test of 4250.

After the FOMC, I want to see a Daily close below 4200 not above it for that 4000 bit to remain in play. If Wednesday we close above 4200, I think we have seen the climactic lows and the train may leave the so called “Melt up” station without 4000/4050. Unlikely but not impossible.

Most importantly these are just my opinions. Everyone has them and these are mine. I am happy to share them with folks but know that these are nothing more than my personal opinions and must not be taken in any circumstance as advice to do any thing.

Will these scenarios work? I have no idea. But based on whatever methodology I follow, whatever information I am looking at, these scenarios make most sense to me personally. Happy to share them, as always :)

If you like my plan and levels, consider sharing my newsletter with your people so we can reach more traders, like your self.

Now some folks have pointed out that my scope of the melt up may be smaller in scope than that of many other melt up scenarios being shared online. Now here is the thing, with the doom and gloom right now, so close to that 4000 mark, if you told me we can trade 4500 in a few weeks, I will think you have lost it.

So for me, 4500 is a very good level, if we can muster that kind of firepower to trade up almost 10% up from here. I do think there will be some impulsive moves, when we get to 4500. If we get to 4500.

I think we may impulsively go for a 4600 even. However, based on my methodology it is hard to predict anything above that as I need to see what orderflow we find, once/if we get there. I am much more rosier for some other names, than S&P500 . I think they could have a lot more room to run if I begin seeing macro I am anticipating take shape. More on that later.

Who benefits more (most?) if FED pivots

For me to answer this question, I need to define my assumptions first. This way I can make sense why an ARKK type ETF may not be an obvious winner when/if the FED pivots versus something like Gold for instance.

See there are two reasons the FED may pivot. One is obvious but less probable - that the inflation dies and the FED can say we are back to 2-3% inflation, and 2% inflation is good, so let us not do any more tightening. Whether 2% inflation is good or not, is beyond the scope of this post but this is something that will cause the FED to pivot.

The more probable cause of this pivot is that we are a debt based economy. The US government itself can not handle interest rates in 5-6% range as it will make their interest payments alone in trillions. And then there is the recession. For the politicians , a recession in an election year is an anathema. They will avoid it at all costs. So this leaves us with a FED unwilling or rather incapable of doing anything. Inflation will run rampant. In this climate, do I think the more speculative recent names like the ARKK or TDOC which used to be 300 and is now 30 will shine?

Nah.

What benefits in this kind of environment is what has been winning recently. Which I think is the gold and gold miners, commodities like oil (if the recession can be avoided which I think will be avoided for now), I think real estate also benefits to some extent, especially if these rates ease. In other words, anything that requires manpower, resources, machinery to create I think may do better , especially if the FED pivots.

Where does this leave the Big Tech darlings and the S&P500?

I think they will carve out a range. I do not expect them to make new highs anytime soon but I dont think they will crash below these levels either for few more months or even quarter or two. Just like this range has formed in S&P500 this year between 4100-4600 which BTW I shared with this substack back in January ever before it was a range, I think we may see a similar range form in some tech darlings like AAPL could remain between 150/170 for a while, GOOG may carve out this 2200/2500, AMZN may find bidders at that 2300/2350. I think any new highs now in these names and hence the S&P500 will require these names to break out of these ranges now.

Some earnings thoughts

AMD

AMD stock which I got bearish at 110 dollars and was a harbinger of sell off in S&P500 and QQQ per my prior daily post on it, is now trading at 85 bucks.

While the charts look weak, I think the stock is a bit oversold. I like it on any dips into 80/82 and I think it may trade 100 dollars on a bounce.

MRNA

I became a long term bear on MRNA at 500 dollars and the stock has now sold off into 135 handles.

This company has been notoriously difficult in the sense they can cause pumps by their statements which then get sold promptly into. I cannot be a bull on MRNA and I think it gets sold into any pumps this time too. My target is sub 100.

A lot of folks think they have a PE of 4 and have 20 billion dollar plus in cash so that makes them cheap. I think contrary to it makes them a moving target of malfeasance. I think any rips into 150-160 post earnings get sold and I may warm up to this stock below 100 not above it.

In healthcare, I like MRK more

Given a choice I like MRK more than MRNA. They took a far more responsible approach to their pharmaceutical delivery over last two years.

What is its downside?

The only downside I see is technical .. it is very close to that 90 level where many bag holders may be. But I think if 86 were to hold, we may test 100+. Now 88.

PLTR stock

Stock takes a tumble after I turned bearish on this at 13 dollars. This stock IMO has a long way to fall to test that 8 dollar range.

To summarize, bearish sentiment is now at all time highs. However I do not share this same degree of bearishness. I think the market is now close to a meaningful swing low- this number could be at 4000-4050 (now ~ 4100). I have steadfastly been a bear since 4620 over last 2 weeks BUT I think we now approach levels which may become unfavorable to the newly minted bears.

If I am right, this does mean some of more beaten down recent names like ARKK and GOOG etc. may find some solace. However I think the most bang for the buck may come for my names like NEM and some of the energy names like OXY, XOM, and commodity names like ADM etc.

I expect the mega caps and S&P500 to remain stuck in range bound action. It comes down to the FED and US Dollar. I think with US Dollar so high and expected to remain high in short term, I think any bounce in these mega cap names and what I called “fluff names” like ARKK may be short lived.

I need to see a sustained downtrend in the US dollar index to say some sort of longer term bottom has been achieved. Until then I have my reasons to believe BTFD (Buy the Dip) has been replaced with STFR (sell the rips).

Any updates to this plan will be shared on my Twitter and Telegram. If you have not follow me below. Remember I will never text you or Telegram you for one on one coaching or to sell any thing. This substack is the only service I have. Any one reach out to you selling any service is a scammer and needs to be blocked ASAP!

~ tic toc 🍀

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Here to post before reading. The best Sunday reading with a cup of coffee, tea, hot chocolate, or whatever you like right here.

Thank you again.

Tic, It would be awesome if you can pen an article on how you think about housing over next 5 years. The rate of growth def seems unsustainable but why are there not many sellers yet? Thank you! Enjoyed the weekly post and looking forward.