Traders-

Today was a very technical day with my levels doing quite well on both sides. Since Sunday night we have been bouncing back and forth between my levels 4450-4536 and I think a resolution is coming very soon. It could be as soon as tomorrow. Keep reading to find out more.

Going into today, at the close yesterday I was bearish at 4487 and my understanding was if we opened or offered below 4504, we may test 4462.

This was the scenario that played out in the morning and we tested down 4462, followed by 4456 orderflow shortly thereafter. After the European close we drifted up to my level 4504 but did not find much resistance there and were able to trade up to 4508-4515 where the sellers entered the scene.

They were able to push emini down to 4492 this is where I sent this tweet after I noticed very heavy bids on tape. This pretty much marked end of that move down with about 6 points of MAE, before ending the day at 4520.

Tech stocks as well as the bank stocks did very well today. AXP and BAC which are my TOP finance stocks did quite well on the day. Oil stocks not so much. Some of this is due to geopolitics as referred to in one of my tweets below. This was the high point in many oil stocks like CVX and XOM.

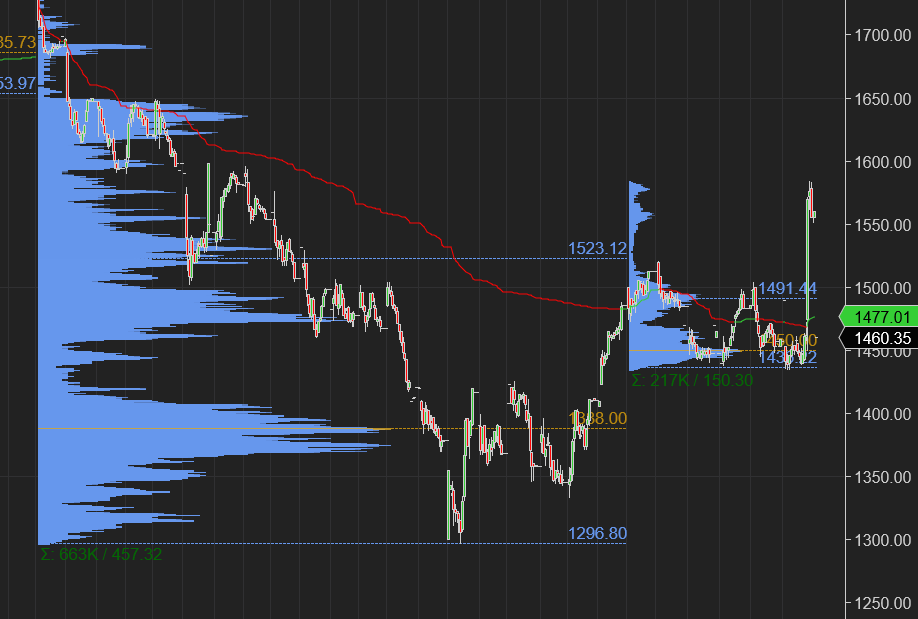

I was also bearish going into the ER of CMG. While I turned bearish on Monday at 1500 before an almost 80 point dump into 1420, CMG stock did rise post earnings to 1580 at time of this post. Part of this was due to strong close on S&P500 emini. Part of this was also technical of CMG per chart A below. In the ER, the management said they have pricing power, but I don’t know if they one and if they had one , I don’t know how it evens out with having to pay more than ever to retain employees. We will see how CMG does over next week or so. I don’t feel very good about it.

Chart A: CMG Rallies after it took out prior Month’s VAH. I think this stock may come under pressure if it closed back below 1525 VAH. Now 1575.

Then I was also bearish on PTON at 30 bucks which ended the day about 20% higher at 37 dollars. The stock did at one point sell off 10% pre market but recovered at the open. I am not sure what is going on with Peloton but it seems some sort of short squeeze event. At any rate, Peloton is one of the worst stocks out there IMO (per my investment criteria) and I won’t touch it with a ten foot pole at any price. If I am a bear though I am watching what happens here at 37-38 as this is a good LIS and if it starts slipping past here, there may be more pain ahead for bears. Longer term I do think this stock settles back into 23/24 range. Right now it is exploring 38/39 after hours.

Looking ahead tomorrow:

I personally think today was a good day for equities for a couple of reasons:

Market has now tried twice and failed every time to break the lows of my range shared on Saturday. 4450-4536. Read the weekly plan if you have not already.

