Traders-

After days of frustrating me and other like minded bears, things moved in favor of orderflow and they moved FAST! Like a 125 point in one session FAST.

A lot of dilly dallying, but at end of the day today Orderflow was proven right in its bearish bias.

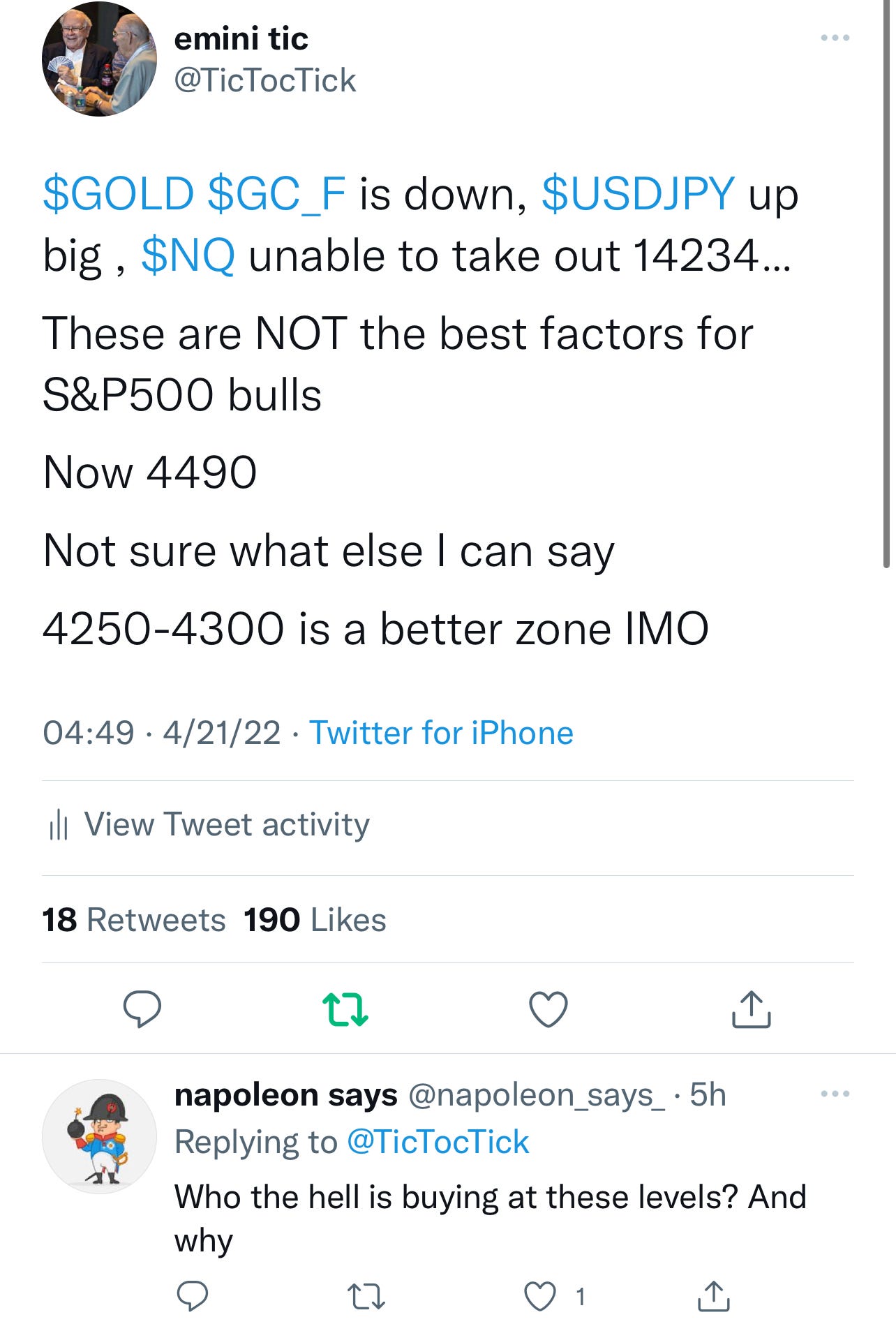

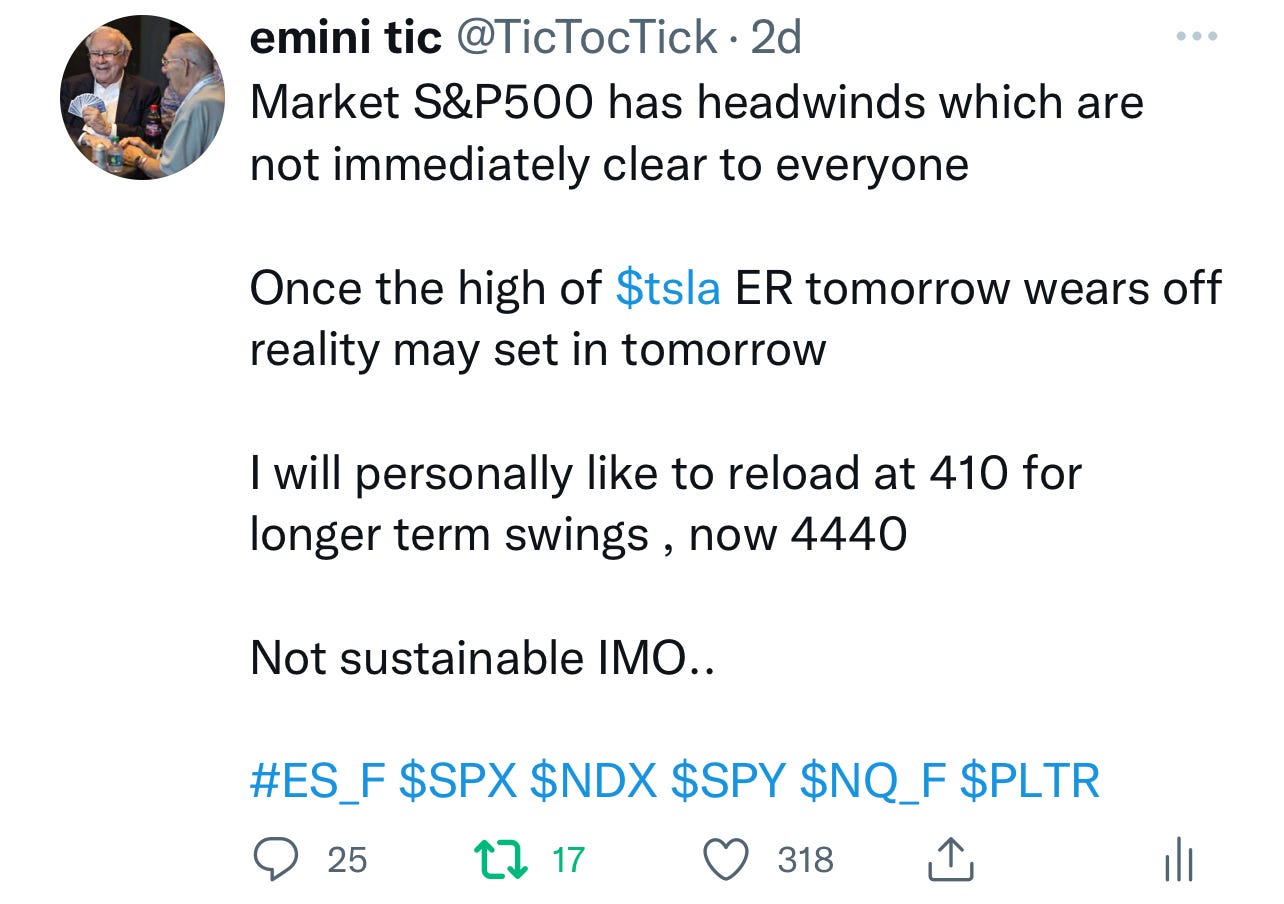

Numerous warnings issued over the past few days.. I was not at all buying this rally to 4500 and called for this level to be the level where the bears may appear out of woodwork. This is exactly how it went down.

