Traders-

Welcome to another installment of my weekly newsletter. This is 5th of the weekly posts and in this volume I will cover my analysis of next week’s action, my thoughts on FOMC, and a few names which I like at these levels.

There are 4 sections today:

A. My thoughts on FOMC

B. My weekly wrap up from last week (New readers can check this out as a Sample Weekly Plan : SAMPLE)

C. Weekly Prep for S&P500 (Trader Tic’s Corner) .. this is where I lay out my tactical day to day levels that I use to make intraday trades in S&P500 . Shorter duration oriented.

D. Investor Tic ..this section lists any stocks which I currently like. These are more thematic and macro influenced . They are not your average high growth, high tech names (but could be if they had any merit in these conditions) that folks usually chase egged on by brokerages and experts, but it is based on my own personal research and macro. Some recent names are RS, ADM, VALE etc

As always remember this is my personal journal, not financial advice. Do your own due diligence. I am happy to share my personal thoughts and levels with you. Hit the subscribe button below to get this weekly post delivered in your inbox every week.

Special deal for the students. 3% off for everyone else.

Valid only till FOMC DAY!

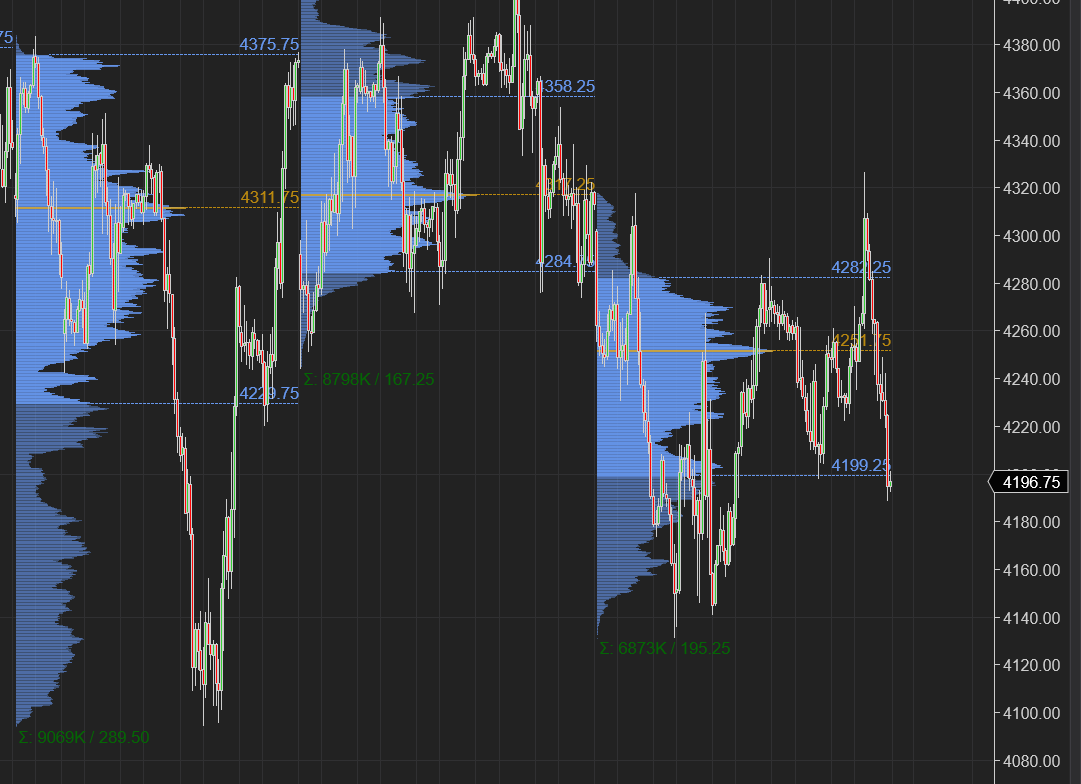

Volatility remained elevated this past week with the average day having an ATR of about 150 points in S&P500 emini. This while quite extreme, had S&P500 go no where when compared to the extremely large range week of 2/21. See below (Chart A).

Value area moved lower below 4271 which is a KEY orderflow level. There are 3 distinct technical factors which are bearish going into next week:

Sharp rejection at 4327 which the key orderflow level from February.

Value has moved lower below 4271.

S&P500 emini could not close above 4224 which was the KEY orderflow level for prior week.

