Hello friends-

Many a times, many of us, assign a lot of value to the power of position within a hierarchical order. We automatically assume that a person in a position of power, whether that be a bureaucratic, political or a business leader, knows much more about us about a particular concept or an idea. This tribal aspect of giving value is hardwired in most of us.

This shows up in many areas- servile deference to our duly elected politicians, sold out concerts to Hollywood types, and making our investment decisions trusting what comes out of Federal Reserve meetings and notes.

In reality this is not always true. People at the very top often times forget about the ground reality, no pun intended. People at the very top build around themselves an elaborate prison which inures them against the real world. This is especially true when the people in charge tend to be highly elite, having gone to the best business schools, having worked in the best consulting firms and investment banks. They hire and promote math whizzes who view the world in terms of numbers and metrics and KPIs.

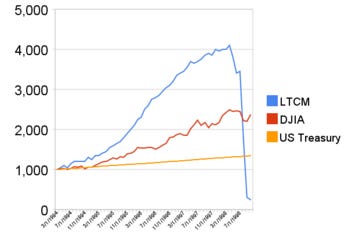

In last 20 years we have seen dozens of examples of this fallacy here in the US itself: the 2000 dot com crash, the WMD hoax, the 2008 Great Recession, Enron, the Long Term Capital LTCM Collapse and so on. The underlying cause of these debacles was almost always the hubris of those at the very top.

Are we seeing the same script play out again in the 2020s?

I think there are signs of hubris and excesses every where but I am going to focus on the FED just for this example as it pertains to the markets that I am interested in.

Most people assume that the FED is this extremely smart machine that knows exactly what is going on in the economy at any time and is expertly navigating it to their desired goals.

Nothing could be farther from the truth.

In my view, FED is not very unlike a giant, unsophisticated brute that thinks solution to everything is to throw more money at the issue. The reason why it has worked thus far is because the Dollar is accepted as the most powerful forex-currency in business world. If the Dollar was not the global reserve any more, the FED will not be able to do much in face of crises like the 2020, 2008, 2000 etc.

Examples of this are every where. See below for a few:

When inflation was about to take off from 0% to 9% in the US, the FED chairman Powell was heard saying “he is not even thinking about thinking about raising rates”. This was just a few weeks before inflation exploded. He was actively fanning the flames of speculation which will bring about the 2022 bear market.

Alan Greenspan who oversaw the FED right before the 2008 Great Financial collapse, quipped the “bubbles are regional and they are well contained” right before the Global housing market imploded, losing more than half of its value.

It was Bernanke, who after that 2008 implosion oversaw one of the greatest heists in the US history where funds were diverted from Americans to the fat cats who caused the 2008 Great Recession.

These are but the big events. They get smashed into the radar but there are several smaller crisis events flying under the radar, almost happening every year, which in my view are being caused directly by the lack of sophistication of FED.

This proves the FED is not some genius machine at the helm of US economics but it is a rather unsophisticated brute that sees solution to every crises as printing more money. These events prove the FED can not predict and can not prevent any single one of these crises; but they can only react to it. So are we supposed to believe them there is no crisis brewing as we speak?

So what is this brute up to now a days?

The Brute was under the assumption it had conquered the inflation when it dropped from 9 to about 4% early this year. I was one of the very first ones (and perhaps the only ones) to remark then that the inflation had actually bottomed and it was bound to go up again. This was about 6 months ago and results are for all to see again with the core PCE from last week.

Then I warned about keeping interest rates at these levels in a country where the total debt exceeds 50 trillion dollars (consumer and government)! I asked that the FED reduce its balance sheet to rein in inflation rather than keep the interest rates so high which directly impacts small businesses’ and households’ ability to function on day to day basis. This was also disregarded as FED stubbornly sticks to keeping the rates at 5% while it stills owns 9 trillion in assets on its book!

The end result of this hubris by the FED is a) growth has started to slow down. For instance, Canada just entered recession b) unemployment has started to go up c) savings are down to 0, credit cards have been maxed out d) housing is on verge of dropping of the cliff e) inflation has begun to uptick again.

