As the perfect Summer of 2024 draws to a close and the airs become chillier, there is a foreboding sense that things are not quite all that rosy as they were made out to be by those in power- including the government, public servants and above all, the FED.

Wall Street banks and traders who only 2 months ago declared no end in sight to the bull markets, and sold a lot of stock in 50 P/E companies to the public, all of a sudden converge on a single idea- that there is trouble in paradise.

A number of factors became apparent in last few days to give some merit to these views-

Most recently this was the Payrolls report on Friday that showed far fewer than expected number of jobs added. The jobs still were at 142000 for the month, but the cumulative unemployment rate from July and August is in line with historical recession indicators when you look at the current 3 month average and compare it to the 12 month trailing averages. Most often this means one thing- we are already in recession.

Oil market took it on the chin this week. We first noticed this weakness in Oil when it was trading at 73-74 a barrel (WTI) and it shed about 10% within a week or so. This despite the Middle East tensions, demonstrates that the likely cause of this move was the underlying softness in demand. Oil also got no relief from the sinking Chinese consumption of oil, with China being the largest consumer of oil in domestic/industrial markets.

The market really did not like the 33% downward jobs revision- another indicator things are not quite right.

Now a number of folks, including myself have been expecting this softness in economy, however atleast on paper, things have held thus far.

Part of this was due to the fact that those in charge of these data releases decided to change the very definition of these key metrics- including how inflation is calculated here in the US, they changed the definition of recession itself. To top it off, the Bureau of Labor Stats (BLS) revised the total jobs added last year by a third. So it seems like a concerted and synchronized effort to not prop things up per se, but just to give an illusion that things are going well- never mind we have the highest level of credit card debt racked up ever, ignore the all time high government debt, ignore the highest trade deficits since March of 2020, ignore the loan delinquencies at highest levels since 2008- ignore all that because we have strong retail sales and we added 3 million jobs last year. Well, sort of.

The end result of all of this was the market finally waking up and now we having these 100 plus dollar moves almost every day. Bond traders now discounting a full percentage point of rate cuts this year- with three and a half months to go in the year.

This was barely a 25 BPS rate cut back in June- July. So within a period of few weeks the market is now predicting a 100 BPS in total rate cuts by this FED. This is a huge deal.

Arguably the US is still the best house in a really bad neighborhood. The Bank of Japan is hiking rates staving off a generationally high inflation, Chinese growth is slowing down, or in other words never really picked up despite all the stimulus post 2020, UK is in shambles- both economically and politically, EU has been in doldrums burdened by regulations and too much state sponsored vendetta against businesses and Canada looks like its in for a really rough ride in next couple of years.

As if all of this was not enough, the all powerful AI trade also failed to spur the markets- NVDA had an awesome earnings but it failed to excite the markets. Well it excited it in a wrong way- was supposed to go up not down.

Now while all of this is going on, you have arguably one of the most important elections in the US, less than 60 days away. The outcome of this elections should have an oversized impact on volatility and the US dollar- having said this, I am aware that this is an understatement.

I covered this in detail before but to paraphrase, a Trump versus Harris Presidency will be drastically different in 3 key aspects -

Taxes. Under Trump you can expect to see the continuation of 2017 type tax cuts for corporations and individuals alike and under Harris you can definitely expect taxation for those on the higher income brackets to go up. Then there is talk about unrealized gains being taxed which will be a disaster if passed thru Congress.

Immigration. With Trump you can expect the wages for Americans to go up. SO it should keep some services inflation pressure.

Foreign policy and energy. Will be a very different world from now in terms of US engagement in overseas conflicts. Also see good support for traditional energy markets like Oil if Trump is re-elected.