However, when you look at this weekly Chart A above, I think the Chart itself does not support bearish action below that 4150/4165. This is strictly a technical view. More on that later.

A. FOMC thoughts

Next week on the 16th, FED will start raising interest rates after ending the QE earlier in the week. Absent of a strong macro event, when all news dies out, FED remains a looming figure which decides where those next 500-600 points or more are going to come from. For any one who is bullish has to have the FED on their side, and this is me trying to make a case why the FED may be after all still on Bulls’ team.

For those who are new to FED’s QE program, it is simply it’s program of buying assets to create new money in the system which in turn leads to more lending/liqudity in markets. This tool has been used quite commonly after 2008 GFC when the rates have been close to 0 or already 0 in several other parts of the world.

This is truly historic not just because of the timing of this but also due to the following factors:

About 70% of NYSE stocks are trading below their 200 Moving Average. VIX has been elevated above 30 for most of YTD. I do not remember a time when FED started sustained tightening in these parameters. This is important because they are tasked with not only controlling inflation but also maximizing employment. From my perspective, 50 basis rate hike may not even make a dent in these CPI numbers but they can certainly derail the economy as there is a lot of debt and leverage in the system.

While it was the “transitory inflation” last year, to some extent Powell can make the argument that the inflation is artificial now with a lot of it already being blamed on Putin and his aggression in Ukraine. This could lead to a question if it makes sense to raise in face of “artificial” inflation.

IMO there are 3 factors which are very good at predicting recession: yield curve inversion, FED tightening and commodity price shock. While there is no control over the yield curves and commodity pricing, the third one is probably in FED’s hands. Or may be it is not. We will find out.

Despite almost 8% CPI now, it is hard for me to imagine the FED tighten aggressively despite this inflation which I think will get much worse.

Why?

Because first off it will almost certainly cause a recession, assuming there is none right now. Second, the magnitude of these rate increases will not even be able to make a dent in inflation, so why bother? Is FED going to surrender to inflation or fight it? Let me know your thoughts in comments below.

Now while the FED does seem to have a choice whether to raise, or pause, our European neighbors across the pond do not have as many choices like we do:

Ukraine and Russia combined account for about 3% of Global export and import. However that is not the complete picture. Europe gets most of its iron, steel and Nickel from Russia.

Both countries are major hubs for global gas, oil and grains. We already see this in prices of energy and grains. Russia is a major corridor for air freight- that will hamper the supply chains even more.

In terms of volume that flies over Russia, it is quite small but nevertheless it is a huge link between Asia and Europe especially for extremely high value products- electronics, chips and all.

Russia is now cut off from rest of the world. It may still be able to sell its wares but through back channels- this will add on more cost and more processing times on already stretched supply chains.

Consider ships languishing in ports, crews unable to do their jobs, aircraft having to reroute, refuel on their way to service major supply chain hubs.

BTW, I think ZIM which I shared earlier in this newsletter at 50 can benefit from this even further. It is 78 now. But I think it could make a run for that 100.

Most of my ideas, with the exception of S&P500 emini, span multiple weeks and even months. My LIS is usually 20-30% and almost none is geared towards shorter time frames.

A Cautious FED?

These trade routes and logistics impact America to a lesser degree but it will be a global event in terms of constrained supply chains. This will increase inflation much more than the current 7.9% in coming months. Probably March will be at 8.5-9% range. To make matters worse, this will take a big chunk out of global output. So things are already slowing down in economy. I think American GDP may fall 5-10% due to these events.

When was the last time you raised rates in a slowing down economy?

You cannot fight this raging fire with a sprinkler of a 25 basis point hike here and there. What is needed is a percent or more hike in every FED meeting this year and beyond. Powell has to become a Volcker.

While the market expects 6 rate hikes this year and a balance sheet run off from Q2, here are the changes that the FED may make in their statements:

They will probably lower the GDP expectations to about 3 % and increase their inflation expectations to 8.

What is helping them is the very strong US labor market so I do not think in this particular FOMC meeting Powell will depart too much from the market expectations which is 6 hikes, 25 points each with an option to do a 50 if needed (but won’t happen).

At any rate, on Wednesday it will be a stark contrast between the US and rest of the world, primarily Europe. The US will come across as relatively unscathed and a position of strength in contrast with Europe, battered and possibly in a recession already.