Nasdaq down 600 + handles off my 14234. S&P500 down 120+ handles off my 4500 (and counting). This is not at all good, coming at the heels of such stellar earnings by TSLA.

I shared the roadmap how this kind of move can come about.. I even mentioned the rallies may come at the heels of TSLA earnings but these rallies may get sold. My plan worked to the T. The market rallied to 4500 on these earnings however today the FED speak deflated it. None of this should be a shock.

This was all being printed on the tape since Monday and I was reading it. It was just delaying and evading and confounding me as the market refused to come down, driven by the uninformed players lapping up the distribution liquidity provided by the whales.

This was made worse by newbie furus and confidence guys on FinTwit, often charging 300-400 dollars a month, they had their flocks get into new calls at the exact same time these markets like SPY and QQQ and TSLA made local tops. Sad indeed.

Bitcoin, SPY, QQQ, Big Tech, Mega caps, ARKK, AMD, PLTR— pretty much everything sold off today as I remained a bear on all of them.

Here is my daily plan from 4/21 where I was thinking the sellers may appear again at 4500: 4/21 Daily Plan

Subscribe below to get my thoughts the moment they are published. 5 times a week.

What is next?

At time of this post, a few minutes headed into the close, there is really not much demand at these levels.

In terms of support, we have 4360 right beneath us. If this goes, we may be in for considerable pain.

Related momentum markets- like ARKK and Bitcoin look weak.

Volume looks pretty strong and healthy here. Healthy for the bears, as in.

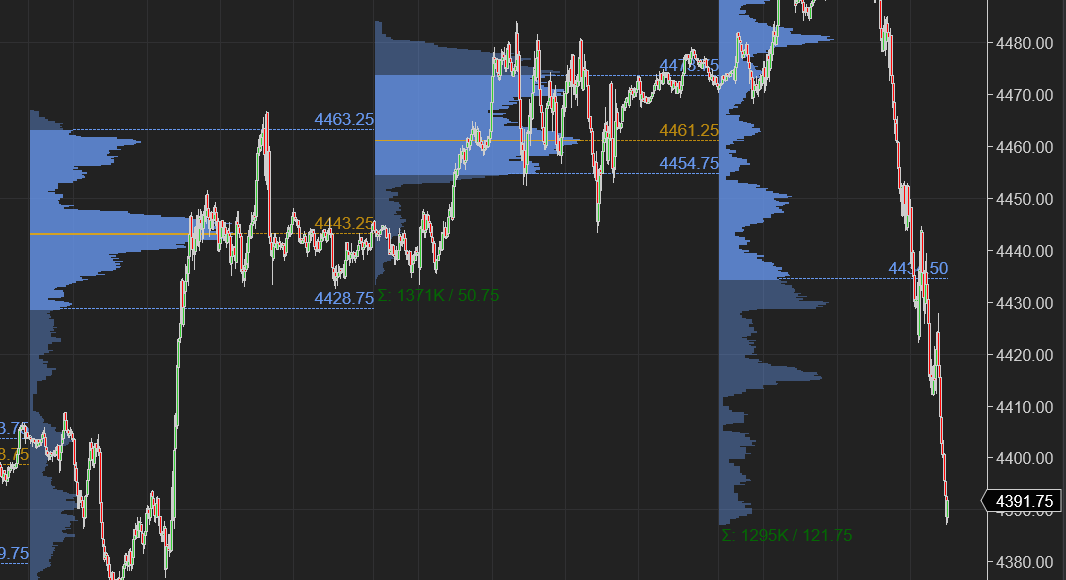

Chart A: A multi nodal day, takes out the P profile shape day as well as the fat profile one from a day before. Not a good look.

Putting this all together, unfortunately I think the bulls or any late bulls may come under some pain tomorrow, and may be even next week. Here are few levels and nuances:

I remain fairly bearish at these levels now. I am in no hurry to touch any of this momentum junk.