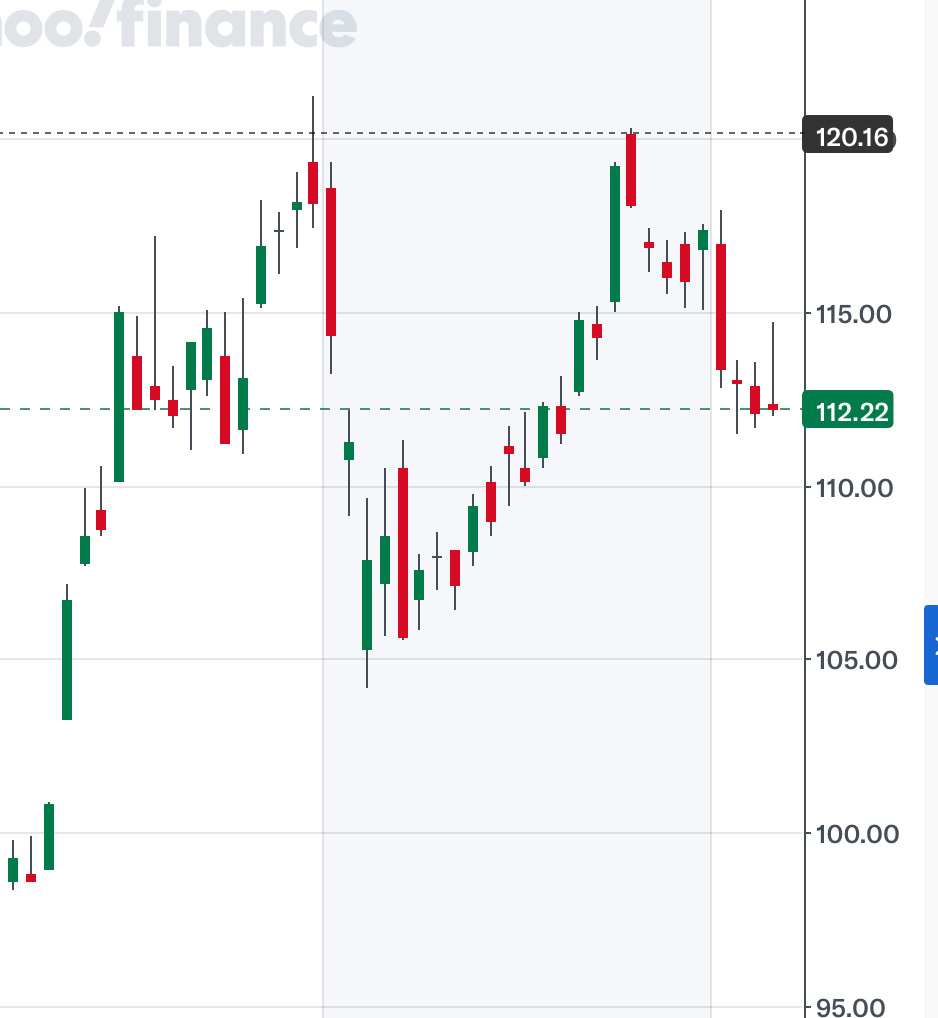

Other non conventional market indicators such a homebuilders’ index also points to further softness in economy as well as home prices. I know this is a fairly touchy topic for many but these advance, real time indicators are as objective as they can be. Back in August, I called for a TOP in the homebuilders, using XHB as a proxy at 120.

What do we see in the homebuilders today?

Obviously the common sense rational is that FED will cut rates massively (which I agree) and it should be great for housing demand and prices (which I disagree).

Rate cuts can be bullish, however you have to understand that the housing market in 2024 is very different than the housing market in 2004. Housing has a lot of corporate ownership right now. A lot of homes are owned by individuals and corporations now, in part to rent and AIRBNB it out. In other words, there is a lot more speculation in the housing market today, compared to even 2006. You could say folks had bad loans in 2006-2008. But today it is worst- housing is being treated as if it is a speculative meme stock. And financially well to do folks own these housing units. It is a crowded trade.

I still think we should see a decent 20-35% drop in home prices as we begin to see FED tightening take its toll on all speculative markets. This has already happened in several cities and areas- it is just that you have not yet seen it in boomtowns just yet where you saw growth fueled by exodus from California and NY.