The first reaction may be for the US dollar to gain versus others like Euro , the equities to sell off and the EM markets to sell off as well- after all things are going as planned, the US is the perfect house in a bad neighborhood.More on this and levels later.

Depending then on various factors - like where we close on Wednesday and how much volume we get at which level, as well as the profile parameters like profile shape, it will be more clearer to me if that move to the downside is going to be a trap.

Most likely I am thinking we trade the contract LOW immediately after the FOMC and that may trap a bunch of new bears. More on that later in subsequent sections.

I also think - more QE not QT may be on it’s way. Globally.

The Western governments have perfected the COVID-19 template of fiscal spending their way out of ANY crisis and I think they will use this again in 2022 to fight inflation (with more inflation?).

I would not be surprised at even more stimulus for higher energy costs. Already the high gas cost is breaking backs (and budgets) of average working class person in Europe and USA/Canada. What makes this worse is as the world reopens after 2 years of this pandemic, it is forced to drive to work and to fly- leisure in some cases but business in many.

This will not ofcourse happen overnight- I think the primary focus remains the current conflict. But sooner or later, the QT will turn into more QE.

Even if first 2 or 3 rate hikes do go though, I think it will lead to more lending then by the US financial institutes as they want to create more credit to reap the benefits of these newfound yields.

Either way - QT or QE- I think S&P500 manages a way to bid higher from here. While this is my general view, see my detailed breakdown of technical levels below. The Macro view is incomplete unless backed up by technicals and levels. As far as the levels go, we do have overhead resistance which needs to be cleared. More on that in Section C.

B. Weekly Wrap up

No week is complete unless we do a wrap up of how we did from prior week’s plan for transparency.

One of my ideas for the earnings was ORCL which I liked on any dips into 73/74. This was a very good play with the low of the move being 73 before closing the week at 80. One of the only few stocks closing green on Friday.

I was also bearish on CRWD at start of the week at about 180 which managed to sell down to 160 before closing the week again at 190.

SCCO has been consolidating at 74/75 which was shared by me at 76. Will see how it does over a week or two next. RS stock shared by me at 170 did have a decent move to close at 190.

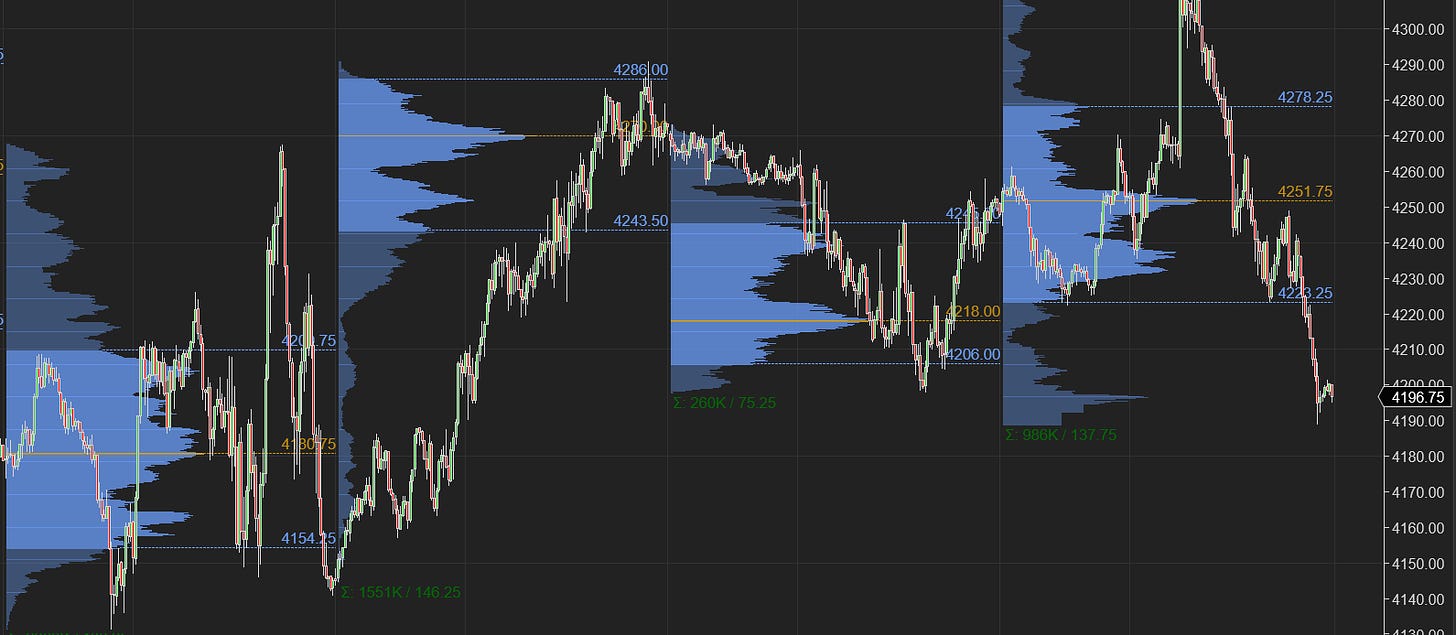

On the S&P500 emini side, my main hypothesis was a balance between 4271 and 4425 with volatility if we broke below 4271. We did manage to break 4271 early in the week and traded down to 4130 where we managed to find bidders. 4271 was a key level though out this week , however we could not trade above 4337 throughout the week, closing on Friday at 4194 . I am not June contract now.

Directionally the week has been choppy with a very stubby profile - it has been a market for the scalpers and hit and run type traders with no clear, sustained direction yet. I don’t know if this gets resolve this week either as this was another inside week.

C. S&P500 Emini

This section describes my current thinking on S&P500 and preparation in terms of which levels I will be watching and trading. While I express longer term views using individual names described in section D, S&P500 emini is much more speculative and shorter term oriented for me.

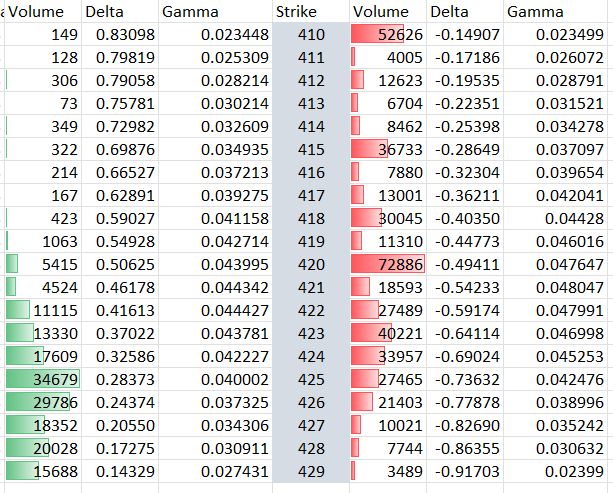

Option Flows

Heavy PUT volume near the recent lows 4090-4100 contract low whereas very light CALL volume may indicate some sort of support here, pre FOMC.

Note this is not the case in Monthly Expiry on the 18th so will have to re-assess at that point. I will update this on the night of the 16th. This could support the hypothesis that pre FOMC market may range between 4150-4271.

Looking at the 2 weekly and one monthly expiry this coming week, I expect chop ahead of the FOMC thru Wednesday. I think it is harder to call Thursday and Friday, from a week away. But things may become clearer as we get close to those sessions and will be shared through my daily plans.

Options volumes, particularly are very heavy at 4100. Again this does not mean these levels can’t trade on an impulse move, but I think they may be harder to hold.

Events Calendar

Following are key planned events next week:

Tuesday:

PPI: Producer Price Index. This indicates to me how well the companies are able to pass on the costs due to inflation to the end consumer. If so, this is a sign of pricing power of companies.

Wednesday:

Retail Sales: recent Consumer confidence has been on a downtrend for a while now.

FOMC decision: See above, Section A.

FOMC Presser: Section A

Thursday:

BOE rate decision and monetary policy minutes. I do want to see how hawkish or dovish they come out to be as it may be the template for global CB. Especially in context of FED a day earlier.

US unemployment claims: FED will be watching this closely especially in follow up to their guidance a day earlier.

Japanese CB minutes and rate decision: will be reading thru it, due to the reasons outlines earlier.

With fairly heavy CB (Central Bank) calendar this week, I think the closes on Friday become important. Even if S&P500 remains under pressure throughout the week, a weekly close above 4271 will be very positive for me.

