Traders-

Excited to share another weekly blog. I have also included very important information that I personally watch intraday, every session, every minute of the day! If you are an intraday S&P500 trader, you do not wanna miss this. This keeps me on right side of momentum and I strongly believe any one who understand this intimately can remain on right side of the momentum with few exceptions (news driven, sudden liquidity issues).

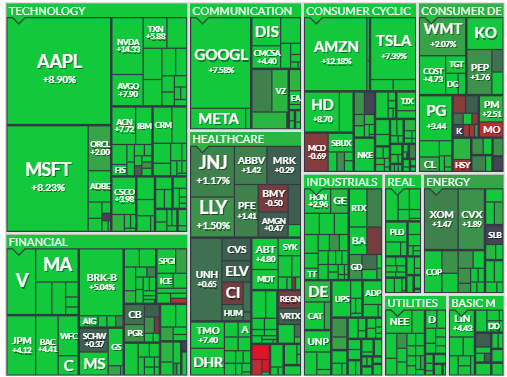

This was the week when what I have been saying in context of swing time frame came to fruition (finally!). It took a little over 6 weeks but in the end the OrderFlow prevailed. A majority of the participants had remained bearish over last 6 weeks but I had been calling for this 3500-4000 range to play out.

This was in context of my call that further auction below 3500-3550 will be hard to come by, unless we traded 3950-4000 area first. It took much longer than expected. In the end, the market got here and that is what matters. Sometimes the message can get mixed up due to the long term and short term calls that I make on this blog- but the tape was clear in this one: we will have a hard time offering below 3500 unless we tested 3950 first.

These calls tend to be 400-600 points in range and can span several days if not weeks. Keep reading to find out what I have been thinking the next 500 point range may be.

On top of this S&P500 Emini action, we called many other names in last week’s letters.

SBUX - up 6%

APPS- Up a whopping 60% in one session (at time of this post)!

SFM- up around 4%

It has been quite hard to find good movers in this market environment but I have been able to research and uncover quite a few and will continue to share with folks here.

In this weekly installment, I want to cover an important theme which is near and dear to me. I have in part alluded to this before , but I want to take this weekly plan to consolidate some of the key indicators and correlations I watch during the intraday auction. If your time frame is intraday, I think this may be helpful to you.

But first, for transparency, a quick review of the action last week

Starting with emini.

I was bullish on the S&P500 Emini this last week with the expectation that the dips towards 3700 area may be bought. This dip came on Sunday night itself when we gapped down into 3730s and then promptly got bid up to 3780 to open the next Monday much higher. The market remained bid for most part of the week except on the day after the election night and it sold down into my support area which I have been sharing with folks here for last two weeks.

Eventually, this also got bought up. And we traded up to 4000 to finish the week up massively for the stocks. This has been a theme of sorts for this market. A couple of things stood out which in hindsight now look very clear but we had been warning about this for several weeks now in this publication.

A) Any hawkish news were being absorbed by this market whether that is the PCE, CPI or any of the last couple of FOMC.

B) Even as many of the leading stocks like TSLA made new lows, the market remained well off the lows.

I also had a very good call on oil last week

I had expected the oil market to sell off into 87 zone from the opening 93-94 on back of the reopening of China being denied by the Chinese government. We also dipped lower than I expected but that was mostly due to the elections.

Here is a link to this plan from last week.

Image A below. We just could not get a single close last week below 3720 which was a very potent signal along with the action in Gold and Dollar.