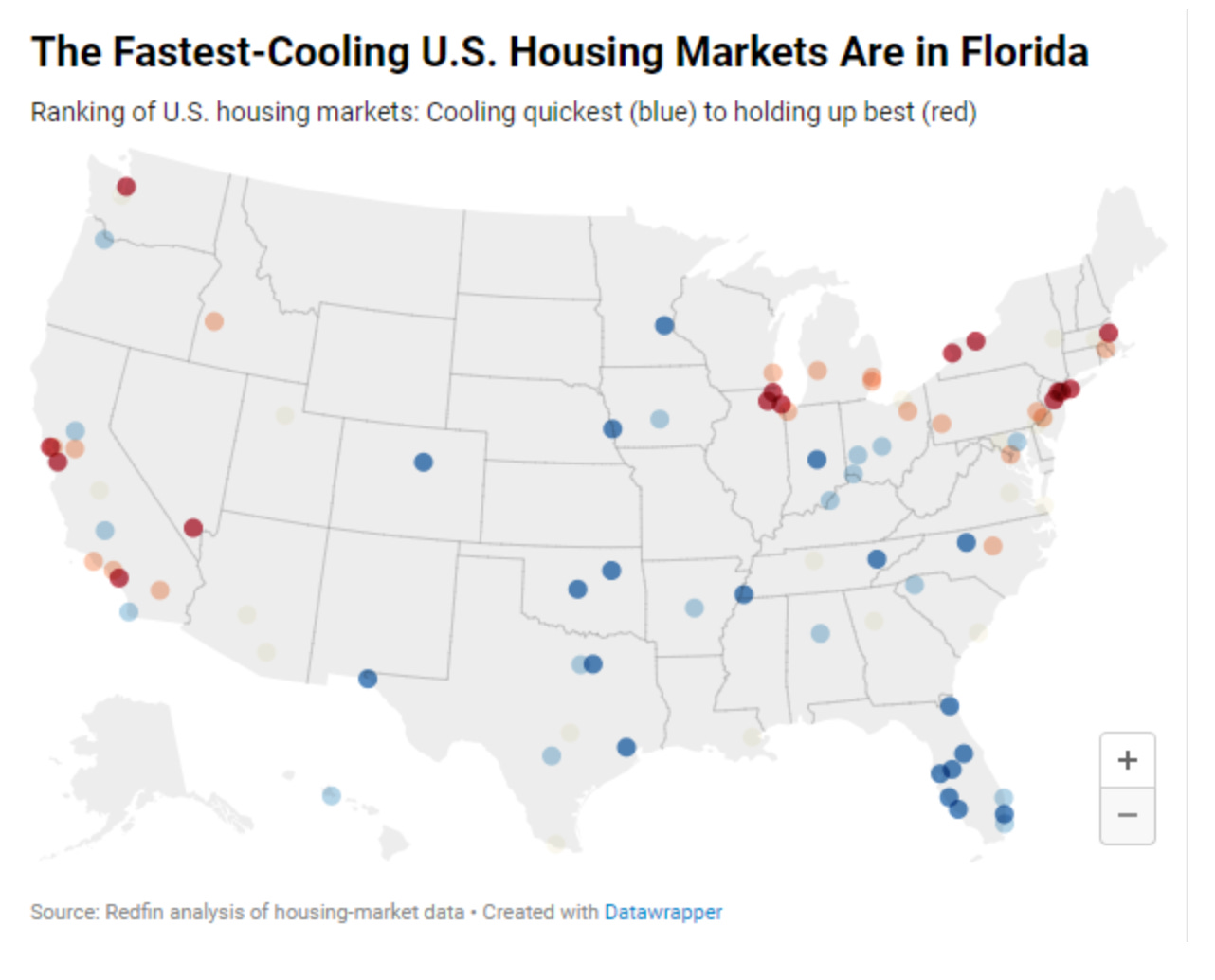

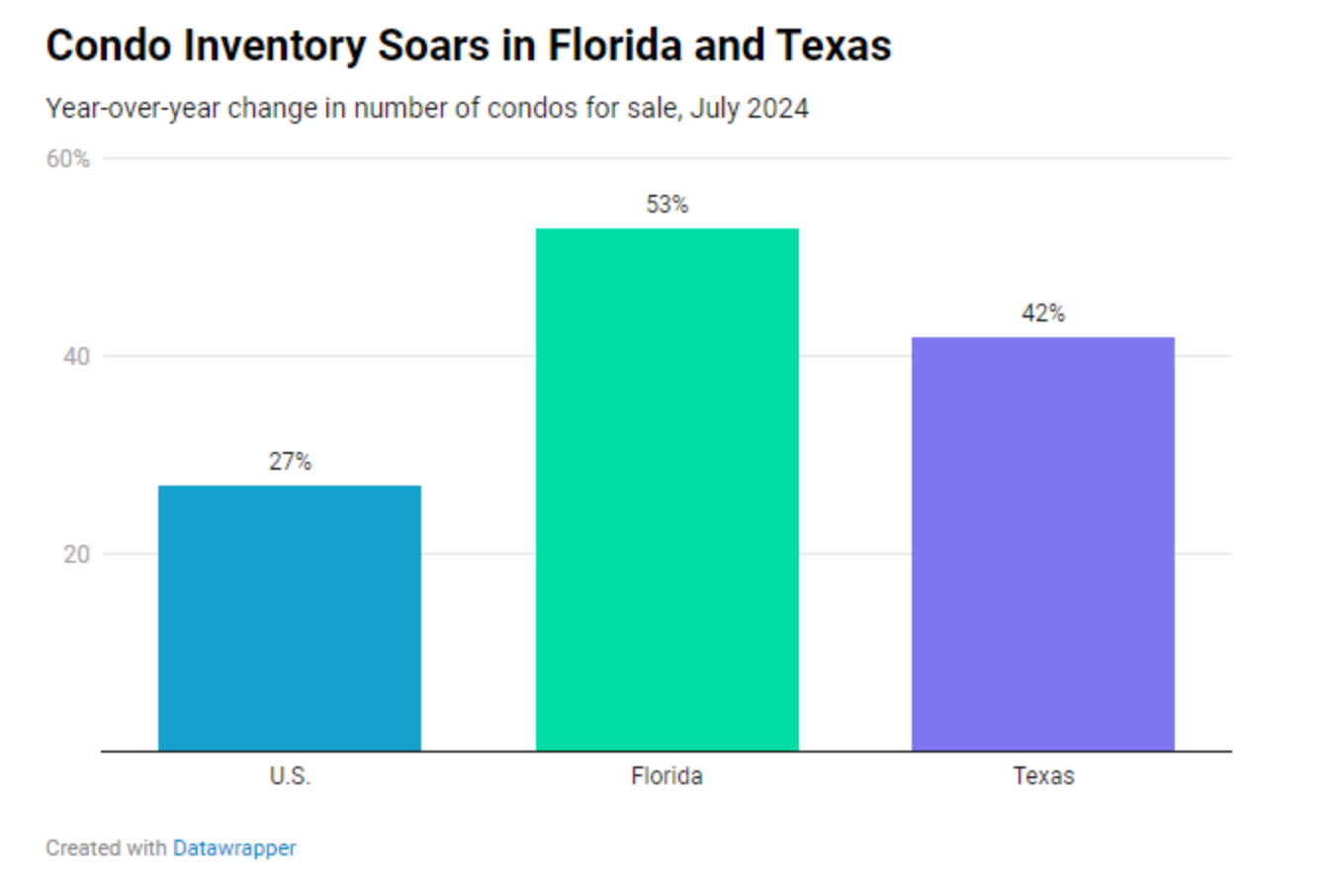

For instance, condo prices are in free fall in Florida and have now caught up in Texas markets, such as Dallas and Houston. West Coast of Florida now is the fastest cooling real estate market in entire US. This would be unthinkable only a year ago.

Per Redfin below:

I will usually stay away from Condos, unless in well established Condo markets like that of the New England, DC, and NYC. These also have lower weather risk, lower cost of insurance, more liquid in case you have to sell (faster to sell). What is not helping condo owners is the HOA and insurance rates keep rising and rising- eventually this is gonna be the last straw that broke camel’s back. Own the property free and clear- try and avoid HOA as much as possible. Remember, long term value always is in the land and location.

If the home prices are gonna go thru the roof now that FED is gonna be cutting massively, why don’t I see homebuilders rally on this? It may be that the news is priced in. We first shared XHB when it was at 70 here in the Stack, NOT 120!. Then you also have competition from existing home owners who will sell now that they can be “unlocked” out of that insanely juicy 2.5% 30 year mortgage. The net effect of this, coupled with higher unemployment rates I think will be softer home prices, not stronger.

