Folks-

What a day!

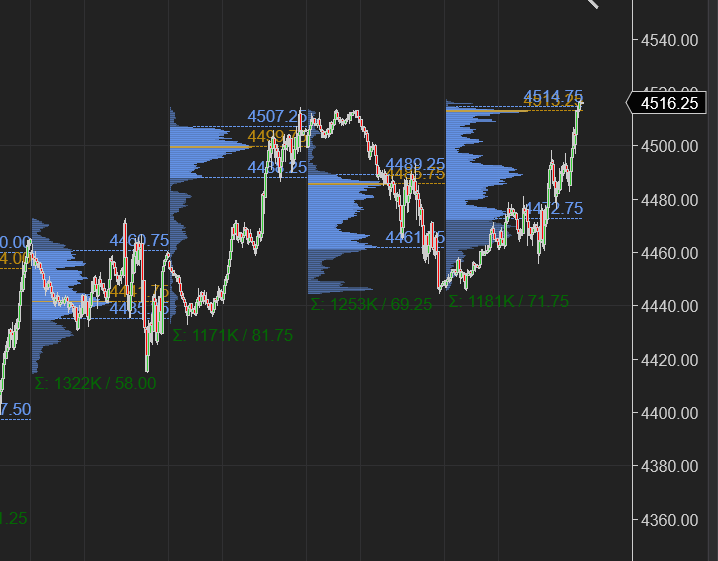

Chart A: Emini S&P500 closed right at the recent highs and recent balance area high on Thursday. Technically this chart does look like about ready to take off and break the resistance, but more on that later in next section.

From my Daily Plan yesterday, I had expected 4450 to be supportive. A lot of FinTwit was bearish but I did not see a lot of reasons for bearish continuation.

Overnight S&P500 emini traded as high at 4481 and my first though was if we traded 4490, we may find sellers to sell back into 4450. The sellers were actually active at the open, offering about 20 handles lower close to 4450.

This LIS at 4490 was then later raised to 4500 on my Twitter due to orderflow.

4500 did remain High of the Day for most of the session, at one point offering about a 20 point zipper to the downside, however it broke in last hour or so of trading to close the session around 4515.

I remained bullish for rest of the session as it was a classical trend day to the upside. The last 10 or 15 points I thought came from “stop runs” during that Power Hour push up.

Here is the link to the trade plan if you have not already reviewed it (some bonus thoughts on crypto and TSLA): Daily Plan

BTW check this post and share this if you wanna win a FREE substack membership. I will be randomly picking 2 winners tomorrow. More details in this link.

From the weekend post, $EURAUD is now down almost 400 pips. FX is having some really cool moves, far cleaner and trendy than equities these days. USDJPY has been on an absolute tear. This is very good for FX traders. A lot of banks like GS and C are in the dog house due to their exposure to Russia and potential default, but had it been regular times, this FX trading would be great for their bottom line.

TLRY was yet another mover today. This thing just took off and is up about 40% on the day. The FOMO is unreal!

What sucks is I had done a Twitter poll on TLRY a few weeks ago at 5 bucks. The sentiment on this was extremely bearish. It was very bearish.

I failed to do anything about it despite such a negative sentiment and missed the whole move, it is now trading about 9 bucks post hours. I think I am not going to chase it here. The FOMO may very well take it much higher. I will probably wait for this news to die down and see if I can get in at 6-7 bucks if it falls back again.

Getting back to S&P500

So as I mentioned previously we are on top of the range, the sentiment still appears fairly negative. This is a recipe for trend continuation. While readers of this newsletter know my thoughts that I remain bullish longer term with my target at 4700, for the day to day action tomorrow, my Line in Sand (LIS) is 4462.

These are my primary scenarios below:

Gap up and go scenario: If we open or bid above 4515, I think we may take off at the open and target 4550/4558 key orderflow resistance.

Pull back scenario: If we pull back into 4462 LIS, I think it may be able to support Emini with a trip back to 4500.

Tertiary scenario: An open or offers below 4462 in the AM will be a bearish case for me with targets at recent orderflow level 4425. For this to work, I think TSLA which has been leading indicator of late needs to take out 980 and then ideally 936 as well. TSLA closed at 1013 today.

We last traded 4516 at time of this post.

Now I will confirm these scenarios with other tools at my arsenal whether that’s the TRIN , Heat Maps or other related markets like Oil , Dollar and Gold.

I did expect some fluff to be taken out of this market as it’s been over bought technically, for it to move higher and I think some of that is already happening as the pullbacks get shallower and shallower. First it was on Monday and Tuesday and now today. Longer term I do think the market remains bid.

My favorites like TSLA has been respecting my Line in Sand at 980 which is a plus as well. I think any serious selling may not come unless we can start chipping at 980 and then 936.

Primary purpose of these scenarios for me personally is to gauge which way the wind is blowing. For instance an open below 4462 may signify weakness to me at the open. This is not to say that I will get to 4425 target in a straight line.

I start with the context and use my tools which I have shared freely in this blog with everyone like TRIN and TICK etc to fine tune my entries or even confirm or deny the scenario itself. For example if we open below 4462 and an hour later we are trading at 4500 with a TICK of 700-800, am I still expecting 4425 on the day?

Probably not. I am not bearish any more. And this is the mental flexibility which IMO is key for intraday trading. To sit there and remain bearish at 4500 just because we opened at 4460, is not me. It is not even about being right or wrong, it is just the nature of my methodology because longer term , I do not have a bearish signal yet and shorter term I cannot sit there and endure a 40 point MAE. Just a little digression but levels and context goes hand in hand. The levels are static and the context is fluid changes every moment with respect to active trading.

I bring this up as a Twitter user MD said I had provided both bearish and bullish scenario today. This is actually not true as what I shared was 4450 support and 4500 resistance along with my bias which was bullish. The levels are fairly solid and we can see most of the day’s action was capped between 4450 and 4500, this is why we did not trade down into 4400 or up to a 4600 today but did MOST of the trading within 4450 and 4500. A lot of these are execution questions like the one MD asked and as far as execution is concerned, it is nearly impossible for me to weigh in on that as there are literally an infinite number of ways to execute.

This newsletter is never about execution. There are several services on Twitter that offer this and are very good at what they do and at charging 300-400+ dollars a month for their services. This newsletter is simply my opinion and thoughts and levels. I do share my bias and context but it is not at all about execution. I wanted to put it out there for anyone who may have the same question as MD.

This is a preview of my daily plan. To receive my plan every day along with my Weekly Plan which has my detailed thoughts on various sectors, ideas and a deeper dive in Emini S&P500 make sure you subscribe to my newsletter.

Click on this link for a Sample Weekly Plan. Click.

There wont be a daily plan for tomorrow but may be a recap of session. I will be back with the Weekly Plan on Sunday along with some more educational posts as well as new tickers that have popped up on my watch lists . Stay tuned!

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Hey Tic, there is a lot of Tweets during the day. Is it possible to stick to Telegram updates regarding level changes?

Always great insight being shared, and nearly all of us are extraordinarily grateful Tic. I realize that a few followers can misconstrue information and attack you for it, implying the fault is yours instead of owning the blame for their trading decisions. I understand why you defend yourself and then try to explain the thought process, but I feel that you may be wasting your time and ultimately just frustrating yourself. May I offer you some advice from an old wise man..."Bees don't waste their time explaining to flies that honey is better than shit." Btw, I’m not the old wise man😂🤣