Folks-

From my plan last night, GEO had another good day at one point rising as much as 15%+ to $8.35 before settling the day near $8.

On the S&P500 side:

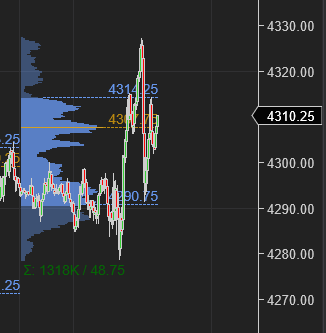

My main expectation was as long as we remained below 4300 , we could trade down into 4250. The overnight high was 4300 and in cash session we tried trading up to 4300, failed at 4298 and traded down almost half way into this target at 4278.

It is around here at 4284 that I saw an active buyer take out all the offers at 4284 , see Tweet A below. This marked pretty much the end of the downside today and we sharply rallied above 4300 to 4327.

4325 was my Scenario 2 target and Scenario 3 LIS. We found sellers here, selling down into my target at 4290 before closing the session around 4310.

This move down from 4325 to 4290 and then 4290 back to 4310 was fairly fast and from a personal style perspective, favored by me as far as the pace of tape goes.

In this post, I share a couple levels like 4325 from today and IMO another likely winner from the “inflation reduction act”.

For tomorrow:

My key levels tomorrow will be the ones below:

4325 and 4280.

Scenario 1: The bulls will need to take out 4325 tomorrow on strong Tic TOP and stocks like TSLA bid up above 930 bucks to target higher prices. If the 4325 level is approached but Tic TOP stalls or starts weakening, I will think we may be able to trade down into 4280-4290.

Scenario 2: The bears on the other hand side will need to take out 4280 to be able to trade down into 4267 area. If 4280 holds, we may be able to retrace back up to 4325 from today.

Emini closed at time of this post around 4310.

We saw some good action in names like WMT today.

I think the market liked the fact that the retailer is able to pull affluent customers away from their traditional stores to shop and spend more at the Walmart.

It traded up to 140 after the report but since then it has softened.

If it fell back to 133-136, I think it may find support for one more push into 141-142 at some point.

On back of WalMart, Target TGT also had a good run and closed around 181. They are reporting their earnings tomorrow.

TGT has shown some strong price action in recent weeks. However, at 181, I will avoid it and see if I like it more at 168-170 area.

In other news, the new 400 Billion + spending bill was officially signed by the President today.

There will be winners and losers coming out of this massive spending but at end of the day I think one thing is guaranteed. The complexity and the headache around filing taxes come every year may increase now into years to come.

Can some thing like HRB win in this? I think so. Look at the Weekly auction below.

They have a high valuation right now but the forward multiple is not bad around 12.

It is trading 47 and change now and I think it may remain bid as long as the 40 handle remains intact.

What you think? Any other winners in this?

Some of my other names shared after the earnings continue to do very well.

ENPH and CMG being a few of them. I shared them with folks here in the Substack at 150 and 1400 respectively and today they close near 300 and 1700 bucks.

It is not every day I see something that makes sense to me for a swing or a long term hold and as soon as it shows up on my radar, the folks here are the first to know.

There is also some noise and questions around the planned price increase for the Substack. The only reason I have held off is that my bearish calls have taken a counter trend heat and I will like it to begin showing some momentum on the downside as far as general market is concerned before the planned price increase takes place. Whenever the prices do go up, I want to assure any one who is currently subscribed and does not resubscribe, will NOT be impacted by these hikes.

If you like my work on this newsletter, feel free to share it and subscribe to reach more traders like yourself.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Fk all these people talking shit..no one can time the market. It’s a gamma squeeze and the true color of the market will be shown

Tic, was such a thin auction, do you see an elevator down situation brewing?