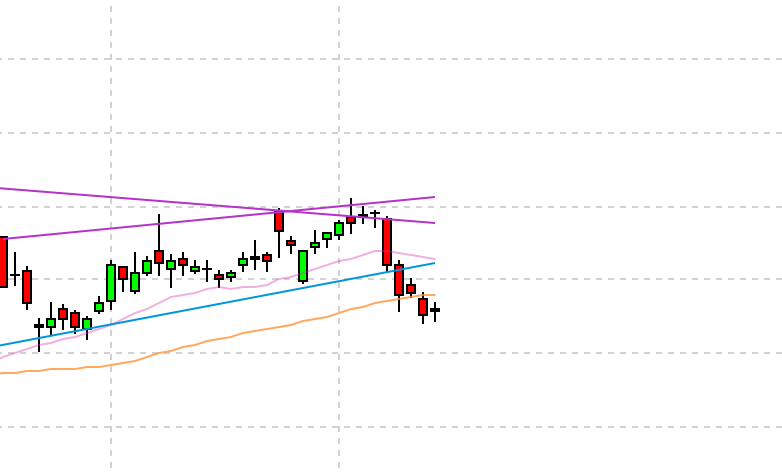

Chart C Intraday Emini

Now looking at some intraday charts, interesting pattern with key levels at 4224, 4271 and 4156.

Looking at the techs only and no other thing- while the bears had a good Friday, I think they may have a hard time offering below 4150. On the upside, while 4300 seems a solid resistance, the market does seem to be raring to go at it. More context follows.

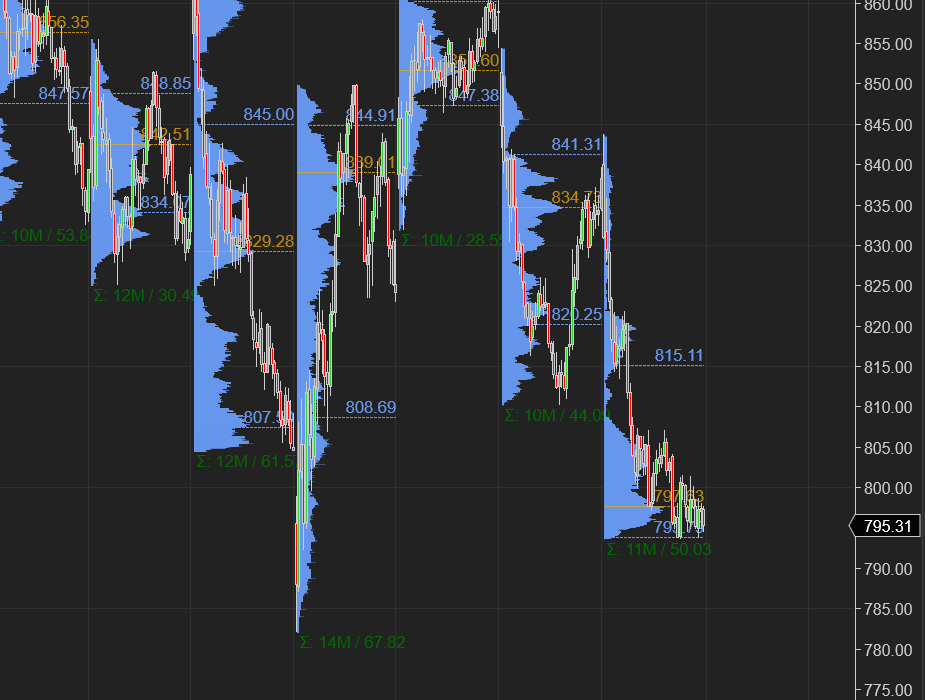

To look at some of the related markets, TSLA which has been having a hard time below my LIS at 899, did sell down below 800 again. I thought the sell off was a little strange- I do like this profile set up and may be pretty binary in outcome. I think this wants to go up here at 795. However those are some key lows in vicinity at 780 which need to be respected.

Chart D: TSLA. Tesla has all sort of headwinds right now. Valuations, wars, supply constraints. Technically also it has been a bit weak. I think if it traded down back into 600 handles, it remains a buy for me there.

Putting this all together for next week:

So after looking at the related markets, events of next week, some option metrics, here are a few levels and thoughts for early part of next week. To call anything right now for Wednesday and beyond is likely futile so we will wait until that Wednesday session to get more context. S&P500 Emini traded 4196 at time of this post.

From a 10000 feet view, I think the market has been having a hard time going down and is being forced down on news. If I am right, this sets stage for a very sharp rally. Rallies are being sold off on balance so there is that- and may be the theme for next few days as the market completes the accumulation process.

