Traders-

This was a cathartic week for many, including me, who steadfastly held on to conviction and were not swayed by the mass FOMO. I personally have been a S&P500 bear from January at 4800, and refused to join the mass FOMO to chase S&P500 at 4200-4300, and this week was a vindication for me, and many other participants who held similar views as me.

This week was the end of mythological arguments around an imaginary FED pivot and inflation peak. I did my part to share my thoughts and warnings as I had 0 faith in this rally, and I hope they helped atleast a few from this unceremonious rug pull.

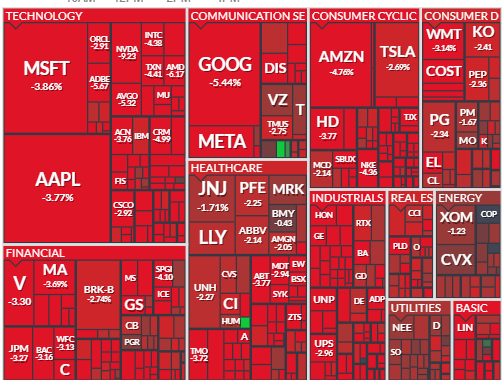

I am sure I do not have to perform a full post-mortem of the events of this week, however, the market crashed and wiped off almost a month’s gains within a couple of sessions.

We can debate the whys and the how’s of this sell off, however, even before the Jackson Hole and the remarks by Powell on Friday, trouble had been brewing at much higher levels and the tape was printing these warnings, almost every single day preceding this crash.

I did my part in almost constant daily updates via this Substack and my reasoning why I do not believe the rally, I hope my updates were useful and timely before a 1 trillion dollar + rout on Friday.

On top of my bearish big tech and S&P500 calls, I have also been a big Bitcoin and Crypto bear. I have been a Bitcoin bear off 60000 levels and reiterated this many times, most recently at Bitcoin 25000 and Ethereum 1900. At time of this blog, Bitcoin is trading now near 19500 and Ethereum is trading now near 1450.

While to many it appeared we had turned a corner and were headed much higher, the OrderFlow had a differing, contrarian point of view and the results are now for all to see.

I want to do a quick recap of prior week’s plan before this week’s levels and scenarios

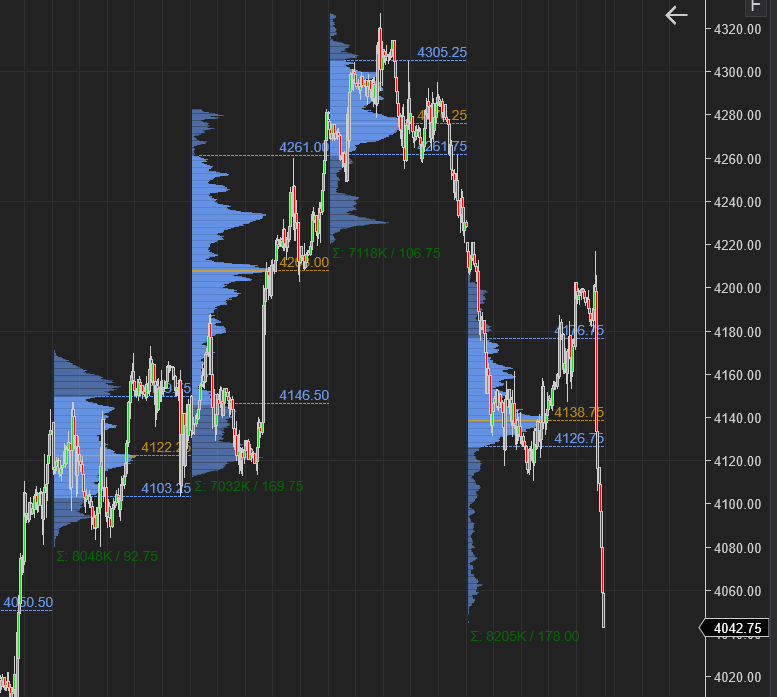

So, about two weeks ago, I shared 4267 as a key level which will cause more volatility and a test of 4000s, if we closed below it. That close happened on Friday, 8/12.

