Folks-

The unusual moves in stocks and the usual carnage of uninformed players continues.

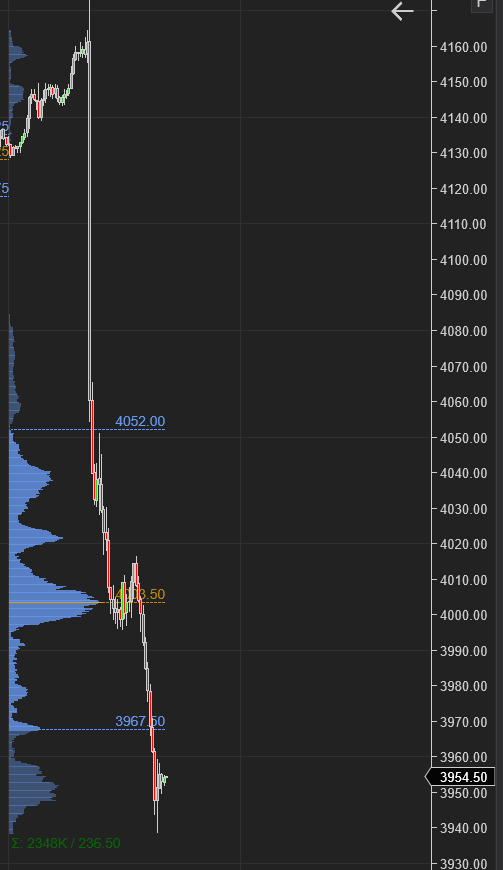

My levels and my weekly plan as well as my levels from last night kept me on the safe side on a massive-massive crater day today.

My plan last night called 4150 to be my LIS and how I will be a bear below this level after the CPI. Further, I shared my context around AAPL stock at the open where I said I will be a bear below 159 on AAPL today even after having sold off some 100-120 points AFTER the CPI.

There was no respite for dip buyers as we lost another 100 handles after the open. We sold down almost 225 points on the session today. This was the worst days in S&P500 for entire year. Talk about myths around imaginary FED pivot and bottoms! I have kept my self safe with my levels and playing with the right hand with the market. I have been spared the sell off and I came out on the top despite a massive red day today.

My weekly plan called how 4100 will be formidable for the bulls. I also said I will not be surprised at all if we closed above it yesterday. I further added with daily plan that 4150 may be the key level today and the high of the day infact was that 4170.

Here is a link to read it if you have not read it yet.

Long term readers also know the importance of 4170 level on the emini. This is why I encourage folks to be long term regular readers of my blog. Do not come with an expectation of 1-2 months, most value is derived from following me over a period of minimum one year. Some of the most consistent people I know have lasted in this market with me for over 3 years now! This is why the pricing is to let folks remain engaged rather than price gauge. Similar content offered by other furus can be as high as 200 dollars or more a month. Though I highly suspect they offer the same level of value. If you have not already, consider subscribing below while the prices are still low.

I also sent an email to Founding members over the weekend. If you have not received it, I will resend it on Saturday or Sunday, Please check your SPAM. If you do not get even then, DM me on Twitter, my ID is @TicTocTick.

Speaking of the unusual moves, AAPL stock rose 4% yesterday and fell almost 6% today.

This 10% move is extremely unusual for a 2.5 trillion dollar market cap company and overall I view this as anxiety and worry in the market. This is just not good. Readers know I have been an AAPL bear from 180 and my target is sub 120. And please this is not a short term call- so I do not expect this will happen tomorrow :)

Now tomorrow, before the market opens we have the PPI. Like CPI measures inflation for the end consumers like you and I, the PPI will measure the price pressures on producers and companies etc. A lot of companies have been eating the inflation components for their goods and services but for how ling is anyone’s guess.

Their cash reserves have dwindled to almost the pre COVID levels- many small companies are struggling so at some point they begin to pass this on to customer and add more pressure on the CPI.

The mainstream media is now catching on to the fact that the widespread inflation is not just about gas any more. However, I have been saying this for many weeks on this newsletter that the inflation has now spread to other sectors of the industry outside of energy. Image below courtesy of CNBC website.

From my weekly plan, emini is not the only thing that worked.

The other big win has been in ADBE which I was bear at 400. That stock is now down about 10% to almost 370.

I was also a bear on TSLA at 305-310 and that stock could barely trade 310, now down below 291. Down 4% today alone. And ofcourse I have been an AAPL bear which was rotten today.

I have been a big bear on the SOX , especially AMD and NVDA. A lot of pundits called for bottom in NVDA- not me. The stock made new lows today and closed below 132. I remain a bear and I think it may trade sub 120-115 even and that is when I may start warming to NVDA. AMD around 70 bucks.

I have been an ARKK bear from 123 dollars last year and it had another bad day today. This after I reiterated my bearish call on it at 50 most recently.

Bitcoin bear too and there is really not much to write home about Bitcoin.

Looking at the session tomorrow.

My key level will be 3970/3980.

Scenario 1: I will remain a bear below it , and my target will be 3880-3892. What may aid this scenario is AAPL remains below 154/155. TSLA remains below 291/292.

Scenario 2: If we open and are trading above 155 in AAPL and TSLA above 292 with Emini S&P500 above 3980, in that instance we may trade OrderFlow Level 4010.

We last traded around 3955 at time of this blog.

Any updates to these levels and scenarios will be shared by me in my Telegram and/or Twitter. Stay tuned.

If you like my content, consider subscribing for up to 5 such letters every week.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Thanks Tic for an excellent newsletter. On point!

Great work. Trolls are dead. I think it will be tough to manage much for bulls without some type of very significant news.

Today was a day where liquidity vanished in the blink of an eye and then just an orderly walk down after the plummet.

Also what are founders and why am I not one!