Traders-

Today proved to be another good, and prescient day for OrderFlow traders, like my self.

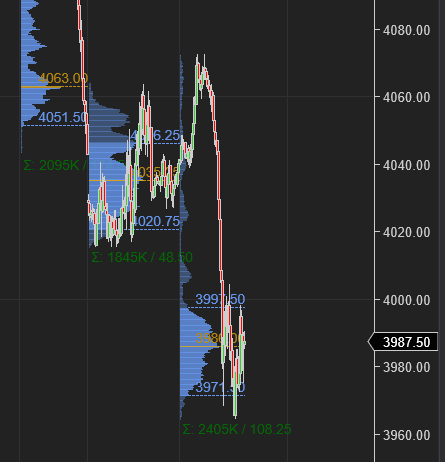

Chart A below.

Heavy volume, heavier than Powell rug-pull Friday as we navigate bunch of support here around 50 SMA and 4000 key round number.

Let us do a quick recap of the session

My key premise today was either we find support at 4030 AND test 407X zone or we break 4030 AND test 3970 to find buyers there for a bounce into 4000.

Well, we hit both scenarios. Overnight, we opened right at my key LIS for the day and in night time we traded as high as 4075, before catching offers and strong sell off to 4030 right at the cash session open.

This level was easily broken within the IB period, and we could not even close above it in the IB.

As a result we rapidly sold down into 4000 and once we broke 4000, there was really not much support into 3970 key weekly level.

We found strong bidders here, traded up all the way to 4000. Spent rest of the session here between 3970 and 4000.

Beautiful, tradeable day, if you have the right levels and context.

With this volatility, OrderFlow levels are working handsomely again. It was never a question of OrderFlow going out of style, but it was all about volatility and with return of volatility these levels become formidable.

BTW a lot of folks have asked me that did not get enough heads up before the pricing increase. The question is can we go back to old pricing.

The new pricing is now final and will not be rolled back. I can say that any one who does not resubscribe, will not be impacted by these price hikes. However, I can offer a one time reduction if any one wants to come in at a lower prices, this will be a limited time deal. Click the link below and use the option.

S&P500 was not the only thing that OrderFlow had a good day with.

From my weekly plan, I had recent bearish bias on these tickers and were all very soft today.

TSLA almost down 10% from my 303 into almost 270. This puts TSLA squarely at doors of 800 dollar key level.

MSFT big sell off from my 272 into 260.

SOX names like AMD, NVDA, MU all decimated from 190 level on NVDA into sub 153 within a matter of days.

HD collapse from 310 to almost 290.

GOOG, ARKK, ZM massive sell offs , all shared here with folks.

I was right on all of these and in fact I was right about many other markets as well which I have not covered here for sake of brevity.

This is the link to my weekly plan, in case you have not yet read it.

This is the link to my plan from last night calling these levels.

I recommend the weekly plan is revisited from time to time during the week to stay abreast of the continuous auction.

On a side note, some Founders have asked me what is next? I ask that please let us wait for another week or so for me to define what this looks like. Most founders are the most loyal and old time readers of this blog and what we do next has to be meaningful and value add. Much more on this to come soon, stay tuned!

My levels for tomorrow

Before we discuss the levels for tomorrow, I want to share a couple of parameters that may have an impact on the auction here at these levels. As long time readers know, I do not speak in absolutes and what the market does next may be influenced by what some of these parameters do next.

We are here at the 50 SMA on SPY. A lot of programmatic strategies use 50 SMA as support and will buy, mindless of other context and factors.

Oil has softened a lot in last session or two BUT is holding 90-92 at time of this post.

TLT has kind of stabilized, Dollar is a little weaker, Gold is weak. This sends me mixed messages that the FED may not be able to follow thru and is all bark, and no bite.

These zones here, around 4000 are also the place where a lot of damage was done to the bears in last CPI. Conversely , this is also a reload zone for a lot of newly minted bulls. So, naturally, I place much higher importance to the auction here, versus at 4300 or 3666- for that matter. The volume today in markets, does not disagree.

From a risk event point of view, we have the Euro and Swiss CPI, along with some FED speak.

The reason I have shared this little tid-bit is that I expect UNLESS the market holds this 3970-4000 zone for a day or so, we can see a rout develop fairly quickly.

The primary thesis is that you have some laggard longs here who got in at the CPI print last month. I would think unless these levels hold, they would be weak hands and quick to shed their positions which can feed on itself.

With this said, my key levels tomorrow will be 3930 and 4010.

Scenario 1: As long as we remain offered below 4010, I expect a retest of 3970 at some point tomorrow and a break of this may target 3930.

Scenario 2: Bids above 4010, followed by an IB close above 4010 is a lukewarm bullish scenario for me intraday which may retest 4030-4050.

At time of this post, we last traded around 3990.

Outside of day to day auctions tomorrow, I think a balanced scenario tomorrow between 3970-4000 is what you want to see if you are a S&P500 bull.

I personally do think next leg of softness and rout can develop swiftly if we were to close below 3930 this week or on a D1 close basis.

Note: D1 is the Daily close which means the last cross at 3 PM CST.

IB is the first hour of trading every morning when NYSE opens at 830 AM CST.

Let me know below if you have any questions on this plan.

This is a FREE preview of my plan and subscribers can get up to 5 of such plans every week. Subscribe below to get similar plans every day.

Share this post with other traders like your self.

This is key spot for other risk on stocks as well, like TSLA and NVDA.

Long time readers know my target on NVDA is 125-135. I became a bear at 300+ and reiterated this several times, as recently as 190. At that time it did not look plausible but now it is only a cinch.

On TSLA side..

I will say the charts do not look as nasty as on let us say it looks like on NVDA and GOOG. However, we are about 6-7 dollars off the key 270 level. I do think if we close below 270, we open the doors to 250 level.

In other news

As readers know my XOM target of 100 dollar was met. I first shared this stock in low 50s here in Substack. It is 96 now. I think Oil stocks may be a little extended now and may need to cool off a bit.

Folks also know when DLTR crashed its earnings and was trading 150, I said I can not touch it here at 150 but may consider it around 140.

The stock is now 138. A lot of these Dollar stores are now attracting erstwhile well to do customers and I think Dollar Tree is worth keeping an eye on. I think if 135 area holds, it may soon resume it’s uptrend.

This is it from now folks. If you enjoyed this post, like and subscribe. Leave a note below with your thoughts.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Awesome Tic. Best newsletter of all times

I’ve never been more excited to read something in my life. I felt in my gut it was time. I feel at ease. I know I made the rite decision bc this is fkin golden! Many thanks tic, I’m very excite!!! (I promise I won’t be annoying)