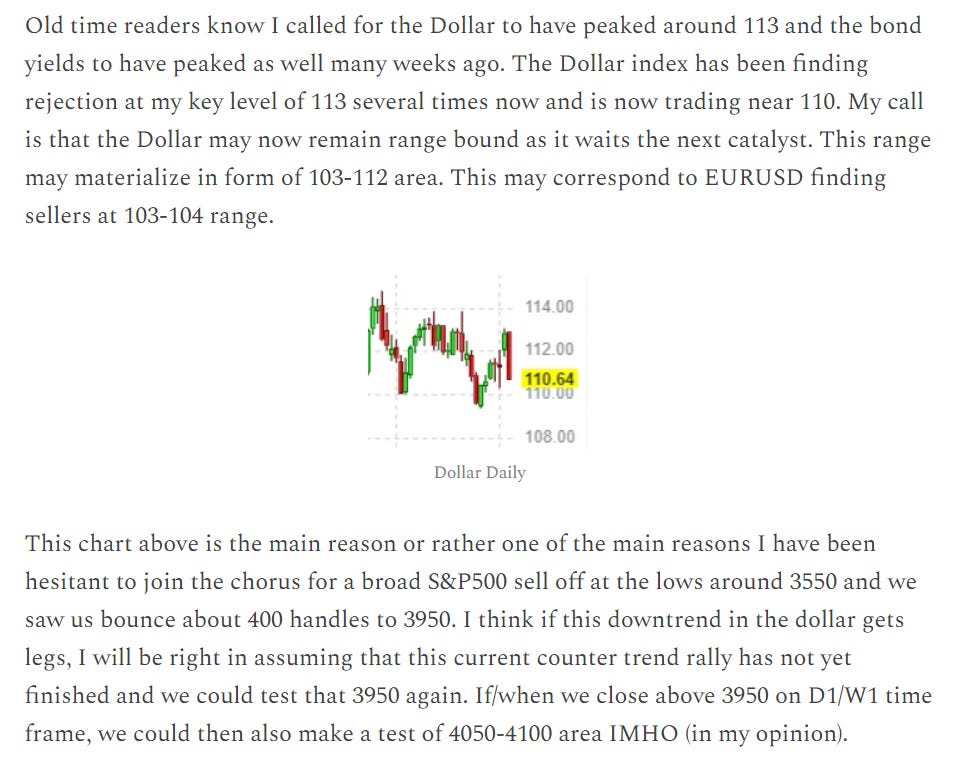

Speaking of the Dollar

I was one of the first and may be the only a couple of folks who correctly called Dollar to have peaked at 113-114 and this week’s auction solidified that call with the Dollar dropping to new lows this week.

We have now traded down almost into 106 area this week. What dollar does next will have a key bearing on the Spooz and Nasdaq next week. Keep reading to find out what I think is next in store for the US Dollar.

Bonds

Not only I had called a peak in the US Dollar at 114, I also called a temporary relief from pain for the US Bonds, in particular I called for a good low in TLT at 93 bucks.

TLT and the bonds had a great week with yields cooling off across several maturities.

How did my earnings calls do last week?

APPS

APPS was simply a monster call. I called for the stock to break down into $10 area which I thought would have been an attractive level. We came down to this 10 on the APPS and then rallied 100% within the week! The stock doubled in one week.

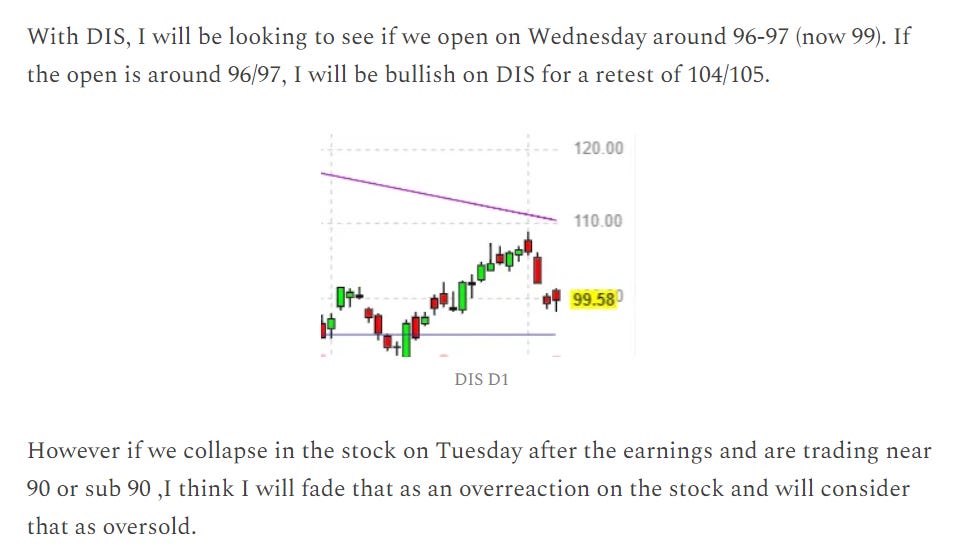

DIS

Disney was also another good call where as I expected we dropped sub 90 dollars after the earnings but this low was bought up.