This is what has to happen for me to warm up to equities at these levels:

Gold needs to stabilize here around 1950. Ideally 1960. Gold was screaming hawkish FED from last 2 + days.

NQ needs to at the very minimum take out 13900. Now 13700.

If USDJPY calmed down a bit and came down below 128 that may help spooz (now about 50 pips above 128)

My two main scenarios for tomorrow are:

Scenario 1: If we open or offer below 4403/4412 tomorrow, I do think we could test and break 4360 to expose 4330 handles below.

Scenario 2: An open or bids above 4403/4412 may lead to a nervous test of 4432. I do think bears maintain longer term pressure as long as 4465 holds the upside. No Daily close above 4465 may mean we remain under pressure for some time, giving more credence to my theory about that test of 4250/4300 eventually.

3 PM Close was 4385.

Regardless of these levels and scenarios, which are geared more for intraday, I think we remain under pressure unless we can manage a close above 4466 now. Predictably, FinTwit can come out to be very bearish tonight, same way everyone was very bullish last night- this may very well cause a short term bounce due to sentiment, however, the line of least resistance IMO remains down until these conditions are met as described above.

Ever since we rejected the 4580 upper range high, S&P500 has been chipping away lower. I will think once we get to 4250-4300, those levels start becoming attractive for me on many of the names. As far as 4400 is concerned- it remains no man’s land IMO.

Intraday , I shard AMD bearish bias at 91 and the stock just crumbled into the close . I think it may test 80-82. TSM bearish move has really started going now 97. FB stock almost dead now, meets my target of 186 almost after I was bearish on this all last couple of weeks at 233. PYPL meets the same fate. SHOP stock which I became bear on that pop at 750 got decimated today closing below 500 bucks.

Look, there will be lot of guys coming out both bearish and bullish tonight on FinTwit. Take everything that is said- with a grain of salt. Know that they are just opining. See a lot of these guys have their heads wrapped in a wrapper of S&P500 always goes up or if TECH goes down then value goes up - or vice versa.

My thing is - it is quite plausible that everything goes down together for a bit. Why not?

I think the FED is now caught swimming naked. Forget about maximum employment and price stability for a moment- they need to protect the bond market. The FED is the biggest player in the bond market and that could care less about the equities.

A lot of my stocks - in oil and gold miners came under attack today. Does that mean tech and growth is now bottoming? Does the fact that the commodities came under sell today automatically mean that the S&P500 and Nasdaq will now rally?

I don’t know . I don’t think so. All sectors can sell off and if it does , it won’t surprise me. Once we get to 4250-4300, if we get there, I may have some more clarity around what’s going on in terms of individual sectors. I am not there yet.

I am my self bearish on general market, even here at the lows around 4390. Even if I did not have the benefit of having observed the order flow this week, and even if I had not been bearish, AFTER a day like today, I will take a breather. If I am bullish, there will be better days for me. That day is probably not going to be tomorrow. I will let the dust settle.

Remember, I am just sharing and publishing this plan as my personal journal. I do not claim this to be correct or make any guarantees these levels are accurate. This is my personal journal to help me prepare and I am glad to share. But this is under no condition a recommendation for you to do anything.

To summarize:

Unless the 3 momentum factors I mentioned above are resolved, I remain a bear on general market, targeting 4250.

A Daily close above 4465 may make me reconsider my stance. Remember the implications of this are that I remain a bear on many many stocks not just general market. ARKK, FB, SHOP, PLTR, AMD, NFLX are just a few of the list. I will share more before their earnings next week.

Remember this blog outlines and fleshes out my thought process. But any of the short term updates and warnings, I share on Twitter as that is more suited to those kind of updates. See below. Make sure you follow me on both Twitter and Telegram. Turn on the Notification Bell.

~ Tic

And how it ended…

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Amazing calls Tic.

tic can you share or give hints on how to spot long term accumulation vs distribution? Like your legendary $4 GME call? 😁