Folks -

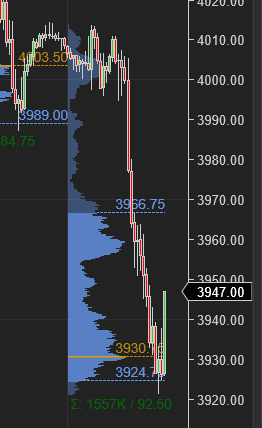

Based on the plan for today, we opened a couple of ticks below 4000. This was a picture perfect rejection of the opening print. The market saw very small uptick above 4000 OrderFlow level and swiftly sold down to my target of 3950 on the intraday basis, eventually touching down into 3940 and is now trading around it at time of this blog. Not only was the open below 4000 level, we also had the IB close below 4000 plus very little trading that happened above 4000 level.

The auction again formed a HVN at the lows and closed above the HVN in consecutive session. With the close today, the emini S&P500 market erased all of the gains from Powell presser last week.

Much of the selling today came on heels of softness in mega-cap tech stocks - I am a bear on TSLA and AAPL at 195 and 148 respectively and the stocks traded down into 178 and 142 respectively. I think unless inflation really takes on and the FED throws in the towel , only in that scenario do I see AAPL make any sense to me at these levels. What are the odds?

While this was a picture perfect bearish scenario below that 4000 open on the intraday time frames, I had expected the session to at least remain above 4000 if not close above 4030 for the 4150 target to remain intact on the higher time frames.

Remember my longer term reason for expecting 4150-4200 is not that the bear market has ended, but that I think those levels may be important to retest in order to revisit the November lows around 3700 later. While this sell off seems non stop from last 2 sessions or so, I still think we may end up retesting 4150 key OrderFlow levels before we retest the November lows.

For the auction tomorrow, there are 3 key events I will keep in mind:

The consumer credit monthly change

Revised unit labor costs

Revised non farm productivity

For oil futures, which made a new yearly low today below 75, I will keep an eye on the crude oil inventories tomorrow. With oil market, the simple dynamic right now is the fear that we are headed into a recession at the moment. So any kind of lower than expected inventory numbers along with stronger than expected economic data tomorrow could be a plus for oil. I think if oil slips into 67-70 range, this could end up being bought as I think energy market is not ready to give up without a fight due to long term structural issues in energy generation.

While the Emini S&P500 continues to be a drag, and with no key events on calendar this week, until next week when we have the CPI on Tuesday followed by the FOMC next Wednesday, I think this makes Emini susceptible to a large vertical move.

My levels for tomorrow’s session

3915 will be my key level.

Scenario 1: I think if we get a retest of 3915/3920, this may be bought for a test of 3950-3965.

Scenario 2: offers or an open below 3915 is something I would think could target 3870-3880.

Some of the selling last two days or so has been exacerbated by the mounting recession fears- to which Morgan Stanley added more today by announcing they are cutting about 1500 of their global workforce.

My understanding is fully that as we get into Spring 2023 these lay offs will mount and we will probably near 5% unemployment or more. A lot of current layoffs are a result of ramp-down of excessive hiring during the pandemic - this is a step in reducing the supply of available jobs so it can catch up to the availability of labor force currently. I do not read much into current layoffs , however, I will think if we start making new highs in the overall unemployment rate, we could start getting closer to a good low in a lot of markets.

Read my prior plan here: click me!

Regular readers know that I have been quite a bear on the cryptocurrencies like Bitcoin and my targets are still quite a bit lower than where they are trading right now.

Once we begin to see the macro situation deteriorate in the US next year or so, I am watching a couple of ETFs that have been very volatile right now. I like to have a list of ideas which I can use if the underlying conditions change enough for me to start making sense of them.

Personally, I do not find much appeal in Cryptocurrencies even at these levels - however I am very interested in the technology and the ecosystem around them, that enables them. I am constantly learning about them and I think they will be the next technical breakthroughs in next decade, along with VR, AR type tech, now that the social media and advertising is receding (good for the society overall!).

One of these is BLOK. It is down significantly from it’s recent highs, however once the macro deteriorates and if it drops into 12-13 range, I think personally for me it becomes attractive at those levels. In overall timeline, I think this is close to a meaningful low.

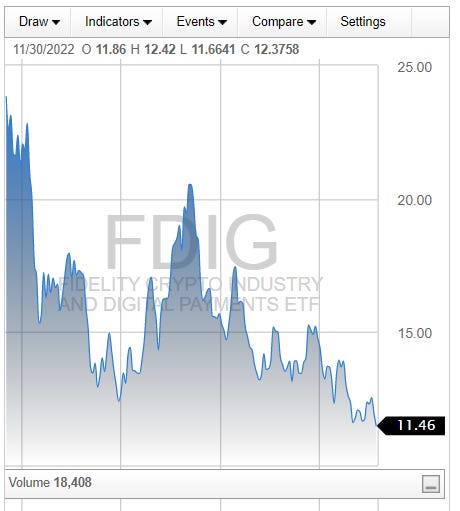

BLOK is a bit more balanced and more expensive than another one I am watching which is a much more pure play on crypto industry - FDIG.

FDIG has lower expense ratio and is more concentrated in the crypto names like SQ but I think it is a good candidate for me once the market situation deteriorates further later the following year. The volume right now on these is super low as they are still relatively new and I do think they will remain volatile going ahead- but if I had a multi year time frame with some more downside in these (10-20%), I think personally for me they make sense.

If any of these interest you, feel free to drop a line why you like them and anything else you want to share with me. TIA!

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

BLOK top 6 holdings: IBM, Accenture, Overstock, SBI, GMO, Microstrategy...

Hard Pass

Tic, can you help understand why TLT hasn’t tanked while ES has been nosediving?