My primary expectation for the session today was that we may find bidders if we sold down into the 3990s on back of the FOMC statement and the comments by the FED chair .

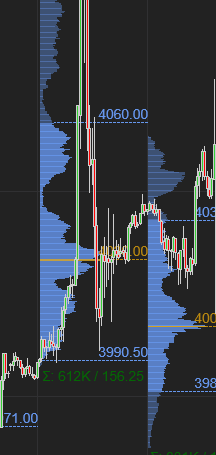

We opened at 4050, traded up to 4100- then found sellers back down into 3990 level, before seeing a strong 50 point bounce from that level.

It is here that I sent out a chat note as I felt that 4040 may offer resistance and I did not want to be bullish on the emini S&P500 as long ad we remained below this level. The level was ok as we did run up quite a bit above it before being subdued , trading down into 4010, to close the session at 4030. These are all March levels . December levels are about 30 points lower .

With the 50 BPS rate hike today, the yields have now risen to multi year highs. We have not seen such high rates in over a decade . Despite this, we saw the bonds rally a bit and dollar weakened further .

As inversely correlated with the S&P500 index, any softness in the dollar has been providing a cushion for the S&P500 . We will see how long it lasts but December is usually not the best month for Dollar demand and we are seeing that play our across various FX pairs like USDJPY and EURUSD.

An additional thing to keep in mind is that not only was the FOMC a key event today, a lot of folks are ignoring another elephant in the room which is the ECB rate decision and the conference tomorrow that gets going at 745 AM CST, about an hour before the US market open. European economy has been surprisingly robust and their inflation situation is no better than the US.

I do think the reason we did not sell off more below 4000 today in the S&P500 was the market anticipation of a 75 BPS hike tomorrow, which I think could be Dollar Bearish and S&P500 plus in the short term .

Longer term however, I am not too bearish on the dollar here near these lows. Look the ECB has a different set of political reality to deal with - the European Union is much more politically fragmented than the US (yes, believe it or not :) ). I think the FED is in far better shape to execute on higher for longer rates than the ECB. So yes, if the ECB comes out with a 75 BPS surprise hike tomorrow, we could see a dip in the dollar and a ripper in the S&P500 - however once the market comes to grip with an Uber hawkish FED and equally hawkish ECB, I think it will soon come to the somber realization what it is looking at for next year or so.

Before the FED decision today , the expectation was for a much smaller , 25 BPS hike in February. I think the FED made it sufficiently clear today that they will go with a larger , 50 BPS hike on February 1st.

This brings the FED peak which was so far assumed to be 4.6% at end of the 2023 to 5.1% now. This also raises the FED funds rate from 3.9% in 2024 to 4.1%. If the FED can actually raise and maintain the rates at 5.1% and 4.1% in 2023 and 2024 respectively, I think it’s a pretty big deal and I think it will put an enormous pressure on the companies deep in debt .

Really when you are looking at an average of 4-5% yields for next 2 years, I don’t care about inflation any more , I think this becomes a big debt and growth story. Or rather a lack of growth story.

I think under such circumstances, 4150-4200 on the emini S&P500 becomes a good resistance level in my view . I think longer term if this level holds the market advance, there may be a good chance we could revisit 3700. A close below 3700 then could expose the levels I shared earlier as potential longer term support IMO (in my opinion). More on this and my exact levels, later in the weekly newsletter . Stay tuned.

Look, from a FED perspective, they are pretty frustrated that since September decision, the market has rallied hard . Not only in the S&P500 but we have seen impressive rallies in bonds and a collapse of dollar and yields as well. The more these markets rally, I think the longer the FED will want to press against this advance using the main tool they have - the interest rates ! I think after the ECB tomorrow , if we see the dollar still weaker , if we see the bonds still bid and yields lower , I would personally not be surprised if the FED brings forth the idea of outright bond sales to support the yields . However , I don’t think they are there yet.

I personally think the FED should do even more - the challenge the FED will have even at at a 5.1% terminal rate next year is the fact that the US being a services economy rather than a good producing country, could see services inflation go even higher - you are now entering the worst months for seasonal allergies, flu, even coronavirus cases could again tick up in next two months. This may mean that the employees call in sick , could put more pressure on already short labor supply and thus could lead to more wage inflation in January and February. Only silver lining in this could be of the Federal government addresses this through more fiscal spending which I would argue is bullish but then it mag lead to more inflation, so a true catch 22!

Before I go into my levels and scenarios for tomorrow , I do want to note one thing about a couple of related markets - both US Dollar and SCHD were good signals for me this week to gauge the risk on and risk off pressure . SCHD remained above 76 all week and EURUSD remained above 1.05 for most part! These correlations were shared with the folks earlier in the week.

Now, I do suspect that the ECB tomorrow has the potential to cause a large move in the FX DXY. I will like to see the EURO Dollar index (EURUSD) settle down below 1.06 for creating pressure on the S&P500 emini (now it’s about 1.07).

My key levels tomorrow will be 4050.

At time of this post , we last traded around 4030. The levels are March.

Scenario 1: With emini S&P500 below 4050 and the EURUSD below 1.06, we could see a retest of 3990. A break of 3990 could target 3950.

Scenario 2: in case it a very hawkish ECB tomorrow that comes out with a surprise 75 BPS, I think we may see a spike in the EURUSD which of leads to a print of 4120-4150 on the emini, that could act as resistance .

Feel free to share the plan with traders like your self.

Recommended reading: weekly plan.

Updates to this plan and more levels may be shared in the chat 💬 below .

~ Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Thoughts on TSLA please. SEC form 4 just released, Elon done selling 22M shares.

Is this the March contract now in the newsletter? Tic thank you as always. You should be on CNBC instead of clown Cramer 🤡