Folks-

Finally a day of reckoning for this FED where they conceded that the window to a soft landing has now narrowed, and in fact the inflation has not come down at all - despite one of the fastest front loading of rate hikes in history.

I would say there was never a window to soft landing, the soft landing was an invention by this FED and there is always been only a hard landing (very hard one too).

According to Powell, the Chairman of the FED, the goods inflation has only slightly come back down whereas the services inflation has picked up more steam. I have been saying this for a while - the FED efforts have barely yielded any effect and today they accepted it as well.

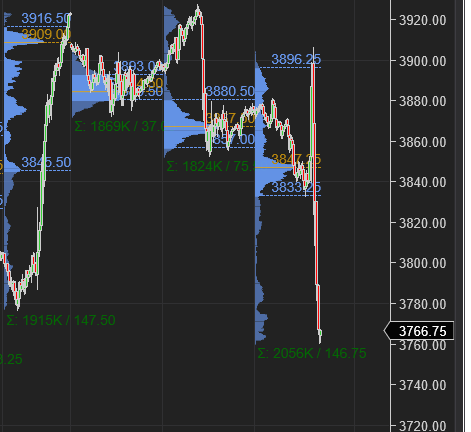

When the minutes just came out, half an hour before the conference, the emini S&P500 was trading around 3820. As soon as the minutes hit the tape, the market considered the minutes to be dovish, and we began a sharp rally in stocks which took us to the OrderFlow level exactly near 3910. We also saw a sharp sell off in the Dollar index as soon as these minutes were released.

Then when the conference began, we sold down as as FED Chair sounded much more hawkish than the minutes themselves. We sold down initially back into that 3830. Found a bid, rallied back above 3870. It was however when Powell started doing some thing he has never done before - to leave no one in doubt about the intent of the FED to fight this inflation, whatever it takes.

And it was this language around “whatever it takes”, that I shared in my plan last night that finally broke that 3830 level.

Just before this support broke, I sent a warning in my Telegram and Twitter that I think this support may now break as I felt Powell speech was very hawkish. Now I tried to send this as soon as possible around 3840, but the time I hit send, we were already trading near 3830.

Chart B Emini sheds it’s gains after the conference begins.

Now from my weekly plan, 3770 was a key level for me this week and we closed below this, though by a small margin of about 5 handles. I do not like these closes, which are within a few handles of a key level. Ideally, I like to see a much deeper close below or above these levels.

Following these minutes, some related markets like the Big Tech stocks sold off quite heavily whereas the others like TLT were more muted.

TLT was infact barely changed at less than half a percent.

Some other key markets like Crude oil (which has it’s own unique forces acting on it) did not budge much as well as I thought the dollar index while up, was not fully cognizant of the degree to which Powell came across as hawkish.

Few tactical ways I use to gauge momentum intraday

So, the S&P500 emini from last several weeks has been very inversely correlated to the Dollar.

So, if intraday, the dollar index is remaining very strong, or very weak, I will not fade that, unless it reversed. We can see in this chart today that this market was in lock step with what the Dollar did today.

Tic TOP

Tic TOP is also a key tool used by me for not fading the weakness or strength in the top S&P500 stocks. Here is my post on this tool if you have not yet read it: TIC TOP MOMENTUM

This in my view is an enormous tool and I will never fade very extreme reads on it.

Some more educational content.

So basically, I am viewing the Spooz action as 1) a function of the Tic TOP and as an inverse of the 2) Dollar index. It is not always, but when I see a new low in the dollar and a new high in the Tic TOP, that is a strong indicator for momentum continuation and vice versa for a new high in the dollar and a new low in the Tic TOP. Feel free to ask below if this concept is not entirely clear but should be straightforward.

What is next?

Personally, I quite a bit agree with the FED FOMC meeting minutes. In fact I had predicted this as a softish pivot ahead of this FOMC and that is what this FOMC notes show- the part I can not understand is Powell’s performance today during the presser.