Now remember, this is my view as a speculator or an investor. Not as someone who needs a home today. If I need a home, I buy when I can. I am always for homeownership rather than renting- if you have stable cash flow, if you plan to live in this home for 5 years or more, if this is your primary home, it is a no brainer to own it.

At any rate, if I am a first time home buyer with a budget of 300-400K, my risk is limited in absolute dollar terms. My bearish point on prices is more geared towards those who own several property portfolios, often on leverage, not an expecting mom to be soon, who doesn’t want to raise her kid in an apartment block next to the freeway.

For those who read this blog regularly, will recall I had a similar view about used cars as well as new cars only a year or so ago. At that point nearly every car being sold was being sold at a markup and it was heretic to even think that we could see a crash in car prices- well the demand is soaked now and there are deals to be had. 0% APR, 10-12% OFF MSRP, $299 leases etc. Take your pick.

Now I laid this framework of where we are in macro to overlay on top of price action we happen to find ourselves in at the moment. One thing I did not address was the political impact of November elections on these markets.

The prevailing sentiment, if you look at these markets, the message seems to be that the markets are favoring a Kamala win on the ballot. Again this is not a political statement but just sharing my view of related markets to be prepared.

A Trump Presidency could be a plus for bond yields, a plus for Oil, a plus for Gold, a negative for the Dollar and a plus for risk on in general.

Instead what we see is a weakening Oil market, higher bond prices (presumably & mistakenly the market thinks a Harris admin will rein in deficits better than Trump), softer stock market. Now you could argue that next week’s debate could help reset some of these perceptions. But the general consensus right now seems to favor Kamala Harris slightly more than Trump odds.

I am offering a really sweet deal to prep for the recession and price hikes ahead. Use the coupon code below to avail of this massive discount. Discount will never expire.

This should be a good segue to lead into next week’s levels

But first to recap the expectations from this week.. I expected a test of 5700 for bears to re-emerge as long as we held 5630 on the downside for this week. While we did rally into 5670 area in earlier part of the week, in latter part of the week we took out 5600 as well as as 5522-5530 area, leading to a severe sell off on Friday, that traded down as low as 5390, barely a few points away from that 5370 level.

On the SPY side, we not only filled the gap at 544, we actually traded and closed far below it at 540.

Now as far the news goes for next week, we have the CPI and PPI in latter parts of the week, with an iPhone announcement event on Monday by Apple. This is perhaps one of the more important iPhone announcements in years as it has the potential to “mainstream” the AI thing. Like most tech bros, most of us are well versed with AI and its vast meme generation capabilities, however, for an average user, this may be the first time they interact with and experience this. So it is kind of important for AAPL.

Then on the CPI and PPI front, bad news has indeed been bad for the stocks for a while, as it confirms what the traders fear most- a severe recession. Remember, these are the same folks who said rate cuts will be very bullish for stocks. Yet here we are in September of 2024, we have these rate cuts now, and not just one 25 BPS rate cut but potentially several 50 BPS rate cuts, and the stocks can’t catch a bid. BTW I still think FED goes big with that 50 BPS - remember this is a very reactive FED and will react never prep.

So, I think a weaker than expected CPI may fuel this further, but a stronger number could help the bulls. A stronger CPI pushes back against the doom loop, it shows that there is still some pricing power for American companies so they can keep this show going a bit longer before the inevitable.

As far as the levels go, 5470 level will be an important level for me on the week. This was an important support level that held earlier in the week and this could act as resistance, unless the bull retake it. These are emini September numbers, I have not yet rolled over to December but should at some point in next few days. We last traded 5410 at time of this post.

Scenario 1: Expecting 5470-5483 to act as resistance for a move down into 5400 which is the b-profile formation from Friday session.

Scenario 2: A Daily close above 5483, which if coupled with a stronger than expected CPI/PPI will be a good confirmation of a bullish close to target 5543.

As a tertiary scenario, I am also quite interested in this 5430-5438 level. If we remain below this level, this could target recent lows at 5392.

Other stuff on my radar

TSN

I shared this Big Chicken stock when it was around 50 bucks here in the Substack and is now trading around 66. One of the catalysts for this stock is that Americans just aren’t eating that much beef anymore, as it becomes out of reach for many, and are now eating more chicken which is more cost effective.