If you look at point 3 above, does this paint this FED as a smart creature who is in control of over destinies?

Or do you now agree with me that it is no more than a baboon that is adept at throwing dollars at every problem rather than solve the root cause? Is this sustainable?

Why does the brute does all this? It is because it is driven by short term expedient goals rather than long sustainability. It robs the Americans of their future lifestyle and prosperity by printing debt in the present moment which mostly goes to FED’s friends in the top 0.1% population.

For instance, when USD 10 trillion was printed in 2020-2021, less than 5% of it went to the middle income and lower income Americans. Most of of it was vacuumed away and sucked into the vast black hole of those in the top 0.1% of the population. Most Americans do not care about this travesty either, as they are living day to day, and they celebrate cheques as little as 600 dollars, losing sight of the bigger picture. Once you hook a population on free money, howsoever small it is, there is no coming out of it ever. However, I digress. My point mostly is to prove that the FED knows no better than you (and I) on what is going to happen a month or a year from now. It just knows that when a crisis hits the fan, it can bail out the people who caused it by printing more money, paid for by the Americans. Since the politicians also think short term that means there is really no one to question the FED on its practices.

If you take into account all these factors, I think it is clear that this is going to lead to a massive recession in the US and elsewhere shortly. This is why, outside of day to day price action, I have been hesitant to call off my lower, longer term levels in the S&P500. I think they will trade and then some more. I like to see the FED panic, begin cutting rates aggressively, actually start panicking to print trillions of more money- this will be my cue that we have bottomed and this will be my signal that we are about to embark on new all time highs again in the S&P500 again. Until then it remains a pipe dream.

If you were not active when the LTCM fiasco and collapse happened, I highly recommend you read up on it. It is a fascinating tale of being smart vs just being lucky. Here is where you can get started but there have been books written about it.

https://en.wikipedia.org/wiki/Long-Term_Capital_Management

If you enjoy the blog and get value and learning out of it, make sure you like, share and subscribe. The Labor Day sale is still valid and is an excellent chance to get in at lower prices before upcoming massive price hikes. If you like to save money, IMO you are smart. Make a smart choice this Labor Day.

Let us now do a quick summary of the action last week

I am not sharing all the names here as they are for paid subscribers but most of the names I shared last week had an excellent week, with many of them going up more than 7-10%.

TSLA: Though TSLA sold off on Friday due to price cuts (and other reasons ascribed by media), it rose more than 10% from my levels at 230 where I became a TSLA bull to target 260. Stay tuned to know if I am still bullish on TSLA or if I am now a bear.

LULU was up 10% on the week after my bullish earnings call on it at 360 to close near 410.

SPY: I was bullish on emini S&P500 expecting the dips to be bought and I was right in my assumption as S&P500 rallied 150 points from the Friday close into 4550 and remains above 4400 for most of the week. This was a large move and some consolidation did not surprise me.

SMCI was a star performer. Up about 12% from my levels to close the week above 282.

GOOG went from about 128 to almost 138 within days.

There were several other great names like XPO and BABA, which I am not reiterating but can be read in my weekly plan from last week.

In the rest of the plan, I am going to share if I am an S&P500 bull or a bear now as well as my view on the likes of TSLA, Oil, Dollar etc

On a side note, many of you are working in niche sectors and industries. DO not let all of that knowledge go to waste. Start writing a blog like this today and link it to my own. The blog can be about anything - it does not has to be market related. DO not let all that great knowledge you posses go to waste after you croak. Start sharing now!

My levels for this week

Structurally, this week’s auction is mirror image of last week’s. Technically, this is a fairly weak looking profile IMO. See image A below. Last week, I was very bullish on this near 4400. So can SPY hold its gains or it will flop this week?

I think this will be an extremely volatile week if past week’s action is anything to go by. This week’s plan will be a little complicated due to relative absence of any major news as well as the profile structure shown below in Image A.