Traders-

Little tricky day to trade today as the OPEN was quite neutral between 4450 and 4536 order-flow pivots from yesterday.

Based on the overnight action, I was expecting 4508 to present some sort of resistance at the open. We opened at 4500 and shortly thereafter tested 4508 and failed. We tried to take this level out throughout the day and failed multiple times to get a bid going, eventually falling about 30 points twice off this level. We closed the day right around at my orderflow level 4480. See below tweet I sent about an hour before USA open.

My weekend post called for choppy conditions before the Wednesday/Thursday events and frustration for directional players. For those who have no yet reviewed it, here are my levels and plan from yesterday: Detailed Roadmap for the Week

Feel FREE to join my substack for similar plans in future (up to 5 plans a week).

Following were some other plays that I shared in last couple of sessions which turned out to be ok:

TSN which I was bullish pre earnings at 90 closed the day at almost 100

DWAC I reiterated my bullish bias at 82 traded as high as ~ 95 today

CMG I want bearish yesterday fell from 1500 to 1450 today

LMT 340 to 395, ZIM ~ 50 to 72 , both did well.

One thing I wanted was to trade lower into NFP lows at 4440 and could not quite get there today. There is always tomorrow!

For tomorrow, my Line in Sand (LIS) for S&P500 emini is 4504. The following will be my 2 main scenarios. If any thing changes over night for me in terms of orderflow, I will be sharing this on my Twitter and/or Telegram. So join those two and turn on the Notification Icon to get my tweets when it goes out (Usually an hour before USA open).

Scenario 1: Open or BID above 4504. This scenario tells me we may be range bound a bit more as we await major news on Wednesday and Thursday. This scenario may target 4522-4530.

Scenario 2: OPEN below 4504. I think this scenario could be bearish one especially if we fail to take out 4504 within the IB period + trade below 4480. IB is the first hour of trade. In this case my target will be 4462. An impulse move may test NFP lows around 4440.

Longer term, NQ below 14800 is not inspiring confidence to me either. It is at 14590 right now. This in turn may be impacted by less than stellar TSLA & GOOG performance today. TSLA in particular, which is now at 907 dollars was uninspiring today. I thought the news that they own 2 billion dollars worth of Bitcoin on their balance sheet was interesting. I just hope this is not an albatross hung around their necks and they do not suffer the same fate as MSTR.

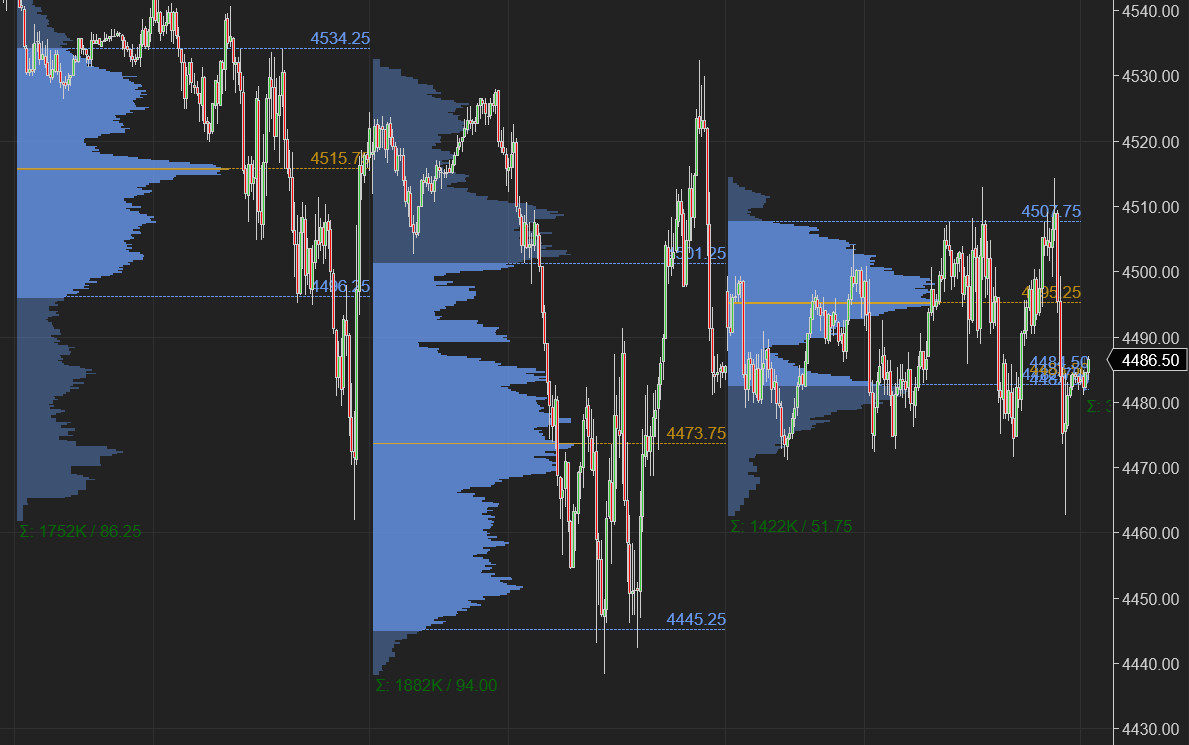

Anyways, I leave you with a chart of S&P500 emini to ponder over.

Chart A: Emini chart. Slow churn waits to make a move much lower, as long as no D1 close above 4536. At time of this post Emini offered at 4487. Weekly plan fleshes out 4536 concept a bit more.

As far as earnings are concerned tomorrow, the ones that peak my interest are COIN, ENPH and PTON. We are almost wrapping up the Q4 earnings season with not too many left after this week.

Starting with Peloton PTON.

This stock managed to close at 30 bucks today egged on by various M&A rumors from AAPL, NKE and AMZN. If you ask me , IMO none of those companies are gonna make a bid for PTON. I think as long as 33 holds, PTON may become victim to gravity and be drawn back into 23/24 area post ER.

COIN was one of my more favorable ARKK stocks and it did quite well today closing at 205. More on COIN and ENPH tomorrow Stay tuned!

See this link: ARKK Analysis

Feel FREE to share this post. Enjoy.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user, they own all copyrights to their products.

Spot on today. Thank You.

Just sub'd and reading up on order flow. What is the 'IB Period" Intial balance yes but what do you consider the IB Period? Opening hour?