With RBLX, my key LIS was 40. Before the earnings we were trading near 39 I believe , below that 39 and we did sell off a lot on this stock after lackluster earnings.

NIO

Last but not the least, NIO was another good call as far as the earnings go where if we dropped into 9 bucks AFTER the earnings, it would have been bullish for me. This was indeed the case and we rallied over 20 % on NIO after that initial drop.

All earnings thoughts and ideas are shared with folks as part of this newsletter. Obviously I am much more active in the earnings season - but this season we made some amazing calls in this publication. Whether that is NFLX, AAPL, APPS.

In other news

Cathie Wood of ARKK fame argued on Twitter that the FED with it’s current rate hikes is going to cause a 1929 style depression. She wrote several tweets arguing that Deflation is a higher risk now than inflation.

First, I do not blame her. She does not only want the FED to ease again but she needs it. Bad!

Most of her so called “innovation” investments are simply a bet that easy monetary policy of near 0 interest rates will continue for ever. So, she is quite invested in FED’s pivot and would want noting more than that, having her flagship fund flail by more than 70% this year alone.

Second, the debt levels in the US right (and the world) right now are very high. The Debt to GDP ratio has never been higher as far as I can tell. There is inflation every where you look - energy cost, housing, food, healthcare, farmland. May be there is deflation only in the price of ARKK!

As I said several weeks ago, I see inflation peak and the rates peak as well but I see a 4-5% inflation for several years to come. This alone will wreck havoc in a highly indebted system even if the FED interest rates now stay at 4% and not move an inch, which also I think is not going to happen.

I personally do not see how a name like ARKK can bottom here:

The rates are 4%, they are expected to raise to 5 and stay there. I expect them to stay there for a long long time.

The mortgages are touching 7% + rates. The credit I think is going to deteriorate in next few months to a year or so.

These factors are very bad for names like ARKK which is like a fish without water when it comes to the FED tightening.

On an admin side note, I opened the newsletter up for a few more days to subscribe at the lowest prices of this year before the prices go up to about $350 for the annual plan and 33 for the monthly plan. Any one who subscribes now and does not resubscribe will be grand-fathered in and will not be impacted by any future price hikes which can be significant given Substack is adding many more features like real time chat which will make this publication very effective at real time updates. Eventually I think with full fledged chat features by Substack , what it allows us to do it raise the membership bar much higher as the service then becomes much more effective and comprehensive in a real time sense. This change will not impact any one who subscribes now and does not resubscribe later.

Now, in this next section I want to spend some time going over what indicators and data I watch during the intraday that helps me when trading emini S&P500.

So, if you fell asleep by now, please grab a coffee as this is important stuff. This is NOT a system or copy trade service but trying to show a few things that I myself watch every day, every minute during the cash session. Learning a new skill or a concept requires first unlearning old concepts that no longer work. Even to this day I am still learning and invest substantial annual resources and energy in price action based strategies and systems. If you are familiar with my work, you know I believe the markets are dynamic and the best way to deal with them is to understand momentum which is reflected in price action.

Folks can have different interpretation of these tools as they see fit, however, I will share in some detail how I view each one of these. Now I do feel these tools or data points are more suited for intraday time frames but if you watch them continuously over days, I think it begins to form some interesting long term patterns.

Broadly, I keep these in view:

Correlated markets

Market microstructure

Market structure with respect to momentum

Let us review each one in more detail.

Starting with the correlated markets.

This is perhaps the MOST important but least understood subject. S&P500 never trades in vacuum - no one simply looks at the index and says today I am going to accumulate or distribute a position. As far as I know, folks look for clues in different asset classes to make this determination. Now, the correlated markets do not always stay the same - they change. And when they change, I try and share with the folks what the context of the day is, who is in the driver’s seat. I share this as much as I can.

Like for instance, there are times when VIX takes over the driver’s seat, then there are times when it is all about the Dollar, there are times when I watch only the bonds. But here are the TOP 4 correlated markets I keep an eye on when I trade intraday. I think if you are not aware of what other markets are doing, I think you are missing out on key market generated information.

A note of caution: if you are super new to OrderFlow and Market Auction and have only been a chart or an indicator person, what you read will be quite a lot of absorb in and may be very new way of looking at the momentum. If you are only interested in the S&P500 levels and my thoughts, scroll down to the sections at end of the blog.