Folks-

A quick recap from the session today.

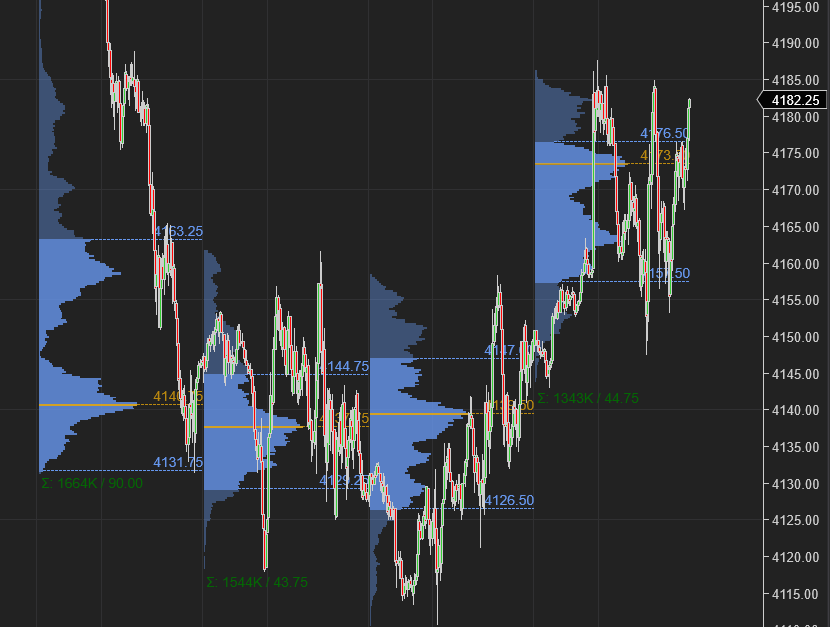

I expected the market to remain supported above 4160 IF we saw it open/remain bid above it in the IB with TSLA above 910 and NVDA above 171/172. This was the Scenario 1 from last night with targets at 4200.

We opened around 4160 BUT ran up to 910 in TSLA (303) and up to 170 in NVDA within first few minutes, with trading up to 4170 in the S&P500.

NVDA which had sold off quite a bit after the earnings last night rallied near and stalled at my key LIS near 176.

Personally for me this was slightly conflicting due to the divergence between TSLA and NVDA etc, however, we did not dip anywhere near 4160 in the S&P500 within the IB and dips were supported into 4160.

Overall, the market remained supported at 4160 level and was not able to break it. We traded up to 4188 but were not able to trade higher at time of this post to trade 4200 target. Every dip into this 4160 level shared by me last night was bought as of this post.

Longer term, 1-2 weeks out, I am seeing some sort of balancing here now between 4130 which was my weekly low target and 4200. I will see a clear trend develop outside of these brackets.

In auction terms:

I expect large move to come of about 100-130 dollars upon a D1 close above or below this range.

So we can expect a retest of 4330 or a retest of 39XX upon a D1 close above 4200 or below 4130 respectively.

As I start writing this letter, S&P500 has now backed down from ~4190 into 4160 handles. With what remains of this session, a break or a breakout may be harder to achieve in the session.

In auction markets, a key concept to be cognizant of is usually when you break or break out of a range like the one we have, a consequent fall back into the range is considered a failure of break/breakout and can lead to retest of the other end and failure of the range.

My levels for tomorrow:

So, the key thing to watch out for tomorrow will be the Powell speak which begins about half an hour into the open.

I do think this event may cause a large range in the S&P500 market.

As of this moment, the SPY index has carved out a range between 4130 and 4200 which may get broken with events of tomorrow.

So, for tomorrow these indeed will be my key levels.

I know this is a little wide range, but I do expect a large range auction tomorrow.

Scenario 1: As long as we do not see an IB close above 4200 tomorrow, I think this level if tested may see sellers emerge for a retest of 4130. IB is the initial balance and I regard it as the first hour of the trading session when the NYSE opens.

Scenario 2: An IB close below or a break of 4130 may target orderflow level 4090.

At time of this post, we last traded near 4200.

PS: In fact as I wrap up this plan, it does look like the Scenario 1 target will be after all get hit as we now trade near 4192.

In other news, I had been bullish on a couple of stocks like ADM at 85/87 and it had a good close today at 91. I think this may be poised for a run higher into the 100 dollar range as long as we hold the LIS at 86/87.

~ Emini Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Thank you Mr Tic . Very informative. I agree that tomorrow will be lot of volatility. JPow is speaking right in the middle of IB

I have a question: I upgraded to founding member subscription few days ago and have not seen a change in the benefits. Can you please clarify what else I need to do for added benefits of founding member subscription. Thank you

Tic you had mentioned a while back that 109-110 may be a bottom for TLT after the recent low of 108. Do you think we go lower than 108?