Folks-

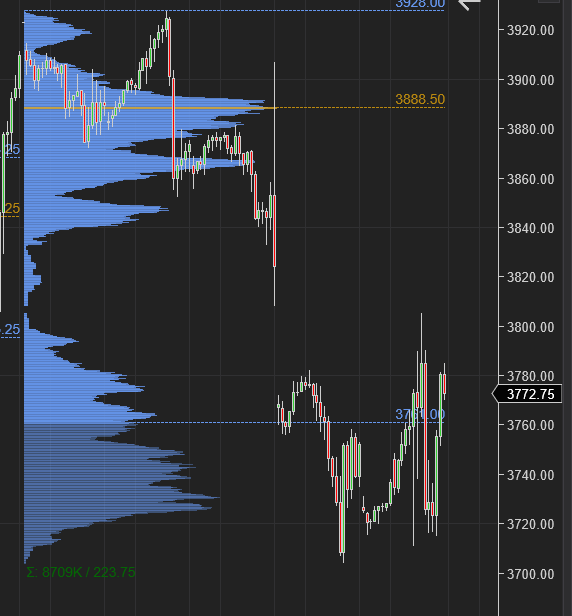

From my plan last week, click here for the link, my key level was 3830 and I had expected the level to be supported if tested.

We tested this level on the FOMC day and immediately shot back up to 3900 from this level. My expectation was if we broke this level, we could go to test 3700-3740 area which then could be supported as next level of support.

The FOMC minutes themselves were dovish but the FED Chair conference Q&A that followed these minutes were very hawkish. As a result, we broke this level, and then traded down below into sub 3740 support zone.

After the FOMC on Wednesday, there was general consensus that we will trade down and crater to new lows below 3700 due to this new found hawkishness by the FED Chair. I was not buying this that we will crater immediately after the FED day and I expected the crater, if one came, to come may be after the mid terms. To put it in perspective, we could not break 3700 even after very strong payrolls report. We could not even make new weekly lows even after a rout in the AAPL stock. So the crater never came.

Ultimately, we closed back above 3770 on Friday PM. On the weekly time frame auction, we crated a “Double Distribution” profile shape. More on this later.

When I first became a bear at start of the year at 4800 on S&P500

At 4800, the market was priced for near 0 FED funds rate. I predicted this market can not remain so high given the rates will have to rise and even a 2-2.5% FED funds rate will be enough to break the market far lower as the market had become so dependent on these near 0 interest rates.

As expected by me, the market started a long, steady downhill ride and eventually traded down to as low as almost 3500/3550. A full 1300 handles lower from it’s peak. $65000 on one contract alone!

At the lows, this market fears a non stop rise in inflation- a nightmare inflation scenario that never peaks.

Now the reality is somewhere in the middle - I think it is safe to know that the 0% rates are probably not coming back any time soon. Actually, I am less confident of that, but I am more confident that we may not see a 2-3% inflation for a long long time.

Then on the other end of the spectrum, I think it is safe to assume that the inflation has probably peaked in many sectors or industries - housing, used cars, electronics, furniture etc .

This leaves me with a scenario where there are going to be some areas where inflation will be sticky to fix- I have been saying this for a while now, for example when the Crude fell to sub 80 a few weeks ago, I said it will be hard for it to stay there for long as I expect Crude (WTI) to stay here in 80-100 for a long time, may be thru next year. Healthcare I think is another one of these industries where inflation may remain sticky.

Average family spends about 20% of their money on transportation and energy, and another 10% on healthcare. This is a third of household costs, the other big bucket being housing (another 20%) and food (another 10%). With energy and healthcare remaining high, assuming housing comes down quite a bit, I still think we stay at 4-5% inflation for 2 years or more here in the US, probably even higher in rest of the world.

The FED funds rate, if it were to peak at 5% , which is my prediction that it will, we are looking at inflation rate and the FED funds rate converge at the same point some time next year.

Now in this moment, when you have 8% CPI and the FED funds rate at 4%, I would say this is still very accommodative policy- but when we begin to converge at some point next year, the policy starts becoming restrictive. Assuming the FED does not outright starts cutting rates again. To put this in perspective, only last year, the funds rate was almost 0! This is a tectonic shift - and the impact of this has not even started to become obvious.

