Folks,

There has been a lot of anxiety over Bitcoin. Understandably so as it is one of the most, if not the most important cryptocurrency.

Last year there was miserable doom and gloom for Bitcoin when I turned bullish at 29000 bucks before a move to 65000 +. Earlier December/late November, I became bearish on Bitcoin again at 62000 and again at 52000 dollars and it has now traded down sub 42000.

Is this the right time for me to turn bullish on Bitcoin again? Is this time different than few of the last turning points?

The honest answer is I do not know. Now I have some thoughts I can share but if you asked me to pin point where Bitcoin may reverse the downtrend, I will not be able to.

Yes, there may be in next 2-3 weeks events that occur on the tape which give me more clarity and as a result be able to call some sort of bottom out, but I am just not there yet.

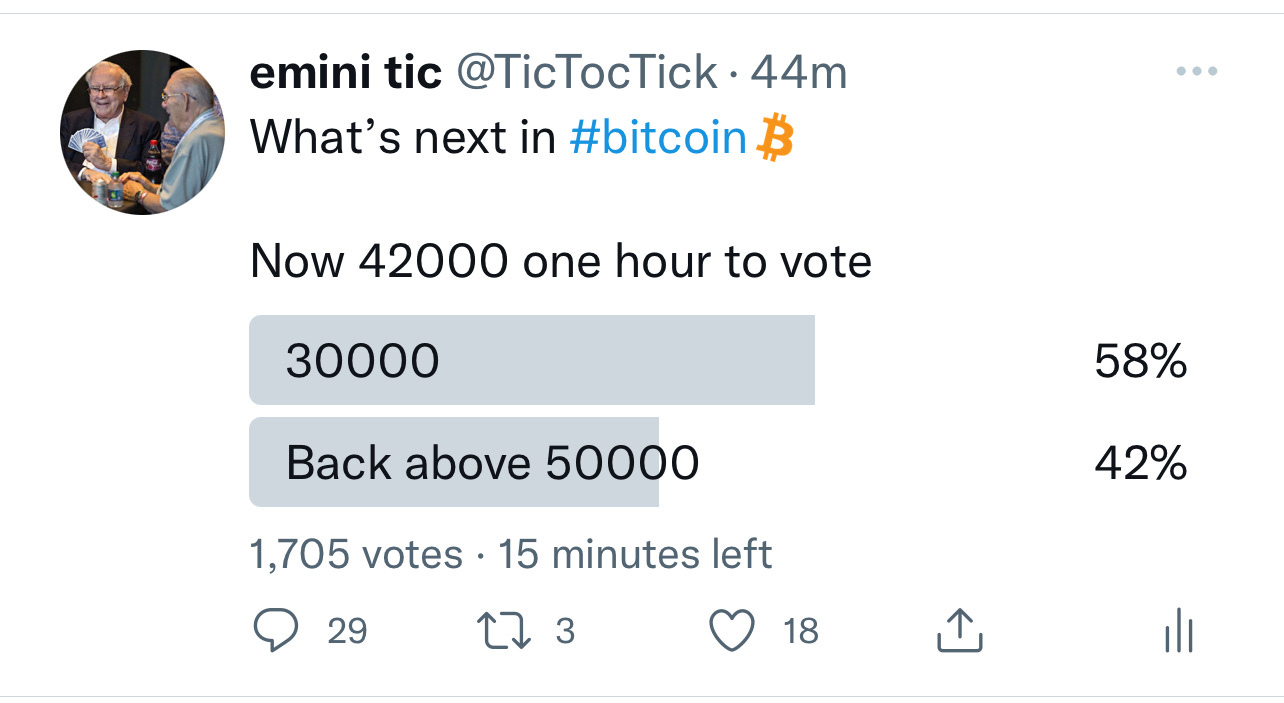

I ask Twitter and I think they seem to be pretty clear we are headed down .. see below.

In meantime, let me spend some ink on what I think is driving Bitcoin and where we may be headed with this… I will also share my thoughts on some of the key Bitcoin stocks, like MARA, SQ, COIN and of course MSTR.

Before you read further, this is really an opinion piece. To back it up , yes the technicals and orderflow are negative, they remain negative at time of this post. But for most part this is an opinion post.

These are the MAIN factors behind crypto decline:

Whales and HODLers: With the Utopia that Bitcoin is , despite what the crypto bros promise us, majority (like 99%) of Bitcoin is held by less than 1% of holders. They make it difficult to balance the ledger on bid and ask. Imagine a product with spreads so wide, that the sellers never sell and the buyer has to go all the way up on the offer side to find someone who will sell it to him. This distorts the market and creates mistrust even amongst the bros (crypto bros that is). A lot of softness right now I suspect is due to this hoarding tendency.

