Folks-

This was a tremendous day for the OrderFlow as the market bounced back and forth between my levels shared with folks last night and this AM.

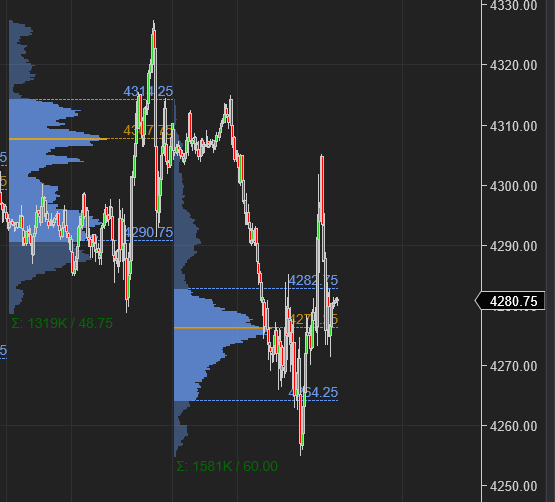

I was bearish at the open and as we sold down into 4263-4267 area, I shared an intraday level with TSLA support at the 906 level and targets at 4284.

This was a good call as we rallied very sharply off this point into 4384 and then followed by the 4300 resistance shared by me in the morning update on my Telegram.

TSLA also had a good run from 906 into 927 before finding sellers there and selling back down below 910. Emini S&P500 had 4300 as the exact session high and then came down below to 4384 area. A great day for two way auction as well as return of at-least some volume as we traded highest volume in last 3-4 days. Chart A below.

Not only TSLA and S&P500 Emini, I had a good call on Target TGT which I was not keen on at 181 after WMT earnings. I shared 170 LIS on TARGET which was almost the low of the day before a jump back into 176+.

Some of my other names shared earlier also did , including GEO which had a 5% up day today.

Here is a link to my plan from last night: 8/17 '22

Also, don’t miss the opportunity to read my weekly plan with very important system that I use to measure and not trade against the intraday momentum: Weekly Plan

The auction today and yesterday I think were one of the most unique auctions in last 10 days or so and I think may lead to meaningful price action from here on.

What did you think about the auction today? Are you leaning bearish or bullish for tomorrow?

For tomorrow, my key levels will be the two below: