Traders-

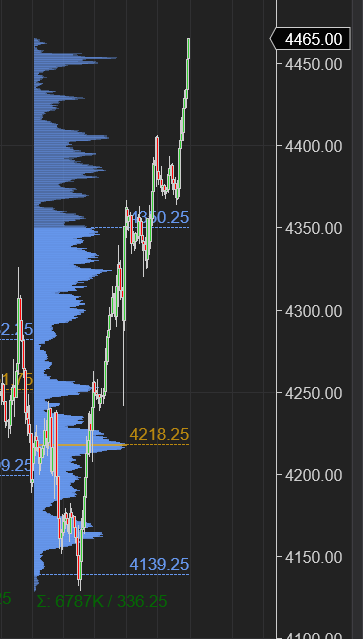

We capped a violent week for the equity bears rallying more than 300 points to close at session highs around 4470 on Friday.

This is the best week for S&P500 since November 2021. Weekly chart below. Read on how I expect this action may continue and some of the levels I will be watching that could challenge the upside march. I tried to provide my reasoning and a theory in Section C why I think there was very little resistance at 4425 (as I had expected we will on Friday) and instead we closed at ~4470.

When we started the week, there was tremendous doom and gloom amongst market participants. At close of the business on previous Friday, majority of FinTwit believed in end OF the world scenarios with their forecasts ranging from 3300 to 3800 post FOMC. At one point I had to disengage from Twitter as I could not believe the negativity.

I was buying none of this and I felt the market will find it hard to sell below 4150, based on Friday auction. See the Weekly levels below. Good for me that this is what ended happening and we rallied sharply off my 4150 without giving negativity any more opportunity to spread.

New readers should start with the prior couple of weekly plans to be aware of context and levels which has been guiding my thinking leading up to this week:

Weekly plans represent my continuous theme and auction levels and are important prep milestones leading to daily action. I post about 5 posts every week but the weekly ones are most important in context of overarching levels and thought process.