Traders-

My primary expectation at the close yesterday was that if we dipped into 3915, the dips may be bought for a retest of 3950-3960.

Here is the link to the plan: Plan

The dip came a few minutes before the cash session today and was low of the day when we opened for Chicago session. We rallied very hard from this level.

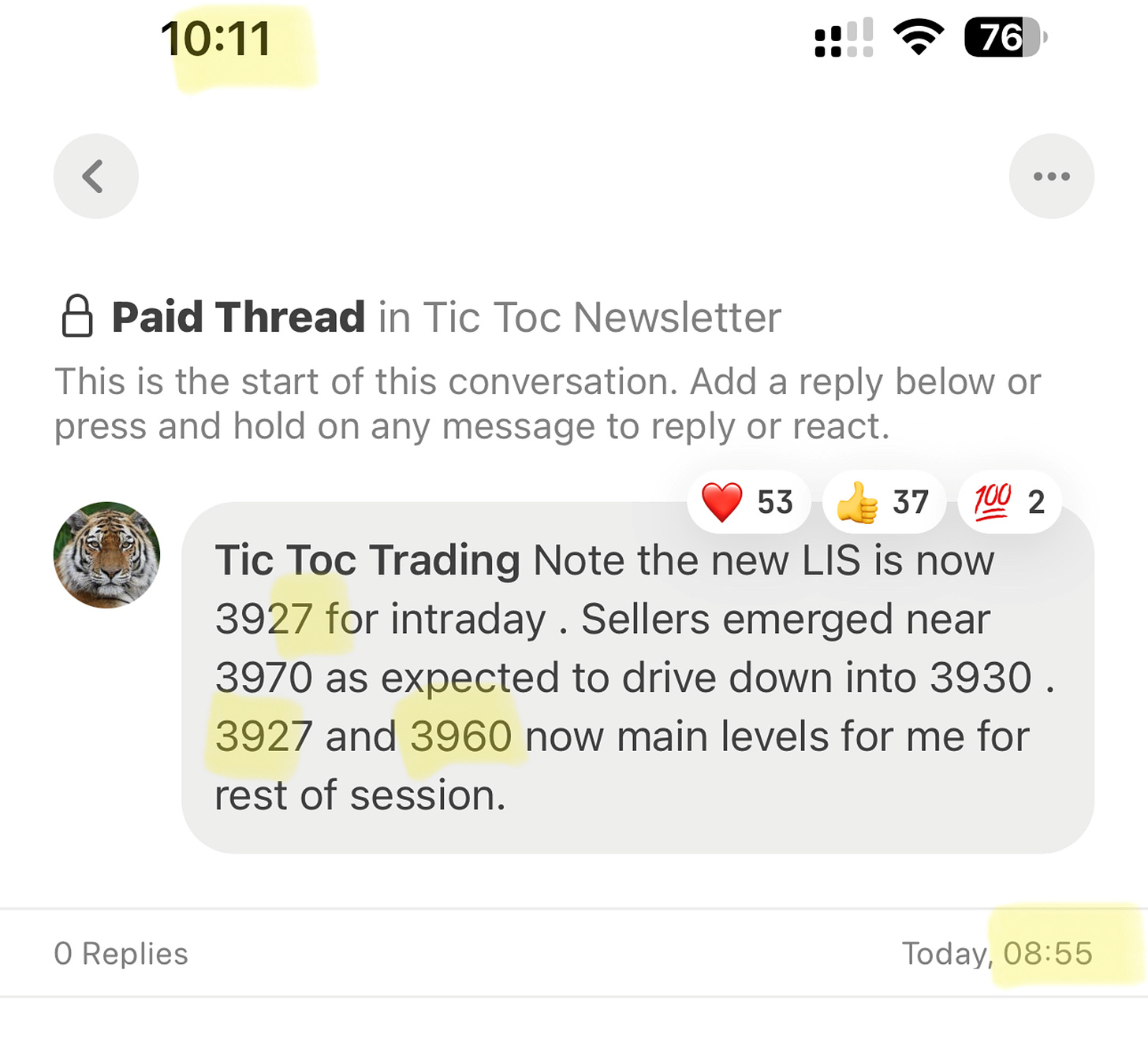

At the Chicago open, I shared the following Substack chat outlining 3927 and 3960 as my main level for the intraday session. These levels contained the market the entire day - with several attempts made to break out of these two, but failing each and every time.