Here is a copy of my trade plan from last week.

So my primary thesis was that the market was weak at the start of last week. In addition, I mentioned TLT, Oil and TSLA as key markets to watch last week which could support or refute this bearish thesis.

On TSLA side of the house, my key bearish LIS was $303 which we really were not able to recover at all last week with closing the week around $285.

Keep in mind that both 290 and 303 are key levels for me in TSLA. We have closed this week below 290 on heavy volume on Friday, though the weekly volume was not so great.

Last week, we closed at 4228 and my key level to defend for the bulls/bears was 4200. However, there was not much for the bulls to defend as we started selling off pretty much at the start of the week.

This 4200 level remained a key level throughout the week and in fact on Friday when we briefly broke it to trade a few points higher in the pre market, I warned folks that this may not be sustainable as soon as Powell opened his remarks.

As soon as he did, we started selling off. We eventually sold down to a low of about 4040, a full 160 points lower of the 4200 level, and about 110 points lower than the IB close level on Friday which was around 4150.

Here are few other ideas from last week’s plan which worked well:

Remaining a Bitcoin bear at 25000 to 21000 where it sold down to below 20000.

ZM Earnings bear from 100 to 80 dollars.

PANW bull at the earnings from about 500 to about 580 dollars.

NVDA bear at the earnings from 176/177 to around 160.

I have been a NVDA and SOX bear in general from many months now. In fact I became a bear on AMD at 110 and NVDA at 300+ many months ago and I think this bearish trend may retain itself a little longer before relief shows up.

If this week’s posts were helpful, consider subscribing to my content for less than a dollar a day to receive Daily updates from me and support my content.