Assume the FED stops at 5% and now keeps the rates at 5% for a year or more. With a likely GOP, which is the 2nd major political party in the US, sweep of the Congress, I could see a scenario where there is constant gridlock in the Congress and nothing really moves- at 5% FED rate, the US is paying almost 2 trillion dollars a year on it’s ever ballooning debt . At some point in early 2023, the US will hit it’s debt ceiling, with a GOP Congress and the Democratic executive , we could reach a point where the debt ceiling is not raised. That is just one of the headwinds as we begin making our case for what are the next catalysts 3-4 months out that may hit this market.

A 5% FED interest rate for an extended period of time will also lead to two things over time :

a) Severe deterioration of credit available by the lenders as well as it will reduce the number of eligible folks who qualify for lending. This will be across both individuals and companies. The Credit will almost certainly contract under this scenario.

b) It may keep dollar strong in a range for next year or so. On top of a strong dollar, it will reduce the profits of many companies. So overall profit of the S&P500 which is about 192 for the index right now , may shrink , increasing the overall multiple, adding more pressure on the index.

These are real catalysts that I see in next 3 month + time frame as we enter the Winters soon. The reason I bring this up is that a lot of models may have accounted for a sharp decline in the CPI to come to the FED 2-3% target - the FED still has a lot of credibility and people actually believe them when they say that the inflation could come down to 2% again next year. So a lot of models may have coded in a eventual collapse in the CPI and hence the FED funds rate. I am saying, I do not see that happen for another 1-2 years. I think inflation may remain high for another 2 years and when the CPI converges with FED funds rate and the rates do not come down, it will break a lot of models - particularly in the housing, consumer credit, and pricing of risk on, growth names.

So, in this backdrop , does this mean we keep crashing in S&P500 and risk assets? More on this in sections later, but my views on where this “meaningful low” in the S&P500 (1-2 years out) is has not much changed from what I shared a few weeks ago in this blog. At some point when we see a harmonization of the FED funds rate and the inflation , we begin to see some stability in risk assets - it is only when we have an undetermined trajectory of “runaway inflation” and unknown FED response that we see the bulk of volatility - which we have been seeing last few weeks. We hear a lot of folks say “do not fight the FED” which is very true - when the FED is in control, like it was last 10 years. Right now, they are not in control, something else is (high CPI).

Some of my other views last week were:

I expected SQ to be well positioned at the prices it was around $50 and we saw an impressive bounce in the stock after it’s earnings of about 13%.

I had expected MRNA to weaken after it’s earnings and the stock shed about 16% after the earnings showed enthusiasm for it’s products and vaccines cool off .

Further, my call in ROKU did well as I shared my key level in the stock around 40. The stock jumped about 25% during the week to trade back above 50.

My call in ABNB was not good as it shed about 8% after it’s earnings report.

CVNA- we saw a good 15% bounce in CVNA before the stock tanked on reports by Morgan Stanley that the stock could be a one dollar stock. I 100% agree with this report but my call was tactical and based on the short squeeze possibility.

We saw a huge jump in Gold of about 4% after my Daily plan on Thursday called for likely support for the shiny metal near that 1600 level.

Many other ideas shared here in the blog with folks did quite well.

This publication does not cater to any one time frame- we have readers from across the spectrum from time frames ranging from a few seconds to weeks to years. The goal is to provide some value add to different time frames. I am myself focused on 3 major time frames - intraday Tic , Swing Trader Tic and Investor Tic. Subscribe below today to hear my perspective on all three. Special offer valid only today.

In this installment:

My thoughts on Crude oil and Dollar

My levels on the S&P500 and Scenarios

My views on earnings like APPS, NIO , RBLX, DIS etc

All themes and ideas shared in this blog are my personal opinions and I am happy to share my opinions with any one that cares to listen. I am not a core technical traders , I am a situational trader and as situation changes, I also change my opinion. Nothing is set in stone and I can change my opinion at any time for any reason.