Folks-

A tremendous day for the orderflow today as many of my calls came to fruition from yesterday.

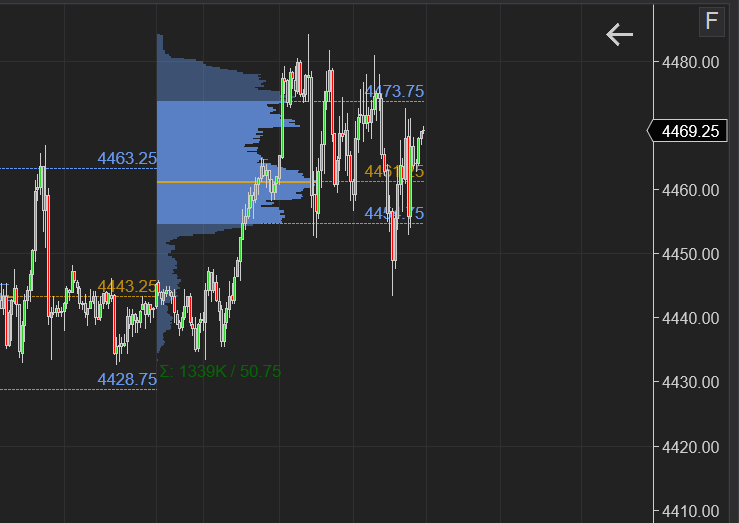

Starting with the SPY, S&P500 side, Scenario 2 was in play. The entire cash and Globex session was capped by my 4480.

We sold down quickly into 4450 at which point I alerted my Telegram to the following text. This was pretty much the low of the day. Was tested many times in the day for multiple bounces off it. At one point retracing all the way back to overnight highs and then finding sellers again. Great bracket between my levels all day today!

FOLLOW ME ON TELEGRAM FOR UPDATES

I have a lot of impostors. Beware: I will never ever text you one on one. If some one does, report and block them ASAP!

I was also bearish on NFLX last night before the ER . Netflix got decimated today, losing about a third of it’s value. Dropping from 350 to 220. I was NOT too keen on it even at 260 and we saw another 15% or so shaved off 260.

TSLA was another victim of the bearish sentiment, in sympathy with NFLX, it dropped about 50 points off my 1030. I wanted more selling. However 980 proved to be too much of a support, and the stock then rallied back up above 1000, now awaiting the ER and Musk conference. I do suspect the stock and Emini on any bounce may get sold due to general market conditions, though I like the stock on deeper pullbacks into 900.

Many of my other recent calls did very well. For example.. UNH , a clean bounce. JPM, a good bounce off my 126. Airlines and hotels which I have been bullish on due to their price gauging did very well-like UAL and MAR both of them I shared here in substack. Many more winners like CVS.

A lot of calls I make are not 0DTE. They are well thought out and are longer time frame.

For instance, I got bullish on CAR AVIS at 260. I was trolled quite a bit on CAR as the stock bounced around in a tight range. Today is finally broke out and is now trading 320 dollars +. Almost up 20%+. Patience is a great virtue.

Tomorrow, looking at the earnings calendar, it is quite thin. However I like the airlines like AAL. Why do I like it? Because I think they are complicit in price gauging with other big airlines. If UAL can do well, I think AAL can also do well. The stock is now trading at 19 dollars .

Chart A: Emini below.

SNAP stock also reports earnings tomorrow.

SNAP chart B below looks quite weak IMO. I think if it manages a bounce into 33/34 it may find it hard to hold on to those gains. I think the stock may find some balance at 25/26.

What do you think, is SNAP a good buy here at 31 or should I wait?

Emini auction has become frustrating for the bears. In the night time, we bounced strongly off 4432. In day time we could not quite take out 4450 LIS. I think this is though just a matter of time before both these levels break and expose some downside.

It is now trading at 4470. While impressive won by the bulls, they also have some over head resistance at 4500. Having said this, for tomorrow my thoughts and levels are listed below:

I am waiting for some of these downside levels to break patiently as I am a mid term bear. Short term I have been trading on both sides, intraday.

While these levels break, I think the key LIS for tomorrow could be 4450.

As long as we remain bid or open above 4450, the market may be supported and could have a tendency to test 4486/4490.

If 4450 were to be offered or if we opened below it, then I think 4412 orderflow level is at play.

Personally, intermediate time frame, I prefer a retest of 4250/4300 for me to get into some of the mega caps. Till then I am in wait and watch mode as long as these names go.

If you like my work, support the substack by sharing my channel with traders like your self.

Be back with much more later. This is the earnings season! Lots of movement- both up and down!

Subscribe to me to receive 5-6 plans like this. Remember this is just a free preview.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Thx Tic, hope you and the son the dog had a good day

Tic, David Hunter contrarion feels, bottom is in. Melt up is on the way. What are your thoughts on it? thanks