For Monday and Tuesday, I do think a range may form between 4150-4271 in anticipation of the FOMC on Wednesday. There may be offshoots to even 4300-4350 due to an impulse move.

I do want to validate this with the Tic TOP indicator whether it is flat, negative or positive for the Monday open. Tic TOP in this volatility has been very potent indicator . Combine this with TRIN, which has been quite remarkable to predict softness in S&P500 whenever it trades below 1. My hypothesis is with TRIN below 1, money is flowing- but it is flowing into all the small caps which cannot support S&P500 . TRIN is not a market cap weighted indicator.

I thought stocks came under pressure on Friday due to the sell off in AAPL and some other names, however AAPL is at a support of 155-156 that if does not hold could lead us down to 150. Consequently if we manage to close above 155 on Monday, I will think of this as a +ve for not only AAPL but also for the overall market.

Regardless of day to day action, I think on the downside, the contract low at 4080/4094 is extremely crucial level which if does not hold could expose next orderlfow levels below 4000. Will we take out 4080 this week? I don’t think so , unless the FED really pulls the rug under us on Wednesday.

A daily close above 4271, even before the FOMC then is great for bulls and could lead to a test of 4327 which must be overcome before we can try 4425 again. Ideally I want to see us close above 4271 the day after FOMC.

While I do think 4700 is a viable target for S&P500 , despite the short term volatility on the downside, that macro picture has been clouded since last week after we could not hold 4271 (due to technical damage). I have no doubt in my mind that the bulls need to do work to take 4271 back if they want to see higher levels again. There is resistance even at 4327 which is a key level I have shared before , right above 4271. But the beggars can’t be choosers and at this stage I will be happy if we can take 4271 back again before we talk other, higher levels.

This may come on Wednesday. And if it trades on Wednesday I will give it more weight than let’s say if it traded on Monday or Tuesday on account of news or some other development.

Eventually, 4271 and 4327 will give up as some of the tailwinds described here become apparent to more and more participants. Now whether that is next week or next month is anyone’s guess. I would think the it must be before June as I expect a significant hit to the S&P500 mega cap bottom-lines from the ongoing conflict which will be revealed in their Q1 earnings reports.

To Summarize:

The Macro picture sucks. The technical picture sucks. There may be short term pain post FOMC may be even before it.

However, I do believe market may not be fully pricing in the extent of the damage that has been caused to the economy by the recent events. This will be met not with austerity and tightening but with more loosening.

I will confirm this with my levels. For this week the 5 KEY levels are 4080/4150/4234/4271/4327. We have had two opportunities to close above 4271 and both were wasted due to low volume. A 3rd opportunity to do so on strong volume of 2-3X the average takes us above 4327 and then potentially 4425.

S&P500 Emini traded 4196 at time of this post.

Key levels are not chart based but result of orderflow. They are exclusive to only this substack blog and can’t be found anywhere else. Subscribe now to receive them every week.

In all of this volatility, my inflation stocks - whether that is an ADM, RS, NEM, VALE are doing ok. On the growth side, I do only like a handful of names like GOOG, AMZN, PLTR and TSLA. They have been under pressure and may remain under pressure due to the factors described here. However, I am in no hurry to see the results tomorrow or next month for that matter. So I will stick with them thru this volatility. Investor Tic will probably add more if they dipped more.

Trader Tic likes the volatility. While it is not possible for me to share every thing I see on tape, I have shared some tools like Tic TOP and TRIN which is what I watch myself and are fairly good leading indicators. I encourage you read about these tools here in my substack. Comment below if you have a question about either of there and let me know.

D. What Else I am watching..

Here’s a few more thoughts, longer term..

KWEB

KWEB is now down 75% off its highs set in 2021 and is now trading around 24 dollars. It is now trading at all time lows. There are a lot of headwinds for this going further- like the ADR delisting fears and worse of them all, a possibility of it meeting the same fate as the Russian ETF, should China decide to invade Taiwan. One thing I do want to keep in mind is while Russian represented 2 percent of all Emerging Market index caps, China is 30%. So should China invade Taiwan at some point, I think the idea KWEB goes to 0 may be a little too far out there.

