Folks-

So a couple of things..

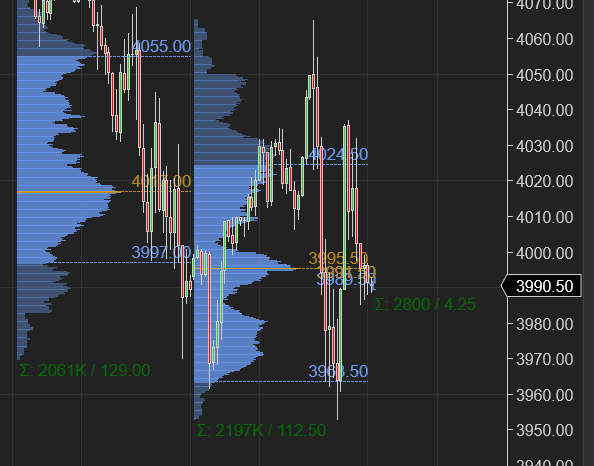

I started my day and saw the market already trading up around 4050, up about a 100 dollars overnight from my levels I shared in this very substack last night. Well, I was not buying this pop. And this why I said on Twitter I expect a very choppy session today as I could not see much demand at this 4050, which up until a couple of days ago was a major support before it broke and has now become a resistance.

This is exactly what happened and we sold down to 4005, where I said this level is key and needs to hold else… well the level did hold for a bit but then it gave up and we traded down to 3950. 4005 was BTW a good level for any one short term in this market today- both up and down.

I became quite bullish at 3950. And this happened to be the low of the day as well before we rallied all the way back up to almost 4040. We did give up about half of these gains back to close the day around 3990.

I was also bearish on COIN at 85 yesterday in plan and we did get a nice round of selling in this stock today. Unfortunately for me, I became bullish around 74 and after the earnings the stock is down big, it is trading about 62. This would not have bothered me at all since my target would have been above 90, however, there is some new language they added to their 10Q to the effect that any coins held in the brokerage may become the property of the bankruptcy estate in event they were to go bankrupt. This is a red flag for me and I will try and get out of COIN for a loss.

I had a good day on the emini side, but the session it self was tough to trade by any yardstick, I think I speak for everyone. I am not going to get into the question of what could have been done differently - as it tends to go into the gray area of execution and execution is deeply personal and I do not want to go into any questions on execution due to that reason, however, I will say this underscores a few things : a) picking the spots wisely from a risk to reward perspective. Which means for me, 4050 is a solid Resistance and 3950 is a solid support and I do not want to be a bull at 4050, and dont want to be a bear at 3950, especially once the market is open and we have had a chance to look at the orderflow and other parameters. b) there is a need to be nimble. I am personally not going to be in a position when I am wrong or atleast I will try my best to not to be in a trade that has gone against me 10-15% or more of the daily range . So if emini is ranging 80 bucks, I am not hanging there in a bad trade once it has gone against me ore than 10-12 handles. So there is that. I am sharing this point in case any one may be wondering if Trader Tic is still long or short once emini has gone 20-30 points against him intrady. He is not.

These are exceptionally volatile times. I have not seen this level of heightened volatility in years even during the trade wars of 2016/2018 or even the volatility during the pandemic was not for this extended period of time. This may mean that volatility is here to stay for a bit longer. This volatility tries and taxes even the most experienced traders. I do think if I have had a rough patch for a few days now, instead of trying to force something good to come out of it, I will just wait and watch the action and learn as much as I can from it in terms of price action.

If there was one key takeaway for me from all this- this is not about guarantees of being right all the time. This is really about a percentage of time I can be right out of a certain set of trades. On good days , if I may be right about 60-65% of the times and when I am right I may be more right than when I am wrong, I will say it has been a good day. There is really nothing more to it, its about a % of times I am right and the size of average win versus average loser. This applies to intraday time frames to investing time frames. On the position sizing side of the house, as I said earlier, I am not expecting to risk more than 15% of the average move on any one trade. Based on the range of the day, that size could be flexible.

I also want to address my call on the melt up at 3950. And I think to put that in context I need to reiterate my position on the general market:

I have been a S&P500 bear from 4800 this January.

Knowing this market, it is in a downtrend on longer time frames (weekly, monthly). The yearly time frame is still up but I think that will change eventually.

This market has been carving out these ranges lower and lower and I was the first one to say back in January the market may range out between 4200 to 4500 with impulsive offshoots to 4100/4600.

Over the weekend in this post, I said I suspect this market is now carving out a new , lower range of 4300 on the topside and probably 3900/3950 on the downside. My melt-up call is in context of this latest range. I do expect this market may move higher and test the upper ends of this range, however, I want to clarify that I am not yet in the camp that thinks we will make new highs any time soon. If I were to qualify this , I will say this is in context of a weekly time frame swing call (1-2 weeks out).

For a longer term bottom , I shared my thoughts in this same post about AAPL. I think AAPL may be the last shoe to drop and once it does, I think we have a nice longer term bottom. I do not think we are there yet.

So with this out of the way, few thoughts and levels for tomorrow:

Chart A shows an attempt to take out the lows from yesterday which failed and an attempt to take out the 4050 recent highs which also failed. IMO this shows uncertainty in the market not necessarily strong trending market.

My primary expectation is that as long as we remained offered below 4000, there may be a tendency to test the lows from today at 3950. Remember the CPI day itself is not the best one for S&P500 based on historic performances.

However, June can be a good month for stocks like AMZN and TSLA- speaking from a seasonality point of view. So I would think any attempts to take out 3950 may fail and this may be confirmed with the failed break price falling back in the Value Area from today.

On the topside, 4050 is a key level- I do think if this gets taken out, we could trade upto 4170-4200 before finding meaningful resistance.

At time of this post, Emini S&P500 is trading 3990.

While we rallied almost 100 points in S&P500 from my 3950 today, what else was impressive was about a 40 handle move in GOOG off my 2280 , about a 40 handle move in TSLA off my 780.

I do think these 2 names are attractive at these levels however under pressure due to the general market. If the general market clouds lift, I can may be see a TSLA trade back to 960/1000. I think we may see 2450-2500 back in GOOG. These may coincide with my range highs and lows as described in prior section.

On the macro front, I like that the US dollar has paused. I like that the oil seems to have peaked and the yields on 10 year have backed down. So these are not necessarily negative for the general market but we are just in so much pessimism and panic mode that the market is not discounting these new events as much as it should.

On a little off topic, before signing off, I want to answer a common question of pricing. This substack has always been 29.99 and that will not change for any one who is already part of it. However, I do want to ensure we gatekeep folks who are truly sincere and serious about orderflow and that may mean at some point I raise the barrier to entry a bit higher. Whether that happens today or later, it will not affect any one who is already a member but may affect those who join later. Wanted to share this with anyone who else may be wondering.

Click here for my plan from yesterday if you have not already read it already.

Signing off..

Stay safe. Stay Nimble.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

So, "urge caution" seems to only mean "look out below, prices look soft", and "melt-up" means the opposite, "prices firming, likely to rally [to top of the range]". Got it!

Hey Tic - I have a question for Investor Tic. I've joined the newsletter because I want to become an investor instead of a trader (I know my strengths and I will lose day-trading). Will you have separate newsletters regarding long-term plays or should we expect you to mention it within your daily/weekly plans?

I know you've mentioned you only believe in TSLA (multi-year position). Are there any other tickers you are eyeing? I'm wondering how I can use your knowledge to invest longer-term. I am looking 5 years out. Thank you!