Traders-

The S&P500 action last week remained lackluster and was not the main event whereas some of the other markets were much more lively and interesting.

Crude oil sold off quite aggressively and spontaneously from a high of about 90 dollars a barrel to a low of about 78 dollars to the barrel, settling the week at 80 dollars.

Some of the other markets like the VIX, Bitcoin and the 10 year bonds were little changed over the week.

On the S&P500 Emini side, my key level for the week was 4030 with the lower target at 3900.

Between these two levels , the market remained for most of the week, neither trading much above it , nor trading below it. The S&P500 market was almost unchanged for the week.

Out of all of these markets, the one I was most surprised by is the oil. The haircut in oil this week was pretty substantial and it makes it even more stark given that we barely moved an inch in the dollar this week. In fact, the current relative weakness in the dollar should have been supportive of the oil market not a tailwind for it.

My take is that this current plunge in oil market is neither driven by the USD strength nor by the Ukraine-Russian conflict. I think the main reason for current sell off is the energy market zeroing on an impending economic slowdown globally and may be front running it. A large sell off here below these levels (WTI is trading $80 for the January delivery), in my view could spread to equities as well. Europe and North America also have been experiencing milder than normal cold weather at the moment and that may be one factor in this equation as well.

Having said that, given the current political climate in the US, given the macro backdrop of a continuing war in Europe and the supply limiting stance from the OPEC, I do think the oil market may remain supported here for another year or so without much deeper pullbacks.

On the weekly time frames however, $80-$82 are important levels and the market needs to take them out for a move back to $90+. Minus that happening, I think we may languish here between 75-82 a barrel.

On the rates and bonds side of the house, we saw strong action in the bonds over last few weeks. On TLT, last we traded as high as about $102, a full 10 dollars up from my $92 line in sand (LIS).

A few weeks ago, in this Substack I made a call that the terminal rates in the US are close to a peak of about 5%. This looks more and more to be the case now , I think we have seen a peak in the inflation and as a result we are lot closer to the peak terminal FED rate near 5% next year. This view is now getting more mainstream as well. However, where I disagree with a majority of folks on this is how long we will stay at this 5% peak.

Consensus right now appears that the inflation will cool down to 2% next year. I do not agree. I think inflation will cool down but it will hover near 5% for several years. The inflation genie is now out of the 2% bottle and will be hard to put it back in.

With the US elections earlier in November, the Government is now firmly gridlocked with the GOP winning the house.

These developments can potentially lead to very interesting, never before outcomes. On the Fiscal spend side, the Federal government I think will be hard pressed to carry on with the populist measures. If we start seeing rapid deterioration of unemployment situation early next year, then that puts onus on the FED to do something. With inflation at that time still potentially hovering at 6-7%, how much and how fast the FED can do anything remains to be seen.

Medicare and Social security are two largest expenses for the US Federal government. However, a 3rd new entrant is creeping up the totem pole aggressively. The US interest payments on it’s debt were about 5% of it’s entire budget last year but will be more than 8% this year and could be as high as 10% next year. Any more fiscal and monetary misadventures could only strive to make this worse.

While the Congress did not go all in for the GOP, it is still split with the GOP taking over the house. This lessens but does not completely eliminate the showdown over the debt ceiling when we get there early next year.

Despite these potential headwinds, there are some historical and seasonal advantages for the S&P500:

November and December, seasonally are the 2nd and 3rd best months on average for the stocks.

Stocks do on average far better when the Congress is split versus the Democrats having the Presidency as well as the House and the Senate. Going back to 1930s , the stocks on average can net 14% a year when the Congress is split versus 10% on average when the Democrats are in power in the Congress as well as the Presidency.

Going back to the TLT technicals for a moment..

So, as I mentioned previously, we rallied up from approximately 92 to about 102 and stalled there. I think from a technical standpoint, unless we close on the Daily time frame above 102 now further gains in TLT may be hard and we could stumble back to 95-96 range.

Earlier we were selling off aggressively in the bonds as there was a lot of uncertainty where that peak in the rates and inflation will be. Now the picture is a little less muddier but it is still muddy about how long the high inflation can persist and I think this will keep the bond market on it’s toes and range bound. I do not think these bonds are set to make or take back their prior highs any time soon and this will keep volatility in these markets active for a while to come.

Next week is the holiday week and the event-risk calendar is pretty subdued

There is not much news planned for Monday but Tuesday is very heavily packed with the FED speak from Mester to to George to Bullard set to speak throughout the day.

As expected, they will say a slower pace of rate increases is warranted - this in itself I think is not very bullish. This is natural and common sense that you have had the fastest ever pace of front loading the rates in last few months and it is now warranted to slow down. I think it will be a mistake to consider this as dovish. The 5 ton elephant in the room is the question that how long will these rates stay at 5%?

Now I think in the US particularly, and the Europe to some extent, in recent years a lot of focus has been on scheme like the “Buy now Pay Later”, housing, auto industry has been propped up on very cheap borrowing cost - I think a prolonged 4-5% FED funds rate is going to undermine all of this. I am fairly confident in my call that we will have a 5% or so inflation for several years to come. 2% inflation was largely due to unification of the world through globalization and trade routes streamlining globally. I think globalization, if not dead outright, is going to go back to a long sleep for few years to come. This will put upward pressure on inflation for many years to come. I am not too worried about what the FED says - I will watch Dollar and TLT.

I think a TLT below 99-100 and a Dollar above 106/107 is bound to put pressure on the S&P500. More on this and the precise levels later.