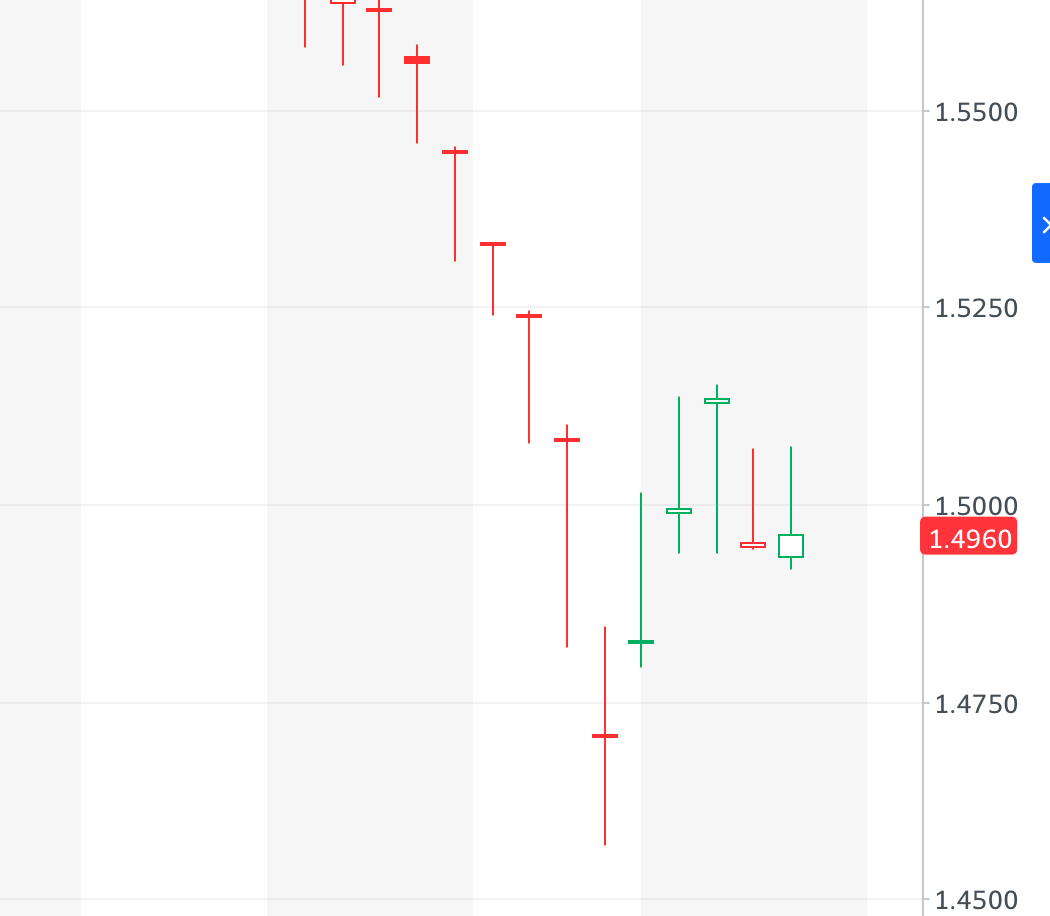

Euro

There are probably going to be several ways to play Euro. I personally like EURAUD.

With this commodity boom which I think is just starting, and what’s to come out of Europe to address the spillover from Ukraine conflict, I think EURAUD seems a bit pricy here at 1.5..

I think at the very least it ought to test 2020 lows at 1.3 and beyond.

POTASH

IPI is probably another way to play the shortages which are hitting globally from chips, to fertilizers, to other commodities.

This is little bit of a speculative name and seasonal but I liked the charts on this and I expect it may test 110-122. Now 84.

LAND

LAND is an old friend of me which I shared earlier sub 30 and it cleared 35 today. I think as long as it holds 30, it may be headed a it higher into 40 and beyond.

As far Buy the Rumor and Sell the News go, I have my sights on DWAC. This is a complete disaster in my opinion as the app rollout was plagued by delays and errors. I was the one who shared this originally at 36. See this link here… However now with my targets met at 100+, and the actual app turning out to be dud, it is on chopping block.

I think this thing if it rips may find motivated bears.. my target will be back under 46/52. Now 71.

GOLD

Gold which I was very bullish throughout last year and NEM which I had been quite bullish on any dips whatsoever last year at 50 is now out of the box. It is now close to 80 at 76, but still some ways off my target of 106 and beyond.

