Traders-

This was a milestone week for the US markets. About a year into aggressive rate hikes by the Federal Reserve and we started witnessing cracks appear in the financial plumbing of the economy with this week’s events surrounding the Silicon Valley Bank (SVB) and it’s competitor First Republic (FRC). There were winners and losers - the best part was that the markets continued to function without major hiccups - as they should.

This was a picture perfect week for the OrderFlow levels and a good case in point that once the volatility rears it’s head, and a range expansion occurs, OrderFlow levels can be a great tool to identify solid support and resistance levels.

For sake of brevity, I will not go into all the details of the prior weekly plans, but I will summarize the day by day action. For anyone interested in a deeper dive, a link to the prior weekly plan is attached below.

To begin the week, I had a bearish view on the market.

My main contention was that I was not buying the breakout will hold above 4080. While the price had moved higher, the value did not move higher. I had expected the 4080 break out to fail and to confirm this I had expected a close below 4080 level could unleash sell off. This was pretty text book in this regards. When the dust settled, the market had sold off about 250 points off this level - in one week.

I am forecasting significant slump in the US economic activity in next few months -

I expect a stranglehold of higher interest rates on the capacity of the households and the businesses to borrow- tremendous shrinking of credit.

The banks will not lend to any one they think can not pay it back and those who can pay it back will think twice about borrowing at higher costs - this will chill the credit creation.

This should also impact the auto sector very negatively with the average used car now nearing 20000 USD as well as the rates on used cars in excess of 10%>

I expect the housing sector to go cold later this year with another 10-15% sell off possible.

It is when we start to see at-least some semblance of panic in the housing market that we can reasonably expect the FED to pivot and begin cutting rates. Remember as long as the FED remains confident, they are not in a rush to pivot- they need to panic! And once they do panic, the markets will panic with them. So it is not unusual for the markets to continue to sell off even when the FED begins cutting rates and will bottom once the long term risk to reward looks favorable.We began the week strong. Tested that 4080 and then stalled.

Monday was in fact the only day in all of this week that the bulls saw any upside whatsoever.

Tuesday onwards, the market was one time framing, she was slipping on the downtick. 4010 was my key level for rest of the week and we barely saw any trading above this level after Tuesday.

After all was said and done, we shed about 250 points this week alone! This is not counting the 100+ points which came off that 4200 level where I first got bearish last month. Friday’s auction barely 200 levels from 3600. We saw even at 4200 the incredible amount of optimism for the markets to push into new highs. I had warned against this optimism multiple times - yes it took a few weeks to crack on the downside, but this is how the S&P500 is with distributions potentially taking weeks if not more.

I am quite comfortable with reading the tape when market gets active and volatile. This was a good week for volatility lovers, and I was actively able to share updates with folks here in the Substack almost on a daily basis.

Some examples of this were that 3990 support on Friday which saw a decent bounce and then I covered the same level as support turned resistance which led to another 50 point sell off on Friday. All chats are real time, they are available for subscribers for no extra cost, however, you must install the app to get it going. Do not forget to turn on the notifications.

I extensively covered in my Daily newsletters what I thought personally the reasons for this week’s price action were. I am not going to repeat that. If interested read the below post for more context. However, I do have some thoughts on where I see this headed next.

4080 area was structurally weak in terms of the OrderFlow. I had expected this sell off to intensify if the bulls were not able to take it out - so no surprises there.

This tape at the open also has been extremely finicky for last n number of weeks - I have personally not seen a tape like this going back years! Of-course you will not see it now (due to current volatility), however if you observed these opens for last few weeks, I had seen nothing like this in years .

With the fall out from SIVB, I personally do not think this spreads to other big banks. SIVB is (or was) extremely niche. It caters to a very small subset of the populace that engages in non-traditional funding like the Bay Area (Valley) startups. With the IPO market in the deep freeze, these customers of the bank had high cash burn rates and it rapidly devolved into this bank run fueled by panic and rumors.

FDIC has now stepped in - however, from what I am reading and hearing, only a fraction of these deposits qualify for FDIC insurance, meaning more than 95% of the customer deposits were larger than the FDIC insurance limits.

This will have a continued fall out- for those who had their cash saved at the bank. This could impact other publicly traded companies as well, like ROKU that had more than 25% of their reserves at SIVB. This could lead to more Silicon Valley layoffs, since the bank was such a fixture in the Valley. I see more effects felt for weeks for this Tsunami for any one associated with this bank.

I think by Monday or Tuesday, the situation should clear up vis-à-vis if this contagion is going to spread to other banks. I think it makes sense for the Federal regulators to step up and assure that the customer deposits are safe, even beyond the legal FDIC limits. Deposits are not in the same vein as other assets which tend to be speculative - and I think everyday folks should be protected from this fallout especially when the FED has an illustrated history of bailing out corporate fat cats for making far riskier (and questionable) choices.