IF you have not already, make sure you install the app and turn on chat notifications as all real time updates have moved to the Substack chat now.

In other news, a cautionary tale

CarVana used to be a 350 dollar plus stock at one point . I have been a long term bear on this stock and expected that one day it could trade 2-3 dollars. Despite being down 90% off it’s highs, the stock again managed to shed about half of it’s value today (another 50% drop in one day).

This is a cautionary tale for any one who does not think that a stock which is down 80-90% can not be down another 80-90%! Now when you come across something like CVNA- which really had no business model to start with, never made any profit and was built on pure speculation fueled by easy money, the reality will eventually catch on with a company like that - and when it does, there are a few things that can happen.

The worst thing is that the company declares bankruptcy . General shareholders most likely lose everything - they have no priority over the assets, if the company has any, and usually lenders and bond holders get far higher priority in such cases.

In case of CVNA, there is not much shareholder equity or assets to start with, probably around 200 million dollars and the company stock is still trading at 5X at that, even after today.

I think the only redeeming factor about Carvana is the brand name - I personally think this company is worth more than where is trading at 3 dollars right now and that is just because I think they have a decent online car sales platform plus the branding. They never really made any profit but on some fronts like if you look at price to revenue, it is almost now selling at 0!

This does not mean that it can not go to 0- deal making has been very hard this year and their only hope may well just be go bust. Go to 0.

However, I wanted to share this as my personal two cents.

Some thoughts for the Emini S&P500 tomorrow

When you look at the risk factors for the market tomorrow and then into Friday is the Costco earnings tomorrow plus the PPI news on Friday.

Costco unlike other retailers like a Target or a Walmart, does not make most of their money on the markups - their markups in most cases are 3% or so. They take a loss on some items like the hot dog and also gasoline at times to entice the shoppers inside the warehouses. They carry a very minuscule number of SKUS when compared with the Target and WALMART of the word and therefore I do not think they will see much decline in sales volume of individual SKUS- or instance, they sell 2 brands of detergent!

Their profit source is the juicy membership fees and the branded credit card with Citi. High inflation does not eat into their margins which are small to start with.

They also do not have supplier related issues as the suppliers want to compete amongst themselves to partner with Costco.

The stock price surge in recent years has been due to an expansion of their ecommerce and their international stores in China and beyond. They have low employee turnover but wage costs are rising - like everyone else. The other risk factor they have is that a lot of small businesses rely on Costco for their supplies and as small businesses get hurt, it could translate to lower sales volumes for Costco. I do not think that the members will cancel their membership due to loyalty - unless as a last resort. Due to these factors combined, I do not think that the stock will have a large percentage move and I think if it were to move up into the 500-505 area, it may meet resistance. I shared longer term levels with folks where I become bullish on Costco but I will not chase it here at 480- here is my weekly plan with more info on COST levels.

For tomorrow, my key level will remain 3927.

Scenario 1: for further bearish auction here to target 3900 and below (3890), I think we need to close the IB session below 3927. IB is the first hour of trading when NYSE opens.

Scenario 2: in case we do not see an IB close below 3927, I think we could retest 3960, break it and target 3980s.

At time of this blog we traded around 3930. Updates, if any, to be provided in the chat room below.

Feel free to share this newsletter with traders like your self !

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

TLT has decoupled with SPY last few days. What’s your take on that Tic?

Tic please do share your TSLA investor numbers to add thanks