Folks-

Welcome to a brand new month! Today we signed off on one of the weakest periods for stocks in several decades and we did it in style- with a lot of chop to go with it! This was actually one of the weakest half year performance for stocks in over 50 years! Something that has not happened since the 1970s!

I myself wanted more selling but things did not go my way as we entered choppy waters after the IB session.

The stage was set with my newsletter hitting the wires last night. I think I sent the newsletter a few minutes after the Globex opened and the moment I hit send, the market softened. The fact is we could not even peek above those levels from last night all day today :) !

The session itself was capped on the downside by my weekly levels. Both my weekly levels got hit today.

Here is the link to the weekly plan.

I happened to be one of the very few people who were bearish this week after Friday’s tremendous rally. The great thing is we did not even peek a tick above my Line in Sand (LIS) on the weekly at 3950 :) !

Here is the link to the daily plan from last night.

I was bearish at the close yesterday and thought we would remain soft as long as we remained below 3851. My target was 3750-3770. Little did I realize that those targets will be hit in overnight session itself. In fact I could not get much sleep tonight and I woke up in middle of night as we had actually traded down to 3765 around 1 AM.

This is a FREE preview of my levels and daily thoughts. If you want my thoughts delivered to you 5 times a week, subscribe below.

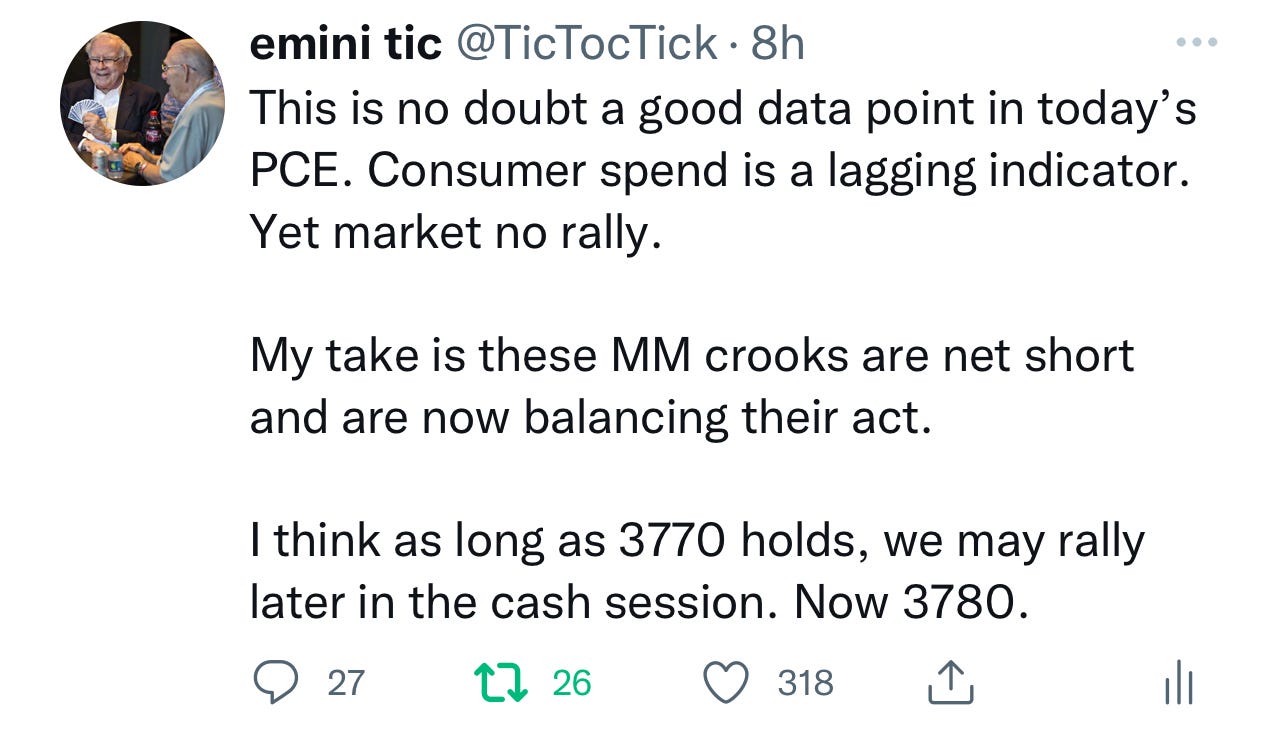

In the morning, an hour before the cash open, the PCE numbers came out. The core PCE was actually weaker than expected. This is a widely followed indicator by FED and FED watchers and I expressed my surprise that we did not get any decent bounce at all off this number - a measly 15 points off 3770.

This was undoubtedly a good number for inflation hawks in the sense that it may be signaling peak inflation. With such a good read, we barely rallied and this was kind of a red flag to me. Then I looked at oil and the bonds and only thing I could think of was that the MM were perhaps short into the release and wanted to cook their books before staging a rally later in the session.

So my view was before the open if 3770 held we could rally off this level. When we opened, we found a 10 points off 3770 and then quickly sold down to right under my target 2 of 3750. The tape started becoming stronger here at the lows and when we revisited this 3770 number, we broke it, traded all the way back up to overnight highs.

Rest of the session was a chop fest between these two levels and we closed the day around 3780.

I had personally expected a close into 3800 and I expected the MU earnings to be very bad which would have caused a sell off in the SPX after the session closed. This really did not happen per my expectations as the market ignored the MU drop into 50’s after hours.

Note that I have shared my bearish MU bias at 60 last week and the stock is down a good 20% off those levels within days. Now this MU stock has since rallied AFTER hours, I think though if it remains below 55, it still remains under pressure.

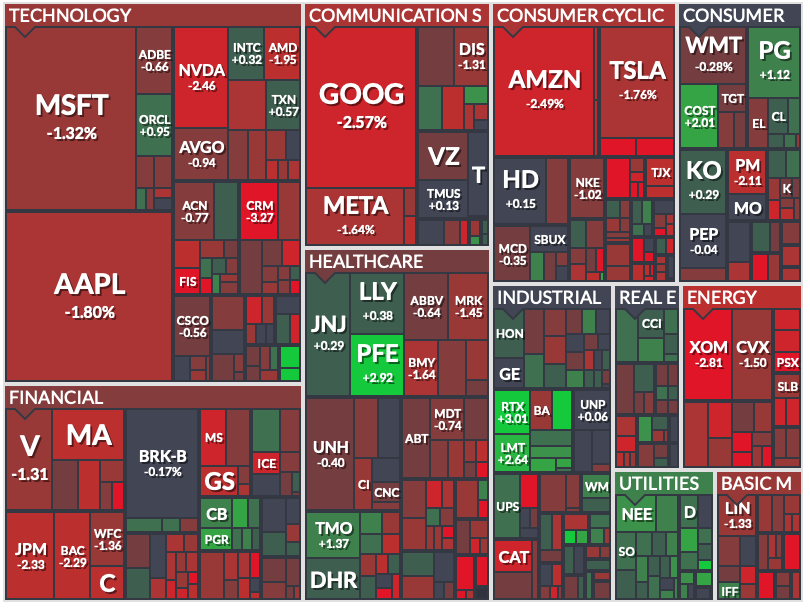

So long story short, I thought today was a weak session technically but a strong session if I looked at the economic data. It was a very choppy day something which I had anticipated.

In other news…

We are now getting closer and closer to the Q2 earnings season. I think TSLA will report it’s delivery numbers and those numbers probably will be released over the weekend.

If the numbers come out on Saturday I would think this gives the market some time to digest in case the numbers are extremely bad. I do think if the numbers are very good, I think a lot of that may already be priced in.