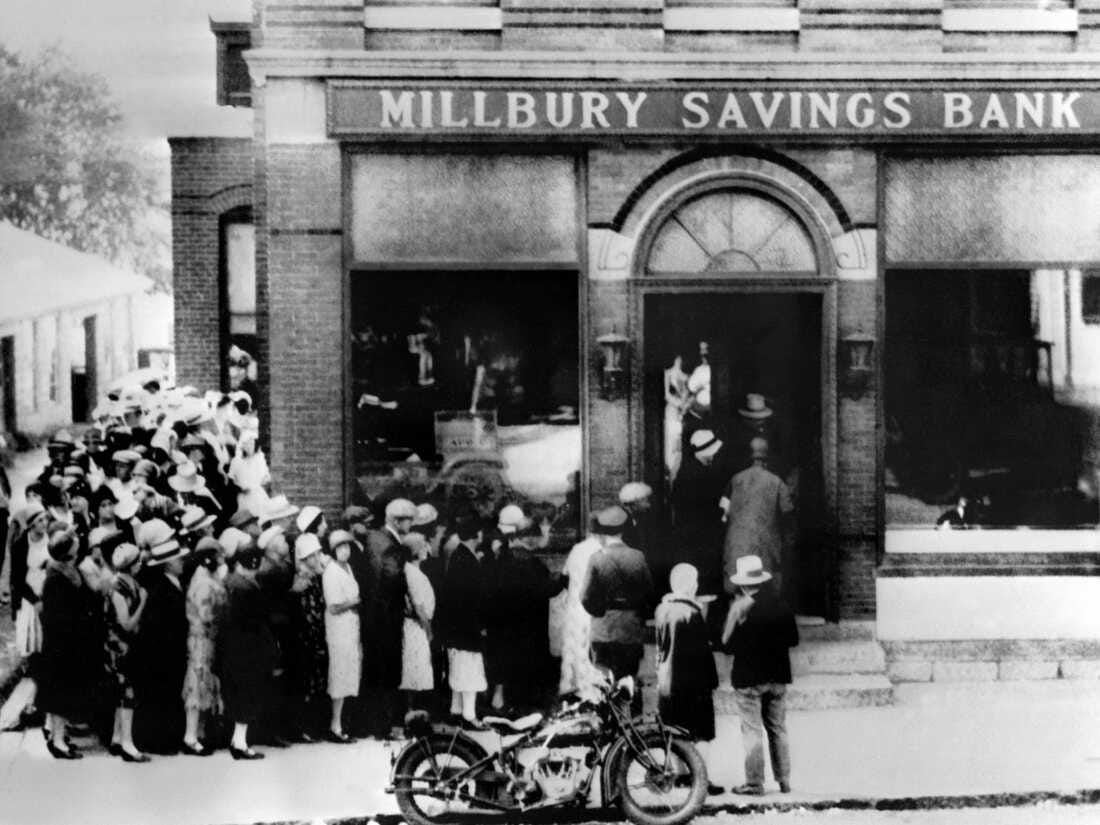

I am afraid if this opacity around safety of deposits continue, we could see more panicked withdrawals of liquidity early next week. It is not that these banks can not handle these requests - it may come down to is it even possible to cover every one of request if this turns out into an avalanche of withdrawals . For one, there are multi trillion dollars in customer funds deposited throughout the US banking system but only about 100 billion in physical bank notes. That is just one logistical nightmare.

Another key factor is that a lot of these banks park excess funds in interest bearing instruments like the USTs. Flush with cash last year, a lot of these investments may be in treasuries which may need to be sold in a hurry much earlier than they mature, which may mean the banks taking a hefty losses on their principal (as the bonds have lost out quite a bit last one year, in many instances they are down more than 60% off their peak last year). So I think it is just prudent for the regulators to allay some of these contagion fears by assuring the depositors. The bailout should should only cover the deposits and nothing else!

Bottomline - while there will be fallout from related entities to this bank, I think this is really very specific to this particular niche bank and most likely does not spread to other mainstream banks. The bank is most likely working over the weekend in order to find a suitor and I think if they manage to find a buyer early next week, it could be a plus for the sector in particular and for the markets in general. More on this later.

Before moving further, let us do a quick poll:

Let us say this situation resolves next week or two, which I think it will, what else remains which is systemic and could spring more surprises down the road?