Charts do not look too shabby either.

XOM

I was a little soft on Oil earlier in the week at 130 before it fell to 108. I was watching XOM and wanted it to go sub 80.

It could not and in fact closed the week at 84.

With some of the weekend events, I do think this could stick around for few more sessions. I like it as long as it does not give up that 80. I think XOM may try recent highs at 90/92 and break them to test 100.

Commodities

I have been bullish on commodities, commodity currencies from late last year and my view have not yet changed thus far. I think we are in a commodity cycle which has room to run. With Russia now offline, some of the other nations may pick this slack up. Whether is an Australia or some other latin American companies.

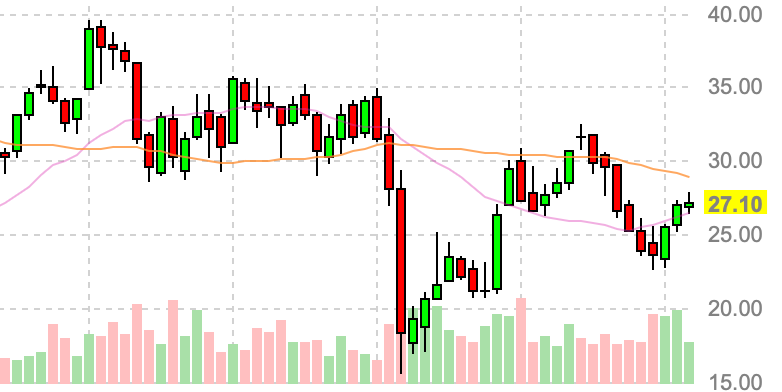

Look at this ILF chart for instance. It has some familiar holdings like VALE which I have been bullish since 12 and has room to run IMO. It is now at 27.

The theme behind a lot of these names is dependent on the commodity boom to continue. Which I think it will unless there was a global shutdown/slowdown like we had in 2020. Even if you look at Europe which I think is the biggest loser of this Ukraine conflict in several aspects, I think they will bear majority of brunt of housing and sheltering millions of refugees. I think they are going to do massive QE which will further depress their currencies and cause more commodity inflation.

Then there are assets like Tesla for example. TSLA has very high street expectations for this quarter at about 18 Billion dollars in sales. If Elon can through some magic pull through this shortages I will be very impressed- but until then I do think TSLA has a very small window to make some sort of highs. At ay rate, the window of opportunity for mega techs to make a run to new highs IMO is 3-4 months out.

So with this backdrop, I have been lucky to focus on these names, in a sense you could call them the new 2022 FAANG. Many of these names I shared way earlier last. year when I started this substack and they are only now starting to go mainstream.

In a sense some of these have been effective hedges against some of the more tech names like GOOG and TSLA for me.

F: Fuels, Gas, Energy - XOM, CVX, XLE

A: Agriculture- LAND, ADM

A: Aerospace and defense - LMT

N: Nuclear - CCJ

G: Gold, Metals - NEM

The current trajectory for me seems to not change. I think this is going in the right direction. What will change my thesis is a few factors once I start seeing them I will share them with this forum. Stay tuned.

I hope by then we have a new theme to hop on to. May be it ARKK and ARKK type stocks, you never know :) But I think that is still some ways off. So focus on what has been working.

This is it from me, for now.

Stay Safe. Do well. If you like this research, feel free to share my newsletter use the buttons below.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user, they own all copyrights to their products.

Thanks Tic. Fed can decrease consumer demand via increasing interest rates. However, as the debt levels are at all high time levels, they cannot increase the interest rates above a certain limit. In this case, decreasing the demand can be achieved via deflating stock market as it will have negative impact on consumer sentiment. I believe that they will try to take the air of the current inflated markets as smooth as possible. The question is the time span to achieve their objective. They might be softer till summer months during which inflation automatically goes down and support the markets, but more aggressive with QT during summer months. We will see.

Thanks for sharing the point about TRIN indicating softness under 1...makes a lot more sense to me now. Also, EUR/AUD very interesting to watch but also USD/JPY imo. The pair seems to be trudging to the 124 level and is a great intraday risk indicator...I think dollar and dollar speculators will push higher based on what you outlined above, but if FED doesn't QT and let's inflation rampant I'm expecting a big bust in the dollar. Also, imagine how good QE and higher market (4700) would look for dems headed into midterms! Thanks for all you do Tic.