My 2 cents on Powell remarks

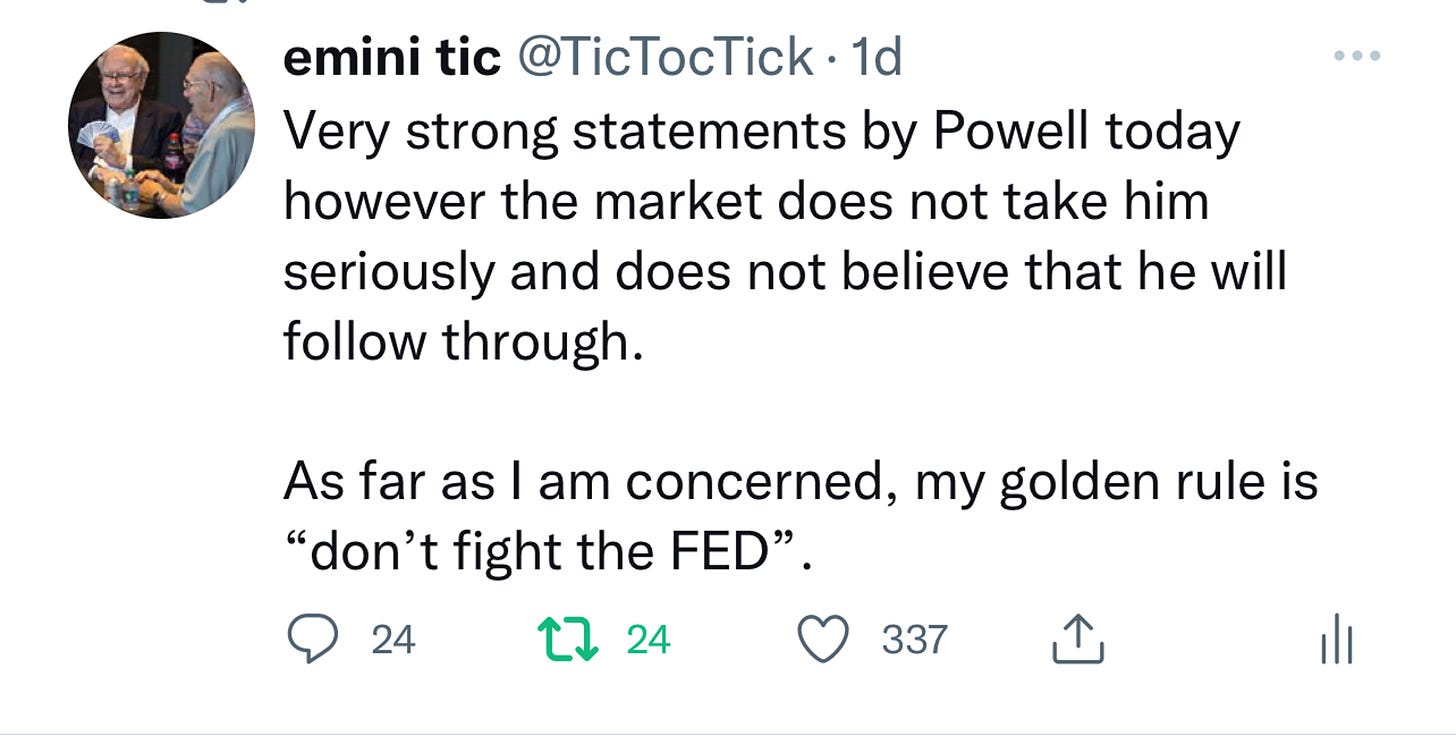

So, the readers here know what I feel about Powell and the FED in general - I have been saying they become dovish when the market traders lower and they become hawkish when the market traders higher. You may be forgiven to make a simplistic assumption that may be they just track the VIX to rime their commentary. Hawks at 20, doves at 30!

There may be many reasons for it, but my personal opinion is it is just to engineer a softish landing where the markets are not throwing too many tantrums and they are also able to watch the interplay between their dual mandate of inflation control and employment in general.

Is it working?

I think whether Powell remains dovish or hawkish depending on how S&P500 is doing, does not matter in the longer term, because of one key commodity price: Oil.

Oil was barely unchanged on Powell remarks and closed above 90 for the week. I think it becomes very hard to rein in CPI when oil just lingers here above 90 and leaves room open for a 100 + oil in Fall/Winter.

So, to read the market tea leaves, I will keep an eye on CRUDE OIL this week and in fact any other week.

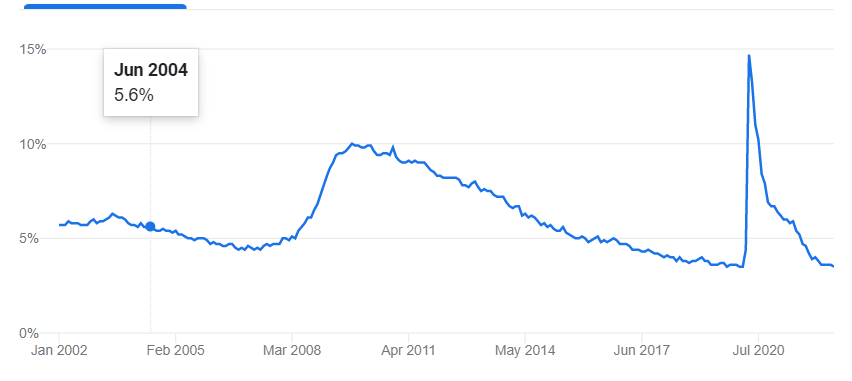

Also, I think the labor component of the CPI is here to stay - as long as we have these ultra low unemployment rates of 3-4% or less.

So, I was not surprised at his remarks, I thought the market was ripe for the FED to pull the rug, and they did not miss.

So, yes these 2 economic data prints are important for me to see when and where we may see a sharp reversal in FED posture. If oil remains bid here above 90, if unemployment rates remain sticky and low here in 3% handles , I just do not see a FED pivot. Remember all these negative GDP numbers do not mean much when we have a very low unemployment rate to combat the CPI. Often GDP deteriorates first and the labor market is the last one to take a hit in such tightening cycles as the businesses try and retain their people for as long as they can and cut those costs at the very end when all else fails. I do not think we are there yet.

My levels for this week

So, we saw this huge dump on Friday and the volume on the day was quite insane but was low on the week.

Where does this put us? Are we going to see a continued sell off this week or can the bulls expect a bounce? It is also the month end and start of a seasonally volatile SEPTEMBER.

What are my thoughts? Read more to find out.