RATES! RATES! RATES! I have been saying this for several months now. It does not even matter if the FED raises by 50, by 25 or does not raise at all, the current terminal rate is exerting enormous pressure on the whole system which is based on debt. SIVB would not have happened, if the rates were still below 1%. And another SIVB could happen any minute as long as these rates stay near 15 year highs! A few months into 5% rate regime and we have seen BlockFI, SVB, FTX, amongst others collapse. SVB won’t be the last.

Inflation & jobs - after the US CPI topped out in Fall last year, the primary engine supporting inflation has been on the services and rent component. Today’s NFP showed the unemployment rate tick up, to 3.6% with about 5.9 million folks unemployed. Hourly wage inflation also came down though it is notoriously seasonally sensitive. A total of 311K jobs were added, below the average 6 month trend. Most jobs were in retail, hospitality, restaurants, and government with the IT and the transport sector shedding the most jobs. IT sector lost about 25000 jobs in February. The average hourly wage stood at $33, an increase of about 5% over last year.

A lot of folks spend a lot of time theorizing what that next rate hike will be- 25 BPS or a 50 BPS. In my opinion, it really does not matter. Though I think it will be a 25 BPS. The reason it does not really matter is a) we are close to an end of the FED hiking cycle. I think they could do may be another 3, 25 BPS hikes through June. b) the US dollar has a fairly decent yield now near 5% and I think this is here to stay for a while. I do not see the FED revert to near 0 rate regime again unless we saw an acute economic collapse like we did back in 2020. This “higher for longer” is more of an overhang on the markets than let us say what the next one or two rate hikes will be.

Below are 2 sample, real time chat updates for subscribers which are not available outside of Substack. Will be adding more features to this along the way in near future.

To help folks during this historic bank run get back in at one of the cheapest prices, I am offering below a major discount, valid today only. Remember once we have the full featured chat on, the prices will be closer to USD 100 a month but this will not impact any one who is grandfathered in at lower prices (as long as they do not resubscribe):

Let us talk about the elephant in the room

I do not take any of my levels lightly. A lot of thought process, planning and research goes into development of these levels. My levels - in any name whether it be S&P500 or TSLA or anything really, are not derived from charts. Most of these are based on me watching the level 2 every day for majority of the session which is inherently time consuming but is more reliable for me.

I have myself struggled with the question if this is it and we are now going to keep crashing lower or if there is going to be at least some sort of support come in?

For those who are totally new to OrderFlow and this blog, I recommend you read the below newsletter to understand my longer term view on S&P500 (a year or so out).

The price action next week is going to come down to 2 things -

The extent to which the bank contagion develops. Personally as I said before, I do think this is going to be well contained. SIVB is predominantly a Silicon Valley financial institution with it’s quirks which are apt for the Valley. The major mistake they made was that they used extremely volatile and short term deposits to buy a fixed rate, long term investment like treasury. A very rookie mistake from a bankers perspective- these guys were just bad at basic banking stuff which is surprising for a bank of this size. The Valley was flush with cash after pandemic and the bank did not do much due diligence counting on the 0 % rates to continue forever. Bad move. Between Friday night and Monday morning, we could see this story develop further- they may get a bailout and/or they may get bought out. In my view for this to become a major systemic event, the deposits at this bank will not be made whole. This will mean that lot of companies (and individuals) will call on their banks and demand their deposits back to buy USTs with it. UST price could surge with this, depressing the yields which will have an effect of much looser financial conditions, thereby stoking more inflation. This will be the worst case scenario out of this situation. The FED certainly is aware of this.

The CPI event on Tuesday should cement the price action for rest of the week.

Over the weekend, you will hear a lot of opinions and you will witness a lot of technical analysis - both on the bullish and bearish side. My personal two cents, based on my 20+ years in this market is simple- this is not a market that is being driven by technical analysis at the moment. The market is in search of value. I do not think that value is at 3900-3950 area where we closed on Friday. However, the situation may look very different on Wednesday morning after the dust settles on these recent events and we see what that CPI print shows in terms of ongoing disinflation trend.

Take everything you see with a grain of salt - Trader Tic in me is taking this day by day, hour by hour. Investor Tic should not be bothered by these wild gyrations that may unfold and should continue to search for good, value areas in stocks that could face the brunt of these moves.

Before jumping into the levels and scenarios for the next week, let me answer the question, if I think we have bottomed:

No. I do not think so. Let me share below why and in what scenario I may be wrong.

However before that, as is the tradition of these weekly letters, let me share some names which did well last week:

I was a TSLA bear at 215 with a target of 170 which was met handsomely this week.

I was a Bitcoin bear at 25000 and we sold down into almost 19000.

I was a VIX bull at 18 before it’s ascent to 27.

Some other ideas like SNAP and WBA did not work in the short term but to be 100% clear these are much longer term names and were not relevant for the weekly time frame.