If 60 holds, I think this stock has good tailwinds, especially if we get deeper in economic slowdown, with the stock potentially headed into 80-90 area. A Harris admin is potentially another plus for this stock.

UNH

If you are a long term reader, you will remember I shared UNH way back when it was 400 for a target of 600.

Now this target was hit this week. What do we do with this now that the 600 dollar target is hit? Become bearish.

No. That is not how it works.

Winners usually continue to win. Trend is your friend. Et Cetera. Add any other cliches you like.

With UNH, I like to see support come in on any tests or dips into 550-570 area, for an eventual push even higher above 620. Healthcare costs do not go down just because we are in recession. I mean your doctor won’t give you a 10% coupon for next annual checkup because unemployment is 6%. Folks will get sick in recession. May be sicker. And UNH has cornered not just the insurance market, but now also controls a wide swathe of health care providers, clinics and doctors. I like it.

Equal weight S&P500 or a tech heavy ETF?

Now it is not an unknown that I think Big tech despite its recent swoon, may well be a little overbought. You still have every one and their dog is knees deep in Big tech. So I am not going to add to that, as every one already probably owns it.

There are often overlooked ETFs which have 2 advantages from my opinion-

They are not as widely owned. This is a big plus.

They are not too bloated with big tech. This could be a plus or negative depending on conditions, but it cuts both ways. In recession, they will drop as well, but while they drop, they will drop lesser and in process, still pay out an impressive dividend, which goes up in percentage terms, as the ETF drops more.

2 of these that I do like are SCHD and COWZ. If you have subscribed to this blog longer than a few months, you are no stranger to SCHD. I first shared this when it was around 65. It is now 82.

Yes it may be a little fluffy, but you can look up its price history, even in severe market stress like in 2020. it tends to fare better than more high beta names like the ones in QQQ.

With SCHD, you also have extremely low fees, coming in at 0.06%. Comparable to lowest ETF fees that I know of. These are some tremendous ETFs which I like to stack.

ULTA

ULTA break lower was a little flakey where the stock recovered some of its lost ground. I have had a bullish bias on ULTA near 350. I still like it longer term, it is now 366. I think if we hold 330 on ULTA, this could head higher into 400-420 area.

MBLY

MBLY is an Israeli ADR active in autonomous driving technology and services. What they offer, has potential value- it is just that they operate in an era where cars are not selling, and on top of that one major stakeholder Intel is planning on selling some of its stake in the company.

While the stock is making new lows almost every day, and there is no telling where it stops, one thing is that they have 2 billion in cash and other tangibles. The company itself sells at a 22 Forward PE which I think is reasonable for the industry. As a tech bounce play, if this were to sell down into 8.7-9.2 area, it is 11.5 right now, with a LIS near 7 bucks, I like it for a bounce back into 12-13 area.

SPY

With SPY, I like the September 20 MOPEX $510 PUT if it can be had around 50-80 cents. It is about 2 dollars right now.

It has a delta of 15, which I think is attractive for st trade. But I think it is a bit expensive at 2, just because SPY market is such as balancing market so 80 cents could be a better price just from a fair value perspective. Now each one of these ideas should be seen independently- with SPY PUT, my Line in Sand will be if we start closing here above 5470/5483. That voids this PUT.

On a parting note, I want to share some tidbit about OnlyFans which you may already have heard about but here is my take.

This company is in news with revenues rocketing to $7 billion and the company itself now is valued at $20 billion. This is a private company but looking at their top and bottomline, they could go public tomorrow, and recession or no recession, they have a bright future ahead.

Unfortunately, this just shows where the mass consciousness sits right now. A lot bright and smart people spend a lot of time researching and writing content for this particular Substack platform- only to be valued at a mere mortal $1 billion, a pittance compared to OnlyFans. What does this tell you? It tells a lot about the state of mass consciousness here in this world in 2024. So, I do appreciate every one of you who is a reader. If you can read more than 10 lines in a go, you are far ahead of the competition.

Reading is hard in 2024- when you can just watch a 20 second Tik Tok or onlyFans and release some dopamine instantly.

Will I be buying OnlyFans stock on IPO? 100%.

Just don’t count on me to subscribe if any of you create content on that platform ;)

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.