Folks-

A key realization for me is the fact that on average if I am a 10 point trader a day, or a 100 point trader a week, can I recover if my average loss exceeds a 10 a day or a 100 a week?

Possible but unlikely.

For those of us who are active in markets and can make profit on balance a day, I think it becomes very important to know these statistics. I must try and not over trade, I must not lose more than 2-3 times my average daily profit, if I have one to remain in the game. I must always remember there is always another day. Even best of the sportsmen and sportswomen can occasionally have bad days or bad seasons, they do not stop playing just because they had a bad day. Same foes for active traders.

I do not want to constantly reinvent the wheel as there is no holy grail in this business. There is only probability and if I am ready at a spot where most dats U am green, I do not want any day where my losses now exceed 200-300% of my daily average.

If I am not at a spot where I am green on average evert day, I keep trying small and even with a simulator which I think is ok when you are starting out. For any one looking for a holy grail or for a perfect set up that works 100 % of times will be sorely dejected.

This is it from me for now for today, ending on a motivational note. Subscribe below for up to 5 such posts a week.

:)

The day started today very nicely for me as my intraday LIS held very well at the open and we rallied about 45 handles at the open with very little activity below my LIS.

I was expecting atleast 3745 but we started selling at around 3730 and we sold all the way down to my weekly level (shared here in this link) 3660 where the buyers stepped in again.

Both my weekly levels were the overnight as well as the RTH session highs and lows (almost) .

Emini levels worked very well however my TSLA LIS today was even better having called the low of the session today. The stock softened after my target was achieved.

Some other names also did very well from my weekly - for example on a down day like today, SAVA stock was up about 10%.

The market continues to be sold and remains under a lot of pressure due to a very strong dollar and very strong rates across various maturities.

This market has strong sell pressure and is a miracle that we have not sold our way down thru that weekly LIS on the lower end.

My key level for tomorrow will be 3711.

Scenario 1: An IB close above 3711 tomorrow may signal to me that we may trade the upper weekly level at around 3785.

Scenario 2: An IB close below 3660 may indicate more weakness and we could target 3620 level tomorrow.

Generally for me a lack of direction and balance trading if open and IB close between 3660/3711 favors slight upside tomorrow.

At time of this post, we last traded around 3670.

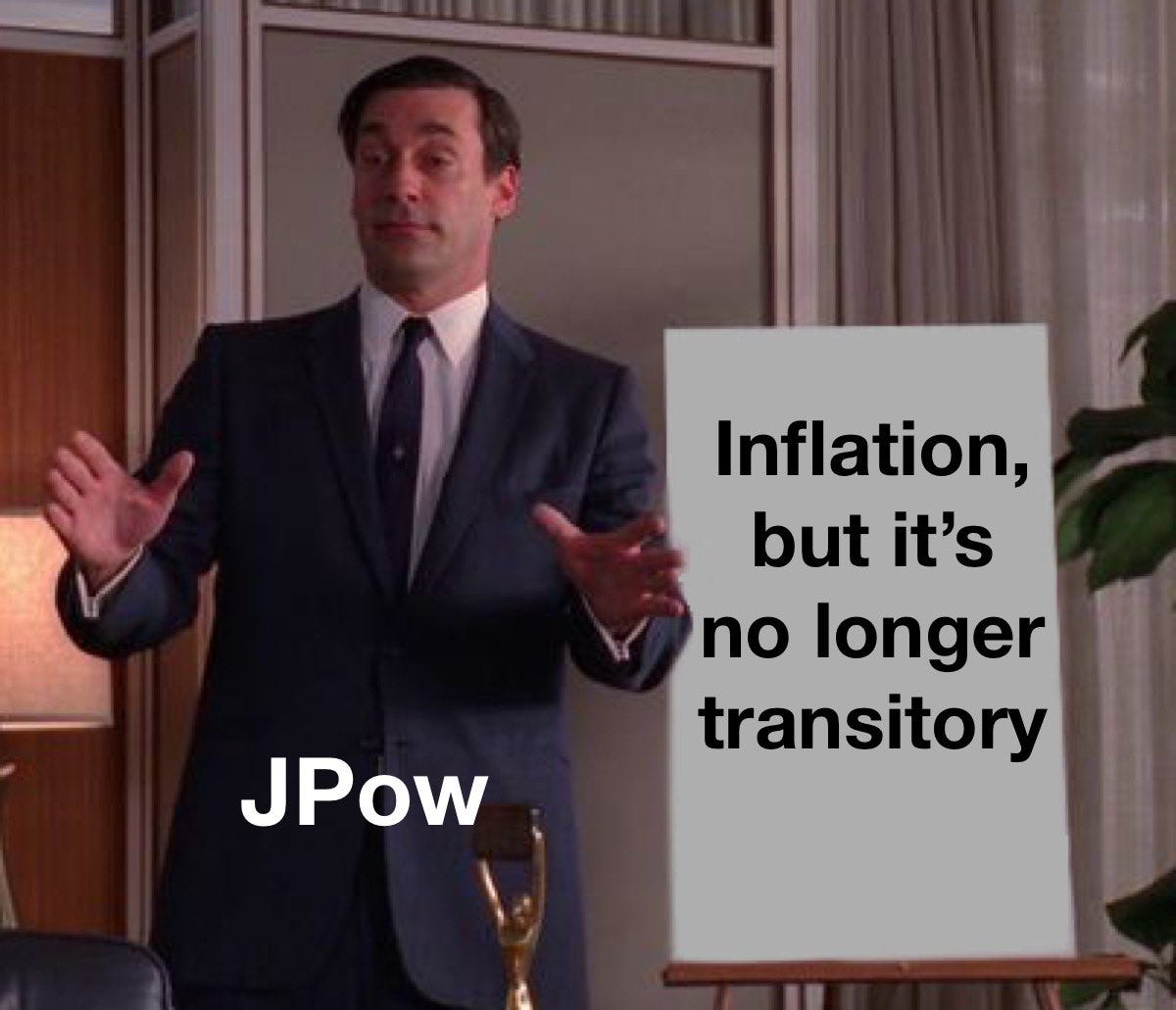

Tomorrow is also the FED chair Powell commentary and could be a factor to consider when trading intraday.

Stock market outlook looks bleak in my opinion when you look at the general market conditions but I think the mega caps as long as TSLA holds that 270 and 150 on AAPL may have some juice to some short squeeze on the upside before one more push lower. See weekly plan for detailed roadmap.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Tic, thanks for the transparency on how many points you currently average per day. This helps me set more realistic goals for myself, a much less experienced trader.

Thanks Tic. Helpful levels today as usual.

Thoughts on OXY or XOM near here? Swing to longer timeframes. Thanks!