Daily Plan 12/23/22

Folks-

Link to my plan from last night.

This plan helps show why it is so important to have a contrarian view in these markets like me and why when the boat gets too crowded, it capsizes.

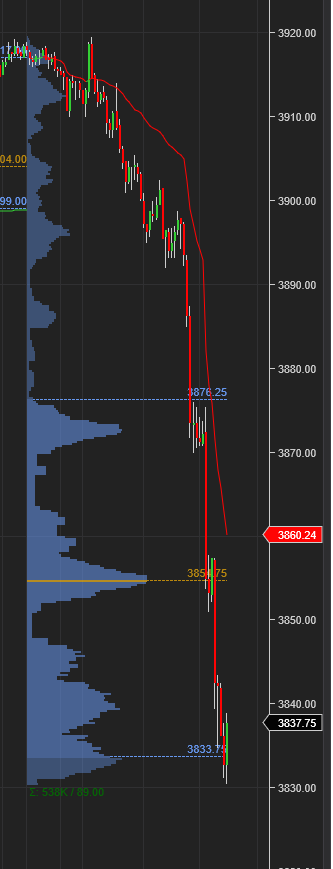

This was amply at display today. Everyone I spoke to or read was bullish at close of 3920 yesterday, except me. Yet here we are, about 90 handles lower, now trading 3830 at time of this blog.

Chart A shows a robust sell day which we called in our plan last night.

Worries about TSLA

There is a lot of anguish about TSLA stock and even the long term bulls have started to question their thesis behind TSLA. Some of these bulls have even questioned the CEO of the company and blamed him for declines. I do not agree. I think may be 5% of this decline can be attributed to Musk but the stock was overvalued and it got sold off - as simple as that.

My levels for tomorrow

If you are a regular reader of this blog, you know my thoughts on the PCE tomorrow.

I think, IMO, TSLA has a decent LIS at 125, and as long as we do not see a D1 close below 125, we may see a retest of 140-146. It is at 128 right now. At these lows, if the PCE comes in weaker than expected, plus some new unpredictability from the CEO of the company, this could cause a surprise upside move in the stock when least expected.

D1 means Daily. RTH means the cash session from 930 AM to 400 PM NY time. IB means the first one hour of trading when NYSE opens.

My key level tomorrow will be 3800.

You can read all about it here.

Scenario 1: If there is no IB close below 3790/3800, we could target 3865-3869 on the Emini S&P500. Scenario 2: In the event we have the IB close below 3790, I will provide an update in the Chat Room below. We last traded around 3840. My current thinking is that the PCE tomorrow will come in softer than expected. I think this if true could cause a rally in the risk assets, like the Emini S&P500.

Some other weekly names that were on the point:

NVDA sell off

COST Sell off

AAPL sell off

TSLA sell off

Several more

This is it from me for now. Sending the plan a bit ahead of close as I am out of pocket rest of the week. Merry Christmas if you celebrate, Happy Holidays to everyone! The weekly plan could be delayed and I may instead send out some educational notes from this year in the weekly note as I think vol may be subdued next week. Stay tune!

On an admin side note, I have been with the folks and a little drawn out and not able to fully stay on top of the comments and replies - I have them temporarily turned off but should be back soon to the normal cadence.

Also, a gentle reminder that if you have not, this is a good time to subscribe as prices will be increased to 40 dollars starting new year. The old subs will not be impacted by this hike. Much more educational content on it’s way for OrderFlow folks!

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.