Daily Plan 11/8/22

Hi traders -

My LIS today was 3766 which was shared via a morning bulletin with the folks here in the Substack. We could not quite trade down to this level but we came close (3770). The first hour or two of the session today were range bound and did not see a break to the either side.

The break came with some rumors swirling about a major announcement by the former President Trump that he may soon announce his run for the 2024 elections. This was enough for the markets to trade and close at my Weekly targets of 3820-3830.

On balance, I sensed that majority of folks were bearish today. I was not too clear of the session in the AM due to the choppy IB , however when we could not trade down below my LIS in the AM IB session , combined with the majority on bearish side again, I had a good sense at 3770 that we may end up higher above 3800.

Here is the link to the weekly plan if you have not already read it yet.

Weekly plan from 10/23 to be in sync with the continuous auction.

Chart A above shows a very skinny profile on very low volume while the market awaits election results tomorrow night.

Not only was the AM session trading for most part above my updated LIS, the overnight session yesterday at the open gapped down and came very close to my weekly LIS before bouncing about 50 handles higher overnight.

For tomorrow, a couple of things are in driver’s seat IMO

First and foremost, the mid terms: Consensus at this time has shifted to the view that the GOP will regain Congressional control and therefore this market has been front running this. Keep in mind if this does not turn out to be the case, I think the first reaction may be to sell off back into some of the weekly time frame levels (see weekly plan above).

Second, as excepted by me in my weekly post last night, the dollar further lost ground today against most G10 pairs.

I think a dollar below 110 tomorrow or rest of the week could keep the rally supported in the emini and conversely above 110.5 it could add some pressure.

The third factor I keep an eye out on is the Donald candidacy, if one materializes: I do think it will be an impulse plus for the general market but in particular, I think it may be good for some names like LMT, NOC and RTX. I also do think it may be an impulse bad for names like TSLA and ENPH , ALBEIT temporarily.

Speaking of ENPH, this one rallied as opposed to expected dump after the earnings , but I did expect this to find sellers on any eventual rallies into 290-300. Today it traded down to near 265 before finding bidders again.

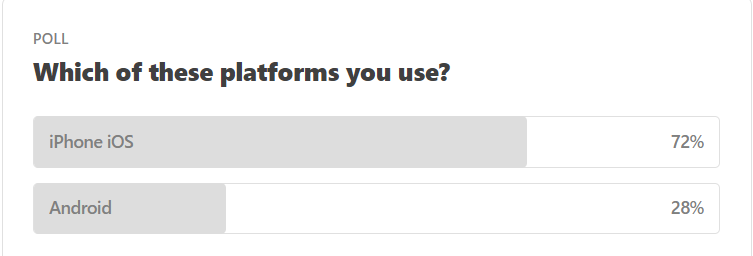

On an admin side note, I polled to see how many folks actively use the Substack app on iPhone versus Android . I had expected to see a far lesser number on Android but I am very surprised that almost one third of the folks use Android. The Substack app does not yet support the chat feature for Android. It is coming at end of November but I was just curious to see if the number of users was small relatively , if I could have gone ahead and started using the chart for iPhone more actively. But certainly not with one third of the users on Android platform as it will mean missing out for quite a few of them.

My levels for tomorrow

In terms of auction structure, we are finding support at this 3740 zone which became so key after the FOMC last week and today was no different.

My key level for tomorrow will be 3800.

Scenario 1: If we open or offer below 3830, we could test 3800.

Scenario 2: If we open or offer below 3800, we could test OrderFlow level 3770.

Directional move may come on an intraday close above 3830 or below 3800.

At time of this post, we last traded 3820. Updates to this plan may be issued via a morning bulletin or on thread below.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.