I liked the fact that both XLF and XLK which is the tech sector did well today with the energy sector XLE making new lows. This becomes important especially tomorrow with the FED speak and Crude Oil inventories. Cheaper oil automatically takes some punch out of inflation fears . Combine this with a weaker than expected CPI , we could end up with interesting results.

Since late Friday the market has been range bound between my levels and I think we are very close to a breakout. Or a break. Little bit more context in my weekly plan re: 4536 and 4450: Weekly Plan Link

What am I watching tomorrow for the parameters of trade?

I am watching the same thing I was watching today. Which is to see if XLK and XLF make new highs and XLE continues to drop.

This may come to fruition at 930 am Chicago time, an hour after the open when the EIA numbers come out.

If the inventory shows a glut of crude oil, we may see XLE sell off due to CVX and XOM selling off- these two together represent more than 40% of the ETF.

Now keep in mind the CAPEX in Oil and Gas has been miserably low last few years due to several factors which I am not gonna go into at the moment; this means a relief in oil prices, if one comes, may be temporary. May be we get a 86 to the barrel (right now ~ 90). But I do think oil trades higher by Summer due to this factor.

Then about an hour and half later we have the FED Member Mester speak at 11 am. While the Central banks have been unusually hawkish of late, I will listen for any dovishness when it comes to this FED member . Note S&P500 did sell off last time the ECB Chair Lagarde spoke. Now Mester is one of the biggest doves there is. So her words carry a lot more weight, especially if she is less dovish than her usual dovishness..

So , putting this all in context, the worst scenario that may happen is an XLE rally with XLK stay flat or starts moving south. This is the scenario that will be bearish for me.

Having said that, these are my main price scenarios for tomorrow:

I think today was a good day for stocks and may continue tomorrow as well. For this to happen, I will think the open should be above 4515.

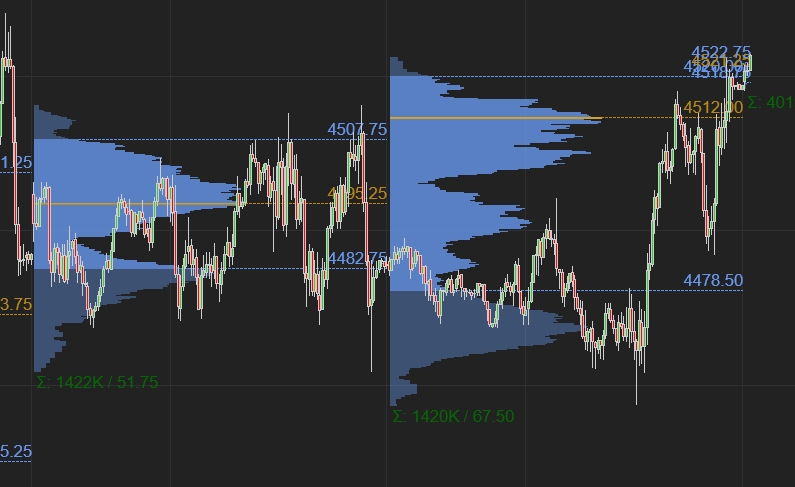

Scenario 1: With this open, I would further think the Tic TOP indicator makes a read of 1-2% + early on in IB. If so, I think S&P500 may target 4536, break it and trade 4552 shortly thereafter.

At time of this post, S&P500 emini is trading at 4518.

Scenario 2: I think an open or offers below 4515 will be neutral for me, and I would think in that case we may test what is there at 4488. And find bids there.

Scenario 3: In the event we open or trade down below 4488, this will be quite a bearish scenario for me and I will target 4456 in this scenario.

Chart B: Emini S&P500 looks ready to pounce if it clears the VAH at 4536.

Longer term I think if we get another day like today with good rally in XLK, XLF, I think we close above 4536 on or before Friday and that may target my 4612.

Other than that , with CMG being CMG and PTON, I had these good plays below shared with everyone .

For tomorrow I am watching CME stock which may benefit due to exploding volumes. For example typical day last year used to have 1-1.3 M volume in emini. This year emini alone on average is seeing 1.5-2 M lots per day. Add Bitcoin futures and treasury futures and it all adds up. I do not think this volatility dies down any time soon either.

CME originally shared by me at 218 last traded 240 dollars.

This is it from me for now. Stay safe.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user, they own all copyrights to their products.

I don’t know how accurate API energy forecasts are but here’s their expectations

https://twitter.com/juliontwtr/status/1491163450776895488?s=21

Paso Robles ⭕️⭕️⭕️

Hello Tic, new subscriber here. Does "open" mean cash session open?