Hey traders-

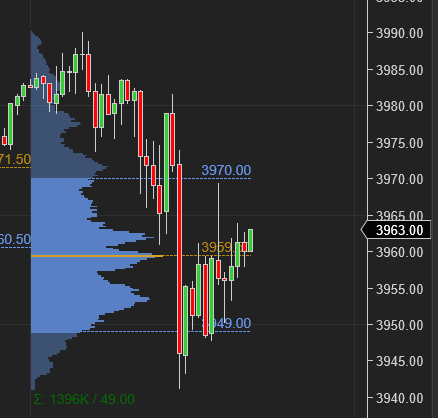

Today was an exceptional example of OrderFlow levels and context and how the market stayed within the 2 levels I shared last night.

I had expected that we will likely see a balanced session today between my upper and lower LIS, unless we broke either of these levels within the IB. Note the IB period is first hour of trading when the NYSE session opens at 930 AM EST.

Not only was my upper LIS the low of the night session as well as the cash session , my lower LIS saw very little trading below it as we rallied sharply higher from it later on in the session- this level then acted as support most of the day, ending the session near 3960.

Click below for a link to my Daily Plan: Daily Plan

The morning auction was quite forceful to the downside but we did not make much headway to the bottom once the lower LIS was tested - having levels like this means I am not getting carried away being bearish at the lows and bullish at the auction bracket upper end.

Tomorrow is a fairly important day with Powell set to speak

Powell is scheduled to speak at 1230 PM Chicago time, about 4 hours into the session but there will be enough events even before he starts to keep things interesting. We have the GDP an hour before the open , followed by JOLTS data at 9 AM and should keep the volatility heightened before the main event scheduled for afternoon.

In other news..

Pursuant to my note from yesterday, the insider selling pressure on AAPL has picked up and I think may be one of the higher imbalances between insider officer purchase and selling I have seen recently. Insider selling by itself is not always negative but when you begin to see trends establish , as we saw with TSLA over last year or so, it is not something I will ignore.

With my LIS at 147, I think if AAPL revisits 130-135 area, it is probably going to break it to trade low 120s.

I have also been watching BABA which I was a bear on most of this year. It is now around 79. If it fills these gaps near 73-75, I think it may make a run for 96-100 area.

If you have not already , consider subscribing to the newsletter to enjoy upto 5 such insights every week. The prices are still low and once the Stack team enables chat for everyone, these prices are going much higher to allow serious traders to be part of the Substack in chatroom.

My levels for tomorrow

There are a couple of things worth noting from the session today:

A) the bounce was relatively weak in the afternoon

B) This was a 2nd close now below this week’s 2nd LIS.

If Powell, JOLTS and GDP was not enough, we also have the month end flows come in tomorrow.

The vol leading up to the events of tomorrow and what remains of this week has been muted. I think this is all going to change tomorrow. I do think we will soon see vol and ATR pick up steam and that may get started tomorrow.

My key level for tomorrow will be 3975/3980.

Scenario 1: An open or offers below 3975 could target a retest of 3920/3930 area. Once/IF at 3920, the weekly levels may become a magnet. See weekly plan for more details.

Scenario 2: An IB close above 3975 could target round number 4000-4010 OrderFlow levels.

At time of this post, Emini S&P500 last traded around 3965.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Hey Tic!

Could you provide a quick update when Android users might have access to the chat feature in Substack?

Thank you!

Buckle up for tomorrow.