Hey guys -

Before the open today , I had a slightly bullish view due to the overnight conditions in related markets, like the Dollar index.

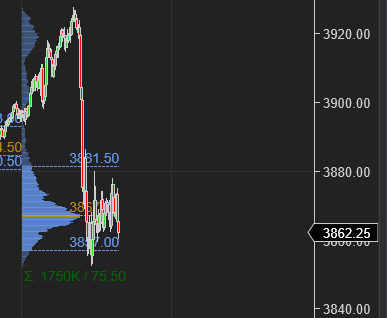

AT the open however , I sensed the market opening was weak as soon as we opened, and I expected a test of at least 3890. I was looking for support to come in at 3890- that did not happen and per Scenario 1, we sold off to 3850 target. Spent rest of the day going nowhere from there and now closed around 3860 area.

Personally, after that first hour or so, the market did nothing much with not going anywhere. A lackluster day with even more lackluster volume.

Chart A looks like more of a liquidity search than meaningful auction to me personally.

The scenarios and levels were pretty spot on with that 3910 IB but I was more or less thrown off the scent this morning by the action in the dollar index. I do think this move is a fake move but I would not like to see this index bid up above 112 or so. Now 111.40 .

Dollar has been an Achilles heel of this market - the market is basking in this dollar weakness and the bulls like me want to continue to see this action.

Little bit longer term than day to day

So, longer term readers know , I called for this range at 3550-3950 about 6 weeks ago and this week we traded up to the top end of this range.

Barring the action today, I have not yet seen evidence that we may top out here and automatically reverse to the lower end of this range. With today’s close around 3860, we are still above some of the weekly levels like the ones around 3830.

FOMC comes out today which will apend everything we have seen thus far this week. Normally, I do not do a super formal plan for the events like FOMC as the event itself can cause a liquidity vacuum and large moves out of the norm.

My levels for tomorrow

Depending on the volatility tomorrow, I may lean on the 3820 level tomorrow (we are right now around 3860).

Scenario 1: Any prints below with an hourly close below 3820 may lead us to a test of 3770-3790 area.

Scenario 2: In general if the 3820 level remains supported, with no Daily closes below it, I am inclined to think we may be wanting to test 3920-3950, later in the week.

The statement itself comes out at 1 PM CST. Conference begins half an hour later.

I would not read too much into the action leading up to that conference with my bracket being around 3820/3830 on the downside and 3890/3900 on the upside (before the conference).

Remember in my view, when not sure not having a position is a position. I personally feel it is easier to react AFTER the event than have a prediction before it.

We may also have a lot of underwater bears around 3800 area. So these add complexity to the auction tomorrow as well as choppiness. The good part about day like FOMC is we may get good 50-60 point tradeable ranges if any of the prior couple of FOMC are to be set as a benchmark.

I may share updates during the day either in my threads or Telegram.

Tomorrow, officially with the rates at 4% will usher in an era in the US not seen since last decade. While the extremely long term average of rates in the US has been about a little more than 4%, this whole 0% or near 0 is very new, may be last decade or so.

Language from the FED on how they may wait for the data and may slow the rate rise down the road could be bullish.

Stringent language around “we will do what it takes” may cause more softness in the index.

Personally, I do not think a 4% rate should be end of the world. I think a 4% is priced in at this point of time, what my ears will be glued to is if they are serious about beating this inflation by matching the rates to the inflation rate- which in my view will be the truly unexpected event tomorrow.

From a tactical view, if we do end up selling hard below that 3820, I think the support may come in around 3770 area - in any case will be sharing this in the daily plan tomorrow.

On balance, hawkishness from the FED and hawkishness from the data has been absorbed last 5-6 weeks. We will see if this trend breaks tomorrow, but I will personally think this market is keying in on the midterms next week and I think dependent on that outcome, a clearer direction may set in. In general, due to the enforcement on tech exports by this Admin, I would think a GOP win may be seen as a positive and a democratic win could be a negative. More on this later.

Be nimble, stay safe.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Tic bro how do you go from saying 4050/4100 to not saying those levels at all in this read, also no thought on $DXY , $TLT ? The weekly/ monthly setups look unreal for reversal and to give this market more legs higher, I see the 3770 level on the hourly but tic what about NAS here I see it way extended compared to emini I just don’t see how or why you’re expected below 3830 now... also $AAPL held your 150 entire week and $TSLA held 218 for multiple sessions now...

frustrating with abnb (down), amd (up) and then the bullish comments on spx yesterday when we fell another half percent. You're certain to mention the winners always, but I wish you'd touch on the losers...