Folks -

The key level today was 4180 with the upside shared at 4195 and the downside target of 4140/4155.

The 4195/4200 bracket traded overnight and we opened a couple of points above 4190. 4197 was the overnight high and the popular expectation today was to see some sort of short squeeze rally which never materialized.

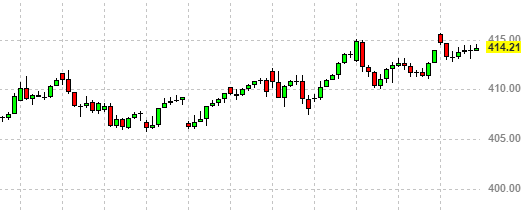

The battle between the bears and the bulls actually occurred at 4180 which for about 6 hours during the cash session today, remained the resistance.

I counted at least 8 attempts to take this level out, with each one failing to close the session again at 4180. Each attempt sold down anywhere from 15 to 6 points with an average of about 6 points. That is about 50-point activity when the range of the entire day was less than 25 points!

See Graph A below.

This was the price action today, the same story as the level from yesterday, something magnetic about these levels!

Again, I am actually very happy if I get one or two levels like this intraday, every day. Though the overall day’s range is so small and the volume remains anemic, if I get 1 or two levels like this where we see 5, 6, or 8 price rejections or bounces of 5-10 points (due to extremely low ATR), they can really add up.

Now some may snicker at these small zippers but you have to take what the market gives you. Remember the ATR now is well below 30! So in a 30-point day, to get a 50-point price movement from one level alone I think is very useful.

Longer term picture remains pathetic.

Now even though in the last 2-3 weeks, SPY and QQQ have been on balance, going up, the breakouts do not hold. It is the same way the breakdowns do not hold.

Chart B below.

This is just the IV crushing everyone on either side of the tape with small-range traders making any scent whatsoever. In the last 3 weeks, we have seen 4 breakout attempts fail. A similar number of attempts to break down out of this range have floundered. The last 3 weeks have been objectively good for MM, option sellers, and scalpers.

Combine this with ultra-low volumes, I think this is just setting up for a very large move.

Another thing that is worth noting is that the market is pricing in more and more rate cuts. This may or may not turn out to be the case. Yes, the FED can cut rates very aggressively if the US falls into recession but given inflation is still above 5%, this may be a coin toss. Also, I find it funny to see the inflation expectations moving from 2-3% this Summer to 3 % at to end of the year to now about 4% at end of the year! This confirms my view that whether the FED raises rates again or not, they will keep rates higher for longer.

I have myself been on the road and that has put my time zones and schedule haywire but thank you for putting up with it while I sort the newsletter timing out a bit better.

My key levels for tomorrow

The key level tomorrow is 4171.

Scenario 1: If we open and remain bid above 4171, we could target 4198-4205.

Scenario 2: If we open and offer below 4171, we could see a test of 4140.

At the time of this post, we last traded 4180.

Before I sign off, I do want to share a couple of thoughts on execution, at least from an intraday context. This may or may not make sense from longer time frames.

In intraday execution, I personally spend little to no time on technical analysis. In fact, outside of a Level 2 DOM, I do not even use a chart or any indicator whatsoever.

The reason I share this is that many of us tend to spend a lot of energy on analysis. I have done all sorts of analyses. In the last 20 years or so, I have studied, learned, used, and researched every single indicator known to mankind. Believe me. There is nothing that I have not used. I am not making this up.

What was my conclusion after all these years? You do not need technical analysis in active, intraday time frames. In fact, it does not even work. You can just use a simple naked price chart or a Level 2 DOM and it will be equally, if not more effective at predicting the future.

In active intraday time frames, I react and do not predict. Would you agree that technical analysis is mostly used to try and predict the future?

What if I told you that the future can not be predicted? Try it. Predict the next moment. You can not. I can not. No one can.

Why is this so?

It is the nature of auctions.

What causes the price to move? Price moves one tick up when you buy all the offers sitting one tick above the last price. Price moves one tick down when you sell to all the bids sitting one tick below you. This is the only thing that can make the market move.

Nothing else can! Now we buy our 1-2 dollar call or put, and we pay maybe 100-200 bucks for one lot and now we sometimes feel a sense that the market now should go our way. It often does but please understand that once you are up 10-20 dollars in your direction, what has gone on in the background to make that happen?

When you bought your 4100 put at 4200 which was trading at 11 cents, and the price is now 4180, twenty dollars in your favor, this means the sellers have overcome 80 ticks to get there. They have eaten every offer on the way down from 4200 to 4180! Offers get reloaded and then reloaded. So this must have been a herculean task to move to eat potentially a quarter million or half million lots to move down 20 points!

On the emini, the notional tick value is about 50000 dollars based on today’s close. The full point value is about 200000 notional. This is a lot of notional trading on one lot alone! Now do the math for a quarter million lots.

The reason I share this is to paint a picture of what it takes to move the market. Now there are traders that have the wherewithal to move the price. They can pick up the entire order book on both the bid and offer sides if they want to.

Now in all this drama, if I am there sitting with my one or two lots and I begin feeling entitled that the market must move entire 100 points in my favor, at the very least I have to be cognizant that much larger traders will have to come and do my bidding and eat up the entire order book from 4200 to 4100. Not only they must come and do so, but they must also come and do so AFTER I have sold my one lot. Not before it!!

This is tall order indeed! And some food for thought.

In my experience, yes this is probable but it is unlikely At least this is not gonna happen every day. Therefore, I must adapt my strategy to react and not predict.

Let other people predict. Let me have 1 or 2 levels that attract enough reaction from the market every day and I am happy. I do not need to know on an intraday basis where we are headed next. As long as we are headed somewhere, I will do well.

Now longer time frames are another story and I have different philosophy around it because I like to sleep and I need to know what I am getting into so I can sleep well :) But that could be another post.

There is really not going on tomorrow except TSLA earnings. See the weekly plan shared earlier for my thoughts on TSLA. Now as I wrap this up, I did see the NFLX ER flash by and I did see the roller coaster of NFLX falling 11% after earnings to now go green at the time of this post. This is a market that is pricing in a full-on dovish, QE FED. The fact that NFLX erased its losses on mixed earnings points in that direction.

Now they are saying the stock is up as the company says they will add far more subscribers in the next half of the year by cracking down on password sharing. The company has added only 100000 subscribers this year, after losing a million last year. In fact, they have lost subscribers in Latin America due to password crackdowns. Why will they gain any in the US? This company does not understand the nature and characteristics of a password-sharer. The password sharer shares passwords because they do not want to buy the service in the first place! The password sharer does not believe in buying the service. He is not going to buy the subscription because you crack down on passwords, in fact he will either stop using it or find another way.

This is probably even more true if the unemployment rate rises later.

Will you buy a Netflix subscription if they stopped you from sharing passwords?

Now with TSLA ER tomorrow, I will be curious to see if they add anything AI related to their lineup. I know they are not yet able to sell ad-supported, subscription cars :)

Not a lot of folks, at least not on the retail side, short stocks. Yes, some have puts but they are negligible in notional value. But retail does love to buy stocks. And I think this whole last month or so is that. Now who is selling it to them? Could be insiders, could be other large accounts.

This is the main disconnect that I have with this market. I am often one of the first to reverse my mind if I saw something that made sense to me based on what I know and my experience. I am just not seeing it.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.