FED: it is easy to blame FED for most market declines but it really is as easy as that! The juices that keep the market humming are earnings. When the FED starts raising rates, the companies find their costs go up as a lot of them need short term funding to keep lights on. They pass on this cost to you, the consumer. You slow down spending. Which means their sales go down which means their earnings go down and which means their stocks go down. Companies with profit see their stocks go down as they make less profit. What about companies which have no profit to begin with ? How can 0 go to more 0, so they naturally are the first ones on the chopping block of short sellers.

Bitcoin’s associated companies fall into this category. There are active algorithms which are programmed to sell the highest P/E companies on any rips as long as the market believes the FED. Note the FED credibility in all of this is very important. It only works as long as the algos and algo makers believe the FED story - high inflation + higher rates.

Technically Bitcoin is not in a very bright spot either. 52000 was a key moving average which was rejected. 47000 could not hold it which is a key orderflow level. Bitcoin is now trading so close to 40000 level which is another major support level going back a couple of years.

What compounds it’s misery is no one really knows if it is really an inflation hedge or actually an inflation bubble which is gonna be popped soon or may be already has been popped.

The good thing is we will all find out in this cycle, if Bitcoin was indeed such a great inflation hedge, then while inflation remained high, it made new higher highs higher lows . Right?

If however inflation remains high, FED raises rates to 2% end of 2023, and Bitcoin is trading below that 20,000-23000 mark then we all know it has room to fall more.

So what are key levels in Bitcoin?

I think 40, 000 is the immediate key level. I expect this is going to break and target the lower orderflow levels 36300-37800. At this time it is trading 41799.

Now what can change it’s course? Same factors I outlined this AM in my weekly plan. Namely a) Nasdaq very close to the support b) FED speak next week and the CPI numbers

Here is the link to my Weekly Plan if you have not already read it: Weekly Plan w SPY, TSLA etc

A bounce if one comes here, I personally think will be shallow. Like may be 45000-46000 which is in line with what I am thinking about other markets like Spooz and Nasdaq too. If we closed above 46500/47000, you may have enough to convince me otherwise. As long as we remain below 47000, I think 30000 is not out of realm of possibilities..

Again, if you ask me for a simple and straightforward metric or related market to call this out a few days out, I will say look what XLF is doing, look what BAC is doing.

Thematically, I think going forward Bank of America BAC stock will be the anti-Bitcoin. BAC good = Bad for Bitcoin. BAC Bad= Good for Bitcoin. If this correlation breaks at some point, I would assume Bitcoin could be a hedge for raising rates :)

What can cause a sharp rally in Bitcoin here at the lows:

Tuesday. Powell testimony can absolutely cause a 7-8% within a day or two.

CPI on Wednesday again has the potential to cause a rally.

Again any rallies, unless we close above 47000 I think will be short lived.

There are still 2 sessions between now and Tuesday. If S&P500 slips below 4660, if TSLA slips below that 1000 dollar mark on Monday, Bitcoin may also come under pressure to test that 36300. And all of this is assuming FED will save the day! That is a big assumption.

Bitcoin type stocks:

MSTR, SQ, MARA, COIN are all KEY stocks in the Bitcoin family

Specifically if you look at MSTR, it has had a double whammy. They carry a lot of Bitcoin on their balance sheet. But they are also a low/no EPS company and are getting beaten on both counts. It last closed at 480 on Friday. Far lower than its lows back in Fall last year when Bitcoin was trading 30k. Little strange.

With COIN I was really surprised when it did not catch a bid despite Bitcoin volatility as it benefits their bottomline. I think it may be because people pulled back from trading on their platform.

SQ and MARA: Again, I think SQ is an unintended casualty of this and MARA fortunes are so closely tied to Bitcoin price. There are very few factors working for or against MARA, other than the actual price per Bitcoin.

Now if I had to rate these companies, I will think SQ and COIN are the most superior of these 4. They are secular in technology in a sense they are crypto technologies and not necessarily Bitcoin technologies. Of the MSTR and MARA, I think MSTR has a more risk due to the way these public companies are when it comes to balance sheet. MARA is so tied to Bitcoin, its fortunes really all come down to the price performance in the cryptocurrency.

They traded 141, 232, 480 and 29 dollars respectively at time of this post.

Yeah so wanted to share this blurb with folks and see what y’all think. I covered Bitcoin as an umbrella for all cryptos, but I think it suffices to say if Bitcoin sells more, the alt coins sell harder.. if it rallies, then the other coins rally harder. Feel free to share with other crypto traders like yourself.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

Mr. Tic, very detailed including related individual stocks, simply the BEST. Thank you

Great work, thanks!