Folks -

At start of the week, my primary expectation was that as long as that 4030 held as support, we could revisit 4100, followed by 4150-4200.

This did not work out as expected as we swiftly broke this support to trade sub 4000 fairly early on in the week.

In the latter half of the week, I expected the lows of the week near 3900 to hold and act as support for a test of 4000. This was quite good as we remained bid above these lows and many attempts to break them failed- rallying several times from this support during most of the week.

However, for the session on Friday, I was bearish for the session as long as we remained below. I had expected to retest 3930s. This did not come for most of the session, but in last few minutes of the session on Friday, we broke for the lows and lost about 40 handles within a few minutes to trade near 3930 and ended the week close to 3930. All shared with the folks in real time.

Here is the link to the weekly plan.

I want to be cognizant of the fact that in my expectation that we could trade 4150-4200, I am not a longer term bull. I think there is still some downside left in the markets - when I become a longer term bull, it means I am anticipating new 52 week highs in the S&P500 and Nasdaq. I am not there yet.

What were some of the other names I shared that did well?

COST

At start of the week around 485, I was bearish going into the Costco earnings. As it played out, we sold down ahead of the earnings near 470 level within the first half of the week. It is here at the lows that I turned bullish, specifically for the earnings event at 473. Immediately after that, the Costco stock rallied back to 485 where it all started, ending the week almost unchanged.

CVNA

We also saw wild action around Carvana stock which I was bullish (short term) when it collapsed on Wednesday. The very next session the stock ended about 30% higher.

NVDA

NVDA was one of those other names which I was not bearish this week and the stock remained bid on any little dips, rallying several times off the lows.

We also got bullish on the Chinese names like BABA in the 70s before a massive move almost going to 100.

Oil

At 77 dollars last week, I had expected some softness in the oil market and it did made new YTD lows this week but bounced off the 70-72 levels. As noted by me a few weeks ago, the oil market is strongly signaling a recession some time next year and is a leading indicator along with the indices like transportation, freight and retail indicators.

These are only some of the names - a lot many other names shared in the Substack last few weeks made new all times highs and could have more juice left. For instance SLV had another good week, it is now approaching 22 and was shared around 16.

Speaking of real time updates, the Substack chat is now alive - for both the iOS and Android users. I strongly recommend you install the app and turn the notifications on as a lot of important Emini levels, for any one active in the intraday time frames are shared in the chat room below. It is available at no cost to subscribers. Similar chats can be 100s of dollars a month but it is free for folks here.

Chat is a great addition to this Substack blog and 2023 will only see the list of enhancements and features go up. While the blog has been geared to share more longer term swing and investment themes, I plan on leveraging the chat room to not only share Emini S&P500 updates but also real time option flows and ideas in coming few weeks. Obviously this means reassessing the pricing as features go up but I do not think these price hikes will impact any one who is already a subscriber and does not resubscribe. Stay tuned, much more to come! If you have no already, feel free to subscribe below while the prices are still comparatively very low. Within a few months, these prices could be in excess of 50 bucks a month (to keep access exclusive). Now only $30s.

On an admin note, I may be reorganizing the weekly letter based on reader time frames for easier access to relevant sections. Help me understand your time frames by participating in these polls. In case of multiple options, pick the one that is most relevant for you.

Next week’s events

Tuesday and Wednesday are extremely event risk heavy days - on Tuesday, we have the US CPI data out, followed by the FOMC on Wednesday.

Let us drill down into the inflation trends most recently and let me explain why I think this particular CPI will come in cooler than expected. Please read the whole section as the context and my summary and outcome are key.

Unless you were sleeping under a ledge for last year or two, you know inflation has been a problem- it costs a lot more to fill up at the gas station, the dinners both at home and away from home have been expensive, everything from services to lumber costs more.

About 2 months ago, I called the US inflation, the US Dollar and the US rates to have peaked around 9% and 114 respectively. Inflation has been steadily ever since climbing down - whether that is the commodities, or gasoline or some other areas like new car prices.

Where has the inflation been persistent and sticky? It has been sticky in the housing shelter, food prices have been high for long, medical services and related costs remain elevated.

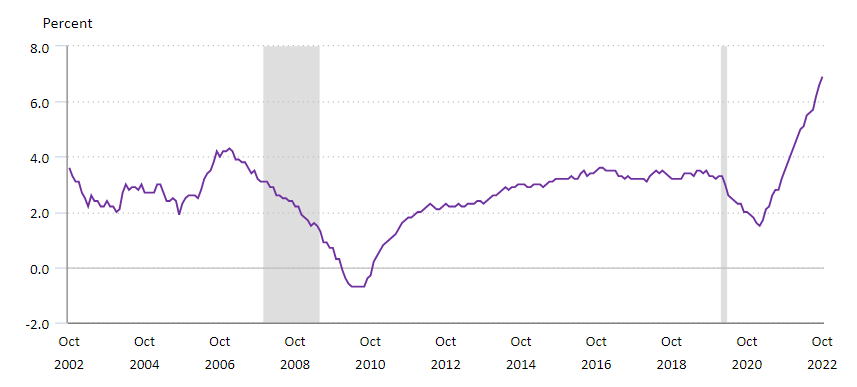

Chart A below shows Shelter costs make new high.