Then on Wednesday, we do have a lot of planned event risk. The key one being the FOMC minutes and the services PMI in the US, and PMI elsewhere in the Europe and UK. I do think these minutes will reflect on what I wrote previously and could be an opportunity to peak inside the FED’s mind.

The NYSE market will be closed on Thursday with an abridged session on Friday. This could be a very dull weak for the Spooz unless we were to get a major surprise from some quarters. There will be no Daily plans for the sessions on Thursday and Friday but I have been working on an educational post for folks and may send it over the weekend for the subscribers.

Let us do a quick recap of the plan from last week

If you have not already read it, and you are active in the intraday time frames, I do recommend this post as it outlines some indicators and markets that I watch every day. Here is the link.

My main call was on the emini S&P500 with 4030/4050 offering resistance and 3900 as support. This was actually the range of the week.

I had a bullish bias on ZIM at 22-25. It did rally about 10% into 30 bucks before selling off into 23 handles. I think as long as 19-20 dollar range hold, we could see a retest of 40 eventually on this name.

With Bitcoin, I have been expecting a test lower of 12500 at some point, Bitcoin on balance has been sold on rallies but still far from my 12500 target.

I had a very good call on Macy’s earnings. This stock rallied about 20% from the 19 and change LIS after it’s earnings.

TSLA stock sold off about 25 handles from my LIS here at 200 shared in the blog.

With Bitcoin, I want to be clear that I am not a crypto sceptic. I do think Crypto technology will blossom and we will see several winners, many going for ten to 100 baggers in this space. I just think it is not Bitcoin. I am a Crypto enthusiast and keeping an eye out on any opportunities that may come along, I just do not see one right now. Once I do, I will be the first one to share with the folks here.

Many times we assume knowing the tech behind a company itself is an edge - I do not agree. I personally know several folks who have amassed massive amount of knowledge in the tech behind Palantir , behind Bitcoin etc. Yet they have been holding longs on PLTR from 30s, in Bitcoin from 60-65 K level. I think that a technical strategy like OrderFlow can suffice and it will be able to find any winners in this space, when & if they show up.

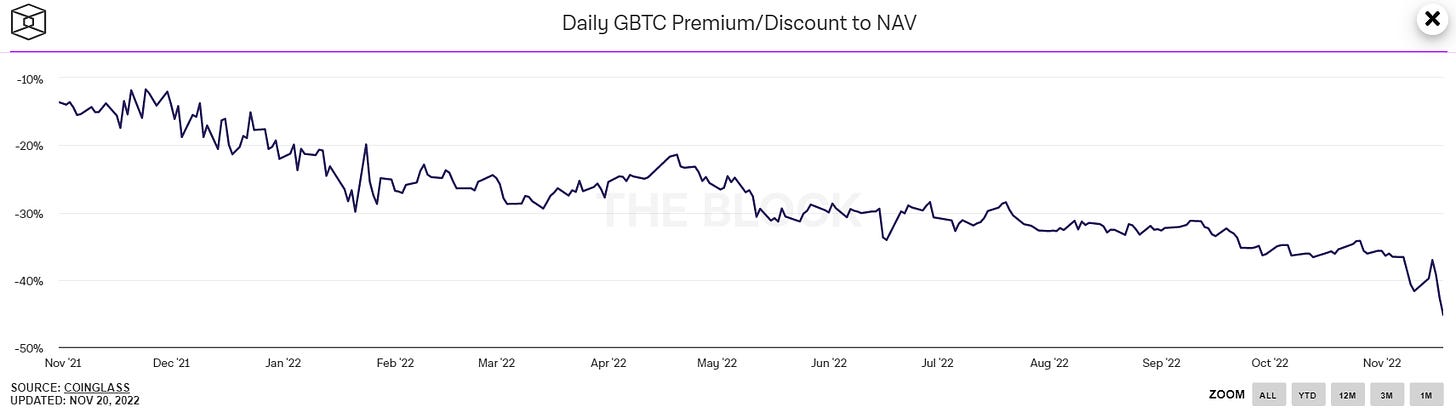

Many months ago I shared a key relationship which may signal the bottom in Bitcoin. Bitcoin was trading 32000 dollars then and it has been cut in half since then.

What was it? It was the GBTC to BTC discount. It used to be a premium once. I said Bitcoin may bottom when this discount stops making new highs (or is it new lows?) .

In fact this relationship made a new low this week.

Mindset is also important in trading, not in some new age folksy way but rather remaining focused and situationally aware of the market action. My personal favorite mindset hacks or tricks are:

Not giving much energy to losing - inevitably if I do 5 trades, one or 2 of them may turn out to go against me. I have 2 options once I put on a trade that turns sour: a) keep it running, hoping that it will come back. It can come back, but it can also run much deeper. b) cut the loss. This frees up mental and other resources to focus on next opportunity.

Focus on identifying when the conditions are right: all technical set ups are not created equally. What matters much more is the underlying price action behind technicals, not the actual technicals. I will rather wait hours or days for the correct set up in terms of price action rather than take every signal, especially the signals based on technical analysis.

This does not mean I become 100% reckless or become risk averse. It just means knowing when to play and when to stop. Then there is some common sense on this as well. For instance, if it is Thursday noon and the market is trading my LIS at 4050, which has been the resistance all day, what are the odds it will breakout here? We saw a good example of this on Friday as well. We sold down to my LIS at 3940. It is noon time now. What are the odds the market will break this level 90 minutes before close?

My levels for this week

My work on OrderFlow does not assign a lot of value to the chart patterns or indicators but a lot of emphasis is put on actual trades as well as stuff like various correlations, seasonality, option flows, sentiment and astrology to name some. No, that last one is not true :)