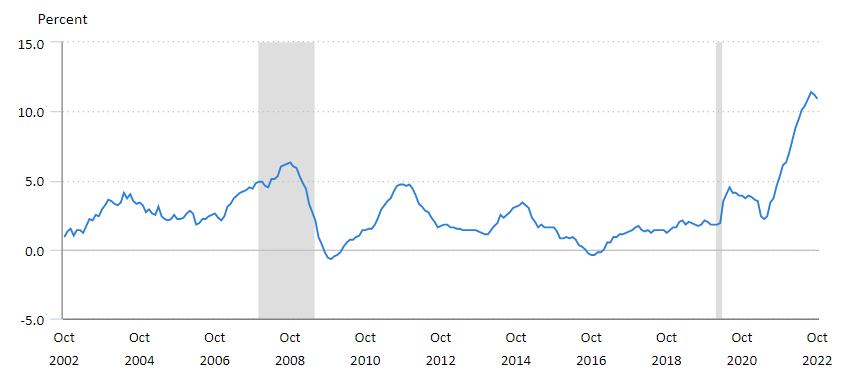

Food prices are another one of sticky areas that refuse to come down. Chart B with food inflation.

Shelter, energy and Food are some of the largest components of the CPI and could remain high for years to come as they have structural issues:

Within the housing market, while prices have been very very high, I do not expect a repeat of 2008. Why? Many factors but to name a few: a) a built up of supply shortages b) strong financial health of the borrowers due to stringent loan controls c) high inflation in raw materials or what it takes to make a new house. This may support housing market till the employment remains robust .

Food also has structural issues with the war in Ukraine globally and within the US, the consolidation of farm lands. Large corporations have quietly amassed vast swaths of food producing farm lands and price inflation will remain high in the food portion of the CPI.

There are similar CAPEX related structural issues in the energy complex as well. While WTI oil has softened quite a bit from the highs it made earlier in the year, I think any activity below 67-70 dollars will be limited, if any and we could retest 80 area again on it soon.

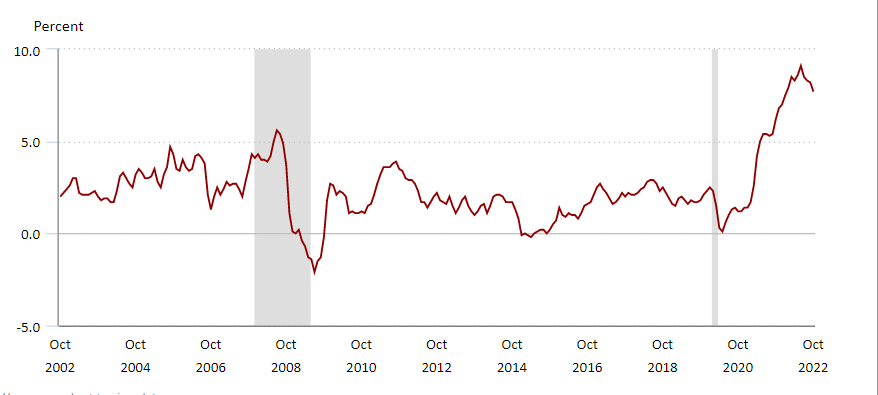

Chart C below shows the overall inflation .

What we see in this chart is that the inflation genie is now out of the 2% bottle - past 15-20 years, we have enjoyed very low inflation in face of the Central banks printing monies out of thin air. 2020 pandemic response by the banks and the governments was the culmination of this trend - I do not think we are going back to 2% inflation any time soon, if ever. Any one who thinks we will now soon go back to 2% CPI should stop dreaming and come back to the real life.

I think 5% inflation is here to stay - for years if not a decade or more. This means the risk free yield should also stay relatively high at 4-5% or even more. And it is in this context that I think the US Dollar may also remain range bound here 100-110 for a while. US Dollar is the Achilles heel for the equity market - in fact the 3500 low in the S&P500 Emini which we called in this blog in October for a move back to 4000 coincided perfectly with the 112-114 dollar top call in the US dollar.

However, in the short term, specifically for next Tuesday, I think the CPI may surprise to the down side. I know PPI was high on Friday which I called in this blog on Thursday night, however, PPI tends to lag the CPI by weeks to months. The companies will be last to pass the cost on to the consumers, and will be the last to pull those costs back. Meanwhile, make sure you subscribe and share this blog before it costs 40-50 bucks while the prices still are low.

Wednesday is the FOMC

Here are some thoughts on the FED response and where I see the FED policy in next year or so.

A few months ago, I was the first one to call the FED funds rate to peak near 5%. Now it is commonly accepted view that the FED will stop at 5-5.25%. However where I differ with the consensus now is the duration of how long the rates stay this high.

I had called for the TLT bottom around 92. TLT has come up almost 20% from those lows that I called here in this Stack.